June 14-16, 2023

Intercontinental Boston–Boston, MA

In the early days of 2022—buffeted by a few “small” things such as Omicron, massive federal stimulus, roaring inflation, an acute labor shortage, and a sky-high stock market—I fearlessly made three predictions for higher education, something I do every year.

Here is a reminder of my predictions:

- #1: The Inflation Monster & College Reform: dormant for decades, inflation is heating up in today’s fragile enrollment environment, but will convince some bold colleges to embark on invaluable reforms.

- #2: “Gainful” Returns—But Will Not Succeed: gainful employment, the most controversial plank of Obama-era higher ed regulation later gutted by litigation and Betsy DeVos, is on the agenda for 2022 negotiated rulemaking. To the relief of many colleges, I predict “Gainful” will sputter again.

- #3: State OPMs—Other States to Follow North Carolina’s Lead: other states will imitate North Carolina’s “Project Kitty Hawk” state-OPM move as a high-stakes but compelling way to ride the online learning wave AND reassert the role of the state.

My 2022 Prediction #1: The Inflation Monster & College Reform

What Actually Happened? I can point to a few somewhat bold moves by individual institutions—see below for examples—but nothing radical. At the system level, the headline is continued stress. Equally, it is hard to “see” all relevant activity in such a big, diverse sector, and it may be premature to say anything definitive about the impact of inflation on higher education institutions. Finite COVID-19 stimulus funds have delayed a reckoning at some schools.

What is clear is that the “Inflation Monster” is alive and kicking. In October 2022, the Consumer Price Index leapt 7.6%, down slightly from recent months, but still a rise of a magnitude unseen in four decades. Interest rates are in hot pursuit, but high inflation may already be entrenched.

College enrollment continues to slide. According to preliminary fall 2022 figures from the National Student Clearinghouse, total undergraduate and graduate enrollment fell 1% over the previous twelve months, spanning two and four-year schools, publics, privates, and for-profits. This follows slippage in 2020 and 2021. Adult undergraduate enrollment continued its decade-long downward spiral.

Two bright spots: 1) Dual enrollment among high schoolers jumped almost 10% this fall and, 2) While degrees slumped, certificate enrollment (undergraduate and graduate) notched 2.5% growth. Both trends exemplify market interest in faster-cheaper but mean much lower revenue-per-student for schools.

Colleges of all stripes saw inflation continue to swallow tuition increases. List tuition and fees, net of inflation, fell 4.4% at four-year privates, 6% at four-year publics, and 6.3% at community colleges, according to the College Board pricing data. This is the first time since 1980 that all three sectors have seen declines two years straight.

