Eduventures’ predictions for 2021 covered a lot of ground. But in this year of educating differently, it did not anticipate a key development: Coursera’s IPO.

In late March, Coursera raised more than $520 million with a 36% price jump during its first day of trading. While Coursera’s opening bump doesn’t compare to Bumble’s 60% or Roblox’s 54% increases, it’s likely to become one of the largest postsecondary IPOs to date.

But this IPO is about a lot more than just money.

Coursera’s required business disclosure statement—its IPO—is chock full of data about

Learner Data at Scale

Coursera’s IPO is a valuable trove of financial and enrollment data recounting Coursera’s short, but unprecedented, decade-long history. While written to attract potential investors, we think this document provides an invaluable glimpse into how online learning has changed since 2011.

With access to 82 million registered learners, Coursera has amassed a gold-standard data stream of learner preferences about program length, credential type, and academic subject area. Armed with this data, Coursera is betting that modularized and “stackable” content will be purchased and consumed at a pace and sequence determined by its users.

According to its IPO, Coursera is fixated on growing its user base:

We intend to continue to invest in increasing the number of registered learners on Coursera and increasing awareness of the Coursera brand. Our large learner base and brand creates a virtuous cycle increasing our value to educator partners and providing incentive for them to author additional content and credentials. This broader catalog, in turn, enhances the appeal of Coursera to learners, thereby further growing our learner base.

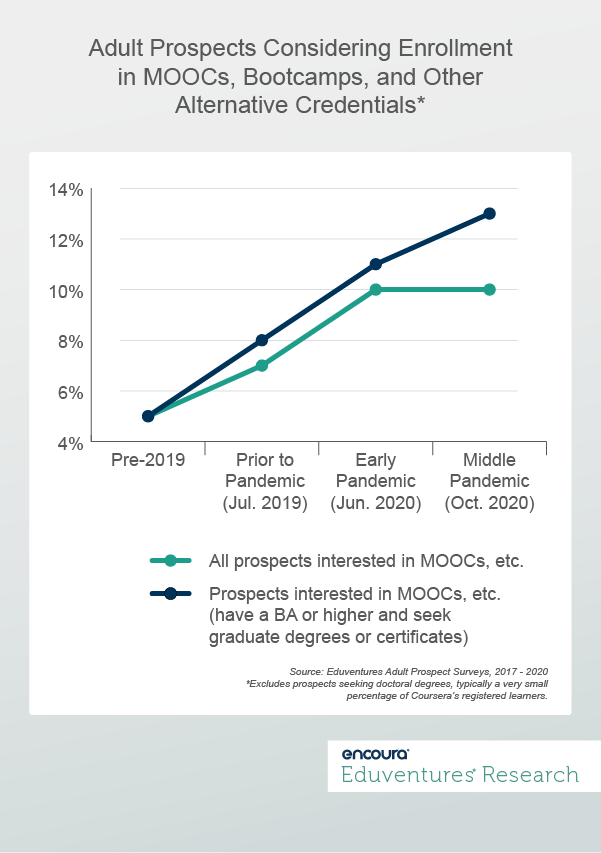

While only 20% of Coursera’s 77 million learners register from within the United States, there’s evidence of increased awareness and interest among U.S. prospective adult learners. Eduventures monitors attitudes among U.S. adult prospects toward MOOCs and other alternative credential pathways, and prior to 2019, preferences for these programs hovered at less than 5% of all respondents. Since July 2019, however, our surveys of adult prospects have detected a steady uptick in MOOC interest, reaching 10% of all prospects in our most recent survey.

Figure 1 charts these changes and those among Coursera’s prime audience: prospects with existing bachelor’s degrees seeking graduate-level credentials.

The increase in MOOC interest is notable; perhaps MOOCs and alternative credentials began to make more sense amid the pivot to fully online and remote learning. But it is also important to point out that it represents growth from a very low base. MOOC interest still significantly lags interest in four-year schools, which has remained flat, at 30%, throughout the pandemic—a steadfast preference that Coursera has factored into its strategy.

Coursera’s game plan is less about any “secret sauce,” and more about the upside of a classic “freemium” business model. Coursera’s model includes three segments:

- Consumer: direct free or low-cost enrollment in certificate-bearing or audited courses

- Enterprise: corporate, government, and institutional enrollment

- Degrees: Coursera’s OPM business, managing degree-granting programs for a share of an institution’s enrollment revenue

