Generation Z (Gen Z) gets college costs in a way that Millennials just didn’t. When they were college-bound, Millennials dutifully took on student loans in a time of escalating tuition costs, leaving many with crushing student debt.

Gen Z has taken that hard lesson on board. They’ve learned from their older peers. Colleges and universities have become more transparent about cost and financing, and families also discuss the cost of college much more than they did before.

This newfound consumer savvy means that institutions have to further shift their approach to affordability for Gen Z, in both their communications and delivery. To truly “future-proof” affordability, they must get beyond net price and how to pay and offer students what we call “lifecycle affordability.”

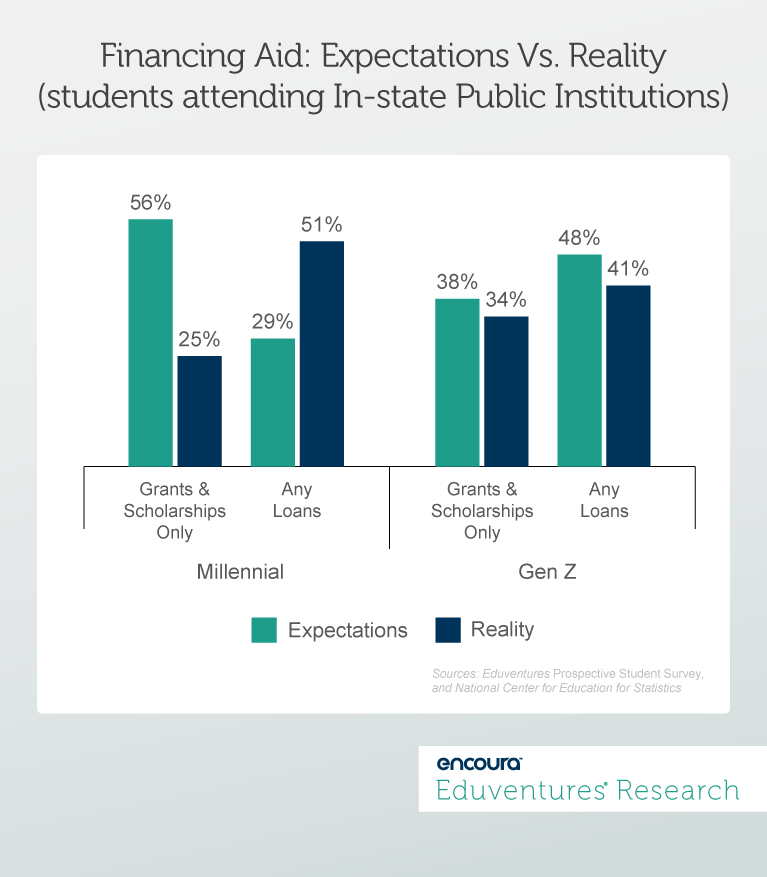

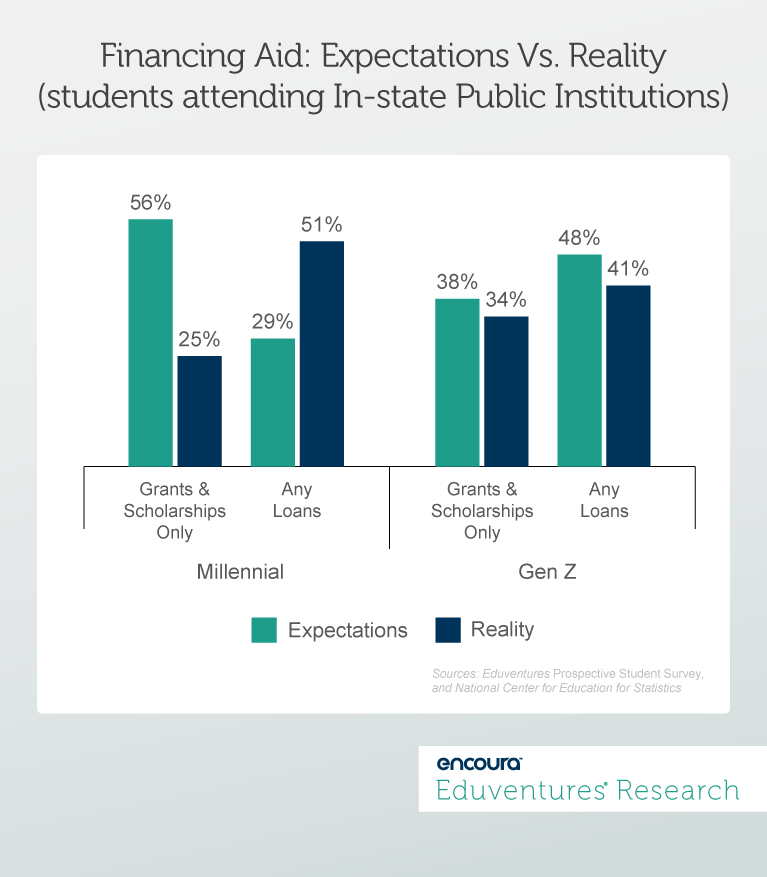

Eduventures Prospective Student Survey provides a look back at student expectations vs. reality for financial aid packages. In the chart below, we examine what sources of financial aid did students expect to receive to finance their college education vs. what sources of aid did they actually receive at that time (as indicated by National Center for Education Statistics Data)?

In 2007, in the good economic times prior to the great recession, more than double the number of Millennials expected to receive grants and scholarships compared to the number who actually received them. Vice versa for loans. Then a bruising decade of economic turmoil affected the way families perceive the value of higher education. Now in a time of accelerating economic growth, Gen Z is far more grounded in the reality of financial aid.

Each of these generations saw rising tuition costs. In the decade prior to 2007, Millennials interested in in-state public education saw a 19% increase in listed tuition and fees; in the decade prior to 2018, Gen Z students interested in in-state public education saw a 14% increase (all in 2018 constant dollars).

