We all want to predict the future. When it comes to the future of higher education technology, many of us look to market activity for clues. For example, some see Anthology's acquisition of Blackboard and the $2 billion purchase of Instructure by the private equity firm Thoma Bravo as a signal that institutions are becoming more open to consolidating their ecosystems under one vendor. Acquisitions like these tend to receive the bulk of media attention and speculation.

Yet, our analysis of vendors classified in our 2022 Higher Education Technology Landscape (Landscape) reveals another lesser-hyped, although more common, type of acquisition activity that might provide deeper insight into potential shifts in higher education technology.

What Are the Trends in Vendor Acquisition Activity?

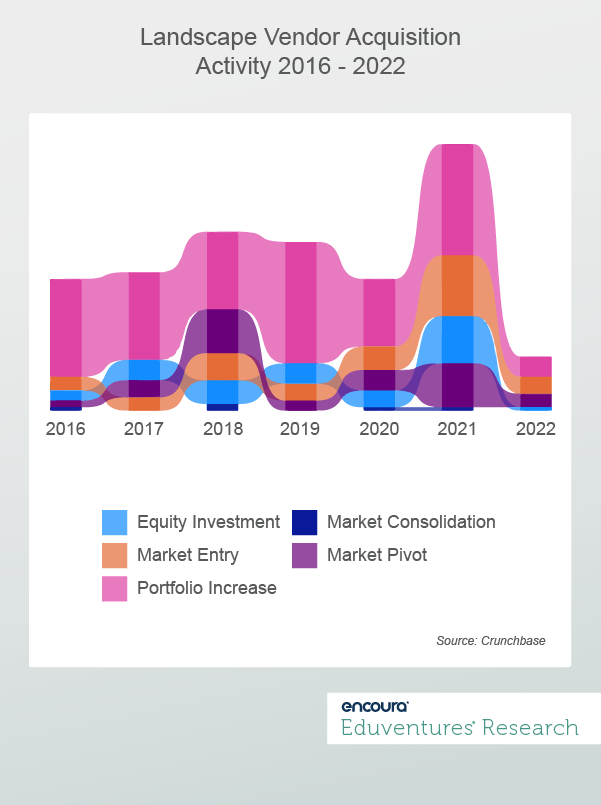

Using the Eduventures Higher Education Technology Landscape (Landscape) and data from Crunchbase, As shown in Figure 1, acquisition activity rose during this period, having dropped from 2019 to 2020. Our analysis also revealed five types of acquisition activity:

- Equity Investment: This type of activity shows when a private equity firm gains a technology vendor classified in our Landscape and includes purchases such as the Blackstone Group's purchase of Ellucian or Vista Equity Partners' acquisition of Pluralsight.

- Portfolio Increase: This type of activity shows when a technology vendor classified in our Landscape acquires a firm outside of our Landscape, such as Blackbaud's acquisition of Attentive.ly or Hyland's purchase of Learning Machine Technologies.

- Market Pivot: This type of activity shows when a vendor classified in our Landscape enters a new product segment by acquiring a vendor also in our Landscape, such as Anthology's purchase of Blackboard or EAB's purchase of Wisr.

- Market Entry: This type of activity shows when a company outside of our Landscape enters the higher education market through acquiring a company that already serves higher education and includes Turning's acquisition of Echo360 or Measure Learning's purchase of ProctorU.

- Market Consolidation: This type of activity shows when a company within our Landscape acquires a company within the same Landscape segment, such as one Constituent Relationship Management (CRM) solution vendor purchasing another, i.e., Liaison's acquisition of TargetX, or an Assessment Integrity Solution (Turnitin) acquiring another (Proctor Exam).

We could dive into the spikes in "Market Pivot” activity (acquisitions of companies already serving higher education) in 2018 and 2021 and the significant increase in “Market Entry” activity (new companies entering higher education through acquisition) in 2021. But the two relevant takeaways from our analysis for this post relate to the “Portfolio Increase” type of investment activity—when companies acquire a firm that falls outside of higher education. In fact, this type of acquisition activity has remained the most common since 2016, which is surprising since we more often hear about other acquisition types like “Market Pivots” and “Equity Investments.”

