The business master’s market has long enjoyed its place at the top of the academic field food chain. In 2020, institutions of higher education reported nearly 200,000 master’s degree conferrals from business-aligned programs. The next largest market? Education, with 50,000+ fewer conferrals.

But in a decade when business master’s conferrals grew by 3% overall (2012-2020), all master’s conferrals grew by 11% and the business market’s share of all master’s conferrals declined from 25% to 23%.

Does this mean that

Business is King but Losing Ground

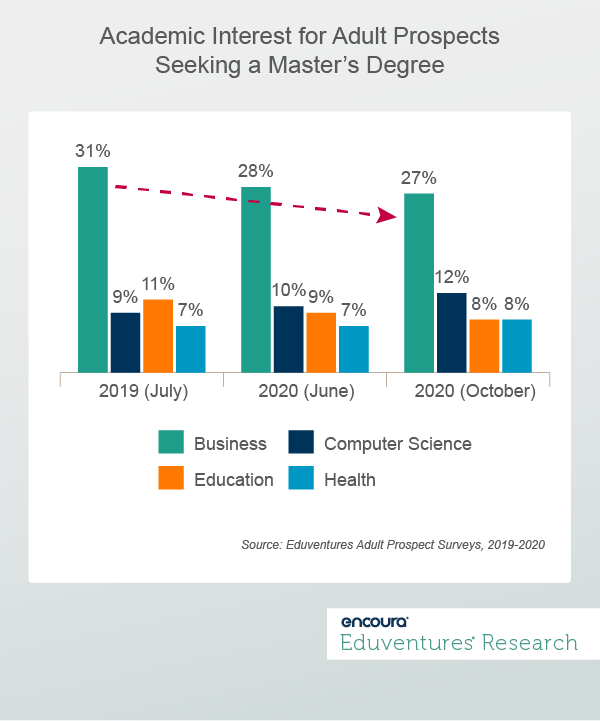

Data from our Adult Prospect Survey™ indicates that, for prospective master’s students, business is still king. Figure 1 plots academic interest for master’s-interested prospective students from July 2019 to October 2020.

Business remains the top field of study, reporting over twice as much interest compared to the next highest subject, computer science, across all three surveys. At the same time, interest in business master’s degrees declined by 13% during this time. Interest remains high but it is in decline, and the aligned market has reported underwhelming performance. What gives?

One explanation may be the rise of the non-degree graduate market. Consisting of for-credit graduate certificates and non-credit programming, Eduventures has reported on this small but rapidly growing segment. It offers a compelling combination of price, time, and prestige from institutional partners to professionals hoping to accelerate career growth during a time of economic uncertainty.

The business master’s market is not immune to these forces. For example, of the top 20 highest enrolling Coursera programs, four are in business and a number of others are business-related. Offered by institutions like Duke University and the University of Michigan, with topics such as “Analytic Techniques for Business” and “Leading People and Teams,” these four programs alone report over 2.5 million cumulative enrollments over time.

While completion data is hard to come by, these massive enrollment numbers signal significant market interest. Although the business master’s market continues its reign at the graduate level, we predict the non-degree market will continue chipping away at its market share.

Another explanation for lackluster business master’s growth, however, could be the decade of uninterrupted economic growth, pre-pandemic. For years, most MBA and other business master’s programs experienced application decline. In 2018-2019, only 33% of MBA programs and 41% of other business master’s programs reported increased application volumes as reported by the Graduate Management Admissions Council (GMAC). As jobs were plentiful, these credentials likely experienced a period of diminished value. And, as the labor market becomes more specialized with an emphasis on future-proof skills, prospects may not have found what they were looking for in more traditional business programming.

The 2019-2020 cycle reversed prior trends, however, as GMAC reported that 70% of MBA programs and 65% of other business master’s programs saw application volume increases that year. How do we reconcile decreasing interest in the business master’s programs, evidenced by our Adult Prospect Survey, and the recent uptick in MBA and other business master’s program applications?

For one, GMAC attributes some of this application growth to the flexible admissions policies (e.g., extended deadlines and deferral policies) embraced by business schools during the fall of 2020 in response to COVID-19. GMAC also reports that median yield rates across graduate business programs slightly declined from 2018-2019 to 2019-2020 despite the application bump, which is more in line with our Adult Prospect Survey data. National Student Clearinghouse figures show an outsized overall graduate enrollment jump in fall 2020, suggesting business may still be off-the-pace.

