With over 35 million students having attended college but never having earned a credential, retention rates, with too few exceptions, remain stubbornly low. Despite modest overall improvement, 40% of institutions reported a decline in their full-time retention rates over the last five years. To combat this problem, a growing number of schools have turned to retention technology.

Our recent study of the Student Retention Solutions market found more than 21 different products in use across 1,200 institutions. One finding, however, highlights an important paradox about the state of retention in the United States: retention technology solutions are least likely to be used by the institutions that need this support the most.

Retention and the Role of EdTech

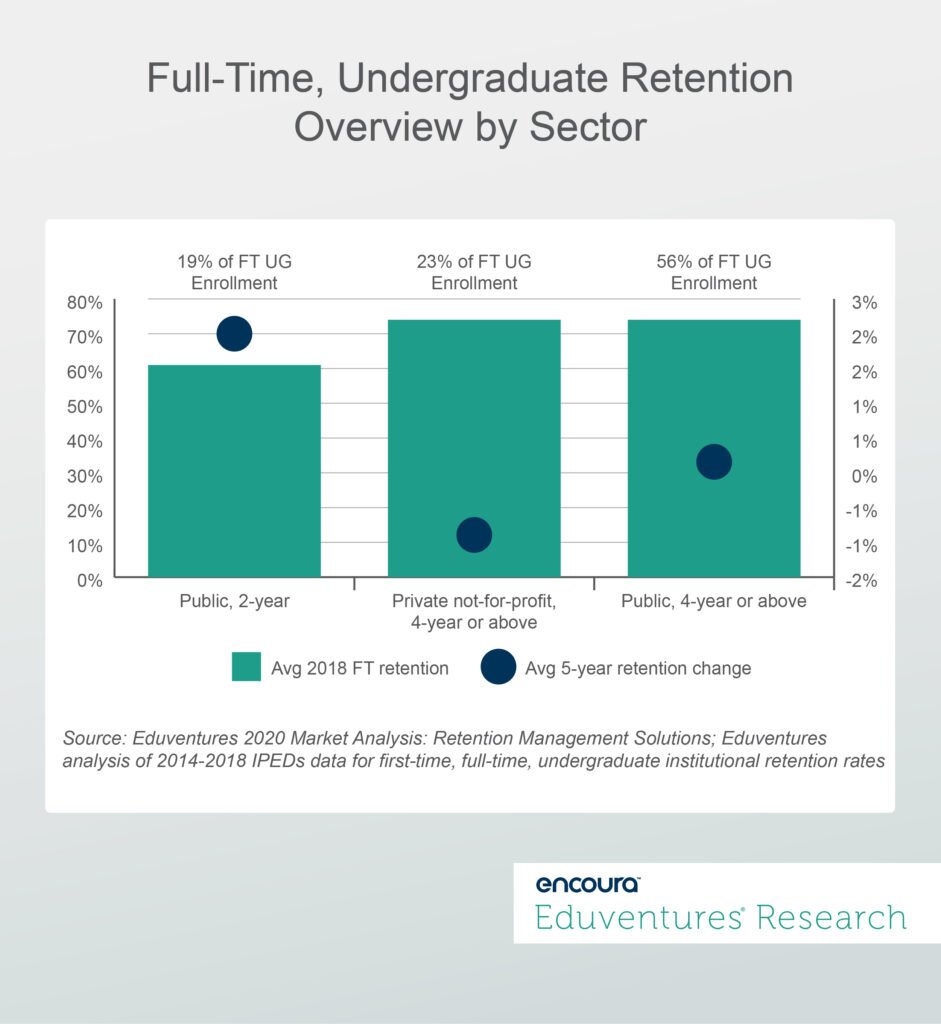

To contextualize this finding, let’s take a closer look at retention rates across three key higher education sectors. Figure 1 shows that retention rates at two- and four-year institutions have seen limited improvement.

Figure 1.

Figure 1 shows two-year schools collectively improved retention at an average rate of 2% between 2014 and 2018, but public four-year institutions—where the majority of students enroll—saw less than 1% improvement, and four-year privates saw their average retention rates decline.

When talking about this technology segment, it is important to remember that Eduventures defines Student Retention Solutions (retention solutions) in a specific way. To fit our definition, a solution must enable colleges to collect, monitor, and act on student data to improve retention. Functionality must include an “early warning system” for at-risk students, a forum for communication between advisors, faculty, and students, and methods to manage student academic interventions. While others might define these solutions differently, we define them this way to differentiate this segment from others in our Higher Education Technology Landscape.

