The student loan news wheel is turning fast! The U.S. Department of Education recently announced changes to their loan forgiveness program following news that Navient will stop servicing federal student loans amid increasing government and consumer scrutiny. This makes it the third lender to exit the student loan industry in 2021.

But the student loan business is not just unpopular among lenders. Today, nearly 15 million Millennials carry an average student loan balance of $38,900, according to Education Data Initiative, delaying home ownership to an average age of 35 compared to age 25 for Baby Boomers. Meanwhile, Gen Z has been watching.

What do we know about the current generation’s willingness to take on debt for post-secondary education?

A Generation of Realists

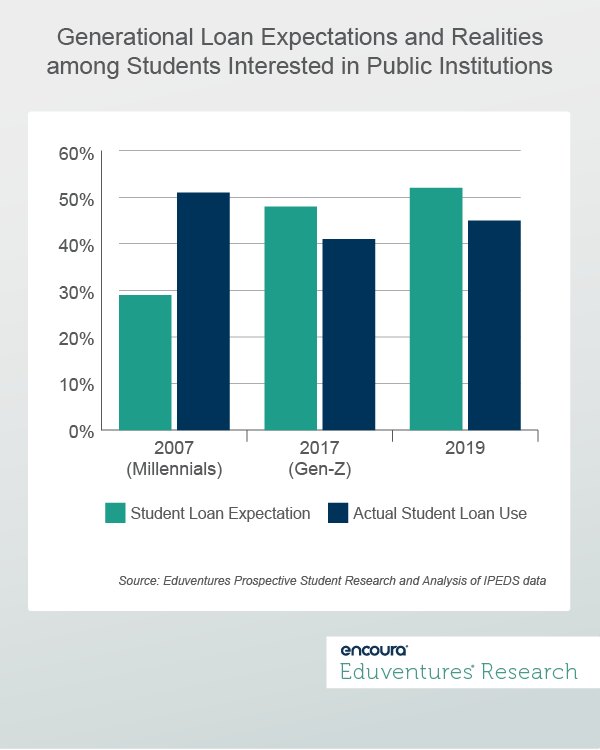

Compared to the Millennial generation, our data has long indicated that Gen Z is more realistic about the necessity of student loans. Figure 1 shows the proportion of prospective students who believed they would finance at least part of their college educations with student loans in contrast to the actual percentage of student loans awarded. We show these data points for three points in time: 2007, a key Millennial enrollment year; 2017, a key Gen Z enrollment year a decade later; and 2019, the most recent year for which financial aid data is made available.

In 2007, less than a third of Millennials (29%) who were most interested in attending a public institution anticipated they would take out a student loan, but more than half (51%) ultimately did so. Interestingly, Figure 1 shows that the actual student loan use declined a decade later to 41%. At the same time, it also shows that many more Gen Z students (48%) believed they would need student loans.

Who are these students who expect to take out student loans? Demographically, students with loan expectations are more often white and from middle-income households. This may indicate that while students from lower income households may hold out for need-based aid and those from high-income households likely have family assistance, the college experience may be out of reach for many middle-income students if not for student loan debt.

It certainly seems that overall, . This should bring hope to any institution with a high price tag and good value proposition: today’s students don’t seem to shy away from debt if they see value. But will this pattern hold up in the pandemic era? Maybe not.

