In a recent advisory call with a public four-year institution, we noted that 80% of traditional undergraduate student inquiries responding to the Eduventures Prospective Student Research showed interest in applying to this institution. Were congratulations in order? Perhaps not. We thought this institution’s inquiry list might be “overqualified,” a result of undergraduate marketing largely to a group of students who are already interested in buying what they are selling.

We’ve also seen many inquiry lists that are “underqualified,” where fewer than 20% of students are interested in applying to the institution. This indicates that students barely know they exist.

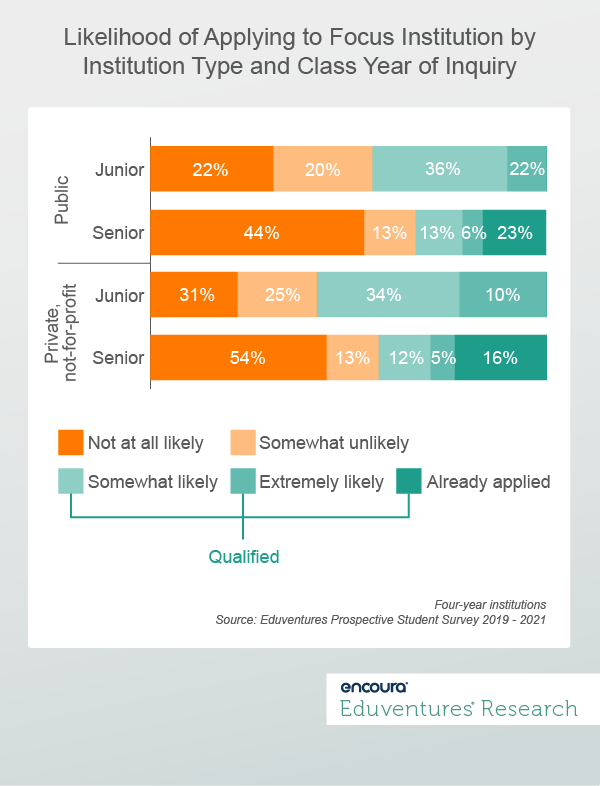

Fundamentally, a school’s “qualification rate” is the percentage of students on their inquiry lists who are open to applying to the institution. We benchmark this key marketing metric through our Prospective Student Survey™, fielded annually to college-bound juniors and seniors in December and January. We ask all students where they fall along the interest spectrum – from “not at all likely to apply” to “already applied” (Figure 1). If a student is likely to apply or has applied, we consider them “qualified.”

In general, juniors show higher interest than seniors. They are earlier in search, still wide open, and haven’t narrowed down lists of schools to apply to. We can also see that public institutions are working with more qualified lists, perhaps trading on natural inquiries to some degree. The corollary of this is that private institutions are most likely casting the net more widely to bring students into the enrollment funnel, working with higher numbers of seemingly disinterested students.

The strategic question, however, is what is the right qualification rate for your institution? What rate will neither stretch your team too thin, nor has it working exclusively with students who are already strongly interested in your institution?

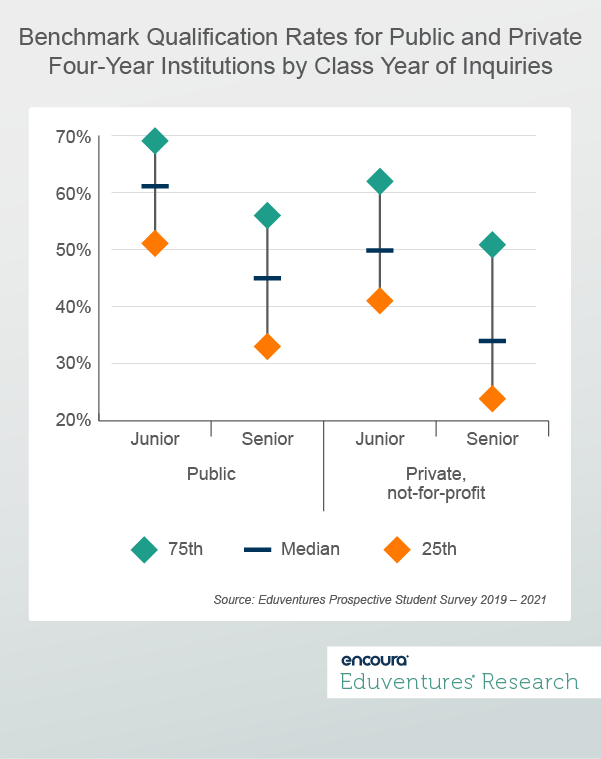

Figure 2 shows benchmark data for public and private, not-for-profit institutions on this qualification rate metric.

