Following changes in the higher education technology market means more than tracking the relative market share of different vendors. At a deeper level, technology trends can also reveal which solutions will disrupt institutional models or produce better outcomes.

To this end, we have evolved the approach to our Higher Education Technology Landscape (Landscape)—by categorizing hundreds of products into specific market segments. Since 2014, we have found that the Landscape has indeed transformed, for many reasons.

?Our 2016 report, for example, featured four solution categories—Admissions & Enrollment Management, Advancement, College-Wide/IT Enterprise Backbone, and Student Success & Instruction—comprising 518 entries (products and services). Our 2019 Higher Education Technology Landscape (Landscape) featured the same four categories of products but included 423 products, a 22% reduction.

And there are other questions we could ask about the Landscape. What about more granular changes, such as which individual Landscape segments, like learning management systems, have grown or decreased? Which products featured in the Landscape have moved over time to different segments or across more than one segment? What does this volatility tell us about the state of the higher education market?

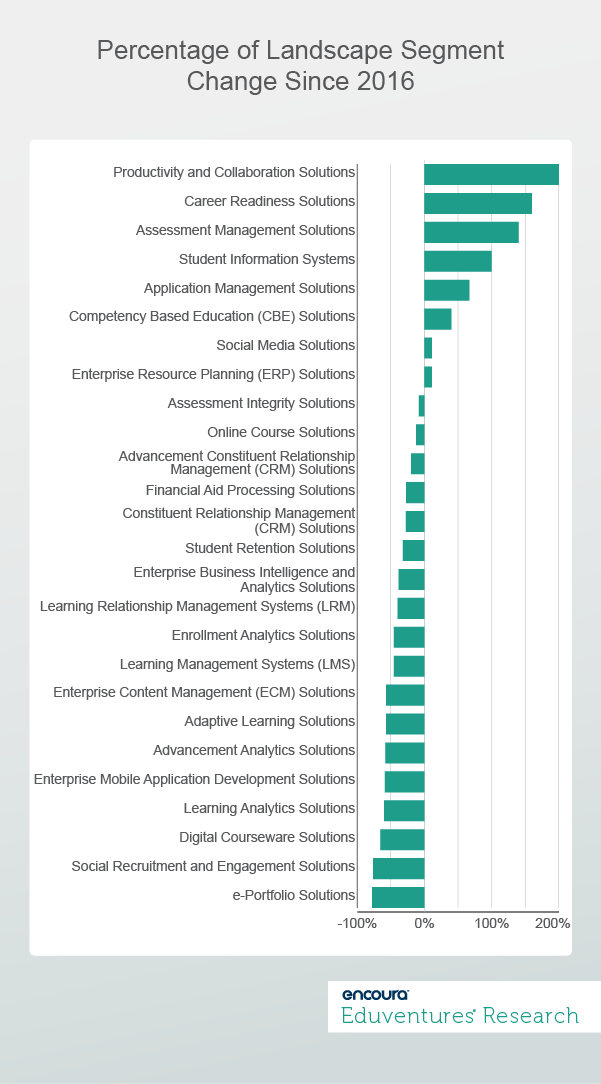

Figure 1 shows the segments that changed since 2016. As shown in the figure, some segments—Productivity and Collaboration and Career Readiness Solutions, for example—have had the highest increase in the number of products in our Landscape. Likewise, other segments—Social Recruitment and Engagement Solutions and e-Portfolio Solutions, for example—experienced the greatest decrease.

Our analysis shows three main drivers of these technology trends:

1. Market Changes

These undoubtedly reflect actual changes in the market environment. Career Readiness Solutions, for example, has increased by 62% since 2018 because we included products offered by vendors such as Wisr, Handshake, and WayUp that have disrupted the career readiness space. Likewise, Advancement Analytics has decreased by over 50% since 2016 because of larger constituent relationship management systems acquiring individual standalone analytics solutions, such as Blackbaud's acquisition of Reeher.

2. Tightened Definitions

Not all change is due to market forces, however. Over time, we have also become more rigorous in how we define segments, classifying products based on whether they perform the core functions that any product in a segment must provide. As these definitions have tightened, the number of included products in the Landscape has decreased. From 2016 to 2017, for example, the Landscape decreased by just under 20%. The bulk of the decreases occurred in the Learning Analytics Solutions, Advancement Analytics Solutions, Enterprise Business Intelligence, and Analytics Solutions segments because some of these products did not meet our refined definition of analytics solutions.

3. Focus on Products, not Services

In 2018, we focused on including products rather than services in our Landscape. For clarity, one could understand the difference this way: a hammer is a product, but carpentry, although it involves the use of a hammer, is a service that delivers value to end users. While the overall number of products in the Landscape remained at 417 in 2018, some segments, such as Digital Courseware Solutions, Social Recruitment and Engagement Solutions, and Financial Aid Processing Solutions decreased between 40% and 50% because we excluded services in 2018.

The Bottom Line

This analysis provides a first step toward understanding the evolution of both our Landscape and the technology behind it. It also raises questions. For example, which Landscape changes mirror the market itself versus our updated inclusion methodology? Are technology trends occurring because of the competitive environment within segments or because of a change in how institutions view products in these segments?

Going forward, our analysis will dive more into these technology trends, concentrating on two key areas:

- Identifying true causes of change: While recognizing that our inclusion methodology will adapt over time, we will dive more into which Landscape changes result from actual changes in the market, such as introducing new technologies—machine learning, for example—or new demand for features like predictive analytics.

- Providing detail on movements within the Landscape: Over time, we may change how we classify a product or include it within a segment. Our future work will provide more detail on these movements, paying careful attention to whether the classification change was because of a shift in product functionality or a change in our methodology.

Stay tuned for these developments, and for our upcoming 2020 Higher Education Technology Landscape this summer.

Never

Miss Your

Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at ACT | NRCCUA

Contact

Thursday, March 26, 2020 at 2PM ET/1PM CT

Eduventures’ Adult Prospect Research Report™ suggests that the attainment of postsecondary credentials is far less of an accelerator of social and economic mobility than previously assumed. Postsecondary education has long been thought of as an engine of career advancement and upward social mobility. Much of this narrative is true: increased earnings and expanded job opportunities are often the result of postsecondary education. This latest research reveals that the challenge may be about a student’s access to postsecondary capital: an accumulation of economic capacity, personal confidence, and academic competence.

Eduventures Principal Analyst Howard Lurie will explore how postsecondary capital affects adult learner decision making about whether to continue their educations, and the implications these trends may have for postsecondary institutions.