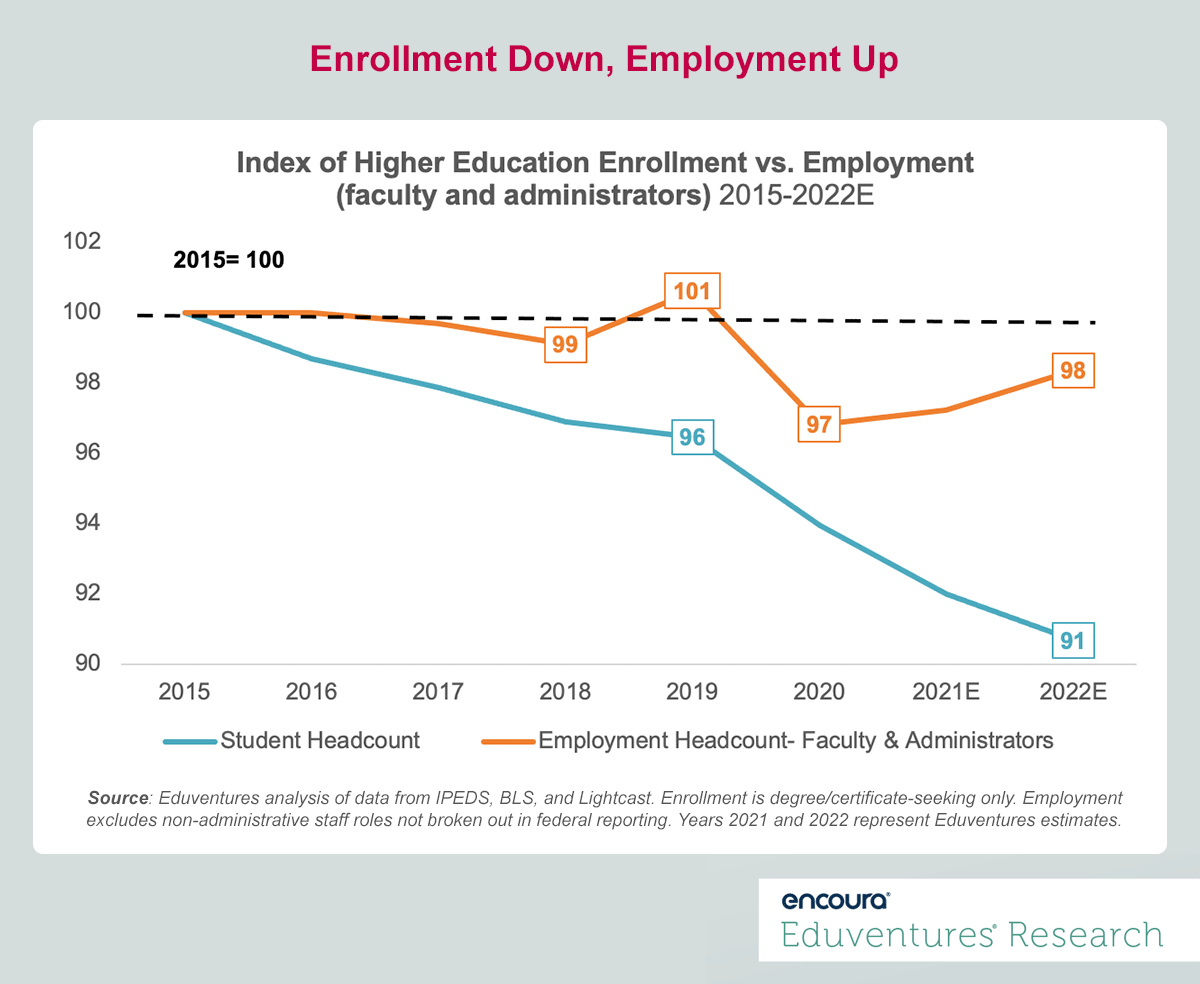

But even as revenue continues to slip, schools are still hiring. Total higher ed enrollment is down about 10% between fall 2015 and 2022 but total higher education employment—wages and benefits account for 50-70% of institutional expenditure depending on sector—is down by less than 2% and rising again.

Figure 1

Hiring may make sense. Data from a recent survey by the College and University Professional Association for Human Resources highlighted tutors and institutional research staff as two in-demand occupations, pointing to student retention efforts and renewed focus on data-driven strategy. Of course, Figure 1 obscures the “right” ratio of staff-to-students and the challenges of hiring for some specialized roles.

Figure 1 underlines that most schools are banking on spending rather than cutting their ways out of current circumstances. If high inflation and weak enrollment persist—not to mention lackluster endowment returns—this approach will become harder to sustain.

Here are some atypical institutional moves—spanning cost-cutting, price innovation and outsourcing—that caught my eye this year. Not exactly game-changing—and by no means an exhaustive list—but notable nonetheless:

- Southern New Hampshire University (SNHU), an online giant, unveiled the first institutional partner for its new back-office outsourcing collective, dubbed Impact.org: the Urban College of Boston, a small school focused on early childhood education. Impact.org is supported by the Transformational Partnerships Fund, a novel philanthropic effort to encourage higher education institutions to explore partnerships as a way to save money and boost quality.

- University of Maryland Global Campus (UMGC), another online giant, controversially disbanded a 51-person course development unit, saying that outsourcing was the only way to revise courses at the speed and scale needed to meet institutional objectives. Dozens of employees were let go, and the university says that outsourcing saves money. Critics are unconvinced—alleging delays and quality assurance issues—and only time will tell whether this bold move nets UMGC the step-change in innovation and market success desired.

- Another gutsy move comes from the SUNY System—facing long-term demographic decline at home—where nearly two-dozen member campuses now offer to match in-state flagship tuition for residents in eight nearby states.

- A potentially high-impact initiative is the National Institute for Student Success at Georgia State University that really got off the ground this year. It has turned that institution’s much-admired student success model into a toolkit for other schools, plus consulting services. The nonprofit already works with 28 colleges and universities and just announced a $25 million gift to fund expansion.

The growing number of colleges and universities offering third party certificates—such as from Google or IBM—to augment student employability is an important trend (see UNC Charlotte). Innovation-oriented consortia are worth watching, including the experiential learning efforts of members of the Coalition for Life Transformative Education and the institutional-edtech company partnerships under the College Innovation Network.

Have I missed a game-changing initiative at your institution? Please let me know.

Verdict: Only marginally right.

My 2022 Prediction #2: “Gainful” Returns—But Will Not Succeed

What Actually Happened? Contrary to my forecast, the Gainful Employment revival—designed to hold colleges accountable for programs with poor labor market outcomes—is still in play, BUT two key things have changed:

- Delay. Details of the restored regulation, originally scheduled for 2022, have been pushed back to 2023 following complaints from college associations about inadequate consultation. What is currently envisaged is that for-profit degree and credit non-degree programs at all schools eligible for federal student aid will be subject to a formula of student debt to earnings, but details are TBD. The earliest a new Gainful Employment regulation would come into force will be July 2024 and the first list of failing programs would not appear until 2027.

