As the year comes to a close, we asked our top analysts to reflect on some critical questions impacting colleges and universities in 2017:

2018 promises to be an opportunity to continue our work with our institutional and technology clients as we deepen and further refine our analysis of prospective adult learners.

2018 promises to be an opportunity to continue our work with our institutional and technology clients as we deepen and further refine our analysis of prospective adult learners.

This example captures the essence of what I saw this year. Rather than breakthrough methods or shiny new tools, institutions that do well are working on the tried-and-true levers of recruiting and student success with discipline, creativity, passion, and … grit.

This example captures the essence of what I saw this year. Rather than breakthrough methods or shiny new tools, institutions that do well are working on the tried-and-true levers of recruiting and student success with discipline, creativity, passion, and … grit.

Is there something wrong with the undergraduate adult market? What does the newest evidence actually say about the importance of convenience to prospective adult students? How much is enrollment success about the right strategy, and how much is about sheer grit? How can schools get out of the vicious cycle—that they may not even know they are in—when trying to get up to date with technology?Drawing on new insights from their research this past year, here is what they said.

Something is Wrong with Adult Enrollment

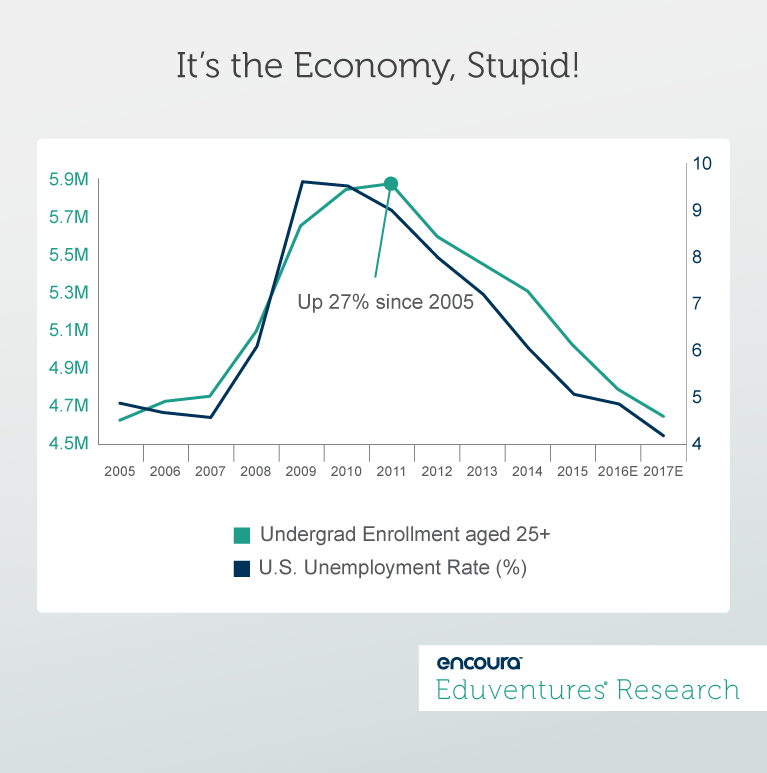

Richard Garrett, Chief Research Officer After hitting record highs in the aftermath of the Great Recession, several years of economic growth have led adult undergraduate enrollment to shrink to its lowest level in 12 years (Figure 1). This decline might be viewed as simply a function of the ups and downs of the business cycle, but I think something else is also is going on.Figure 1. The Rise and Fall of U.S. Adult Undergraduate Enrollment

