Eduventures’ recently published 2023 Master’s Market Update report, previewed in a May webinar, posits that, following a decade of sustained growth, the master’s market may be looking at a decade of stagnation. With this dramatic shift, today’s post examines the largest master’s program in the market today: the MBA.

What can we expect regarding MBA market performance in the future, and what does this mean in light of historic trends that have come to define the MBA market?

The MBA Market Right Now

As the largest master’s field (over 100,000 conferrals were reported to the most aligned CIP code in 2021), the MBA is not immune to the current challenges plaguing this market. Applications to MBA programs were down 6.5% in fall 2022 after growing 3.8% in 2021, according to the Graduate Management Admission Council’s (GMAC) 2022 Application Trends Survey.

In the study, more MBA programs reported application declines (60%) than either growth (37%) or stability (3%). Indeed, the National Student Clearinghouse (NSC) estimates that fall 2022 enrollment in graduate business programs declined by 5.3%, which is much faster than average (-1.2%).

Unlike some professional fields where a master’s is required for practice, the MBA market is heavily influenced by the labor market. Current labor market conditions help explain the post-pandemic decline, as GMAC points to a hot hiring market and lingering effects of the Great Resignation where employers are increasingly focused on retention thereby dampening incentives to pursue an MBA.

Three Critical MBA Trends from the Last Decade

While current conditions suggest a market in decline, a swift shift in our nation’s economic health could be a boon for the MBA if history is any indicator. But future recession-driven enrollment growth may not be as potent as in the past thanks to a long decline in the graduate enrollment rate, slowing key graduate age cohort population growth, a shrinking working-age population, and the proliferation of non-degree offerings heavily positioned in the business vertical.

But three trends from the last decade also show long-standing MBA market challenges that must be internalized along with current market conditions.

Trend #1: MBA Productivity is Down

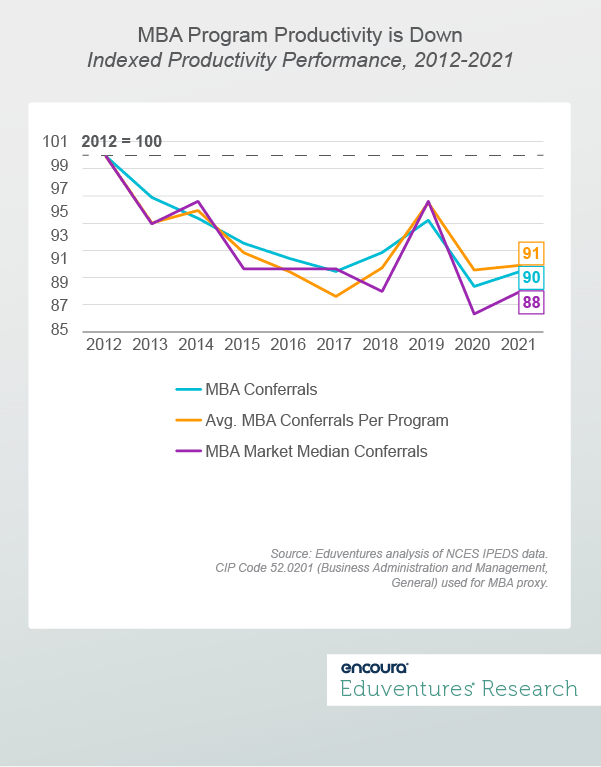

MBA program productivity is down across the board. Figure 1 tracks degrees conferred, average conferrals per program, and the market’s median conferral point over the 2012-2021 period.

As all master’s conferrals grew by 15% over the past decade, MBA conferrals declined by 10%. Average conferrals per program—at 103 in 2021—have declined by 9%. While this matches the overall master’s market decline, that trend was driven by a deluge of new master’s programs entering the market. MBA average conferrals per program fell even as programs left the field.

An average of 103 conferrals per program still makes the MBA market highly productive compared to the overall master’s market (with an average of 27), but it is heavily skewed. The market’s median conferral point stood at 46 in 2021, down by 12% since 2012.

Trend #2: Online MBA Activity is Up

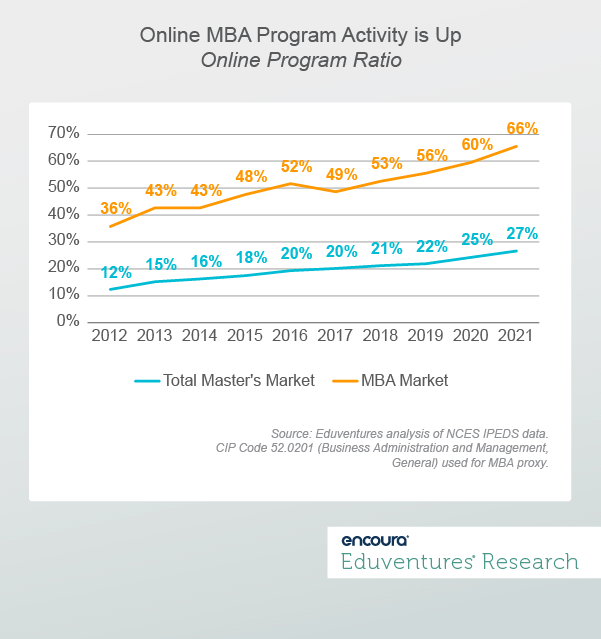

As MBA program productivity declined overall, MBA online program activity only increased. Figure 2 shows the ratio of MBA programs offered online.

