“360,316 already enrolled.”

It is big numbers like this—featured on the homepage of the 10-course Data Science “specialization” from Johns Hopkins University and many others offered by other schools on Coursera, the giant MOOC platform, that both substantiate and obfuscate the notion of a non-degree graduate boom.

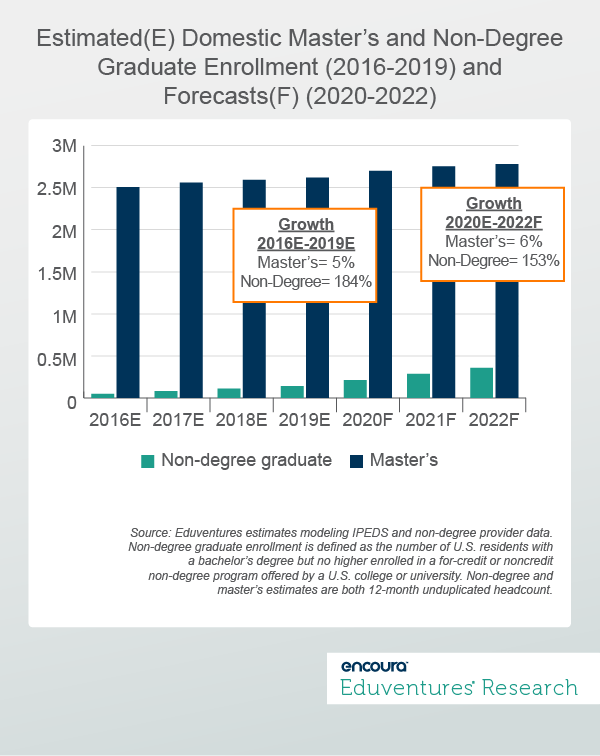

Eduventures recently published Insights Report, Fall 2020 Enrollment Scenarios, Part 4: Graduate Students, considers the graduate market from various angles, including the rise of non-degree online programs. This Wake-Up Call takes up the challenge of making sense of this high-velocity market segment.

Less is More

The pitch for non-degree graduate programs goes something like this: in a fast-paced world, ponderous master’s degrees are often stuck in the past or overly abstract. Many middling schools are in the market; some expect busy working students to come to campus, and most charge a hefty price tag. Better to take an up-to-the-minute course sequence with a fit-for-purpose pedagogy offered online by a top university—for a few hundred dollars.

As we have discussed previously, reality is more nuanced. Based on data from the U.S. Department of Education, the non-degree graduate boom looks less impressive. In 2019, almost 1,000 colleges and universities awarded about 71,000 certificates above baccalaureate level, up nearly 50% since 2010. That year, however, graduate certificates amounted to 7.3% of the awarded master’s total, rising to 8.5% in 2019. A rising share, yes, but hardly a dethroning of the master’s degree, a market that grew 27% over the period, adding about 175,000 net new conferrals—more than double the entire non-degree segment in 2019.

Then again, the problem with the non-degree graduate market is that official data is often lacking. A non-degree program that does not offer academic credit or is otherwise not eligible for federal financial aid need not be reported at the federal level. Indeed, freedom from approval and reporting norms is part of the appeal for today’s new breed of non-degree program.

Returning to the big number with which we started: on the face of it, a single non-degree program on Coursera, with its 360,316 students “already enrolled” is five-times the size of all non-degree graduate conferrals.

Come again?

More is Less

Reconciling these figures requires a closer understanding of what “360,316” actually means. Platforms like Coursera are in the promotions business, offering little detail on what “360,316” refers to. First, such enrollment totals are global, not just U.S.-based. Second, it is unclear whether enrollment is concurrent or cumulative over time. Third, since initial enrollment is free, many “students” may be transient.

Modeling available data, Eduventures arrived at estimates and forecasts for U.S. non-degree graduate enrollment. Factors considered included:

- Revenue and growth for leading platforms (e.g., edX, Coursera, Get Smarter, Emeritus, eCornell)

- Revenue share accounted for by non-degree programs

- Average program pricing, use of free trials, and intelligence on completion rates

- U.S. enrollment share on leading platforms (and likely higher share among paying learners)

- Share of learners with a bachelor’s degree but no higher (i.e., the prospective master’s student)

- Non-degree graduate conferrals reported to IPEDS (and conferral growth) as discussed above

The Coursera CEO has stated the company earned $225 million in revenue in 2019, while in 2018 edX reported “certificate” revenue of $35 million. Both firms earn significant sums from member institutions, paying for technology and marketing, as well as revenue from students, so total revenue is a poor guide to enrollment. Both entities cite rapid year-over-year growth on the order of 50%, supercharged by the pandemic.