To provide further clarity, some examples of the major players in this segment include Hobsons, Blackboard, Civitas, EAB, and Campus Labs, which collectively comprise 75% of the market. The remainder are either enterprise-wide solutions that have added retention functionality (such as Campus Management, Oracle, and Salesforce), or standalone, niche providers that have carved out a beachhead among a specific segment of institutions (such as Pharos 360).

The Retention Paradox

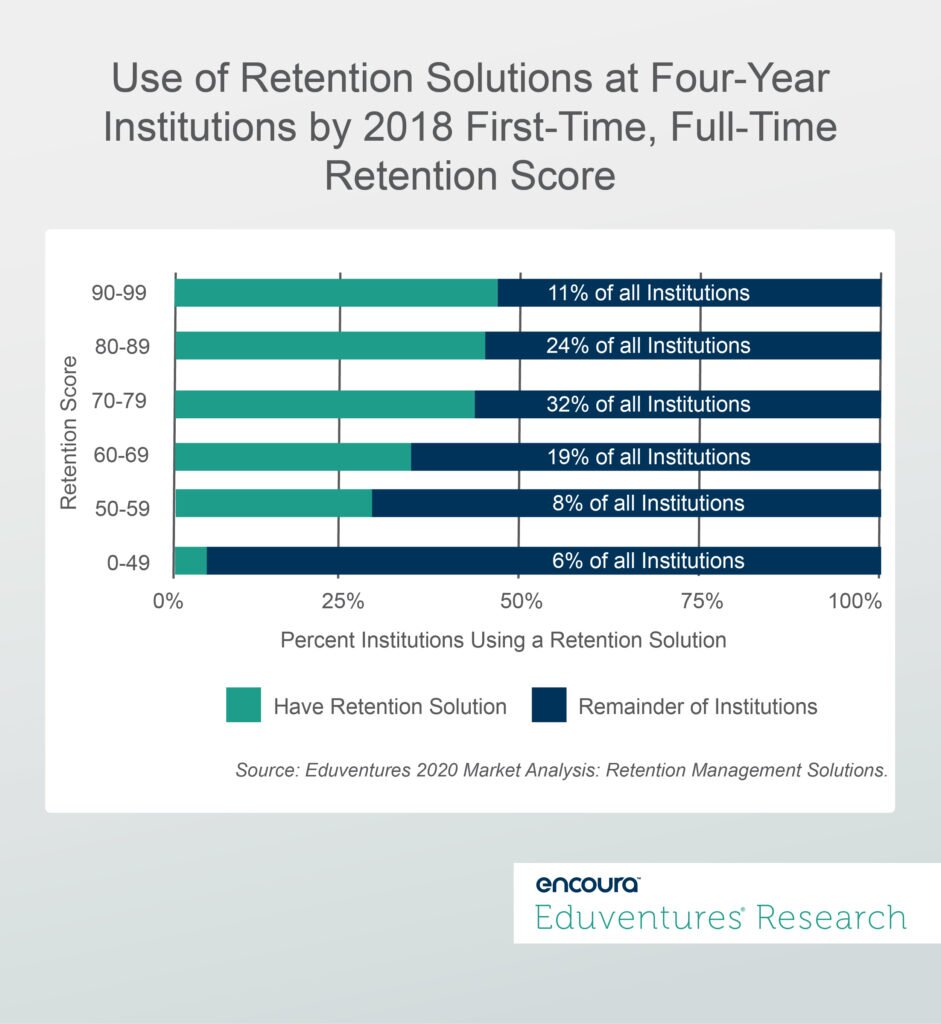

To better understand the retention paradox from our study, our analysis focused largely on four-year, full-time retention rates. Figure 2 shows the percentage of institutions that have a retention solution, segmented by their retention scores (rates).

Figure 2.

Figure 2 shows that schools with the highest retention rates (percentage of first time, full-time bachelor’s students who enrolled in the subsequent fall term), which on average tend to be more highly selective publics and privates, are far more likely to have a retention solution. On the opposite side of the spectrum, those schools with the lowest retention rates were eight times less likely to have one.

