This month, Eduventures released our comprehensive report on Learning Management Systems (LMS). In writing this Deep Dive on the most discussed segment of the education technology market, we wanted to go beyond simply reviewing shifts in market share to shed some light on why so many institutions have been switching vendors. In order to do this, we reviewed over 20 different LMS platforms and met with the vendors to gain insight into their product roadmaps and ask some tough questions about why they are winning (and losing) clients.

We also spoke with clients that had recently switched from Blackboard to Canvas, or from Moodle to Brightspace, or who were considering something completely different, such as a one-to-one device program using iPads and iTunes U as the LMS. We singled out seven vendors that every institution should consider when evaluating a new LMS, as well as six criteria that they should use to determine whether each is a good fit. The seven vendors selected scored best against these criteria, have the best chances for longevity in the market, and actively anticipate institutional needs in creating their learning experiences.

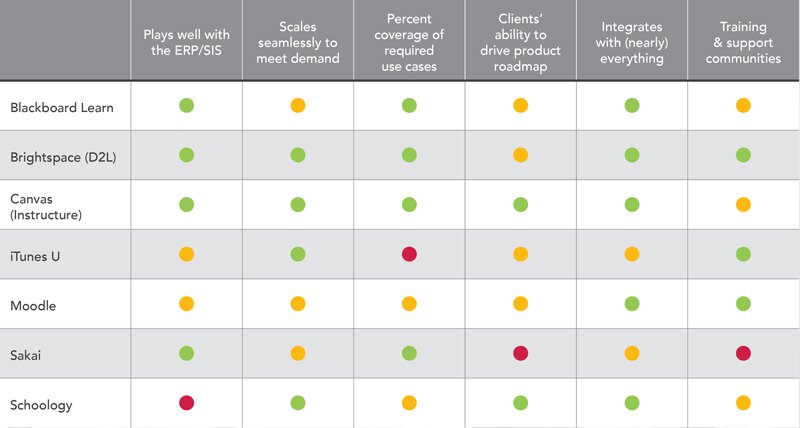

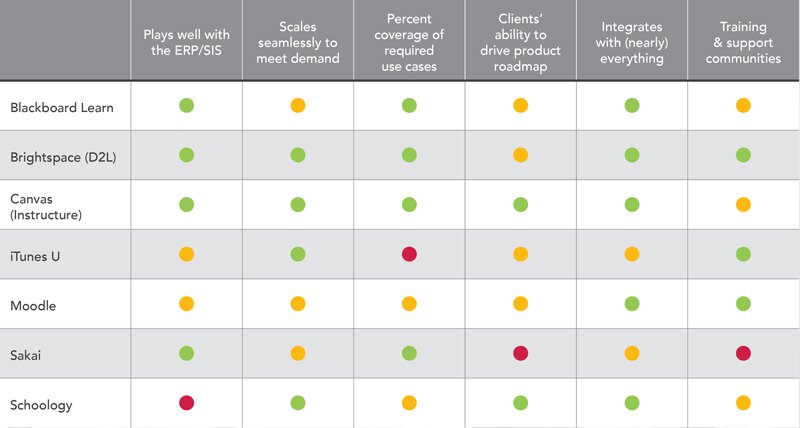

The chart above presents the report’s high-level findings. You’ll have to be an Eduventures client to read the definitions of these criteria and our detailed analysis on each vendor’s scores. For now, here are high-level takeaways that should spur honest conversations with faculty, IT staff, and vendor representatives:

The chart above presents the report’s high-level findings. You’ll have to be an Eduventures client to read the definitions of these criteria and our detailed analysis on each vendor’s scores. For now, here are high-level takeaways that should spur honest conversations with faculty, IT staff, and vendor representatives:

