Dear Readers,

Each year we ask our analysts to highlight one topic from the past year that has impacted our work with colleges and universities. From a reshuffling of college majors to the growing role of out-of-state recruitment to the students behind the boom in non-degree programs, here are their answers to the question, “What have you learned this year?” for 2023.

We hope you’ve enjoyed another year of Wake-Up Calls. Thank you for your readership and Happy Holidays from us at Encoura/Eduventures!

Sincerely,

Cara Quackenbush

Executive Vice President of Eduventures Research, Encoura

Click the author to jump to each section:

- Major Matters – Kim Reid, Principal Analyst

- A Once Rock-Solid Bachelor's Market Stumbles –Clint Raine, Senior Analyst

- Out-of-State Recruitment Takes Center Stage – Johanna Trovato, Principal Analyst

- Who Are Non-Degree Graduate Students? – Richard Garrett,

- Is the U.S. in an Ambition Recession? – Chris Gardiner, Senior Analyst

Major Matters

By Kim Reid

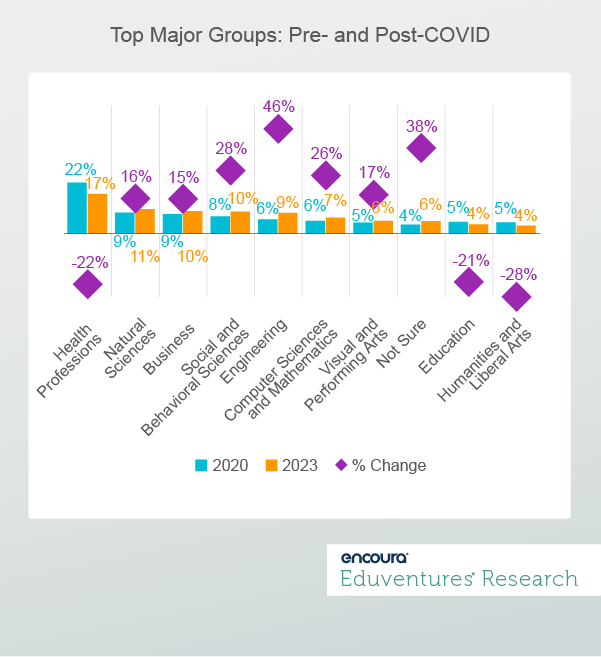

I learned that shifts in undergraduate major interest could destabilize enrollment for institutions that are not prepared. Analysis of the Eduventures Prospective Student Research™, pre-pandemic to post-pandemic, shows dramatic changes in the academic majors students are most likely to study (Figure1).

Here are four key takeaways.

- Demand for the health professions (-22%) has softened. Could part of this softness be due to the pressure placed on these professionals during the pandemic? When will demand come back?

- Strongly career-articulated majors like business (+16%), engineering (+46%), and computer sciences (+26%) have increased in demand.

- Majors that scratch the Gen Z itch to be creative or make an impact on the world like social sciences (+28%) and visual and performing arts (+17%) have also risen.

- Major areas that were in trouble before the pandemic continue to be in trouble after the pandemic (education -21%, and humanities, and liberal arts (-28%).

These changes are occurring for two main reasons. First, students from low-income families are less present in the college bound pipeline. Their typical major interests, like health professions, may consequently be diminished (see A Once Rock-Solid Bachelor’s Market Stumbles).

Second, the pandemic focused students on pursuing majors that lead more directly to a career. These are majors that are associated with strong job growth or high salaries.

What does this mean for your institution? Colleges and universities must be strategic about how they position their majors for the market. They must also think about the students who no longer consider attending college. What types of academic reforms are necessary to entice those students with relevant majors that lead to strong outcomes?

