It’s all over the higher education news cycle: institutions are rapidly moving forward on revamped pricing strategies. The COVID-19 crisis and ensuing economic calamity have pushed the question about the viability of tuition price resets right to the top of the priority list. Now more than ever, it seems as if financially strapped students and their families should truly desire lower-priced options. But will they?

While institutions that serve first-time, traditional-aged students are making decisions quickly these days, they are right to slow down and question the wisdom of tuition price resets. It may seem like a grand idea, but according to our analysis, the reality is: it depends.

What happens to institutions who reset?

Historical analysis provides some guidance on how schools perform after a reset, but keep in mind that we are also entering ahistorical times.

We compiled 10 years of tuition data from the National Center for Education Statistics (NCES) in order to explore this question. Our analysis identified all private not-for-profit institutions that decreased listed tuition and fees by more than 3% in any year between 2009 and 2017. We then followed key enrollment metrics, including application volume, yield, first-time enrollments, discount rates, and further changes in listed tuition and fees, in the ensuing five years after the initial decrease.

The data showed that significant price changes were the exception and made by a rare breed of institution. Just 57 private not-for profit institutions made a tuition decrease of this kind during this time period. These institutions were generally small, with an average first-time enrollment of 265 in the year prior to the price change.

Some schools made bolder moves than others, though. Roughly half decreased listed tuition and fees by 18% or more, the other half by 17% or less. Did these different pricing strategies make a difference to the metrics in the following years?

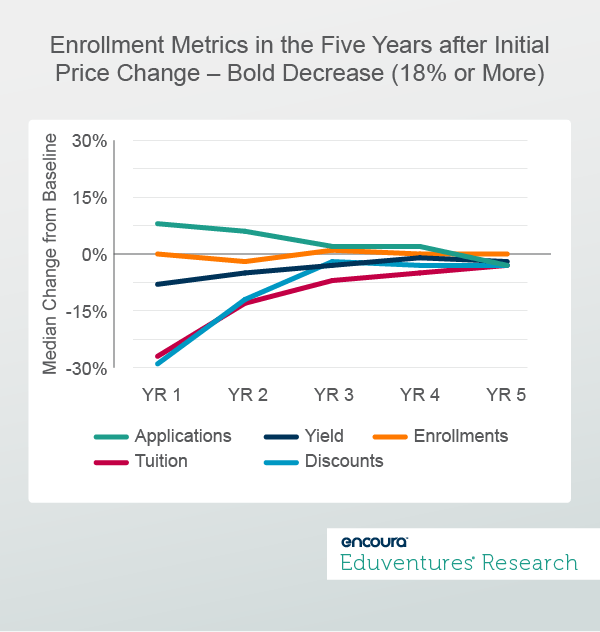

Figure 1 shows what happened to the enrollment metrics for those institutions that made bigger decreases (18% or more): the very definition of regression to the mean.

In the year prior to their tuition price resets, these institutions had median listed tuition and fees of $23,000, a median application volume of 875 students, and a median enrollment of 146 students. After the price reset, they saw an initial bump in applications that returned to the baseline after five years. They saw an initial drop in discount rates that climbed back and sustained a new low just below the baseline after five years. Yield saw an initial dip, but stabilized after five years. Enrollments stayed steady throughout.

This indicates that if you are looking for a stabilized discount rate, a substantial drop in tuition might do the trick. It also indicates that there may be no panacea for enrollment.