A Shining a New Light on Adult Learners

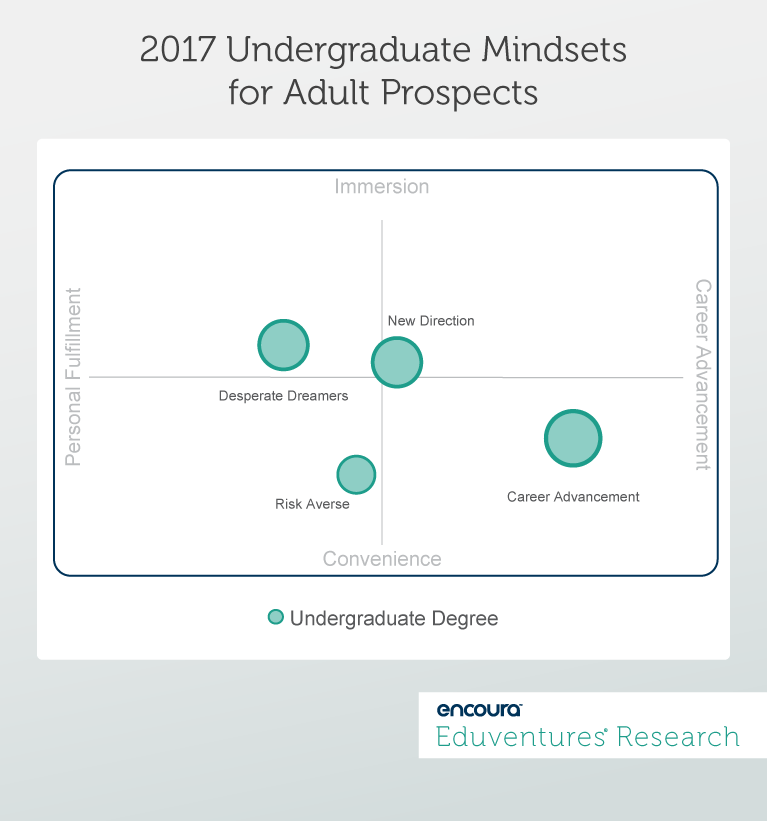

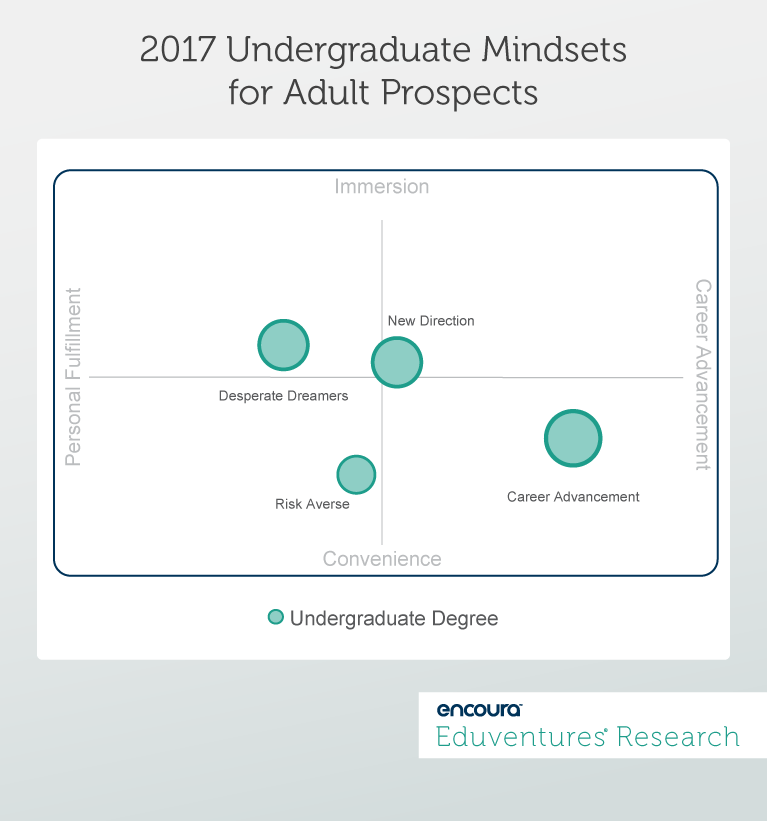

Howard Lurie, Principal Analyst Despite a sizable enrollment decline in recent years, there’s little doubt that adults over the age of 25 still represent a sizable and diverse segment of current and prospective college students. More obscure, however, has been a precise measurement of the range and diversity of how these adult learners wrestle with the prospect of returning to school. Thankfully, this changed in 2017. Based on a new research design, our 2017 Adult Prospect Survey features 10 data-validated behavioral and attitudinal mindsets of prospective learners who are seeking either certificates, non-credit courses, undergraduate degrees or masters and professional degrees. These reveal a range of preferences about what and how these prospects want to learn. While I’ve thought of adult learners as predominately seeking ways to advance their careers, these new mindsets have opened my eyes to several other essential dimensions. Based on data about their expectations, desired experiences, and preferred features, 55% of prospects in the 2017 survey are attracted by either highly immersive programs or those that offer convenience and fit with their busy lives. Others are more likely seek a balance between these two extremes. While career motivations are present among almost all prospects, our study identifies 25% as more likely to be motivated by highly personal, and less purely economic, goals. It’s possible to see significant range and variety in program preferences and desired outcomes among four prospective undergraduate mindsets identified by the 2017 study (Figure 2).Figure 2. Goals and Preferences Axes: Prospective Undergraduate Adults

2018 promises to be an opportunity to continue our work with our institutional and technology clients as we deepen and further refine our analysis of prospective adult learners.

2018 promises to be an opportunity to continue our work with our institutional and technology clients as we deepen and further refine our analysis of prospective adult learners.