A Once Rock-Solid Bachelor’s Market Stumbles

By Clint Raine

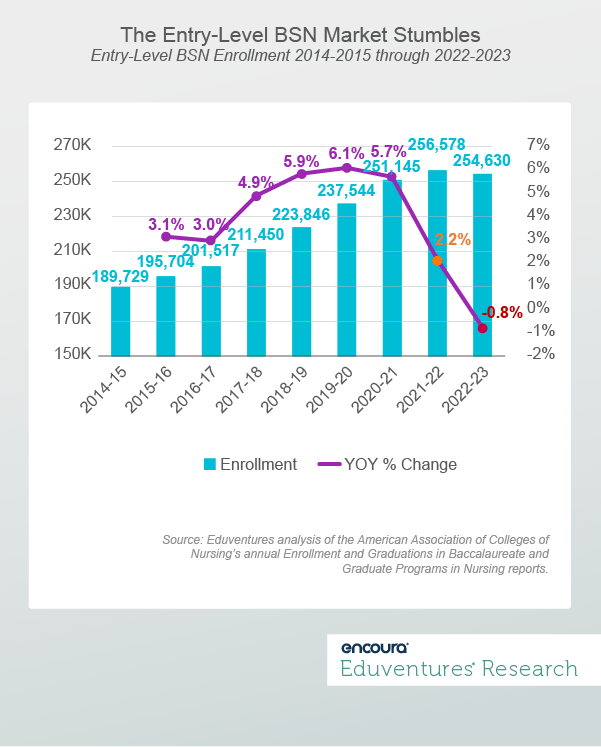

In 2023, I learned that the entry-level Bachelor of Science in Nursing (BSN) market saw its first enrollment decline in 20 years—a significant development for one of the largest bachelor’s program fields.

Enrollment in entry-level BSN programs is tracked by the American Association of Colleges of Nursing (AACN). Figure 2 shows that enrollment growth since the 2015-2016 academic year slowed in 2021-2022 (+2.2%) and declined in 2022-2023 (-0.8%). Both are stark departures from steady growth of 3% or more in prior years, and for a field that defied initial pandemic-era declines.

What caused the decline? It’s likely that numerous factors played a role. For example, AACN has consistently pointed to faculty shortages and a lack of necessary clinical sites as reasons BSN programs turn away qualified applicants. In 2022-2023, however, there were 795 entry level BSN programs (up 21% since 2014)—the most ever and an indication that supply may not be the only challenge.

This puts demand under the microscope. While nursing has long been the most popular major for traditional-aged, college-going prospects, our annual Prospective Student Research (PSR) reveals that the proportion of students interested in nursing has been declining since 2019, falling from 6.6% of all major interest down to 5.5% in 2023 (a statistically significant decline). Initial 2024 PSR response data shows a continued decline in nursing prospect interest (down to 5.0%) and that it has been dethroned as the top field of interest by Business and Management at (6.1%).

We can point to two possible explanations for this decline: prospect awareness of recent pressures on the nursing profession, and the loss of Career Pragmatists™ in the college pipeline since the pandemic began. On the latter, prospects most concerned with immediate college ROI and finding a job demonstrate above-average interest in health-aligned programs. Since 2020, many have put off college for a hot labor market. The question now being, will they come back?

For schools, if these trends continue, the prospective nursing market will become more competitive. Knowing who these prospects are and what they are looking for in an education program will become more imperative. The big caveat here is that the BSN market remains large, nursing interest remains high, and the field is connected to strong labor outcomes. Time will tell if the 2022-2023 decline is the start of a longer trend, but it is unlikely the market will see another 20-year period of sustained growth.

Out-of-State Recruitment Takes Center Stage

By Johanna Trovato

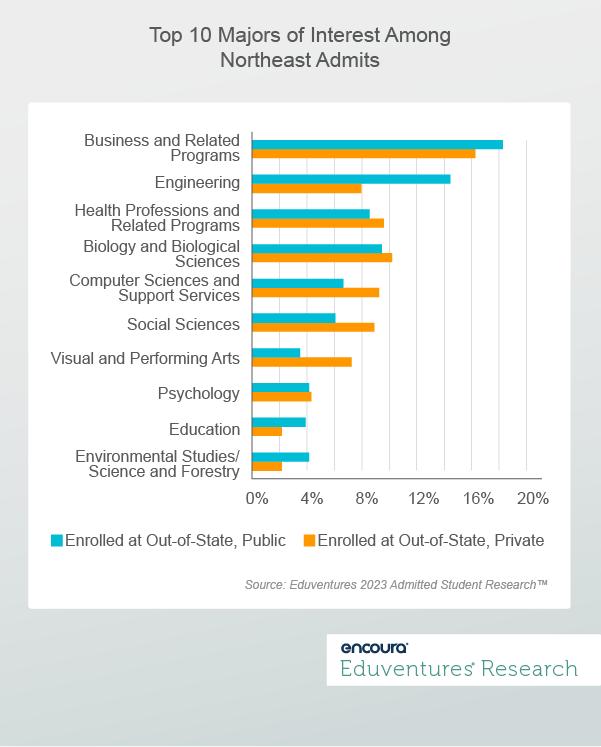

In 2023, I learned that, like many of our college and university partners, I underestimated the complexity of out-of-state recruitment. Often, schools focus on just a few aspects examined separately, such as the most promising geographic regions or major preferences of students in a target state. These are of course important considerations. But there are many confounding factors that must also be considered for anyone on the ground recruiting these students.

