After trying times, international students are once again on the minds of recruiters. With the COVID enrollment dip levelling off, institutions are itching to gain their fair share.

In the fall of 2019, four-year institutions enrolled 70,517 non-resident first-time undergraduates. In 2020, enrollment plunged 24% with the COVID restrictions. By the fall of 2021, however, a strong recovery had commenced with fall enrollment coming in just 5% shy of pre-pandemic levels.

The numbers aren’t yet in for this year. But optimism is growing with 65% of institutions reporting increases in international applications for fall of 2022, according to the Institute of International Education spring 2022 survey.

With all this turmoil, how should we now approach this market?

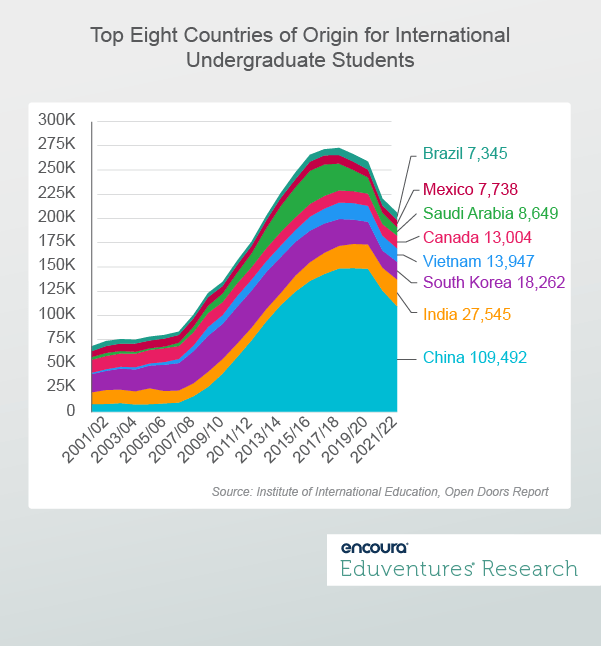

Figure 1 shows undergraduate international enrollment trends for the top eight countries sending students to U.S. institutions of higher education. In the 2021-2022 enrollment cycle, these eight countries accounted for nearly two-thirds (64%) of undergraduate international enrollment.

Notably, even before the pandemic, the political climate in the U.S. had chilled international interest in studying in the U.S. Then came the long cold spell of COVID, which decimated enrollment. In 2021, the top three sending countries were the stalwarts: China, India, and South Korea. But given that enrollment from China has declined precipitously post-COVID, it is worth considering how these other countries contribute to international enrollment on your campus.

Enrollment practices have also changed since 2019, when they were revamped to meet the COVID moment. As enrollment stabilizes post-COVID, one thing has become clear: it is crucial to know your markets to be effective in recruiting. As international markets come back to life, it’s time to rethink your approach to these markets. Principal among considerations is the notion that international markets are not monolithic.

Eduventures’ Prospective Student Research™ gives us the granular insight into international markets needed to mount effective marketing and recruiting campaigns in a diverse set of countries. Let’s look at how students from different geographic areas think about U.S. college enrollment.

International Student Mindsets

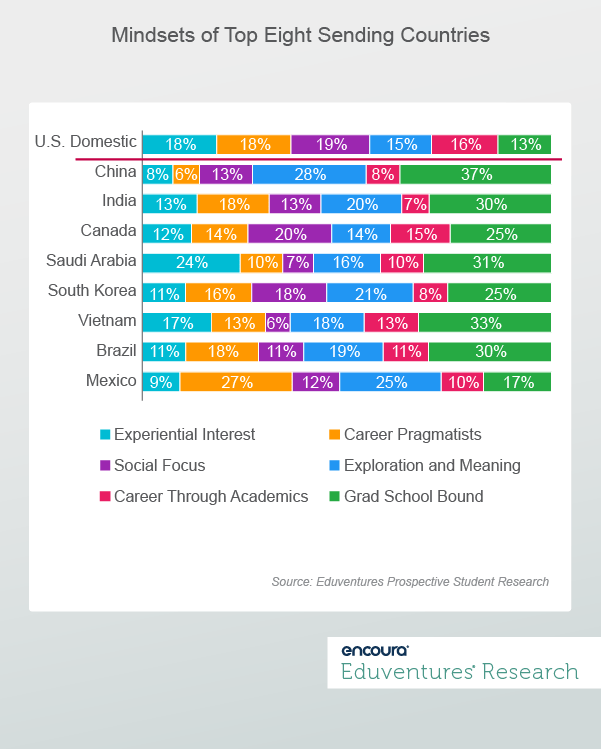

First, in Figure 2, we see how Prospective Student Mindsets™ (Mindsets) from key recruiting countries differ from those of U.S. students.