For illustrative purposes, we are focusing on students who are interested in attending in-state public institutions. The trends shown here apply equally to those attending institutions with more expensive price tags.

Fundamentally, this means that Gen Z students, whom we regard as debt averse, savers, compromisers, and pragmatists, are savvy shoppers in comparison to the prior generation. What does this mean for institutions working to ensure an affordable path to and through college for these students?

Each of these generations saw rising tuition costs. In the decade prior to 2007, Millennials interested in in-state public education saw a 19% increase in listed tuition and fees; in the decade prior to 2018, Gen Z students interested in in-state public education saw a 14% increase (all in 2018 constant dollars).

For illustrative purposes, we are focusing on students who are interested in attending in-state public institutions. The trends shown here apply equally to those attending institutions with more expensive price tags.

Fundamentally, this means that Gen Z students, whom we regard as debt averse, savers, compromisers, and pragmatists, are savvy shoppers in comparison to the prior generation. What does this mean for institutions working to ensure an affordable path to and through college for these students?

Each of these generations saw rising tuition costs. In the decade prior to 2007, Millennials interested in in-state public education saw a 19% increase in listed tuition and fees; in the decade prior to 2018, Gen Z students interested in in-state public education saw a 14% increase (all in 2018 constant dollars).

For illustrative purposes, we are focusing on students who are interested in attending in-state public institutions. The trends shown here apply equally to those attending institutions with more expensive price tags.

Fundamentally, this means that Gen Z students, whom we regard as debt averse, savers, compromisers, and pragmatists, are savvy shoppers in comparison to the prior generation. What does this mean for institutions working to ensure an affordable path to and through college for these students?

