- #1: Contrary to prevailing wisdom, the U.S. would not experience an enrollment-boosting recession this year.

- #2: Taking the consensus view, the Supreme Court would reject the Biden Administration’s loan forgiveness program.

- #3: Online learning platform Coursera would follow its job cutting announcement of late 2022 with more cuts in 2023.

My 2023 Prediction #1: America Dodges Recession for Another Year

Why did many people anticipate a recession in 2023? COVID stimulus and supply chain crunches saw inflation rocket to over 9% growth year-on-year, a rate not seen in decades. The Federal Reserve responded with a rapid rise in interest rates. This combination—higher borrowing costs undermining business confidence, pushing up unemployment and depressing consumption—usually spells a recession. But it didn’t happen.

In late 2023, unemployment is up slightly but remains near historic lows, and there are still far more job openings than people looking for work. Inflation is coming back to earth and interest rates have plateaued.

In fact, aside from the anomalous COVID downturn of 2020, the nation has not seen a recession in almost 15 years: the longest period of uninterrupted GDP growth in U.S. history.

Why is this happening and what are the implications for college enrollment?

There is a lot of talk about the impending “demographic cliff” of fewer high school graduates, but much less attention paid to the enrollment implications of an aging America. Low birth rates, subdued workforce participation, and an aging society mean fewer prime age workers relative to demand. All spell a shortage of workers which creates disincentives to enroll in college.

The burgeoning retiree population stokes spending that is less subject to macroeconomic forces. This fuels activity despite conventional efforts to cool the economy, supporting job openings and employment, which undermines college enrollment. These dynamics are set to continue for decades.

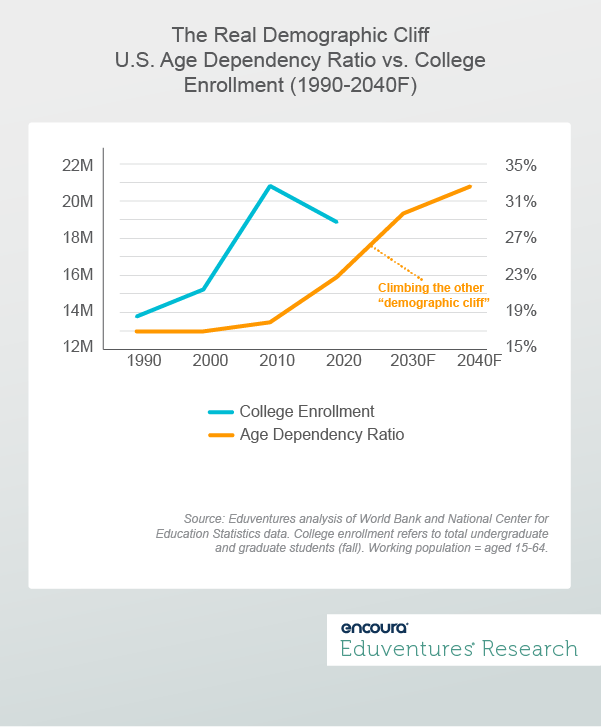

Figure 1 shows this arguably much more imposing “cliff.” It tracks Americans aged over 65 as a share of the working age population—the age dependency ratio—and total college enrollment from 1990.

Figure 1 shows that between 1990 and 2010 the age dependency ratio was flat and college enrollment soared. But the ratio jumped in the 2010s accompanied by an unprecedented fall in college enrollment. By 2030, the age dependency ratio is forecast to jump again.

The relationship between age dependency and college enrollment is not simple and many other factors are at play, but what is certain is that higher education leaders have no experience of a world where the age dependency ratio hits 30%. This “demographic cliff” dwarfs that impacting high school graduates.

What are some implications?

Higher educational attainment attracts higher wages, aligning education and productivity. But a sustained tight labor market driven by a growing age dependency ratio weakens enrollment incentives, particularly for more marginal prospective students.

Labor shortages prompt employers to invest in automation. If these efforts are successful, leading to a surplus of workers in some sectors, colleges might see an enrollment surge. What share of the productivity gains flow to workers in terms of higher wages will also shape enrollment demand. Automation may create more jobs than it destroys, exacerbating the underlying population crunch.

What should higher education leaders do?

The surest way to economic mobility remains a college degree, so higher education leaders should do all they can to give prospects the facts. Colleges should also double down on the human skills least vulnerable to automation, accentuating the value-add of a human worker. In the wake of Generative AI, a coding bootcamp might not be the most important addition to a degree program. Empathy, ethics, cross-cultural fluency, historical sensitivity, disciplinary interplay, non-quantitative pattern recognition, and the sort of problem-solving that can’t be bested by sheer computational power are among the ways colleges can ensure their students stay smarter than AI.

Exploring new ways to serve older Americans also makes sense.

Higher education can thrive in a high age dependency, low unemployment, AI-world. But we must adapt.

A recession in 2024? I’m going to stick my neck out again and say “no.”

My 2023 Prediction #2: Pivoting from the Biden Administration’s Loan Forgiveness Program to SAVE

As many anticipated, in June the Supreme Court ruled that the Biden Administration lacked the power to enact mass forgiveness of student loans.

