The State of the OPM Market in 2024

In 2023, the Department of Education (ED) threw a wrench in the Online Program Management (OPM) market suggesting more intense regulations would be put into place to increase transparency. In a previous post, we discussed how institutions and OPMs should move forward in this environment.

Since that time, the OPM market has had a bumpy ride with an increasing amount of acquisition activity. This raises the question: is this OPM market fluctuation a reflection of regulatory uncertainty, or the state of the (largely graduate) online market?

Industry right-sizing, preparing for Ed regulations, or both?

The Department of Education (ED) has suggested that it will release guidance about new third-party servicer definitions in early 2024 with no indication about whether the exception to the incentive compensation ban will remain in place. In the meantime, top OPMs have kept busy:

- Pearson Online Learning Services was acquired by the private equity firm Regent in March 2023 and has rebranded as Boundless Learning. This came just as the company’s largest client, Arizona State University, ended its contract. Pearson did not receive compensation for the sale, but instead gets 27.5% of the company’s future revenue—a stark contrast to the $650 million that Pearson paid for Embanet Compass in 2012.

- Wiley, which had put its OPM division up for sale in June, was acquired by Academic Partnerships for $150 million, making the combined company the largest OPM provider based on total partners. This comes just five years after Wiley had acquired Learning House for $200 million.

- 2U is smartly preparing for anything that the Department of Education might do by creating a non-revenue share business model if the hammer comes down. In its Q2 2023 earnings call, it announced a “flat fee model,” a fee-for-service arrangement with three- to five-year commitments.

- 2U is also shifting its focus to “portfolio management,” which entails strategically transitioning programs and partners out of (and into) 2U partnerships. The company has reached a mutual agreement with the University of Southern California, 2U’s first and most infamous partnership, to wind down their collaboration. At the same time, 2U announced 50 new degree programs with six new partners.

Other OPMs have paused new program growth, implemented layoffs, and cut spending—a product of regulatory uncertainty and an online market that has come back down to earth.

While Eduventures sees evidence of a slowing OPM market, what is the actual impact?

OPM Market Has Slowed, Matching Online Graduate Enrollment

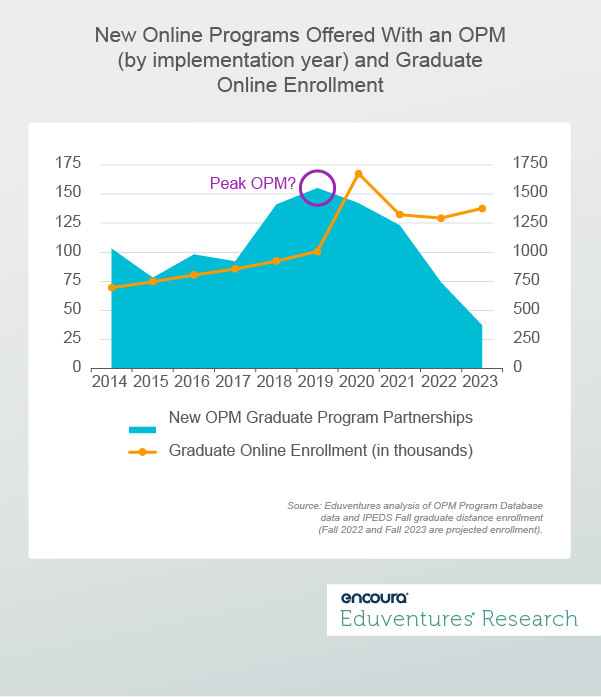

Eduventures’ OPM Program Database tracks more than 500 institutions, 40 OPM partners, and 3,000 supported programs. Figure 1 shows new OPM-supported master’s program launches between 2014 and 2023 (since the majority of programs supported by OPMs are at the master’s level). It also shows fall graduate online enrollment (via IPEDS) between 2014 and 2021, while we have estimated fall 2022 and 2023 enrollment.

Figure 1.

This shows that the pandemic directly contributed to a graduate online enrollment spike but did not lead to a similar spike for new OPM-supported master’s programs. In fact, master’s degree partnerships peaked in 2019, before the pandemic and years before ED released the regulatory guidance in early 2023, suggesting that the challenges in the online graduate market preceded the regulatory uncertainty.

Data from 2022 shows the fewest new OPM-supported master’s program launches since 2015 while 2023 had the fewest total new OPM-supported program launches in more than a decade.

Even with these headwinds, the market for institutions looking to partner with OPMs remains strong. A recent survey of 385 institutions by The Chronicle of Higher Education and P3-EDU indicated that 29% of institutions, about a third, are interested in partnering with private companies for “online program expansion”—not an insignificant figure.

The Bottom Line

This data points to a slowing of the OPM market that preceded both the pandemic and any forthcoming regulations. This is a troubling sign since many institutions have depended on online graduate programs—often in partnership with OPMs—to offset enrollment and revenue challenges. But the graduate market has shifted, making this strategy less certain.

Now questions loom about what OPMs will look like in the future and which ones will survive this down market.

We know that the revenue-share model is attractive to institutions lacking the funds, capacity, and expertise to launch online programs independently. Eduventures expects that the Department of Education will keep the revenue share model but will boost regulatory oversight for these companies. But we also expect increased demand for online program enablement–where institutions pay for specific services, either bundled or unbundled, as competitive pressures increase.

Whether partnering with an OPM or not, this suggests that institutions now more than ever need to be strategic about launching new online programs and growing existing ones. Being data-driven with enrollment projections and meeting employer needs will be vital for success in the future.