Each of these generations saw rising tuition costs. In the decade prior to 2007, Millennials interested in in-state public education saw a 19% increase in listed tuition and fees; in the decade prior to 2018, Gen Z students interested in in-state public education saw a 14% increase (all in 2018 constant dollars).

For illustrative purposes, we are focusing on students who are interested in attending in-state public institutions. The trends shown here apply equally to those attending institutions with more expensive price tags.

Fundamentally, this means that Gen Z students, whom we regard as debt averse, savers, compromisers, and pragmatists, are savvy shoppers in comparison to the prior generation. What does this mean for institutions working to ensure an affordable path to and through college for these students?

Take the Long View on Affordability

Gen Z students take the long-view on affordability and so should your institution. Analysis of Eduventures Survey of Admitted Students shows that in students’ final enrollment decisions, the brand perception of affordability outweighs the actual net costs. That is to say, when it comes down to selecting between the final two institutions under consideration, the dollar amount of the financial aid package doesn’t mean as much as student perceptions about longer term perceptions of affordability and value. Brand perception of affordability vastly outweighs net cost for students attending in-state public institutions (11:1). However, even at high-cost, out-of-state institutions, both private and public, the brand perception outweighs net cost 2:1 in the decision. So, think beyond net cost and consider how the entirety of affordability might play out in the minds of students considering your institution.Answer These Four Questions for Gen Z

1. Can I afford to choose this school right now?

Of course, students will look at the net cost and financial aid package your institution offers and ask whether they can even afford to make the deposit and choose to attend. It’s just the start, though. Thus, financial aid strategies remain a critical but limited part of your overall affordability strategy.2. Can I afford the cost of attending over time?

Gen Z students will also consider whether or not they will be able to support tuition payments for the duration of their enrollment, whether they will be able to pay for housing, books, or even eat. Institutions should develop strategies to allay fears or concerns about affordability during enrollment. These would include things like tuition or financial aid guarantees that make payments manageable for families. Institutions should also understand what administrative factors influence students’ cost to enroll and what causes stop-outs related to financial stress. Additionally, institutions should provide resources for students who need food assistance or other small grants to continue enrollment due to unforeseen circumstances. At the time of enrollment, students should know that these services and financial counseling will be available to them.3. Can I afford the long-term debt?

Gen Z will ask whether the debt they expect at graduation will impede their ability to live the life they desire. Will they be able to pay off their student loans? Will it prevent them from travelling? Getting married? Buying a house? Starting a business? Or pursuing any other such dream? Institutions should respond to these questions by first trying to reduce the amount of debt packaged as loans where possible. Not all institutions are able to do so. Institutions should offer alumni counseling on successfully managing their debt, navigating deferment or forbearance of student loans if necessary, and utilizing career services as their career needs change or mature.4. Will it all be worth it?

Ultimately, this question is all about the value of the education; is the total cost of education going to get me what I want as an outcome? On this front, Institutions must focus on developing and demonstrating outcomes for Gen Z s. Eduventures Prospective Student Mindsets™ address the most common pathways that Gen Z students seek. Students today have more financial pressures than ever when it comes to choosing and paying for school. This generation has shown itself to be wise in its understanding of the difficulties it faces. Like the Millennials in 2007, Gen Z is entering college in a relatively healthy economy and the economic conditions it will graduate into are unknown. Institutions should take the opportunity now to “future-proof” affordability for Gen Z.Is your institution taking steps to future proof affordability? Have you had a different experience with Gen Z and college cost? Tweet us @EduventuresInc using #EVWakeUpCall.

Gen Z now dominates the traditional student landscape. This new generation brings with it new priorities, behaviors, and habits – and, most importantly, new challenges for admissions counselors, enrollment managers, and anyone tasked with devising marketing strategies to capture their attention.

This report examines three key areas of Gen Z college search behavior and communication preferences to help schools create more effective outreach strategies:- Six Prospective Student Search Strategies

- Most Used vs. Most Trusted Marketing Channels

- The Influence of Search Stage