But that’s not the end of the story. The government’s next move could be more impactful.

While still vowing to pull off widespread forgiveness some other way, the U.S. Department of Education is now pushing SAVE (Saving on a Valuable Education), a new income-driven repayment (IDR) plan. SAVE is much more generous than prior IDR plans:

- SAVE raises the income exemption from 150% to 225% of the poverty line (225% equals $44,000 for a family of two), meaning that a borrower’s monthly repayment is zero if their income falls below that threshold.

- Under SAVE, loan balances will not increase. The government covers all unpaid interest.

- Most borrowers are eligible. The only exceptions are Parent PLUS loan holders and borrowers under the former federally guaranteed private loan program.

SAVE means that many borrowers will end up paying much less (or nothing at all) on their student loans, much of which will be forgiven after a period of time. Nearly six million borrowers have already signed up. Expect many more to follow.

What impact will SAVE have? Boosters say that the program will aid consumer spending, encouraging home ownership and retirement savings. The move is heralded as a much-needed rebalancing of public and private funding for higher education: mass loan forgiveness by any other name. Critics cite a big bill for taxpayers and an incentive for schools to hike prices and downplay outcomes.

Will SAVE help enrollment?

By significantly reducing out-of-pocket costs over the long term, SAVE changes the game on college affordability. This is speculation, but I wonder if SAVE is already boosting enrollment interest. Figure 1 shows FAFSA application numbers for the third quarter of the 2023-24 application cycle (April-June 2023, the latest available after SAVE was announced).

SAVEd? FAFSA Application Growth 2019-2024

| FAFSA Application Cycle | Pre-Pandemic Baseline (2019-20) | Post-Pandemic Baseline (2022-23 vs. 2019-20) | Post-SAVE Announcement (2023-24 vs. 2022-23) |

|---|---|---|---|

| Dependent Students | 1,295,864 | 1,344,675 (+4%) | 1,496,528 (+11%) |

| Independent Students | 1,947,698 | 1,871,792 (-4%) | 2,007,135 (+7%) |

Table 1.

In Spring 2022, early post-covid, dependent student FAFSA volume was up 4% over the pre-pandemic baseline, while independent student volume was down. But a year later, a few months after the SAVE announcement, dependent volume jumped another 11% and independent volume was up 7%. Not bad in an otherwise challenging enrollment environment.

The Q3 period is not when most traditional undergraduates apply but is much more significant for less traditional and older applicants, underlining that a more forgiving student loan horizon may be a factor in these FAFSA gains.

Colleges should talk up the benefits of SAVE.

My 2023 Prediction #3: Cuts at Coursera? Not This Year!

In November 2022, Coursera, a big online learning platform company that offers courses and programs from leading universities and companies, announced an unspecified number of layoffs. The rationale was to slow spending as the not-yet-profitable company navigated the rocky post-pandemic landscape.

My prediction was that 2023 would see more layoffs as Coursera and its peers struggled to find growth in an increasingly crowded and commoditized space.

In fact, Coursera has had a decent year and has not made further cuts. In the latest quarter, total revenue was up 21% year-over-year. Revenue from the direct-to-consumer business hit 27% growth, faster than trend. This is consistent with early National Student Clearinghouse enrollment data for fall 2023 showing robust non-degree growth. (Although it should be noted that non-degree programs from the likes of Google and Meta—rather than those from universities—appear to be leading the charge at Coursera).

But there are still red flags for the company. The more cost-efficient B2B business is slowing, and while degree enrollment is up, degree revenue lags. Annual revenue-per-degree-student remains very low at less than $2,500, attributed to momentum in lower-price markets outside the United States.

If not for unusually high interest income in the latest quarter, Coursera’s net loss would have grown year-over-year. Despite the late 2022 headcount reduction, the company’s aggregate cost base has changed little.

2U, owners of the rival edX platform, posted job cuts this fall.

For more analysis of the learning platform space, and the pros and cons for university partners, look out for Eduventures’ updated report on Coursera, edX, and Udemy (another big learning platform), coming Spring 2024.

Bottom Line

My 2023 predictions highlight two major trends college leaders must watch carefully: deep population and labor shifts that are weakening enrollment incentives and much more generous student loan terms. The latter will help compensate for the former, but colleges must innovate if they are to thrive.

Coursera and its peers are examples of program and price innovation in search of new markets. Their long-term viability and significance will become clearer over time.

In early January, I will publish my higher education predictions for 2024.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Chief Research Officer at Encoura

Contact

This recruitment cycle challenged the creativity of enrollment teams as they were forced to recreate the entire enrollment experience online. The challenge for this spring will be getting proximate to admitted students by replicating new-found practices to increase yield through the summer’s extended enrollment cycle.

By participating in the Eduventures Admitted Student Research, your office will gain actionable insights on:

- Nationwide benchmarks for yield outcomes

- Changes in the decision-making behaviors of incoming freshmen that impact recruiting

- Gaps between how your institution was perceived and your actual institution identity

- Regional and national competitive shifts in the wake of the post-COVID-19 environment

- Competitiveness of your updated financial aid model