Deep and introspective conversations. That’s how many colleges and universities begin a branding effort. In these discussions, an institution with high self-esteem can easily be blinded by its own beauty; conversely, one with low self-esteem can overemphasize its flaws.

While these conversations are certainly important to have, it is difficult to craft an authentic and relevant brand without first understanding the external market reality facing your institution. To do this effectively, you must find out what students really think and feel about you: the beauty and the blemishes; the bold and the bland.

Ideally, every institutional branding discussion should begin with unbiased, data-based market research that shows your position and perceptions relative to peers and aspirant institutions. It should take you outside the bubble of your organization’s conventional wisdom.

Unfortunately, several impediments may prevent institutions with the best of intentions from gathering true market perspectives:

- It’s too time-consuming – a custom market research engagement can take months to complete, but leadership is chomping at the bit to make changes now.

- It’s too expensive – branding studies can surpass six figures very quickly. Your institution just might not have the budget for it.

- Unbiased data isn’t available – even if your institution has the time and money, getting an unbiased sample, beyond your own inquiry pool, is difficult to obtain, and costly.

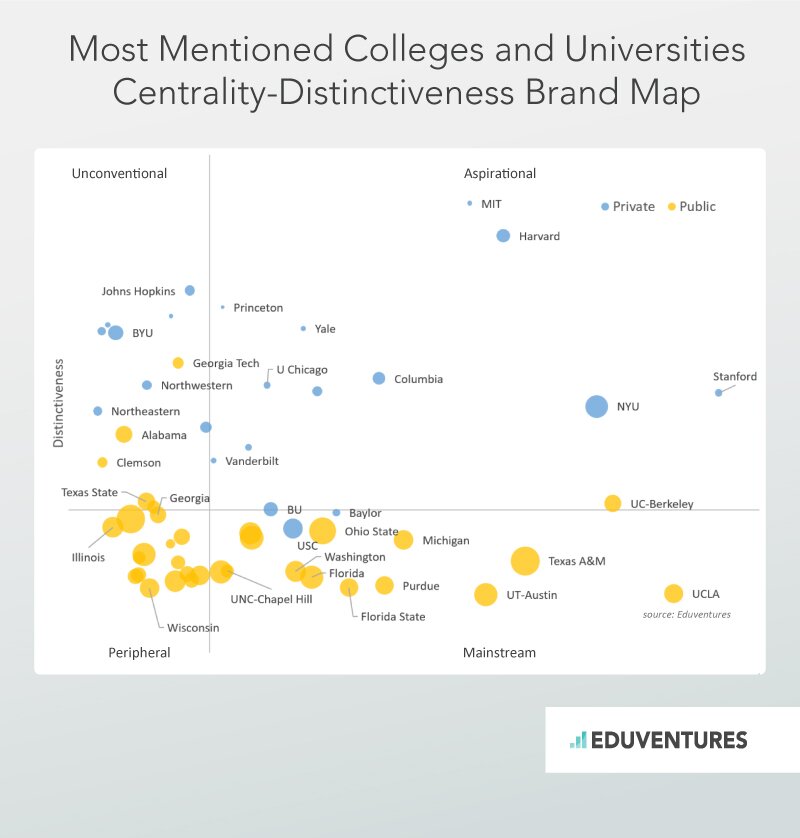

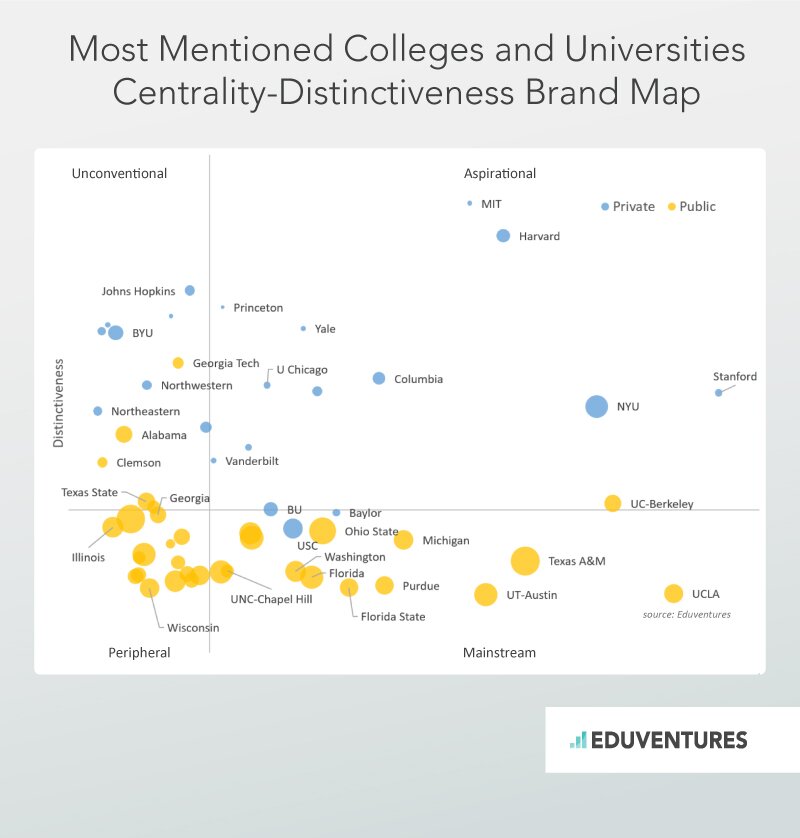

Mapping Your Brand Position

Our data allowed us to create Centrality-Distinctiveness Brand Maps. These maps enable schools to link brand perceptions to brand performance. Below is just one high-level example that looks at the brand positioning for the most mentioned brands in our national sample. Centrality is very straightforward—how many times an institution was mentioned by students in the sample. For that reason, big private brands like Stanford, New York University, Harvard, and Massachusetts Institute of Technology (MIT) lead the way. Similarly, but not quite the same, flagship institutions from populous states lead the way on centrality for the public sector. To measure distinctiveness, we used open-ended word associations in order to develop scores that increased with the frequency of use. That is, if your institution had the same probability of a word association as the rest of the population, then your distinctiveness score remained low. If your institution had divergent probabilities of word associations from the population, then your distinctiveness score increased. It’s important to note that this is not a sentiment score with positive or negative connotations. It measures how distinct you are relative to all other institutions, for better or worse.

*Bubble size = number of first-time degree and certificate seeking enrollments

In our map, looking only at the most central institutions in the country, MIT, Harvard, and Johns Hopkins are the most distinctive private institutions, while Georgia Tech, Alabama, and Clemson, are the most distinctive public institutions. Georgia Tech stands out for it engineering prowess, while Alabama and Clemson are riding a wave of college football success (Clemson took out Alabama in this year’s NCAA College Football National Championship). In the broader sample, though, there are many highly distinctive brands that are less central to the national story but deserve an examination within their particular competitive context. The most distinctive institutions overall are the U.S. Military Academies, followed by Fashion Institute of Technology, and Oberlin College. What this centrality-distinctiveness map shows us is that it’s hard for institutions, especially in the public sector, to be both distinctive and central. In some sense, an institution must own its market position, make the most of it, and create realistic plans relative to its current position.