Another View of the Business Master’s Market

Digging deeper reveals a notable intersection of two disciplines: business and analytics.

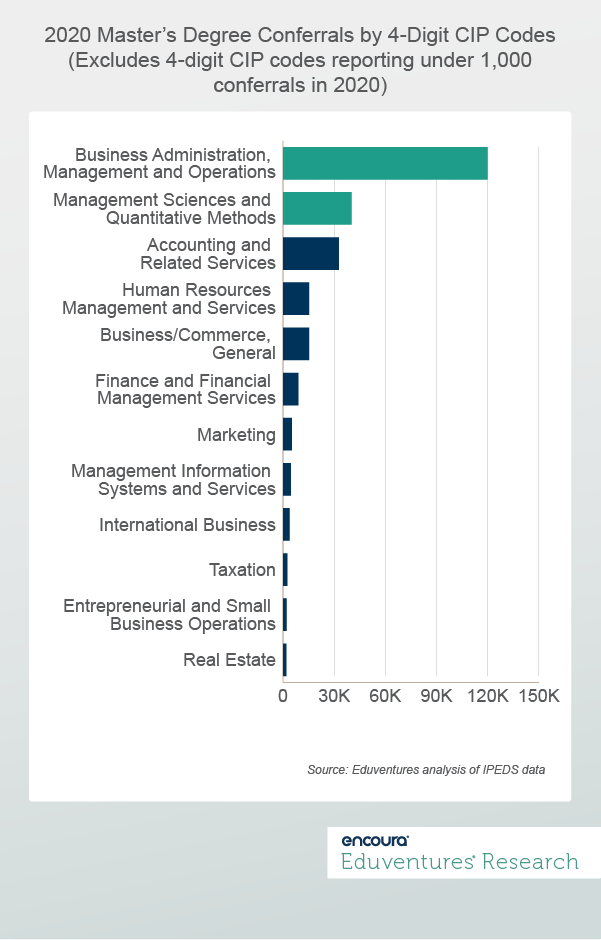

Figure 2 details 2020 master’s degree conferrals across the four-digit business-aligned Classification of Instructional Program (CIP) codes.

The business administration, management, and operations areas, where the majority of MBA programs report conferral data to, recorded 120,023 master’s degree conferrals in 2020, down from 127,695 conferrals in 2019. All other business-aligned markets—including management sciences and quantitative methods, the next highest-ranked discipline—are dwarfed in comparison, but longer-term conferral data reveals an interesting trend.

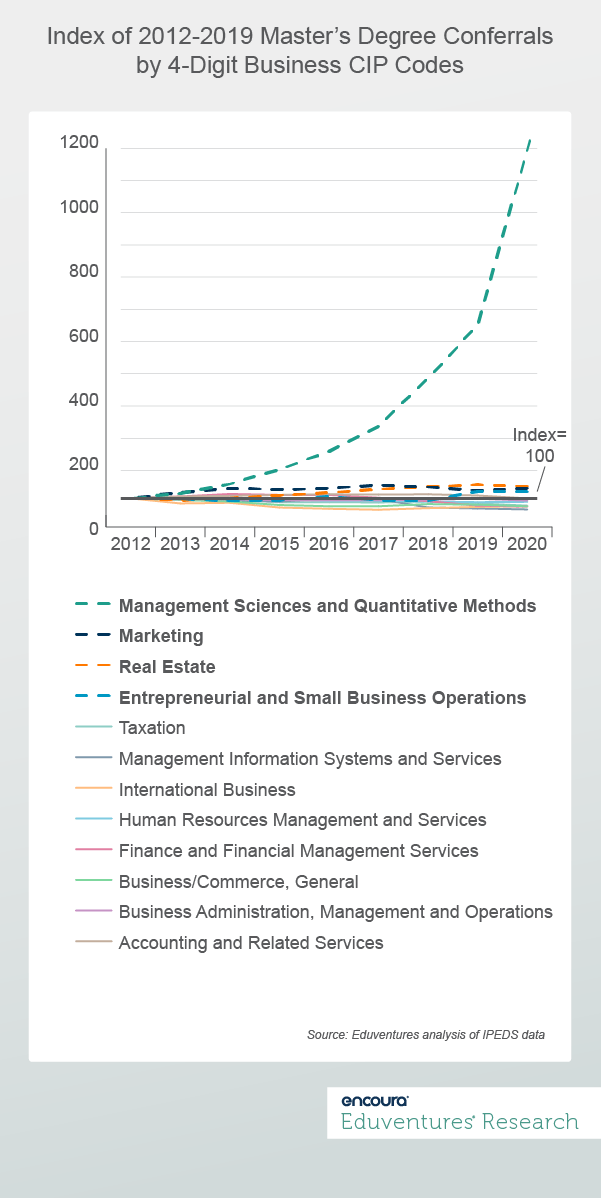

Figure 3 plots indexed 2012-2020 master’s conferral growth for those business CIP codes listed above. Note how management sciences and quantitative methods now looks when taking this view.