For instance, Figure 3 shows the top 10 majors among admitted students from the Northeast, broken out by those who chose a public or private institution outside their home states.

This shows that the top two program areas, business and engineering, are of greatest interest to those enrolling at an out-of-state public school. Those enrolling at a private, out-of-state institution, however, were less interested in pursuing engineering and showed greater preference for computer sciences, social sciences and visual and performing arts than their peers at public schools.

Why is this important? Had we examined just the academic interests of students in the Northeast, we would have missed important factors that can help recruiters in these areas work better with prospects. Not only can the actual enrollment behavior change the pattern of interest, overlaying the institutional type highlights further distinctions.

Additionally, while many students in the Northeast are likely to enroll out-of-state, they tend to stay within the Northeast. This means that the recruitment conversation must be tailored not only to students in the region, but also to your institutional type and distance to your recruitment region.

The same is true for many other aspects of out-of-state recruitment, including Student Mindsets™ and enrollment drivers. Out-of-state recruitment is a puzzle with many pieces rather than a straightforward process with cookie-cutter approaches. Observing general trends is an important starting point, but to get an edge on the competition, a more detailed analysis will yield the best results.

Who Are Non-Degree Graduate Students?

By Richard Garrett

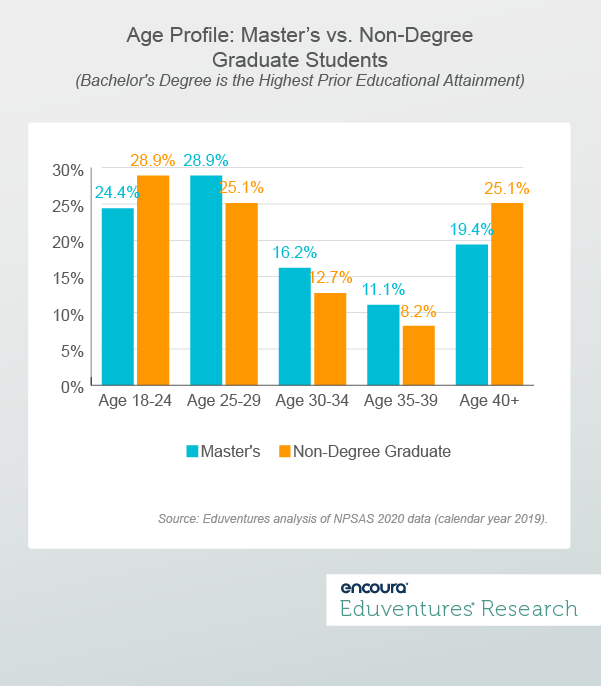

In 2023, I learned more about the demographics of non-degree graduate students, a fast-growing but little understood market. New data from the National Postsecondary Aid Study (NPSAS), a federal survey of 21,000 graduate students, encompasses valuable but little-known details not available in IPEDS, such as student age, prior educational attainment, and income.

NPSAS is conducted every four years, and the latest results—published in 2023—are from 2019. This data may not be as timely as we would like, but the findings are no less relevant.

The new data addresses an important question: Is the booming population of non-degree graduate students (for-credit) a new market or is it eating into master’s degree demand?

At first glance, the two populations are quite different. Master’s students skew younger and non-degree graduate students skew older. But the picture changes when controlling for educational attainment.

Figure 4 contrasts the master’s degree and non-degree graduate student age profiles, for students with a bachelor’s degree as their highest educational attainment.

It turns out that the two populations are similar by age.

It is the same story by student income: when comparing master’s and non-degree graduate students irrespective of prior education, the latter are better off financially. But NPSAS shows little difference in income mix between master’s and non-degree graduate students with comparable prior education.

Why does all this matter?

For both fall 2022 and 2023, National Student Clearinghouse reported that graduate certificate enrollment grew considerably faster than master’s enrollment. Yes, non-degree graduate enrollment remains much smaller than enrollment in master’s programs, but other Eduventures research argues that official figures undercount non-degree scale.