For public institutions, the median qualification rate is 45% for seniors and 61% for juniors. A public institution working with senior inquiries with a qualification rate below 33% is very low; a senior qualification rate above 56% is very high. For private, not-for-profit institutions, the median qualification rate is 34% for seniors and 50% for juniors. A private, not-for-profit institution working with senior inquiries with a qualification rate below 24% is very low; a senior qualification rate above 51% is very high.

But what do these rates mean?

A Qualification Rate that is Too Big

Would an institution ever choose to have a high qualification rate?

If you know your qualification rate metric and your rate is quite high, consider first whether you have a legitimate reason for this high rate. If, for example, your institution has enormous brand equity and students largely come to you, you may not need to stimulate interest in the broader market in order to meet your strategic enrollment goals—this situation is rare. Even if this is the case, you may want to strategically target growth in key market segments. In those segments, your qualification rate should reflect a broader casting of the marketing net.

What do we do if our prospect pool is overqualified?

In the case of a qualification rate that is too high, you may not be reaching far enough beyond your natural inquiries to stimulate broader interest. This could have your marketing and communications team become too comfortable with a tried-and-true message that doesn’t serve the purpose of growing enrollment. Use market research, like Eduventures national Prospective Student Research, and data science to identify areas of search expansion that match institutional goals.

A Qualification Rate that is Too Small

Would an institution ever choose to have a low qualification rate?

In certain cases, perhaps. If you are building a new market or new programs that require you to stretch into territories or student segments who don’t know your institution well, you may have an artificially low qualification rate as you build your brand reputation. But if you go too low, you risk marketing efforts that will be lost in the wilderness of students who don’t know who you are and don’t care to know.

What do we do if our prospect pool is underqualified?

In the case where your qualification rates are low, you are reaching out to a large group of students who have low or limited interest in your institution. This could overstretch your marketing and communications group and potentially dilute the message. We recommend considering a more strategic approach to building your marketing funnel. Use market research, like Eduventures institutional Prospective Student Research, to understand which students are open to consideration and target your search into these segments.

Additionally, consider ways to monitor and engage interested students beyond those who self-identify as inquiries, such as tracking email click-throughs. These activities can reveal students who are curious secret shoppers and move them into the category of interested inquirers.

A Qualification Rate that is Just Right

Congratulations! You’ve found the Goldilocks zone. Your inquiry list is balanced with students who have a legitimate interest in your institution, students who are tougher to reach but strategic targets for your institution, and that unavoidable group of students that is just disinterested.

The benefits of the Goldilocks zone are many. Most of all, it will enable your enrollment marketing team to work with efficiency to meet strategic enrollment goals.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at Encoura

Contact

Tuesday November 30, 2021 at 2PM ET/1PM CT

Institutions have increasingly focused on improving transfer student pathways to support them along their educational journeys—a focus heightened by the impact of the COVID-19 pandemic. Now transfer students are speaking out on what types of support they need from colleges when they are considering enrollment.

Research from Eduventures 2021 Transfer Student Survey™ focuses on the motivations, concerns, and search behaviors of two different types of transfer students: those who plan to transfer (prospective transfer students) and those who have already transferred from one school to another (retrospective transfer students). We further disaggregated this data by demographic subgroups such as first-generation status, gender, household income, and race/ethnicity. We then ranked their responses by frequency.

Our analysis points to a missing key piece in improving the transfer student pathway: the importance and role of the receiving institution. In this webinar, Eduventures Principal Analyst James Wiley will reveal key insights from the 2021 Transfer Student Survey that will equip receiving institutions with actionable data for improving transfer student pathways, including:

- The top concerns of prospective transfer students

- Areas where retrospective transfer students could have used more help

- How prospective and retrospective student subgroups vary in their concerns

- How to retain transfer students after they enroll

Deadline extended to December 6!

Over the past three years, Eduventures has developed a behaviorally and attitudinally-based market segmentation of college-bound high school students we call Student Mindsets™. This year, the sample of nearly 40,000 respondents was drawn from the myOptions® database of college-bound high school juniors and seniors as well as institutional inquiry lists, allowing us to refine and validate the Mindsets in a national sample of unprecedented breadth and depth.

These market “Mindsets” get at students’ imagined paths through college by assessing the desired outcomes of college, perceived importance of college experiences, and key decision criteria at time of application.

The fundamental purpose of the Eduventures Prospective Student Research is to help institutions better understand how college-bound high school students approach one of the most important decisions of their young lives. For a teenager, the college decision looms as a complex make-or-break moment, a pivotal turn on an imagined path to adulthood.