One Part Strategy, Two Parts Grit

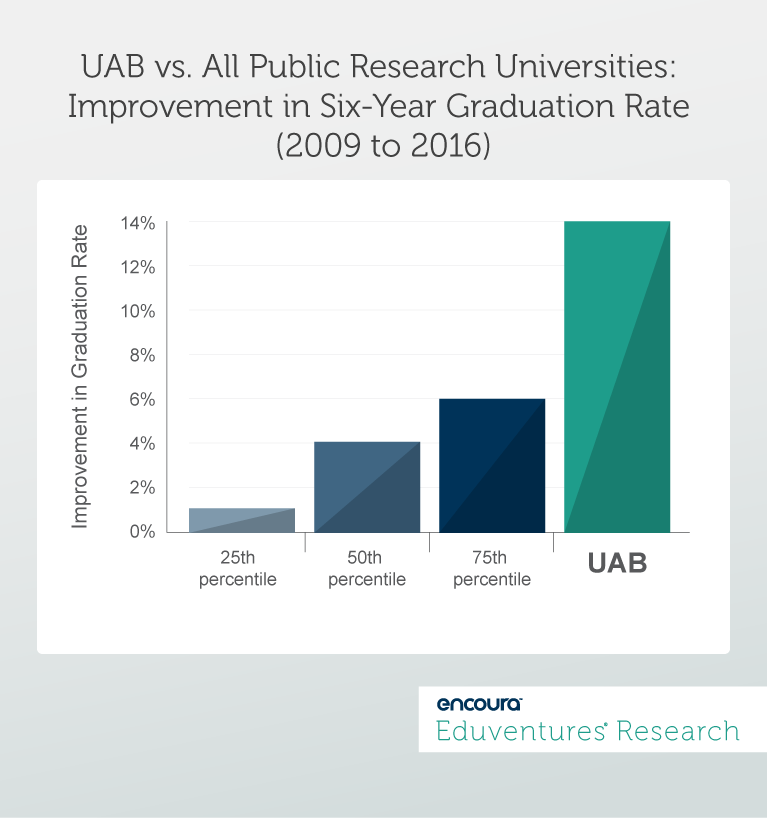

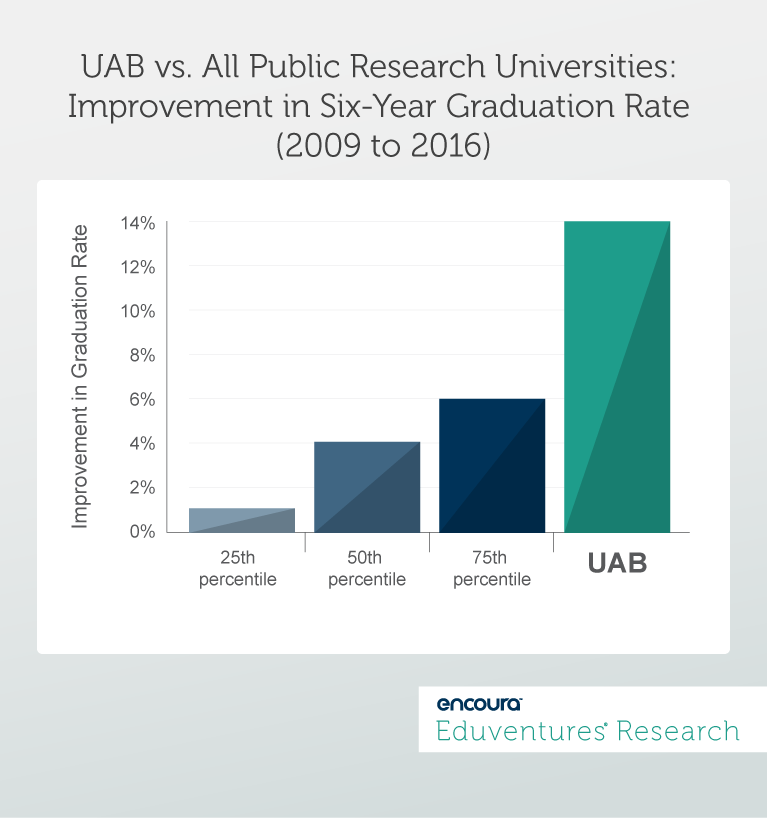

Kim Reid, Principal Analyst In 2017, we can say that higher education has been in an entrenched period of stress for almost a decade. The pressure to improve institutional performance isn’t easing up; it’s increasing. While there are many ways institutions respond to this environment, the most effective exhibit one of the most important characteristics they would expect from their own students: grit, the perseverance and passion to achieve long-term goals. How has this grit manifested itself? Effective higher education teams realize that grit has to be an institutional value not an individual characteristic. They work passionately, deliberately, and collaboratively to refine objectives and activities that will achieve institutional goals. This can take many forms. One example that sticks in my mind is how the University of Alabama, Birmingham (UAB) tackled student success. UAB understood two things: it needed to get its students to graduation, and that the pathways toward this goal were primarily academic. Straightforward concepts, perhaps, but easier said than done. The university reorganized its administration of student success to create an accountability structure. It then led parallel efforts to build on first-year connections and rethink the advising ecosystem. UAB used some technology, but not a lot. Instead, thoughtful program design, testing, evaluation, and iteration—all functions requiring the institutional value of grit—are responsible for its success. As a result, UAB improved its six-year graduation rate by 17 percentage points over five years.Figure 3. UAB Student Success vs. Average

This example captures the essence of what I saw this year. Rather than breakthrough methods or shiny new tools, institutions that do well are working on the tried-and-true levers of recruiting and student success with discipline, creativity, passion, and … grit.

This example captures the essence of what I saw this year. Rather than breakthrough methods or shiny new tools, institutions that do well are working on the tried-and-true levers of recruiting and student success with discipline, creativity, passion, and … grit.