Why should we care about the “Portfolio Increase” type of acquisition activity? In addition to their frequency, the simple answer is that these acquired companies have products that may enter the higher education market for the first time, or perhaps they have functionality that enhances the existing products of the acquiring companies. For example, when the Enterprise Content Management Solution vendor, Hyland, acquired Learning Machine Technologies, a credentialing solution in the governmental space, it added the product to its portfolio, giving it an edge over its competitors. Likewise, when Blackboard acquired the predictive analytics company, X-Ray Analytics, it incorporated the analytics function of the acquired products into its existing products, including Blackboard Learn.

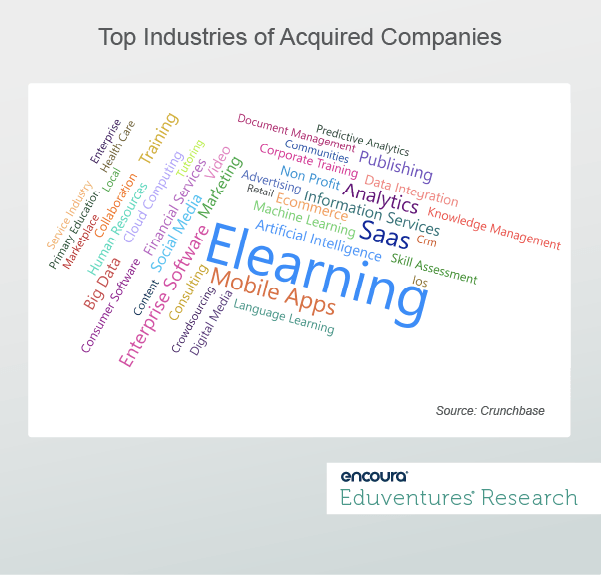

Because purchasing companies introduce newly acquired products or features to the higher education market, this type of acquisition activity may also help predict what we might see in the higher education technology market. So, what does this analysis reveal? Figure 2 shows that most acquired companies within the “Portfolio Increase” category are within the e-learning, analytics, or mobile apps industries—a strong indication that this type of functionality will increasingly find its way into the higher education landscape.

The Bottom Line

Tracking big-ticket acquisitions is a handy way to get some sense of potential shifts in the higher education technology market. For example, the Anthology/Blackboard partnership introduces the possibility of a single vendor providing operational solutions (the student information system, course evaluation solutions, financial aid solutions, etc.) alongside teaching and learning solutions, like the LMS. Such an approach might appeal to institutions that want a more unified set of technologies covering disparate areas and may lead other vendors to combine or figure out a better way to integrate across the entire institutional ecosystem.

Yet, ignoring what net-new types of products that vendors may introduce into the higher education technology marketplace is to overlook what additional functionality we may see in higher education technology products. For example, a Learning Management System provider might enhance the learner engagement with its solutions by adding gamification to its functionality. Likewise, a Student Information System vendor may decide to provide insight into the student journey by launching an advanced analytics product. Restricting our view only to equity investments or acquisitions within the market misses what may be right around the corner.

Of course, not all portfolio increases will lead to new products or functionality. Some may result only in the acquiring vendor entering a different market (K-12, for example). But we have seen a clear track record of many companies executing this type of acquisition activity to widen their portfolios, and we should track this activity carefully.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at Encoura

Contact

Eduventures 2022 Higher Education Technology Landscape (Landscape) visualizes 367 vendors and their products, organized into over 44 separate market segments rolled up into four major categories aligned to the student lifecycle.

Throughout the year, we analyze these vendors and products and make that content available to clients. Several vendors have multiple products in their education technology portfolios.

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values, so you can create a productive and distinctive program portfolio.