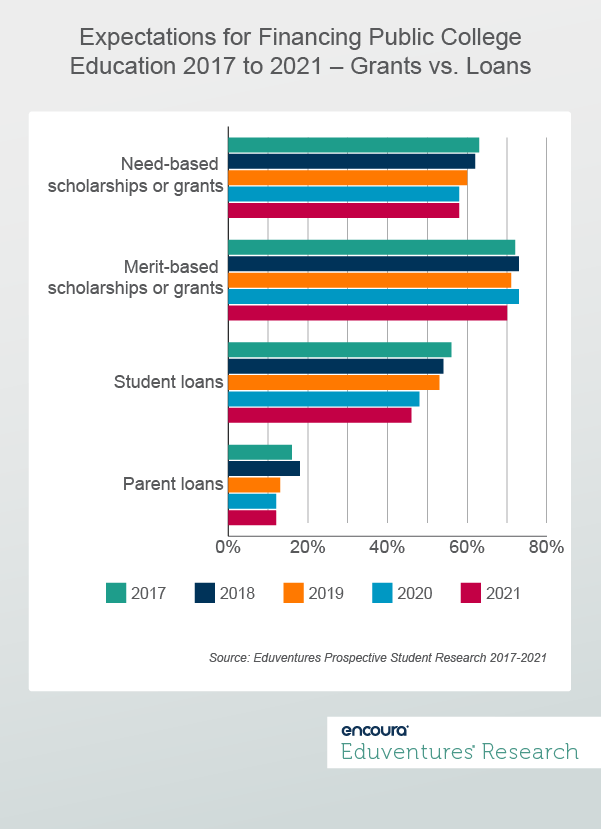

Based on data from our annual Prospective Student Survey™, Figure 2 shows the progression of student expectations between 2017 and 2021 for four types of college financing: need-based scholarships or grants, merit-based scholarships or grants, student loans, and parent loans.

Here, we see that the vast majority of students—70% or more—expect to receive merit aid and that this expectation has not changed significantly over the past five years. Additionally, the expectation for scholarships, either merit or need-based, is greater than the expectation for student loans. And very few students expect that their parents will take out loans on their behalf.

But more notably, we can see a clear “pandemic dip” in student expectations—or willingness for that matter—of taking out student loans. From 2019 to 2020, marking the early phases of the pandemic, the proportion of students who believed they would take out student loans dropped five percentage points, from 53% to 48%. Over the five-year span shown in Figure 2, the expectation for student loans dropped by a total of 10 percentage points, indicating that the pandemic did not initiate this decline, but rather exacerbated it.

In essence, while prospects are becoming less willing to take on debt for education, they continue to expect merit aid to fill in the financial gaps. The reality of student aid statistics seems to agree with their notion – to a degree. The National Center for Education Statistics (NCES) reports that the proportion of all first-time, full-time undergraduates who received institutional grants has increased by 16% over the past 10 years while the proportion of students who took on student loans has decreased by 10% during the same timeframe.

But the proportion of undergraduates who received any type of institutional grant aid – merit or need-based – in the latest reported academic year (2019-2020) was 49% and therefore far off the hopeful expectations of 73% of our sample. For most institutions—and students—swapping student loans for grant aid is not a realistic trade off and could potentially risk enrollments at many schools. What should they do?

The Bottom Line

With increasing sticker prices and decreasing expectations for student loans, one might paint the tail end of Gen Z as less realistic than their older peers. But this view could lead them down a perilous road at a time when the cost and value of higher education is so heavily scrutinized.

Instead, institutions should reconsider how they talk about cost and offer tangible solutions to the affordability problem to students and their families.

Some institutions have tried to solve the affordability problem by lowering their sticker prices, with mixed execution and results. Others reprioritize their financial aid allocations to benefit the students with the highest sensitivity to student loan debt or, alternatively, their most crucial student segments. Another solution may be to reframe the student loan conversation. Guaranteed tuition pricing, guaranteed employment, income-based repayment, and financial counseling offered to graduates may help shift the perception of student loans from “bad debt” to an investment into one’s future.

If Gen Z student loan expectations are sliding backward, the conversation about higher education affordability and—more importantly—value has changed for the current generation and, likely, those that follow. Attitudes toward student loans are just a small aspect of the complex topic of affordability. Finding solutions to solve the affordability problem will be no easy puzzle to solve, but it is critically important.

In reaching for answers, it is also important to remember that while student expectations for college financing may be easily shrugged off as unrealistic, their ultimate financial decisions are not made in a vacuum. College—and how to pay for it—is often a family decision. We look forward to delivering the results of our Prospective Parent Survey, which will provide much-needed insight into the current calculus, in 2022.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

Tuesday, November 9, 2021

Colleges and universities seeking to improve the effectiveness of their transfer student marketing intuitively know that not all transfer students are the same. To be successful, enrollment offices must use a persona-based approach to recruit transfer students.

The most recent Eduventures Transfer Student Research reveals the six distinct types of transfer students every admissions office should be well-acquainted with. Join Eduventures Senior Analyst Johanna Trovato as she breaks down the latest findings into practical insights you can immediately apply to your transfer student marketing strategy.

- Who are the six Transfer Student Types?

- What motivates them?

- When does each Type consider transferring schools?

- What are each Type’s top college search sources?

Enrollment offices can use these findings to make more informed decisions about their transfer student marketing strategies, ultimately helping them best support and engage each Type of transfer student along their education journeys.

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values, so you can create a productive and distinctive program portfolio.