More institutions are actively evaluating their adult undergraduate offerings, especially “degree completion” bachelor’s programs geared toward the “some college, no degree” population. These programs typically skip general education courses and offer major coursework only. Using a combination of enrollment and survey data, Eduventures can estimate the size of this market and identify critical insights about these prospects that can put these programs on the right path.

But we’re also seeing a rise in the number of large online providers offering a full program. Given this dynamic, does it still make sense to launch more typical “degree completion” bachelor’s programs?

Degree completion programs are attractive options for both students and institutions. Students with associate degrees can start major coursework right away, often by using articulation agreements between their community or technical colleges and a four-year institution. Institutions, then, do not need to offer general education coursework for these adult, often online, students, alleviating the messiness of transfer credit evaluations, which can be challenging all around.

But the market is in flux. There was a 2.4% decline in all bachelor’s degree conferrals between 2021 and 2022, while conferrals of those aged 25 and over declined by 10%. The associate degree market has seen ups and downs in conferrals over time (+/-3% growth year-over-year), however, there have been over 1 million associate degree conferrals per year over the past decade.

With all these associate degree completers per year, it makes sense to look at degree completion programs. But how many of these associate degree holders go on to pursue a degree completion bachelor’s degree?

Degree Completion Market Size

National Student Clearinghouse (NSC) indicates that almost 2 million people completed a bachelor’s degree in 2023. About one fourth of those who completed a bachelor’s degree had already earned a prior credential, such as an associate degree, certificate, or bachelor’s degree.

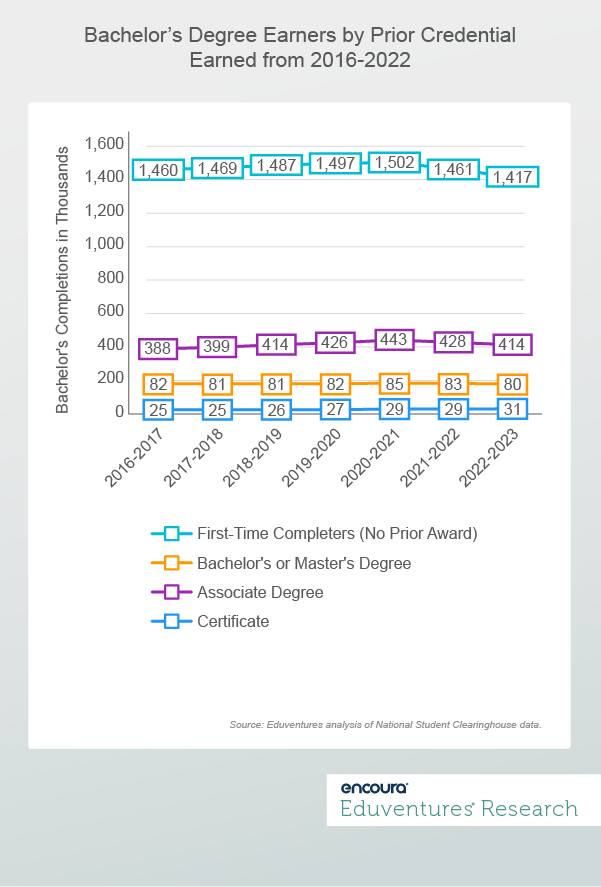

Figure 1 shows that first-time bachelor’s completers have declined to a 10-year low in 2023 with 1,417,000 completers.

Figure 1

There were 414,000 bachelor’s degree completers that previously had earned an associate degree in 2022-2023. This total grew 7% from 2016-2017 but is down from 2020-2022. Another 111,000 bachelor’s degree completers had earned a certificate, bachelor’s, or master’s degree.

This associate-to-bachelor completion data includes both traditional-aged transfer students and adult degree completion students. Based on National Student Clearinghouse (NSC) and IPEDS data, Eduventures estimates there to be between 300,000 and 400,000 annual new students enrolled in degree completion programs nationally. This estimate is accounting for data showing that only half of all transfer students earn a bachelor’s degree.

Still a sizable market, but what do we know about the preferences of associate degree holders? The Eduventures Adult Prospect Research™ provides some answers. About 54% of them want to earn a bachelor’s degree as their next credential. Here are some other key characteristics of these “degree completion” prospects:

- A majority earned their associate degree fully on campus (44%) or in a hybrid modality (43%). They are less likely to want their next program on campus (14%), and more likely to want a hybrid modality (61%). These prospects desire flexibility, like many adult undergraduate prospects, because they are working full time.

- Overwhelmingly, they prefer to attend an in-state public college or university (72%). This matches community college articulation agreements with in-state public schools and their preference for low cost.

- They are most interested in business (25%), health professions (13%), computer science/technology (9%), and psychology (6%). These academic interests are aligned with the associate degrees they earned.

Flexibility, low cost, and career-alignment—as with adult prospects generally—are common themes. Further understanding the characteristics and preferences of regional degree completion prospects can allow institutions to improve communication, program positioning, and targeting of this sometimes elusive group. But challenges remain in this market, particularly when competing with fully online programs that offer the flexibility prospects are looking for. How are some of the most successful schools doing it?

Looming Online Giants

While there is no data to ascertain institutional enrollment for “degree completion” programs, evidence suggests that large-scale, online, undergraduate-serving institutions may be enrolling more than their fair share of students. Four of the five largest undergraduate enrolling institutions—SNHU, Western Governors, ASU, and Grand Canyon—grew total undergraduate students by over 75,000 from 2019 to fall 2022 (representing 18% of all four-year online undergraduate growth).

These schools offer all courses online and therefore do not actively promote “degree completion” programs. Instead, they promote the ease of the transfer process. These schools are likely to attract degree completer prospects just by being highly visible in the market, especially with competitive pricing aligned to that of in-state public institutions.

The Bottom Line

In the context of the current market, should your institution consider launching a new degree completion program? It depends.

Success will be highly specific to institution type and other factors. For example, public institutions are the primary preference for these prospects because of existing articulation agreements and preferences for affordability.

Degree completion prospects are elusive and hard to attract into the top of the funnel, often confounding marketing teams. When they do enter the pipeline, they expect a smooth admission (and transfer-credit) process. Institutions need to remember they are also competing with highly-resourced and student-focused institutions that have streamlined the admission and enrollment processes—some are promising admission decisions and transfer-credit evaluations within days of completing an application.

Ultimately, the days of launching a “degree completion” bachelor’s program and expecting students to navigate your institution’s enrollment process on their own are gone. To succeed in this market, schools need a comprehensive adult and online undergraduate strategy that includes program offerings aligned to regional needs, competitive two-year college articulation agreements, effective program positioning and targeting, and a streamlined student journey with proactive communication.