As non-degree graduate programs continue to grow in number and variety, proliferate online, and are offered by many leading universities at affordable prices, master’s programs must be watchful. NPSAS data reveals that non-degree graduate students look remarkably like their peers enrolled in master’s programs.

This suggests very real direct competition between non-degree programs and master’s degrees (as well as potential to stack non-degree into degree). To dig deeper, look for more Eduventures research on non-degree markets in 2024—touching on topics such as field of study, certificate attainment, pricing, and financial aid—leveraging non-standard sources like NPSAS and census data.

Is the U.S. in an Ambition Recession?

By Chris Gardiner

In 2023, I learned about the phenomenon called an “ambition recession,” referring to an overall career reorientation among working age U.S. adults rethinking what is important to them in life.

A widespread de-emphasis on career carries important economic and higher education ramifications. But is it real?

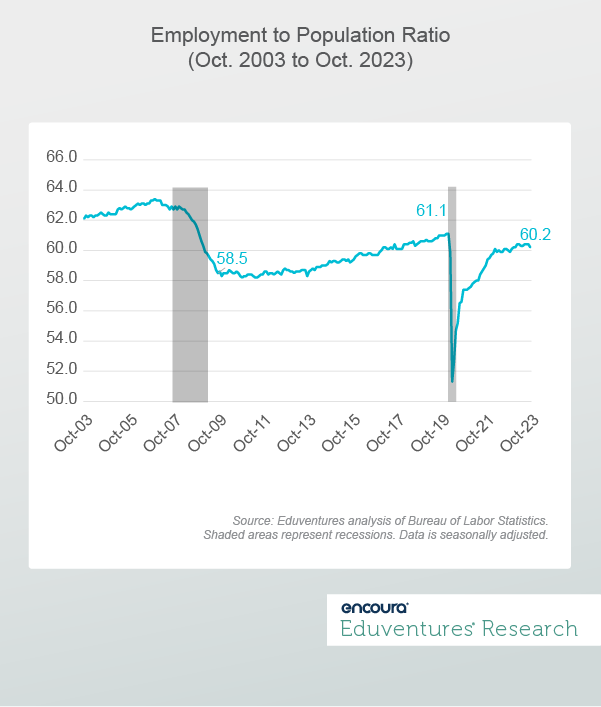

Figure 5 shows the employment to population ratio for the last 20 years. This ratio indicates how efficiently an economy provides jobs for people who want to work.

This shows that the current employment to population ratio is 60.2 (October 2023). It has still not eclipsed pre-pandemic levels but is still higher than at times following the 2008 recession, where unemployment was high through 2013. Unemployment is back to pre-pandemic levels, but the employment-population ratio is not.

Is this a sign of "ambition recession?" There are underlying demographic issues at play here including age and gender. Proponents argue that this reprioritization toward spending more time with family/friends and pursuing hobbies and personal interests—over career goals—resulted from the disruption of the pandemic, but effects are still lingering.

This phenomenon has been used to explain “quiet quitting”—another buzzworthy phenomenon where workers put in the minimal amount of effort possible—supposedly spawned, in part, by remote work. Some also say that an “ambition recession” could explain the declining enrollment rate, as career growth is a key driver for prospective students to further their educations.

"Ambition recession" or not, the continued tightness in the labor market, driving up wages and lowering the premium for more credentials, poses a challenge for higher education. This career-focused recession could explain the limited growth in the graduate market and half a million fewer adult undergraduates (age 24+) between fall 2019 and 2022.

Ultimately, this is a complex issue with a multitude of factors. Even if some working adults are evaluating their lives holistically, higher education needs to offer programs that can make a direct career impact when they inevitably refocus on their working lives.

In 2024, institutions should sharpen their focus, evaluate current programs for market alignment, and investigate new program opportunities.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

This recruitment cycle challenged the creativity of enrollment teams as they were forced to recreate the entire enrollment experience online. The challenge for this spring will be getting proximate to admitted students by replicating new-found practices to increase yield through the summer’s extended enrollment cycle.

By participating in the Eduventures Admitted Student Research, your office will gain actionable insights on:

- Nationwide benchmarks for yield outcomes

- Changes in the decision-making behaviors of incoming freshmen that impact recruiting

- Gaps between how your institution was perceived and your actual institution identity

- Regional and national competitive shifts in the wake of the post-COVID-19 environment

- Competitiveness of your updated financial aid model