June 14-16, 2023

Boston, MA

A pair of announcements made in February by the Department of Education (Department) is raising the alarm for companies that provide a wide range of outsourced software and services, and the institutions that rely on them.

The first looks to evaluate the exception carved out for online program management (OPM) companies that provide recruitment as part of a bundle of services. This affects about 13% of all Title IV institutions, according to Eduventures’ estimates. The second changes which vendor relationships, a.k.a. “third-party servicers,” must be reported to the Department. These providers range from CRM to LMS to retention solutions—impacting the vast majority of institutions regardless of whether they have online programs, let alone work with an OPM.

History of the Incentive Compensation Ban

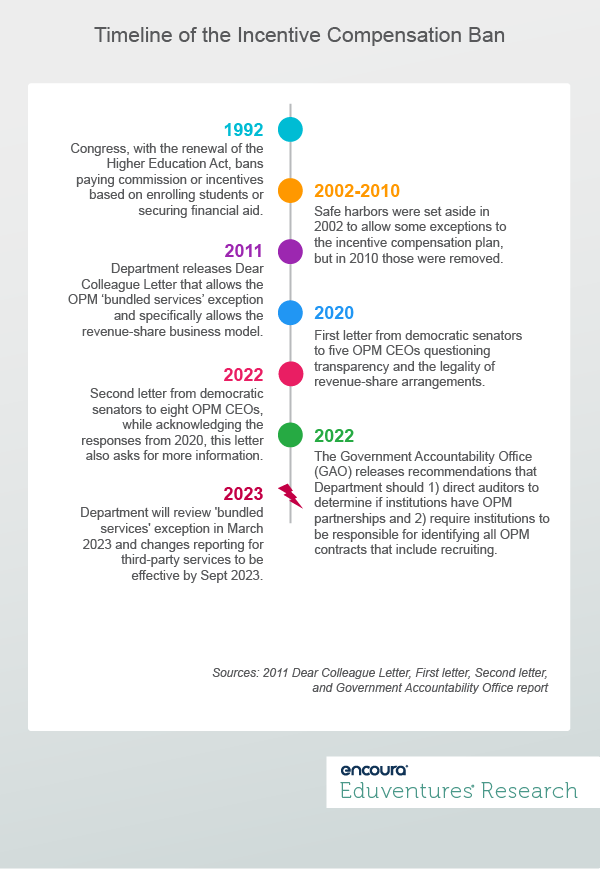

First, some history of how we got to this point (see Figure 1). In 1992, before the dawn of online education, the Department implemented what has become known as the “incentive compensation ban,” preventing schools from paying recruiters commission on domestic student enrollments. Largely aimed at for-profits, the impetus was to protect students—many of whom use federal student loans—from predatory behavior.

In 2011, the Department carved out the “bundled services exception,” which allows OPMs to charge institutions a share of revenue per student if recruitment is bundled with other services, like marketing and student retention. This revenue-share model can be attractive to institutions, minimizing up-front capital needed to launch new online programs and shifting the financial risk to the OPM. Some OPMs offer the option of payment for services rendered, known as “fee-for-service.”

Important to understanding each of the developments in Figure 1 is the politics behind them. The incentive compensation ban was bipartisan for the first decade (1992-2002). Since then, each administration has pursued revisions aligned with its own political ideology.

Republicans have promoted deregulation to unlock innovation in higher education that the private-sector is better equipped to handle. Democrats, on the other hand, are concerned with protecting students from predatory practices (and taking on too much debt) while trying to save taxpayer money.

Now that the pendulum has shifted, the Department is putting into place key regulation and oversight to reveal these third-party servicer partnerships. What is the Department hoping to accomplish?

The Department’s Plan

The Department is reviewing the incentive compensation exception for bundled services citing the growth in online enrollment and “associated Federal student loan debt.” The listening sessions (scheduled for March 8th and 9th) are designed to gather information across a spectrum of stakeholders. The public hearing notice, however, includes some curiously specific and pointed questions about the revenue-sharing model, for example:

- How would changing third-party servicer contracts from a revenue-sharing model to a fee-for-service model impact the services, such as recruitment, currently provided to an institution under the bundled services exception?