Non-degree pricing varies. Longstanding players, such as eCornell, tend to charge $2,000-$4,000 per non-degree program; edX asks $1,000-$2,000 for its longer “professional certificates” but well under $500 for its shorter XSeries. Coursera now offers a $399 a year subscription, offering access to thousands of courses and programs for one price. All the evidence suggests that average per student non-degree pricing is falling, as programs proliferate and providers search for the right intersection of price point, student engagement, and enrollment scale.

Eduventures estimates (Figure 1) that right now there may be some 210,000 domestic, paying students without a master’s degree (i.e., the prospective master’s population) enrolled in non-degree programs offered on the likes of Coursera and edX and similar platforms. Average revenue-per-student, allowing for significant variation by provider, program, and learner, may be as low as $500. Given what we know about provider revenue and pricing, it is hard to arrive at much larger student totals.

Eduventures estimates suggest that the non-degree graduate domestic market, in enrollment terms, is only about 5% of the size of the domestic master’s market. This is up from just 3% in 2017 and projected to hit 13% by 2022.

We also predict that both markets will receive a boost in the coming year, driven by the pandemic-induced recession. Online learning as a pandemic management tool is in tune with a master’s market that was already perhaps 40% online pre-crisis, allaying consumer concern and supporting enrollment.

After 2022, Eduventures expects that the scale and prominence of the non-degree graduate market will mean that the master’s market starts to shrink.

Figure 1 suggests that the “360,316” enrollment figure for a single Johns Hopkins program on Coursera, and the many other large enrollment totals cited on the site, are vastly inflated by non-U.S. learners and non-paying learners on free trials who do not progress. The huge number of single-course learners on MOOC platforms may also be factored into such program totals, connecting headline platform-wide enrollment in the tens of millions to much more modest program revenue.

If our estimate is on target, total domestic paying enrollment—without a master’s degree—across all relevant platforms (some 210,000 students) is lower than the promotional “360,316” for a single Coursera-hosted program.

Bottom Line

The combination of top universities, career-ready programming, creative pedagogy (mix of self-paced, hands-on projects, and feedback), and low prices—not to mention a pandemic blowing online learning into the mainstream—amounts to a compelling business model.

Non-degree graduate enrollment and revenue is growing fast, but this segment is still in the shadow of the master’s degree, which enrolls vastly more students in the U.S. and is much more lucrative. Platform promotion to the contrary is just noise. The fact that neither Coursera nor edX is profitable suggests that the non-degree model, the bulk of the business, is still being refined.

Important considerations going forward include the relationship between non-degree and master’s programs, not least because a growing number of universities now offer “micromaster’s” and the like, offering low-price introductions to conventional master’s degrees. From the university perspective, ideally non-degree graduate programs both strengthen the master’s pipeline and address non-consumption. For many schools, avoiding a long-term master’s downturn in the wake of non-degree competition may prove difficult.

Another head-scratcher is the role of large non-university platforms offering similar non-degree fare, such as LinkedIn Learning and Udacity.

Eduventures welcomes alternative perspectives on domestic non-degree graduate market size. In the meantime, we invite you to read our latest report, Fall 2020 Enrollment Scenarios, Part 4: Graduate Students.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Chief Research Officer at ACT | NRCCUA

Contact

Hindsight is 2020. While the uncertainty of the past several months has provided us with unforeseen challenges, it also offered us guidance on how to better prepare for the future.

On September 3rd, President Brent Ramdin was joined by University of Tampa’s AVP of Enrollment, Brent Benner, as well as Encoura Enrollment Consultant, Tye Mortenson, as they discussed how University of Tampa was able to navigate the challenges of the last recruitment cycle. The conversation focused on the impact of test optional on admissions, the increased competition for out-of-state students, and the urgency to pivot to virtual recruiting methods.