Since 2016, well before the pandemic-induced enrollment decline, international enrollment in U.S. colleges and universities had stalled. This plateau, often attributed to divisive rhetoric, public policies, visa restrictions, and heightened competition from other countries, turned into a cliff during COVID-19.

Years 2022 and 2023, however, reveal signs of recovery—even growth above pre-pandemic levels—for some markets. So, which degree market is seeing the biggest rebound?

The Latest Trends

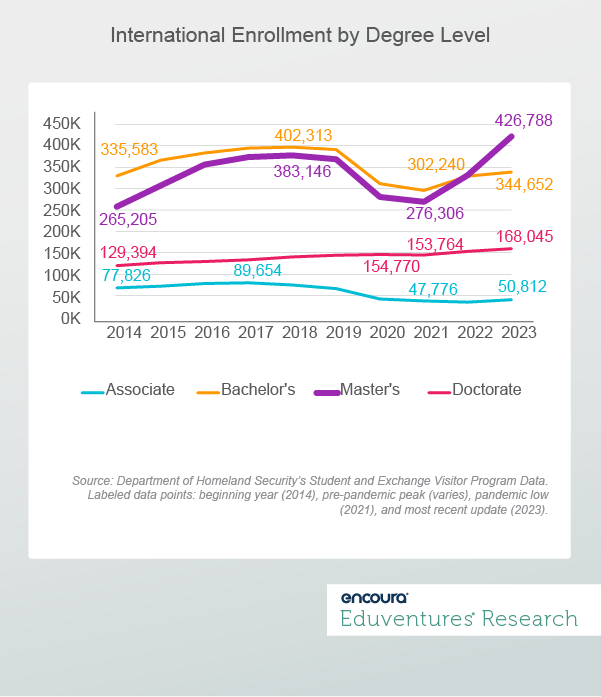

Based on Department of Homeland Security (DHS) data, international enrollment in U.S. colleges and universities experienced significant decline over the pandemic, falling by 22% between 2019-2021. No degree market, save doctorate degrees, was immune to this trend. Over these two years, international enrollment fell across all markets: associate (-38%), bachelor’s (-24%), and master’s (-26%).

But recent trends offer some hope. Between 2021 and 2023, international enrollment at the associate and bachelor’s levels began to rebound from pandemic lows (6% and 14% respectively). In both of these markets, however, enrollment remains below pre-pandemic levels.

On the other hand, international enrollment at the master’s level exploded by 54% between 2021 and 2023, surpassing the pre-pandemic high watermark from 2018.

Figure 1 plots these international enrollment trends.

Figure 1 shows that in 2023, international master’s enrollment surpassed international bachelor’s enrollment.

Looking ahead, Eduventures’ recent 2023 Master’s Market Update report forecasts a stagnating master’s market—a departure from the previous decade that was characterized by double-digit enrollment growth in master’s programs. This forecast predicts a slumping domestic market influenced by reduced growth among key age groups, diminishing signs of an impending recession, and weakening demand among U.S. prospects. For example, the graduate enrollment rate among those ages 25 to 44 has declined from 8.5% in 2013 to 6.5% in 2023.

Given this forecast, the international master’s enrollment rebound is an important development.

Countries of Origin

Where is this growth coming from? The short answer is India.

