June 14-16, 2023 | Boston, MA

Special Keynote Session: José Andrés

Coming out of the pandemic, Eduventures has seen increased interest in non-degree programming—among adult prospects and institutions alike. Many institutions, especially those seeing adult learner enrollment decline, are scrambling to jump into this growing market.

IPEDS data, however, shows that non-degree programs grew by 18% between 2016 and 2021, while non-degree completions grew by 7%, suggesting supply is outpacing demand. Before institutions dive in, they should make sure to test the waters.

Non-Degree Market Maturity: Over One Million Unique Credentials Currently Available

To start, the data shows that the non-degree market is already quite mature. According to IPEDS, non-degree programs comprise 29% of all academic programs, second only to bachelor’s degree programs (32%), and nearly double the number of master’s degree programs (16%). But while IPEDS reports more than 72,000 non-degree programs and more than one million completions, it is important to remember that this data is not comprehensive.

Non-degree programming is a hodgepodge category of different credentials, spanning single-day continuing education workshops to for-credit courses, micro-credentials, and certificates. This does not count the multitude of institutional non-credit offerings and programs delivered by MOOC platforms (Coursera, edX) and non-academic providers (Pluralsight, Udemy).

Credential Engine, the non-profit mapping the credential landscape, reported over one million unique credentials in the U.S. in 2022, which includes degrees, certificates, licenses, diplomas, and certifications. Overall, postsecondary degrees account for just 22% of all credentials identified, while 63% are non-degree credentials—showing the magnitude of the non-degree market.

Non-Degree Market Viability: Analyzing Eduventures Adult Prospect Research™

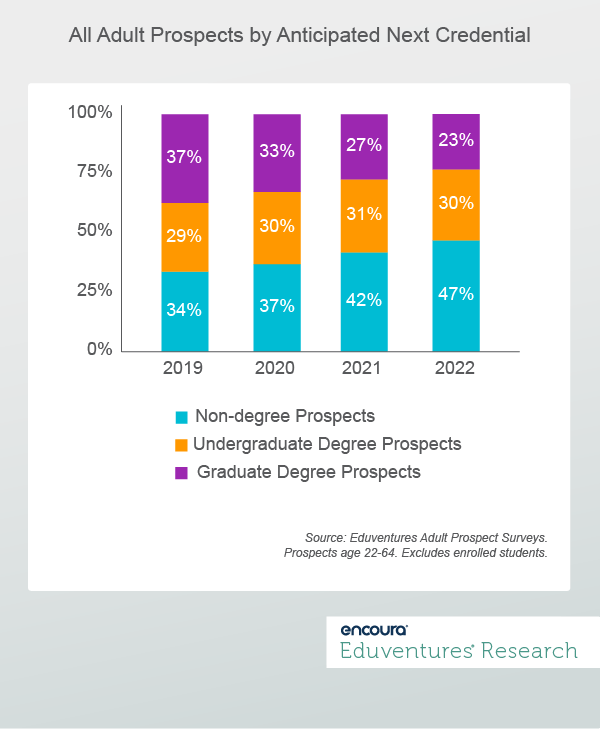

For more insight into this robust market, we turn to our Adult Prospect Research™ to understand adult prospect motivations, attitudes, and credential preferences. In Figure 1, we show the change in interest among non-degree, undergraduate degree, and graduate degree adult prospects between 2019 (pre-pandemic) and 2022.

Notably, non-degree program interest has grown from 34% in 2019 to 47% in 2022, a 38% increase over that time. This compares to a 3% increase for undergraduate programs and a 38% decrease among graduate programs. Amid debates about debt and return-on-investment, graduate prospects seem to be hedging toward faster and cheaper alternatives.

Experiencing recent challenges in graduate degree enrollment, many institutions are looking at this increase with interest and feel the urgency to reprioritize new program development into non-degree programs. Indeed, graduate-level (both post-baccalaureate and post-master’s) certificate program growth (46%) has exceeded conferral growth (40%) between 2016 and 2021. We would advise some thoughtfulness for institutions considering entering this market.