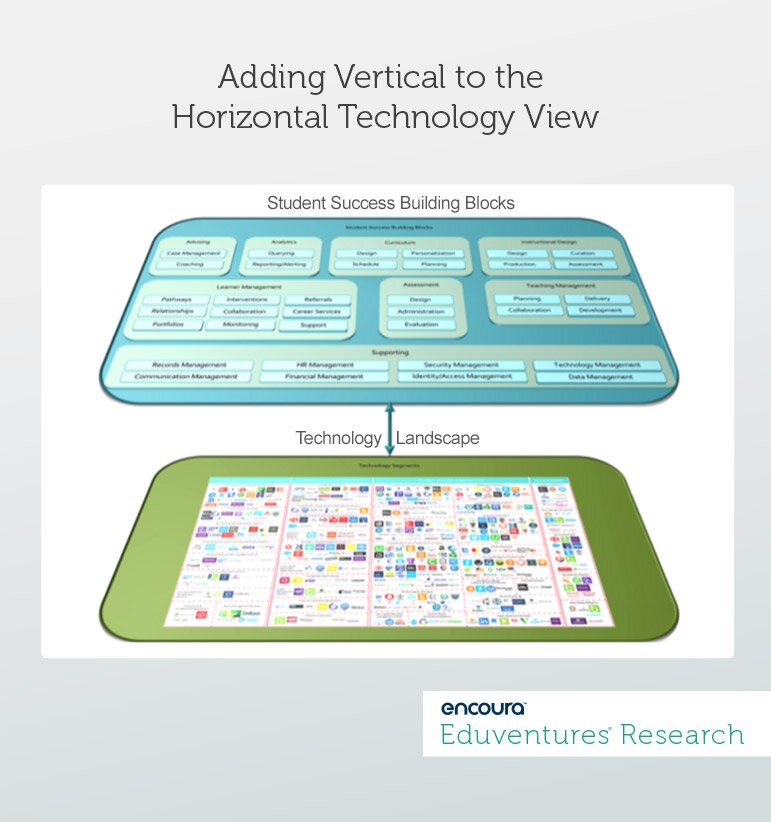

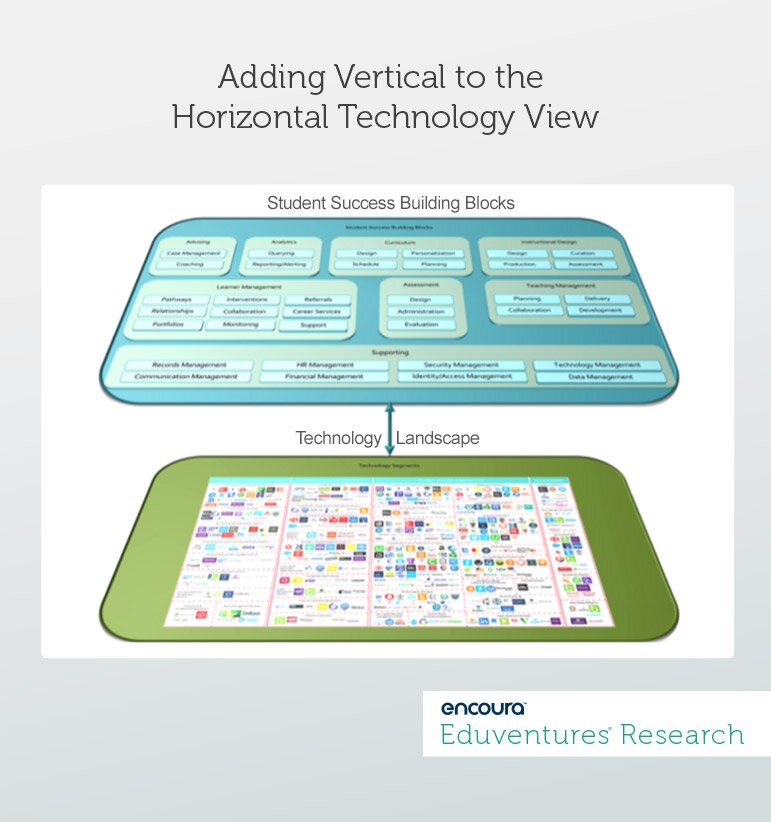

Why Viewing Technology Horizontally Only Tells Part of the Story

James Wiley, Principal Analyst Over the past year, our Higher Education Technology Landscape has classified over 500 products in 41 different segments, ranging from backbone systems such as enterprise content management to student success solutions such as learning management systems. We believe that this product-level, horizontal view of the higher education technology world is useful because it gives structure and clarity to the noise in the marketplace (look for an updated map in early 2018). In our advising calls with institutions and vendors over the course of this year, however, we learned that a sole focus on this view can be misleading, suggesting that the only differences between products are their segment classification and specific features. Therefore, we decided to add another lens: “building blocks,” the critical drivers of student success—for example—such as persistence, academic achievement, or career advancement. I’ve found that viewing the marketplace vertically through this lens enables institutions to better understand how specific products best align with their needs—such as personalization, instructional design, and learner management—and helps vendors understand how best to develop, position, and message their products to institutions. We look forward to sharing more thoughts on this over the course of 2018.Figure 4. Horizontal and Vertical View of Technology