- To what extent does the bundled services exception impact institutions’ abilities to create or expand online education offerings? To what extent would fee-for-service models impact institutions’ abilities to create or expand online education offerings?

These questions suggest that the Department is trying to understand potential unintended consequences if changes are made to the exception for bundled services. While Eduventures does not believe that the Department will dismantle a large and thriving industry, it does want to shine a light on companies that have worked in the shadows.

If perhaps the Department is considering rescinding the exception, it would cause some smaller OPM companies—many of whom are not built to transition to fee-for-service—to go out of business. While many larger firms would be able to weather this change, it would impact roughly 600 institutions that rely on outsourcing to operate online programs. Most importantly, it could affect their students who may lose essential student support that OPMs provide that institutions may not have the ability or capacity to take on.

But the Department is largely ignorant to the size and scope of OPM partnerships across higher education. The GAO report released in 2022 (see Figure 1), found no mechanism for either auditors to evaluate OPM partnerships or institutions to report them. The new third-party servicers coverage definition reaches well beyond OPM partnerships but is the first step toward understanding and cataloguing the overall OPM/outsourced services landscape.

While the reporting change will add bureaucracy to both institutions and companies, the goal is to get everything out in the open so that potential breaches of incentive compensation can be investigated and dealt with, which was the original goal from 1992.

The Bottom Line

What can institutions and OPMs do to help the Department understand these relationships and prepare for the worst-case scenario?

- Educate the Department on revenue share model dynamics. An underreported aspect of the OPM revenue-share model is that it is not predicated on initial enrollment. OPMs really make their revenue when a student persists through the entirety of the program. That is why student retention is almost universally paired with marketing and recruitment services in the “bundle.” This dynamic makes it so that OPMs want to recruit students that fit the program, will succeed, and graduate.

- Explain how enrollment goals are determined. OPM-supported programs have enrollment goals that are typically established collaboratively by the OPM and institution. The OPM speculates how many students they think they can attract based on market factors, and the institution dictates the maximum based on class sizes and faculty availability. The public needs to understand this process in greater detail.

- Provide transparency about recruitment tactics. OPMs have been less than forthcoming about their recruitment tactics. The prevailing thought was that if institutions understood the “secret-sauce” of student enrollment advising, then they would seek independence from an OPM. OPMs need to show more transparency, backed up by data, about tactics being used to recruit students, as that is a key grievance of opponents of the OPM industry.

- Examine reliance on OPMs. If the Department does upend the OPM revenue-share model, institutions would likely have time to renegotiate their contracts with OPMs. There would be OPMs that cannot make the transition to fee-for-service, so institutions would need to strategically evaluate bringing those services in-house. This, of course, is easier said than done and would be challenging and disruptive to smaller, more tuition-dependent institutions.

Later this month, Eduventures will publish a new report to our subscribers covering the OPM market, “Industry Guide to Online Program Management Part 3: Field of Study Trends.” For further reading on this topic, see Eduventures' previous posts, including What the Senate OPM Probe Means for the Future of the Industry, and many OPM-related reports in The Eduventures Research Library.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

This recruitment cycle challenged the creativity of enrollment teams as they were forced to recreate the entire enrollment experience online. The challenge for this spring will be getting proximate to admitted students by replicating new-found practices to increase yield through the summer’s extended enrollment cycle.

By participating in the Eduventures Admitted Student Research, your office will gain actionable insights on:

- Nationwide benchmarks for yield outcomes

- Changes in the decision-making behaviors of incoming freshmen that impact recruiting

- Gaps between how your institution was perceived and your actual institution identity

- Regional and national competitive shifts in the wake of the post-COVID-19 environment

- Competitiveness of your updated financial aid model