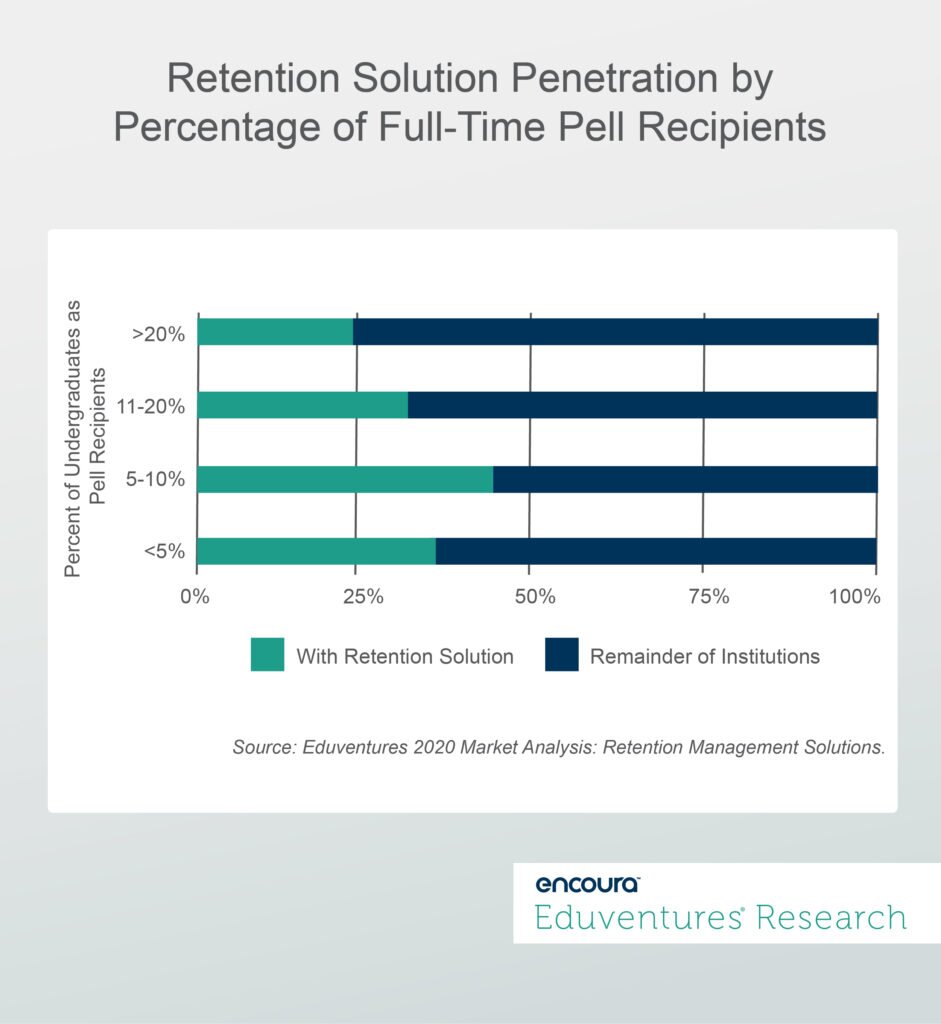

Furthermore, Figure 3 shows that institutions with higher percentages of Pell-eligible students were also less likely to have a retention solution. We use Pell eligibility as a proxy for low-income students; these students have lower retention rates than their non-Pell peers.

Figure 3.

Taken together, these findings highlight a seemingly paradoxical trend: institutions in greatest need of retention support are less likely to have a retention solution.

One contributing factor is not mysterious: institutions with the highest achieving students—those that have high retention rates in the first place—are most likely to have the resources to acquire new technology. The same can be said for many institutions serving fewer Pell students.

Another piece of the puzzle discussed further in our recently published retention report is that the “low enrollment” institutions (defined as less than 1,000) may see less need to use a technology solution for retention. These institutions (more than 750 in total) make up nearly a third of all Title IV eligible, four-year non-profit schools, and span all retention profiles. With smaller populations, it is entirely possible that higher-touch, lower-technology retention tactics may be preferable to the scale and automation promised by these types of solutions.

Are there other reasons for the disparity in retention technology acquisitions? To be sure, nearly all institutions are engaged in retention programs at some level. For many, the use of retention technology comes down to a simple return-on-investment (ROI) calculation: will the cost of purchasing new technology translate into increased revenue through improved retention rates?

The Bottom Line

Whether an institution has a stellar retention rate or is looking to improve, retention-focused technology will continue to play a role in evolving student success initiatives. Eduventures’ recent report on this topic, Eduventures 2020 Market Analysis: Student Retention Solutions, establishes an important baseline, identifying which types of institutions use which solutions. It also chronicles the ebbs and flows of retention solution adoption over the last decade and analyzes the changes in retention rates that have been reported by institutions using (or not using) one.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at ACT | NRCCUA

Contact

We understand the incredible challenges that COVID-19 has caused for each of you, your institutions, and most importantly, your students. We recognize the immediate impact the industry is already facing, and we understand the potential long-term consequences to come. We are committed to being a trusted resource for all of our members and providing institutions with timely insight to better support your evolving needs.

In addition to our weekly Wake-Up Call, we are committed to delivering timely and relevant answers to real-world questions that institutions are now facing in light of COVID-19. These Snapshots will cover a broad range of questions that our team has received over the last several weeks. You’ll find concise and pragmatic advice around traditional student demand, program innovation, and adult learner demand.