- Coverage. In an unexpected and (I think) clever move, the U.S. Department of Education has proposed that only for-profit programs and non-degree programs at all schools will be subject to sanctions but ALL Title IV programs at ALL schools will have to report Gainful Employment data.

The rulemaking delay may mean that my original prediction proves true. With more time, higher education lobbyists may dilute the specifics or even stop the regulation entirely. Colleges may point to the federal College Scorecard, a consumer tool that already encompasses Gainful-type data at the program level across all schools, as negating the need for the proposed Gainful data collection for all schools and programs. But it will be harder to argue—without threat of sanction—that routine publication of program outcomes data is illegitimate or unduly burdensome.

These days, both Democrats and Republicans seem bent on “holding higher education to account” with Democrats focused on alleged predatory practices at for-profits and Republicans viewing Gainful as a “fiscally responsible” alternative to Biden’s student loan forgiveness plan. The College Transparency Act—recently passed by the House and requiring the U.S. Department of Education to beef up student outcomes tracking—may emerge as a Gainful alternative.

On balance, I’d say that Gainful now looks more likely to return—and more likely to impact schools and programs across the board—than seemed credible a year ago.

Verdict: Unclear (delayed).

My 2022 Prediction #3: State OPMs—Other States to Follow North Carolina’s Lead

What Actually Happened: While I am not aware of any “state OPM” (online program management) effort comparable to North Carolina’s Project Kitty Hawk (PKH) announced in 2022, one state made a more tentative move:

- Oklahoma’s legislature established the Oklahoma Education Commission on Online Learning, spanning K12, higher, and technical education. The remit is ambitious—to research infrastructure, professional development, open education resources, and pedagogy—but timing is leisurely: the commission need not report until 2027.

A non-statewide system echo of PKH was CUNY’s announcement in March of $8 million in stimulus funds to create CUNY Online, an online learning design and support infrastructure across the 260,000 student CUNY system.

Why have we not seen more PKH-style initiatives? Perhaps other states are unconvinced that a centralized effort is the right bet, preferring to leave institutions to duke it out, with or without commercial OPM partners. In 2022, two more states (Montana and Nebraska) partnered with Western Governors University (WGU) to expand online capacity, turning to a national online giant rather than investing in online at homegrown schools. WGU is now partnered with ten states. Getting “back to normal”—meaning back to the physical campus—may have pushed online learning down the priority list in many states post-pandemic.

Legislators may see more mileage in funding students rather than infrastructure, such as New Jersey’s 2022 expansion of “free” community college and public four-year study for middle class families and California’s new College Corps scheme which will fund thousands of students to engage in credit-bearing community service designed to lower college costs. New York’s Tuition Assistance Program is to be expanded to part-time students at a cost of $150 million. The New Mexico Opportunity Scholarship, with initial funding of $75 million, will make college tuition-free for many in the state.

Some states this year focused postsecondary policy outside conventional higher education, such as Maryland’s removal of degree requirements from thousands of public sector jobs, Colorado’s investment in noncredit education tracking, and workforce education drives in Connecticut, Texas, and elsewhere.

What is the latest on Project Kitty Hawk? The effort is now proto-operational, with a 50-strong FTE staff composed of internal hires and secondments from third parties, including Accenture, ACUE (the faculty development firm) and Collegis (a kind of OPM). Officials decided that some reliance on outsourcing was key to gathering the necessary expertise and speeding time-to-market.

A detailed plan is now in place projecting that PKH will support almost 30,000 new adult students by FY28 and by then be revenue positive and self-sustaining. But the document acknowledges that the state’s public colleges and universities, while said to be interested in PKH, have yet to make any “firm commitment” on collaboration. The PKH team is organizing “road shows” around the state to drive home why the initiative is a win-win.

It is notable that the plan does not cite any similar initiatives from other states, other than to note past grand online collectives that have ground into the dust. “All eyes are on North Carolina” write the plan’s authors, underlining the uniqueness of Project Kitty Hawk thus far.

Verdict: I was wrong about Project Kitty Hawk sparking imitations elsewhere in the country. But if PKH starts to gain traction, other states will regret that they did not act sooner.

Look out for my 2023 predictions in early January.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Chief Research Officer at Encoura

Contact

This recruitment cycle challenged the creativity of enrollment teams as they were forced to recreate the entire enrollment experience online. The challenge for this spring will be getting proximate to admitted students by replicating new-found practices to increase yield through the summer’s extended enrollment cycle.

By participating in the Eduventures Admitted Student Research, your office will gain actionable insights on:

- Nationwide benchmarks for yield outcomes

- Changes in the decision-making behaviors of incoming freshmen that impact recruiting

- Gaps between how your institution was perceived and your actual institution identity

- Regional and national competitive shifts in the wake of the post-COVID-19 environment

- Competitiveness of your updated financial aid model