With 66% of programs offered online, the MBA market ranks seventh among fields with at least 30 master’s programs. And while the proportion of all online master’s programs grew faster than the MBA market (116% growth vs. 83%), the gap between online MBA and the total online master’s market grew from 24% in 2012 to 39% in 2021.

Significant OPM activity in this space has contributed to online MBA saturation. Eduventures’ recent report, Industry Guide to Online Program Management 2022, Part 3: Field of Study Trends, found that business master’s programs represent 30% of all OPM-supported master’s programs (the next field is health at 16%).

Trend #3: MBA Consolidation is on the Rise … Again

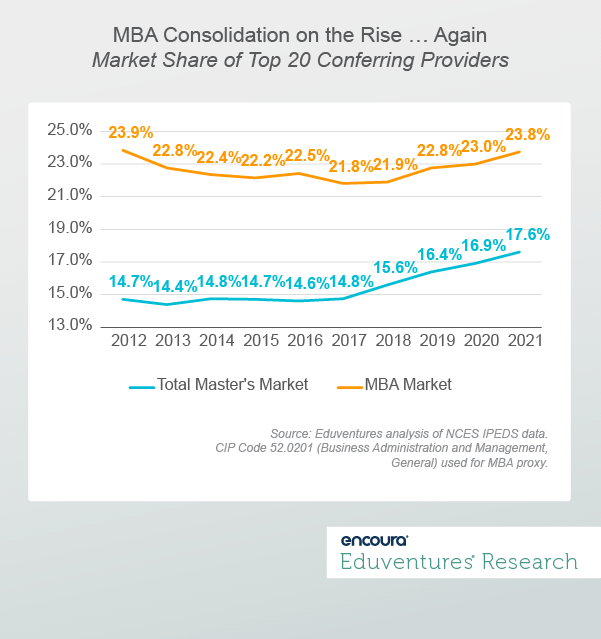

The MBA program market is less productive, more online, and, as Figure 3 reveals, more consolidated compared to the master’s market average.

While the overall master’s market has seen a rapid rise in the market share claimed by the top 20 conferring schools since 2017, the MBA market has long seen more intense consolidation at the top. As of 2021, the top 20 MBA providers claimed almost 24% of all MBA conferrals. Critically, the last few years erased a period of increased fragmentation. Now, MBA consolidation matches 2012 levels.

The Bottom Line

The MBA market is less productive, more online, and just as consolidated as it was a decade ago. Future labor market downturns are likely to produce less enrollment upside for fewer providers. With this heightened competition, what should MBA programs do?

- Focus on Localization. The 10 largest MBA providers are online giants like WGU, SNHU, and Grand Canyon University, followed by the likes of Duke and Michigan. For schools lacking massive online reach and distinguished brand names, strengthen connections in your immediate region, tailor programming to regional needs, and establish partnerships with local employers to attract and support prospects and graduates.

- Stay on Top of In-Demand Programming. Track preferences for curriculum components, such as strategy, analytics/data science, and change management, to align your offerings accordingly. GMAC is a good source of information.

- Know Your Prospects. Track preferences among MBA prospects—their motivations, desired program features, and modality preferences. For example, 64% of business master’s prospects report interest in some form of hybrid programming compared to 56% of all other master’s prospects. The flexibility of online combined with high-impact, in-person touch points also reinforce a localization strategy.

- Look for Lanes of Innovation. Quality. Speed. Price. University of Illinois, Urbana-Champaign, selected all three, going against conventional wisdom. Its 2019 all-in bet on the iMBA – a fully online MBA from a top 50 MBA program for under $24,000—increased completions by more than 500%. Not everyone can make this formula work, but all schools must ask themselves, “what sets us apart?”

- Offer Multiple Pathways. Graduate business prospects are showing decreased interest in master’s programs, according to the Eduventures Adult Prospect Research™ survey. Master’s level interest decreased from 67% in 2019 to 54% in 2022, while interest in graduate certificates rose from 4% to 11%. While still a smaller market, the shorter and less expensive non-degree option is resonating. Consider creating a coherent program ecosystem where students can progress toward an MBA through completed courses or certificates.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values, so you can create a productive and distinctive program portfolio.