LMS by the Numbers

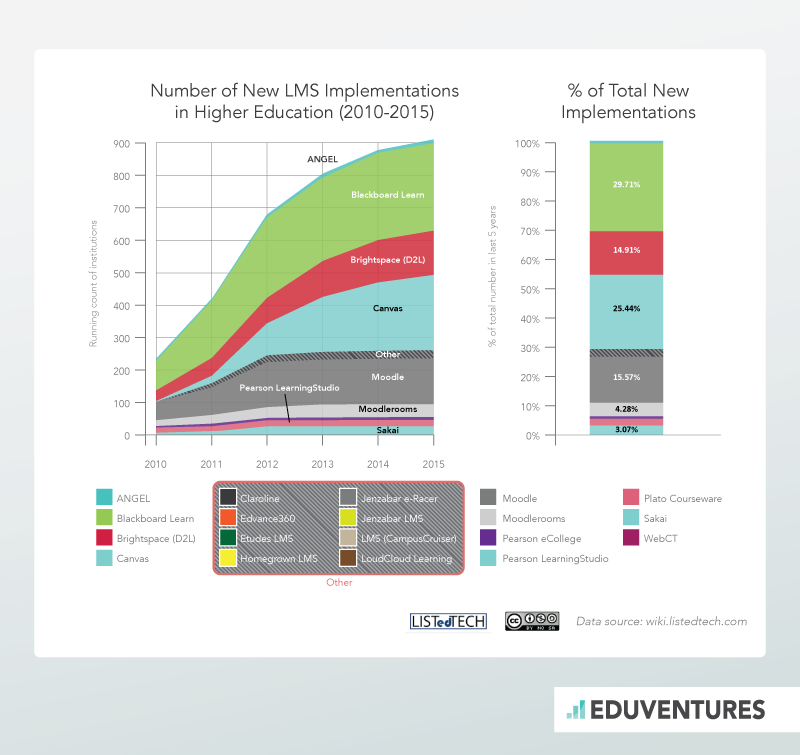

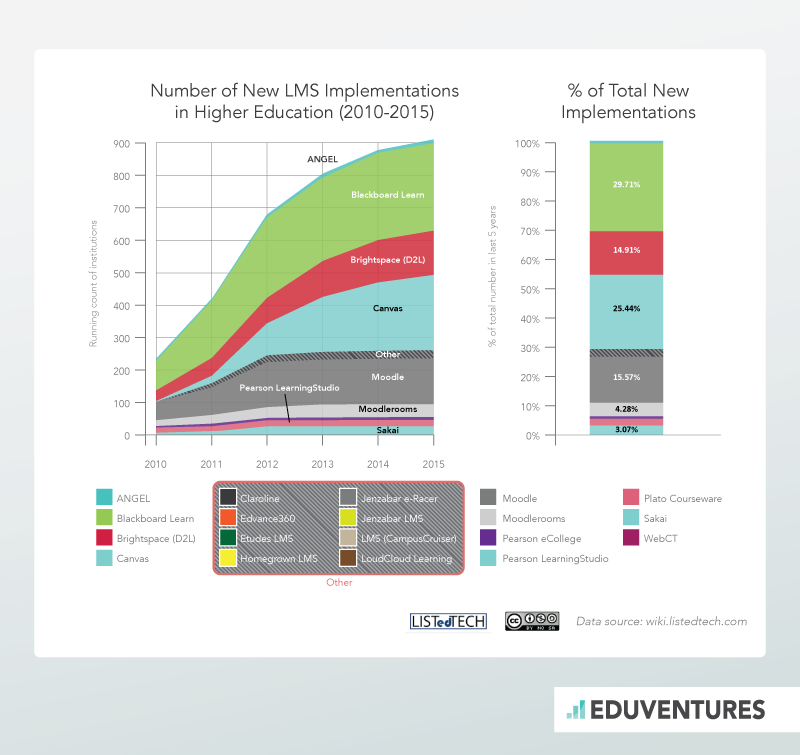

In case you missed the wide ranging media coverage on Blackboard’s slipping market share and the rise of Instructure to win the hearts and minds of faculty and instructional designers, here are two definitive charts from ListEdTech that tell you everything you need to know about LMS buying trends in higher education. In the past five years, nearly 900 institutions have migrated or consolidated systems, representing nearly 20% of the potential market for this type of technology. Among institutions replacing an LMS, a whopping 91% switched to Blackboard products (Academic Suite, ANGEL, CourseInfo, and WebCT). While some institutions might be replacing legacy Blackboard platforms with the more modern Blackboard Learn, more than two-thirds of institutions are going in a different direction entirely. This graph would have you believe that there are only four contenders for new LMS business and that the market is nearly evenly split between Blackboard Learn, Brightspace (D2L), Canvas (Instructure) and Moodle/Moodlerooms. In reality, other LMS options are just as good a fit for schools but receive much less attention as viable options in traditional media channels.

The Vendor Contenders

In addition to the top four vendors by market share, Eduventures identified three vendors that should be included on the short list of companies invited to respond to an RFI/RFP. Eduventures’ Overview of Learning Management Systems includes detailed profiles on these seven vendors and their products: Blackboard Learn, Brightspace, Canvas, iTunes U, Moodle, Sakai and Schoology. Our profile of each vendor includes its alignment to our six evaluation criteria, a summary of notable innovations and differentiators, and our forecast and predictions for how it might adapt its product strategy in the future. The chart above presents the report’s high-level findings. You’ll have to be an Eduventures client to read the definitions of these criteria and our detailed analysis on each vendor’s scores. For now, here are high-level takeaways that should spur honest conversations with faculty, IT staff, and vendor representatives:

The chart above presents the report’s high-level findings. You’ll have to be an Eduventures client to read the definitions of these criteria and our detailed analysis on each vendor’s scores. For now, here are high-level takeaways that should spur honest conversations with faculty, IT staff, and vendor representatives:

- Examining all major platforms, we didn’t see major differentiators in any vendor’s ability to impact teaching and learning. However, some vendors, such as Canvas and Brightspace, clearly focus on supporting instructional designers through comprehensive course content authoring and on importing complete courses from legacy LMS platforms.

- Instructure, D2L, and Blackboard clearly have the most comprehensive, holistic LMS platforms when it comes to features, hosting models, and the breadth of services offered.

- iTunes U offers a compelling alternative to a traditional LMS if your institution is committed to a one-to-one laptop or iPad program for students and faculty. With the advancements in iOS 9.3 meant to solve problems from previous large-scale rollouts, there is great potential for getting all of your apps and content through Apple’s ecosystem.

- Moodle remains the best choice for institutions that still hold a nearly religious preference for open source software and those seeking the absolute lowest total cost of ownership.

- While Eduventures can’t recommend Sakai as a valid option for most institutions, if your IT staff is incredibly sophisticated and you absolutely need to customize a platform to your unique institutional needs, then you should consider Sakai. Given that even the “Father of Sakai” has become lukewarm about its prospects and is turning his attention to standards for educational app stores, I’m not confident about this platform’s longevity.

- Perhaps the most distinctive offering among those we surveyed is Schoology. After making a significant name for itself in the K-12 LMS market through its mastery of the freemium model for educators, it is looking to enter the higher education market in a similar fashion. It is well poised to win over faculty jaded by inadequacies of their current LMS and impatiently waiting for their IT department to do something about it.