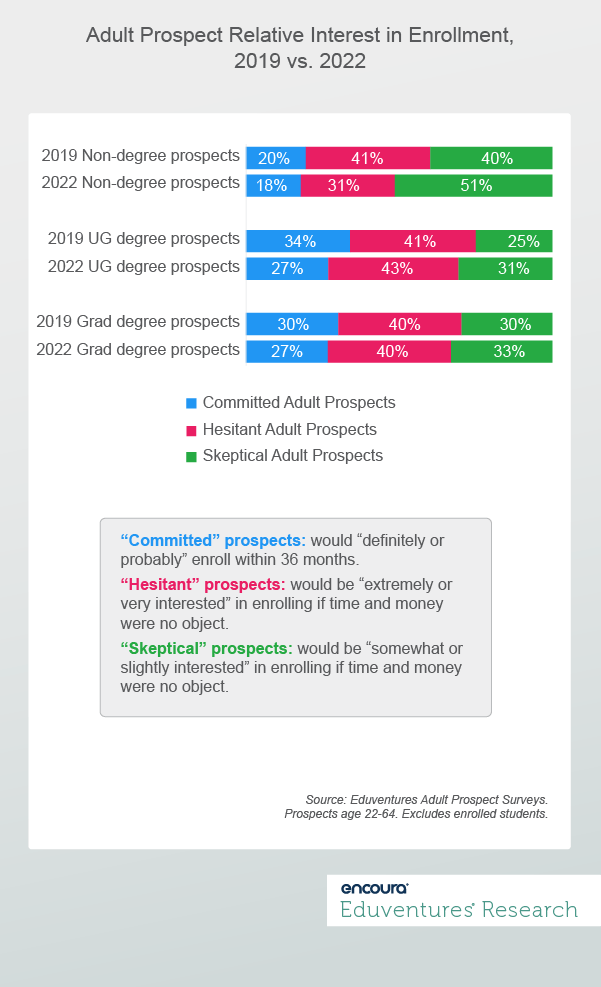

In addition to understanding the overall number of prospective students at each credential level, Eduventures also evaluates the relative level of commitment these prospects have toward enrollment.

Non-Degree Prospects: Less “Committed” to Enrolling than Degree Prospects

Figure 2 shows the relative interest of non-degree, undergraduate degree, and graduate degree prospects. The common theme across all credential options is a decline in the percentage of “committed” prospects—those who would “definitely or probably” enroll in the next 36 months— between 2019 to 2022.

The percentage of “skeptical” prospects—those who would be somewhat or slightly interested if time and money were no object—increased over that same time period. This increase in “skeptical” prospects aligns with the tightening labor market and lower unemployment.

Non-degree prospects (18%), however, show significantly lower levels of “commitment” than both undergraduate (27%) and graduate degree prospects (27%). At the same time, we see a marked increase in “skeptical” non-degree prospects (40% in 2019 to 51% in 2022).

This 51% of “skeptical” non-degree prospects in 2022 is much higher than both undergraduate degree (31%) and graduate degree prospects (33%). This suggests that even though we see increased overall interest in non-degree programs, the relative interest is weaker than it is for degree programs.

It would be reasonable to assume non-degree prospects value shorter time to completion and lower costs – but even if time and money were no object, they are still lukewarm, at best. This softer interest may make them less reliable to count on for enrollment goals.

Some institutions are attempting to capture the best of both worlds—degree and non-degree options. One example is The University of Texas System that announced a $1.5 million grant by the Strada Education Network to expand its micro-credential initiative, which “infuses career readiness into the undergraduate curriculum and co-curriculum by including relevant industry micro-credentials and skills badges at no additional cost to the learners.”

The Bottom Line

Eduventures data points to increased interest in non-degree programming. But despite a rise in both supply and demand—the former being steeper—there is good reason to carefully study your options before wading in. Credential Engine estimates there are more than 650,000 unique non-degree credentials in 2022, which was 11% more than counted in 2021.

While they continue to grow in number, the data reveals that non-degree prospects are less committed than degree prospects, making them a less reliable source of enrollment and revenue.

A comprehensive non-degree strategy is needed to capture the best non-degree program opportunity, as this market is more competitive than many think. We advise caution for institutions that may be leaping before they look.

For Eduventures clients interested in further reading on the Non-Degree Market, please see the recent report Sizing Up the Non-Degree Market: Evidence from Coursera, edX and Udemy in the Research Library of the Encoura Platform.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

The higher education market has reached a level of maturity that requires a more sustainable approach toward academic programming. Because the stakes are higher than ever, Eduventures has moved beyond the conventional standards of program feasibility to focus on the end goal – the overall success of your institution and its students.