Let’s start by acknowledging that the title of this Wake-Up Call is a bit of an overstatement. Far from “dead,” the online program management (OPM) market appears to be going strong.

Past Eduventures research reports have defined this market largely based on market share, separating the “Big Five,” from the “Middle Market,” from the “Niche Players.” But much has changed since 2015. While traditional players still largely define the space, new developments call for a new way of understanding this space.

Recent Eduventures’ analysis suggests that schools that partnered with OPM providers between 2012 and 2016 experienced greater enrollment growth than those that did not. Despite these gains, however, the OPM market continues to suffer from imprecise measurements and definitions.

A grievance filed by the faculty union at Eastern Michigan University (EMU) illustrates some of these tensions. The faculty there objected to the more than 50% revenue share EMU paid to Academic Partnerships for managing its online programs. Despite widespread and vocal protests from the faculty senate, an independent arbitrator sided with the school’s administration, arguing that there is no basis for faculty “input” regarding the marketing, enrollment, and course production services provided by the OPM.

This stand-off at EMU—part of a pattern seen at other schools over time—speaks to some challenges with the conventional OPM model, but the industry has already adapted. As we looked afresh at OPMs, we began by asking what exactly constitutes an OPM?

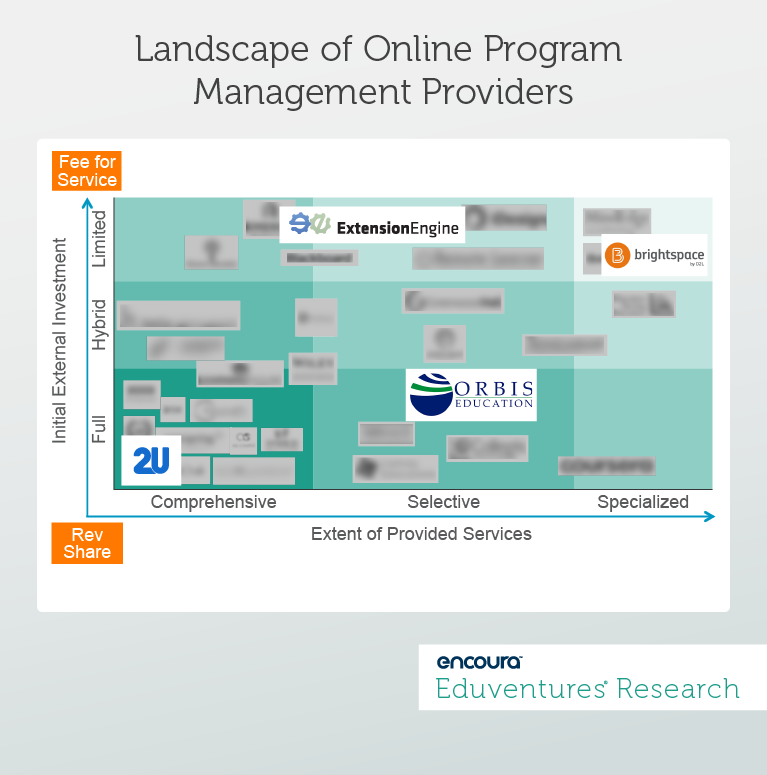

In a new report, Expanding the OPM Definition, Eduventures used two core dimensions to better capture today’s OPM market: the level and type of services provided, and the extent of the company’s upfront investment in online programs (Figure 1). It also includes a 2016 OPM market sizing as well as forecasts for 2018 and 2020.

Services Dimension

To reflect the full menu of services offered by today’s OPM companies, we grouped them across three categories: comprehensive (encompassing classic, end-to-end service providers like 2U and Pearson Embanet); selective (those with a focus on a particular content vertical or set of services like Orbis Education or Extension Engine); and specialized (those focused on a specific learning modality like competency-based education such as Meteor Learning).Investment Dimension

Similarly, we charted each provider based its level of upfront investment, from a “full” upfront investment and revenue share model, to all or mostly fee-for-service with little to no upfront investment, or “limited” model, and everything in between. The spread on these dimensions illustrates both the staying power of the classic OPM model, which many providers and institutions remain happy with, and company efforts to acknowledge faculty and leadership reticence. For some schools, the online market may be too crowded to justify major commercial investment and substantial revenue share. Online learning is mainstream at many institutions today, making schools more self-sufficient than in the past. The accommodation of fee-for-service, shorter contracts, narrower offerings and more client flexibility is an evolution, not a rejection, of the OPM model. Here’s a short list of what to expect in the OPM marketplace during 2018 and beyond:- Raising the Bar. As the online market gets more competitive and crowded and the gap between school and standard OPM capabilities decreases, firms will need to work harder. This will prompt OPMs to be that much more selective about which schools they work with and retain.

- Merger, acquisition, and partnership activity will increase. Moves by 2U and Learning House to acquire other OPMs or non-degree providers will be imitated. International expansion will also increase as firms seek growth outside the U.S. Case in point, 2U just announced its first international partner, University College London, in the United Kingdom.

- More outsourcing alongside in-house capabilities. Selective and specialized OPM providers will find new ways to collaborate with school-based teams, minimizing the “us” versus “them” mentality. This will help ease and avoid EMU-style stand-offs.

- Demand for exclusively online degrees will continue to flatten. Online enrollment growth won’t go on forever, dampening school incentives to work with a traditional OPM.

- History doesn’t always repeat, but often echoes. The next economic downturn will spur more students to return to school. The more flexible and nimble OPMs will win market share when the next recession hits.