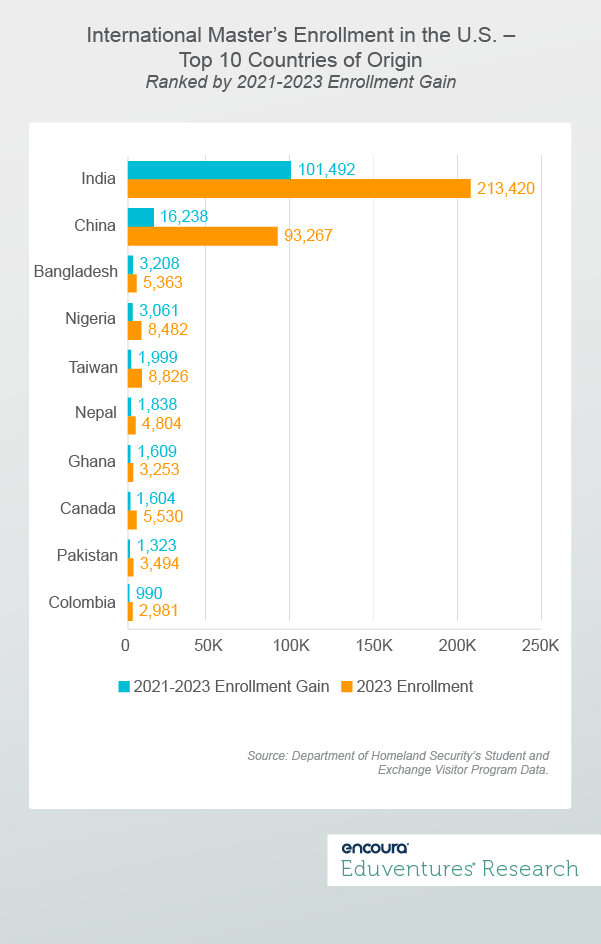

Overall, 2021-2023 saw a net gain of 150,482 international master’s enrollments. India alone claimed 67% of this growth, rising to more than 100,000 enrollments. Figure 2 details the 10 countries of origin responsible for the most growth, plotting 2021-2023 enrollment gains compared to 2023 overall enrollment.

As Figure 2 reveals, the master’s enrollment rebound is quite isolated. Just nine countries of origin saw U.S. master’s enrollment grow by more than 1,000 over the 2021-2023 period. In fact, just one other country aside from India—China—reported growth over 10,000, but even China’s 2023 enrollment share is dwarfed by India’s (at the undergraduate level, China is the biggest market and India ranks second).

In-Demand Programs

Field of study intelligence for international enrollment is hard to come by. DHS data allows for segmentation by STEM vs. Non-STEM classification, but no more granular than that. For reference, 77% of international master’s enrollment was in STEM-aligned programming in 2023—not a major surprise given the 24-month Optional Practical Training (OPT) extension aligned to STEM fields.

But NCES (National Center for Education Statistics) IPEDS degree conferral data offers some insight. Figure 3 provides two perspectives on the top master’s degree markets for international students in the U.S.: one based on the largest markets, which count the most degrees awarded to non-resident students, and another based on the most international-intensive markets which have the highest proportion of non-resident students earning degrees.

The International Master’s Program Market Landscape

| The Largest International Master’s Markets Top 10 | #colspan# | The Most International Master’s Markets Top 10 (at least 500 international conferrals) | #colspan# |

|---|---|---|---|

| Field | 2021 International Conferrals | Field | 2021 International Conferral Ratio |

| Computer Science | 9,914 | Computer/Information Technology Services Administration and Management, Other | 82% |

| Business Administration and Management, General | 9,764 | Computational and Applied Mathematics | 77% |

| Computer and Information Sciences, General | 6,691 | Computer Software Engineering | 72% |

| Management Science | 5,677 | Operations Research | 71% |

| Electrical and Electronics Engineering | 5,037 | Computer Science | 69% |

| Management Sciences and Quantitative Methods, Other | 4,877 | Industrial Engineering | 68% |

| Mechanical Engineering | 2,927 | Computer Engineering, General | 68% |

| Financial Mathematics | 2,706 | Programs for Foreign Lawyers | 66% |

| Information Technology | 2,635 | Financial Mathematics | 65% |

| Information Science/Studies | 2,572 | Business Statistics | |

| #rowspan# | #rowspan# | #rowspan# | 63% |

Figure 3.

Figure 3 confirms the broader view of STEM dominance (recalling that 77% of enrollment is in STEM fields). The top 10 programs in both views consist mostly of technology, engineering, and data-aligned programming. Of note, computer science and financial mathematics appear in both lists.

The Bottom Line

With a tightening domestic master’s market, the significance of international master's enrollment for schools aiming to sustain or expand their programs at this level cannot be overstated. While potential challenges like rising costs, visa restrictions, and unfavorable safety perceptions of the U.S. may dampen future enthusiasm, initial data reveals that international master's enrollment is rebounding in a post-COVID-19 world.

In light of this, schools would be wise to strengthen programming aligned with favorable international market trends and build pipelines in countries seeing strong enrollment gains.

Conversely, at least some of the explosive growth seen over the last two years can be attributed to pent-up demand and delayed enrollment from the pandemic, and perhaps even the political climate in preceding years. The incredible year-over-year gains seen in 2022 and 2023 will likely soften in the future as demand normalizes.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

Encoura Digital Solutions serves as an extension of your enrollment marketing team, boosting your institution’s reputation and visibility with proven digital marketing strategies, to connect you to your best-fit graduate students.