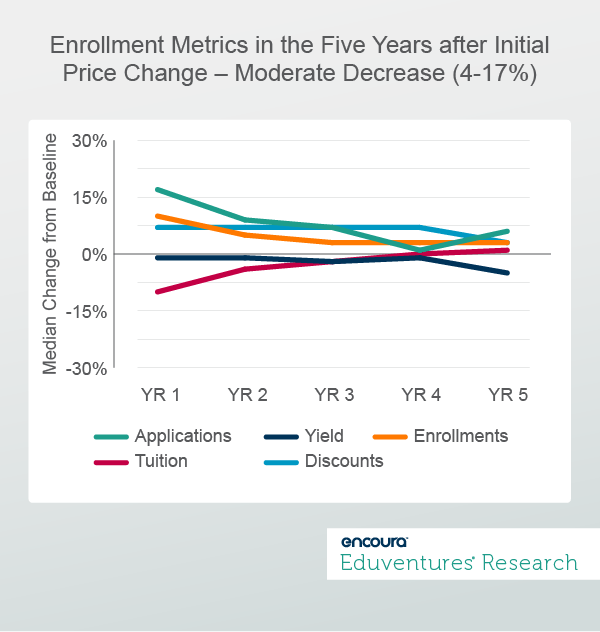

Figure 2 shows what happened to the half of institutions that made more moderate changes (decrease of 4%-17%) to listed tuition and fees.

In the year prior to their price decreases, these institutions had median listed tuition and fees just shy of $17,000, a median application volume of 486 students, and a median enrollment of 151 students. For these institutions that made smaller commitments to listed price reductions, the results were quite different. These schools saw sustained application and enrollment growth, but they also saw sustained growth in their discount rates. Their tuition and fees not only returned to the baseline rate, but rose above the initial level after five years.

At this point you might be wondering, what was the strategic purpose behind these different pricing decisions and how were they supported?

When looking at medians, it is important to keep in mind that there are many individual stories to tell behind the data. In this case, some institutions set out to stabilize or grow headcount and others sought to stabilize net revenue. Some had successful implementations of pricing strategy, while others did not.

In either case, these overall metrics reveal only a slice of the whole story. Individual institutions can have enormously divergent results depending on their strategies, implementations, and market conditions—a topic covered in our forthcoming report on this subject.

Are these the right market conditions for tuition price resets?

On the face of it, students and families are under more economic duress than ever and the cost of higher education is more out of reach than ever. So why not drop the sticker price in order to counteract the declining enrollments some are anticipating in the private sector?

Our advice is: not so fast. It’s advisable to remember that all pricing changes must be strategic – both in good economic times and in bad. That is, a change in price must have a rationale. It must be accompanied by a fundamental improvement or realignment of the educational offering in the market. And it must be delivered with a comprehensive marketing and communications plan. Otherwise, it’s a meaningless signal in the market.

The Bottom Line

Before you seriously consider resetting your tuition, here are three conditions that must be met:

- Your students are highly sensitive to affordability.

- Your institution is seeing declining enrollments and/or increasing discount rates.

- You are reinventing your educational offerings to bring greater value to students.

The current crisis provides ample reason to realign and reposition educational offerings to provide students the most relevant educations for the future. If your institution can articulate and deliver a differentiated, developmentally appropriate, “new traditional” education for Generation Z, then now might be the time to reset your price.

If not, then a price change might be a lost signal in a lot of noise. You may end up with an initial burst of success followed by a regression to the mean. But if you can demonstrate both a different value and a different price, you might be one of the institutions that breaks that pattern.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at Encoura

Contact

We understand the incredible challenges that COVID-19 has caused for each of you, your institutions, and most importantly, your students. We are committed to being a trusted resource for all of our members and providing institutions with timely insight to better support your evolving needs.

In addition to our weekly Wake Up Call, we seek to provide timely and relevant answers to real-world questions that institutions are now facing in light of COVID-19. These Snapshots will cover a broad range of questions that our team has received over the last several weeks. You’ll find concise and pragmatic advice around traditional student demand, program innovation, and adult learner demand.

Thursday, February 20, 2020 at 2PM ET/1PM CT

Research on your admitted students can provide enrollment leaders insight into why students enrolled in their institution -- and perhaps more importantly, why they didn’t -- but without benchmarks, an institution can only understand its result in isolation.

Inevitably, an institution is compelled to ask: How does its admitted student metrics look in comparison to other institutions in its category. Using data from the Survey of Admitted Students™, our latest benchmark report outlines the nine key benchmarks that every college and university can use to inform recruitment, yield, and institutional identity.

In this webinar, Eduventures Principal Analyst Kim Reid will identify key strategic questions every enrollment leader should be asking to measure up the institution’s yield performance and how to take specific action to improve your class.