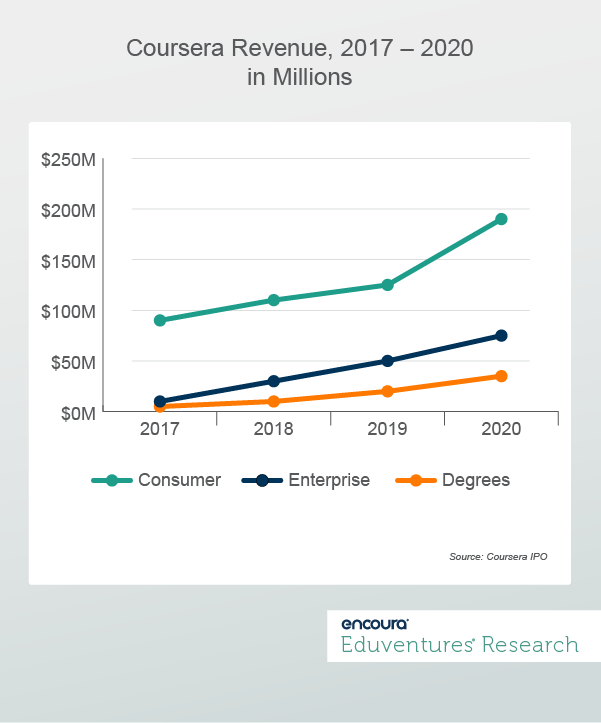

Coursera’s ability to thrive as a public company is dependent on its “conversion” strategy: the ability to shift the ample supply of learners from free and low-cost learning experiences to higher-priced offerings. Figure 2 illustrates the revenue growth for these segments since 2017.

Notably, Coursera’s “Consumer” segment grew by 65% between 2019 and 2020, to more than 30,000,000 registered learners. Meanwhile, its “Degrees” business accounted for 11,900 registered learners in 2020, up from 6,217 in 2019. While this is a significant gap, Coursera is squarely focused on shifting its “Consumer” learners into its other segments, a strategy shared by other MOOC providers in search of sustainable revenue.

The IPO is crystal clear on this process:

New learners to our platform typically begin to engage with our free courses, which serve as a funnel to grow our total learner base and drive referrals to our other offerings, including our paid offerings. Through both our on-platform and off-platform marketing efforts, we engage our free learners by highlighting key features that encourage conversion to our paid offerings. These efforts include campaigns targeting existing learners, personalized recommendations, and performance marketing across leading social media platforms.

It also shows that by the end of 2020, barely 5% of its 77 million registered learners paid for a course or program offering, a rate that still accounts for 3.6 million paid learners. This eclipses its online competitors, such as edX that claims roughly half a million paid learners, and enrollment at wholly online schools such as Western Governor’s University (171,000) and Southern New Hampshire University (135,000).

The Bottom Line

Coursera’s IPO contains more than just financial data designed to placate would-be investors. A close reading suggests some relevant lessons about modality, branding, and revenue:

Online learning has been tamed.

A decade after “the year of the MOOC,” Coursera credentials, including degrees provided by elite partners, are no longer novelty items. Coursera’s IPO is about a 10-year journey from obscure “disrupter” to global public company, financially dependent on recruitment, enrollment, and the sale of affordable credentials from recognizable schools. This pivot helped accelerate the acceptance and legitimization of online learning among both learners and employers, made even more necessary by COVID-19. Broad acceptance of online learning will benefit Coursera and other MOOCs, but it will also benefit any school seeking to grow its online learning portfolio.

Brands eat platforms for breakfast.

Coursera must remain tightly aligned, rather than apart, from its institutional partners. Coursera is unabashedly dependent on the signaling power of its partner’s brands rather than its platform or ability to offer a significantly differentiated online learning experience compared to other MOOCs or wholly online schools. Thanks to the IPO, we know that this is a costly reality: in 2020 alone, Coursera paid $108 million in partner fees. This brand fidelity is good news for elite institutions with an existing Coursera (or other MOOC) partnership. But despite the benefits that elite schools have brought to the modality, it also signals further challenges ahead for less well-known schools that rely on local markets for enrollment. And unlike the hype that followed the launch of MOOCs nearly a decade ago, these challenges will be very real.

It’s a marathon, not a sprint.

According to its IPO, Coursera has “incurred significant net losses since inception and anticipate that we will continue to incur losses for the foreseeable future.” While Coursera’s revenue increased 59% from 2019 to 2020 (from $184 million to $294 million), it has remained unprofitable. Its conversion strategy (free users to paid customers) is built for the very long-haul. While Coursera’s scale is unique, its financial challenges are instructive: institutions or other providers aspiring to affordably build and sustain a global online audience need to anticipate a long runway and rely upon significant upfront investments.

Coursera’s IPO won’t make for a great beach read or end up on the New York Times' bestseller list, but it should be required reading for every postsecondary leadership team seeking to sharpen its school’s value proposition and competitiveness in the coming years.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at Encoura

Contact

Tuesday May 25, 2021 at 2PM ET/1PM CT

Driving prospective graduate students to your institution’s website is a critical element in a successful enrollment strategy. Leveraging the power of Search Engine Marketing (SEM) can help identify and attract prospective graduate students, while also building brand awareness and maximizing your potential reach. Is your digital strategy for boosting graduate enrollment ready and in place?

In this webinar, we’ll discuss three intent-based strategies proven to drive graduate enrollment.

You’ll learn:

- How to build a smart and responsive SEM strategy for your institution and master the art of building a keyword strategy, taking Alexa and Siri into consideration

- How to protect and extend your investment in SEM with Keyword Remarketing

- How to leverage YouTube’s rich, interest-based filters to find adult learners actively searching for programs

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values, so you can create a productive and distinctive program portfolio.