When looking at conferral data over recent years, the management sciences and quantitative methods market (a blend of four disciplines: management science, business statistics, actuarial science, and management sciences and quantitative methods, other) stands out in the business field for its performance—by far.

The management science market is the largest of the four, reporting 12,047 master’s conferrals in 2020. This represents a 862% jump from 2012 and a 129% jump from 2019! What caused this massive year-over-year increase? A review of 2020 reporting reveals that several providers, including the top four conferring schools in this market, reported conferrals to this CIP code for the first time in 2020. While some of the growth seen over the last year reflects either newer programs or schools reorganizing their CIP code reporting efforts, conferrals from schools that reported to this market in both 2019 and 2020 still saw a strong 40% increase from 2019 to 2020.

Growth like this is both striking and hard to ignore. Business “Analytics” master’s growth is explosive, in contrast to a shortfall in general MBAs. Harder to see in Figure 3 is that some other specialized areas, such as Real Estate, Marketing and Entrepreneurship, have also done well from a lower base.

The Bottom Line

According to Emsi, from September 2020 to August 2021, job postings for management and business and financial operations occupations (requiring a master’s degree) saw an increase in 21,308 postings including “data analysis” as a hard skill: a 93% increase.

But this trend reinforces more than challenges longstanding patterns in the business master’s market: less interest in general MBAs, and more interest in shorter, specialized business master’s. The analytics boom is very significant, and may be growing faster than genuine employer demand, risking a correction, but there is no question that the underlying need is real and sizeable. General MBAs remain very popular but it will be hard to keep this segment from falling further from its lofty heights, and it is not yet clear that even the “analytics” rocket can turnaround below-market overall business master’s growth.

Blurred lines between “business” and “technology” are a headache for designers of prospective student surveys and for schools trying to decide under which codes to report programs. The National Center for Education Statistics (NCES), a division of the U.S. Department of Education and manager of IPEDS data, is alive to the problem: the 2020 “Classification of Instructional Programs” includes a new “Data Analytics” code, but under “Multi/Interdisciplinary Studies”, not business or computer science. Keeping up with “business” master’s trends means looking for evidence in multiple places, and distinguishing general and specialized programs.

If you are interested in exploring the business master’s market further or want to understand your school's position within it, contact your Client Research Analyst today. Eduventures Program Strength Assessment and other custom research products work together to provide an informed view on program health today and market opportunity in the future.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Client Research Analyst at ACT | NRCCUA

Contact

Over the past three years, Eduventures has developed a behaviorally and attitudinally-based market segmentation of college-bound high school students we call Student Mindsets™. This year, the sample of nearly 40,000 respondents was drawn from the myOptions® database of college-bound high school juniors and seniors as well as institutional inquiry lists, allowing us to refine and validate the Mindsets in a national sample of unprecedented breadth and depth.

These market “Mindsets” get at students’ imagined paths through college by assessing the desired outcomes of college, perceived importance of college experiences, and key decision criteria at time of application.

The fundamental purpose of the Eduventures Prospective Student Research is to help institutions better understand how college-bound high school students approach one of the most important decisions of their young lives. For a teenager, the college decision looms as a complex make-or-break moment, a pivotal turn on an imagined path to adulthood.

Thursday September 9, 2021 at 2PM ET/1PM CT

High school students are once again hopeful for a full-fledged traditional undergraduate college experience. While the pandemic caused many students to postpone their dreams of student life on campus, the upcoming year seems to be reigniting some of those hopes.

But what lingering effect will this past year’s experience have on the way current high school students approach their college choices? How can colleges and universities help students recover and reimagine what their college experiences might be going forward?

In this webinar, Eduventures Principal Analyst Kim Reid will reveal how high school students have entered their senior years this fall with significant shifts in their Student Mindsets™ about college. She will share how underserved students are changing their mindsets in unique ways from their peers, how to assess students’ expectations and goals as we come out of the pandemic, and how institutions can best reach and recruit prospective students given these notable shifts.