Principally, we see many more international students in a Grad School Bound mindset, especially students from China (37%). But we would be remiss to say that international students are all focused on graduate school outcomes. Most are not.

For example, 28% of Chinese students are Exploration and Meaning. Saudi Arabia has a high proportion of Experiential Interest students (24%) compared to other regions. Mexico has a high proportion of Career Pragmatist students (27%). The balance of messaging into each of these key countries should therefore be different.

Preferred Majors

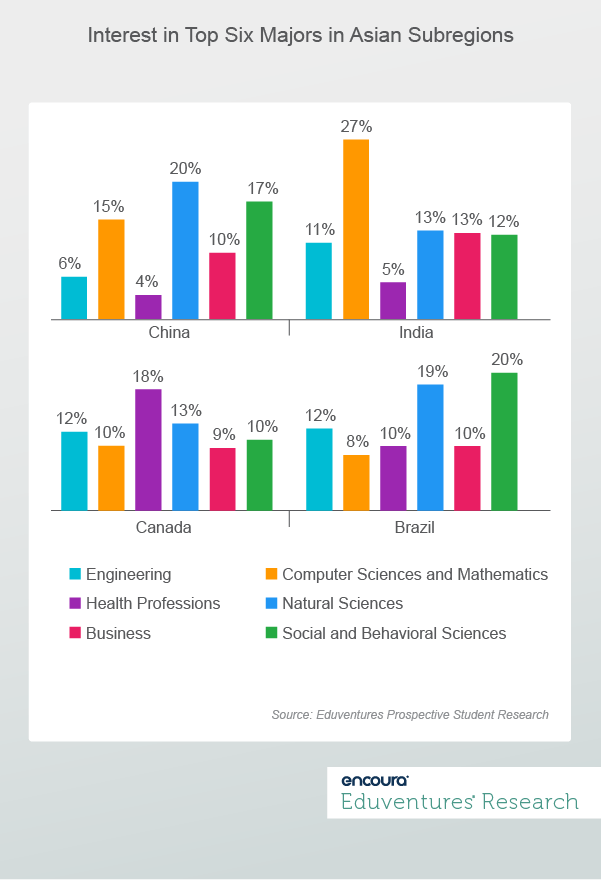

We also know that institutional stories begin with academic majors, which are strongly related to Prospective Student Mindsets. Figure 3 illustrates this by focusing on the demand for six top major areas across four example countries.

Computer sciences and mathematics (27%) dominates interest among Indian students. Chinese students are interested in natural sciences (20%), social and behavioral sciences (17%), and computer sciences and mathematics (15%). Canadian students have the greatest interest in health professions (18%) while Brazilian students gravitate to the social and behavioral sciences (20%) and natural sciences (19%).

Financial Profiles

Finally, cost matters when it comes to paying international tuition. Table 1 shows, for the same four countries, the degree to which students are financially supported by family, and the degree to which they expect merit or need-based financial aid.

Table 1. Financial Support Among International Prospects

Parents/Guardians Will Pay Everything Expect Merit or Need-based Scholarships China 84% 39% India 52% 80% Canada 40% 76% Brazil 36% 91% Source: Eduventures Prospective Student Research

These two metrics—family financial support and the expectation of financial aid—go hand-in-hand. In China, the expectation for parental support is highest and the expectation for scholarship aid is lowest. Conversely in Brazil, the expectation for parental support is lowest and the expectation for scholarship is highest.

In every market, colleges must not only consider the pathways that students see through college alongside the all-important major interest, but they must also consider the degree to which international study is realistic.

In some countries, interest outstrips ability to pay. Cost is the number one barrier to enrolling international students when there is little to no financial aid available. Communications and recruiting efforts must be realistic on the affordability front.

The Bottom Line

The international market is on its way back, but it may never get back to where it was in 2016. Increasing competition means that your international efforts must be distinct from your domestic recruiting efforts, but also fine-tuned by country of origin.

Here are the four most important things you need to know about each international market to take advantage of the opportunity.

- What Mindsets are most prevalent? This determines the way you balance messaging in the market to maximize the relevance of your institutional story.

- What majors are in demand? Lead recruiting efforts with strong messages in the top major areas for that country. Understand the relationships between the majors of interest and the key mindsets evident in the market.

- How much financial support will students have? Family financial support varies widely depending on a student’s country of origin and government sponsorship may be one avenue of financial support. But your enrollment targets must be informed by the realism of financial constraints.

- How big is the potential market? Put your recruiting efforts in context. How big is the opportunity to enroll students from a given country based on a match for mindset, major, and financial support?