“Our … vision [is] to fully transition our tuition revenue to private sector employers over the next 10 years,” said Karl McDonnell, CEO of Strategic Education (which includes Capella and Strayer universities) in 2020.

When low unemployment is making adult learners think twice about enrollment, and even graduate enrollment is flatlining, schools are rethinking the enrollment playbook.

Colleges have long seen companies as a source of students, but the past decade witnessed a new breed of intermediary designed to scale things up. Organizations that manage partnerships between schools and companies—Guild, EdAssist, and InStride—have convinced more schools to get involved in B2B. But three years on from McDonnell’s prediction, is B2B the enrollment gamechanger boosters claim?

To B2B or Not to B2B?

Industry concentration is one reason schools like B2B: a mere 0.2% of companies in 2022 had one thousand or more staff on the books but employed 42% of the American private sector workforce—a record.

The growing prominence and spending power of these organizations make them a cost-efficient recruitment channel for schools and intermediaries. In turn, corporate partners like the turnkey education benefits, employee support, and tuition discounts. More companies are paying tuition upfront, meaning that staff no longer must seek reimbursement, a welcome boost to hiring and retention in a tight labor market. And a growing share of companies are paying off employees’ student loans.

Strategic Education is building its own employer partner network, dubbed Workforce Edge, which also works with other colleges and universities. Fifty are named on the site, including University of Southern California, UCLA, and University of Florida.

B2B has attracted big names: InStride counts Amazon as a partner and Guild works with Walmart. But how big is the B2B market?

Like the non-degree market—another fashionable play to try to overcome mainstream enrollment challenges—B2B has a data problem. It is not straightforward to figure out how many students enroll through B2B arrangements. If B2B programming is not eligible for federal student aid or the employer picks up the tab, colleges are not obliged to report enrollment to the government.

The Association for Talent Development, representing larger companies, estimates that companies spend $1,280 per employee on workplace learning. Nine percent of that is categorized as tuition assistance. Eduventures estimates that larger organizations spend $7 billion a year in this fashion.

That is only 4% of total higher education tuition revenue, but closer to 20% of adult and graduate tuition revenue.

In 2022, EdAssist, one of the largest B2B management organizations, processed over $1 billion dollars in tuition assistance. Eduventures estimates that perhaps half of large-company spend on tuition assistance is under management at the likes of Guild and EdAssist.

B2B Edge

Another source—the Census Bureau’s Current Population Survey (CPS)—offers a different perspective on B2B. CPS tracks monthly self-reported higher education enrollment.

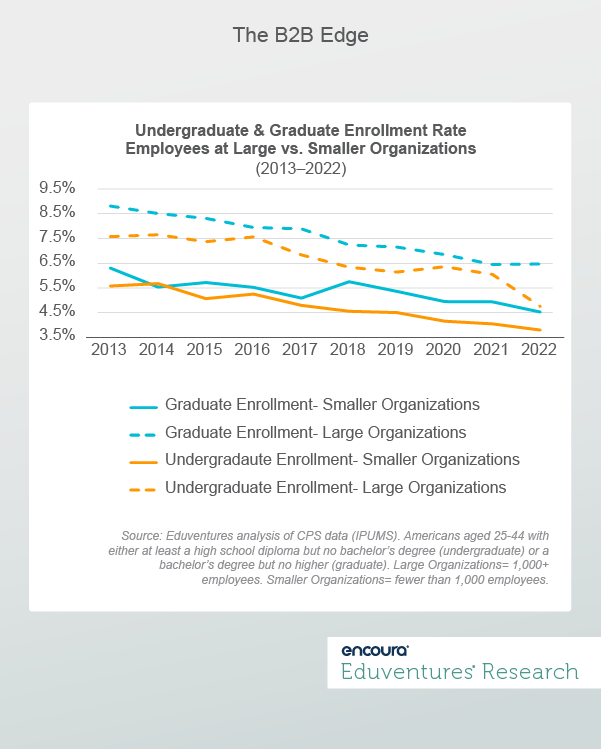

Using CPS, Eduventures computes the Higher Education Enrollment Rate: enrollment as a share of eligible prospects by age and prior education. Figure 1 shows the undergraduate and graduate enrollment rates among employees and at large and smaller organizations, underlining B2B enthusiasm.

Between 2013 and 2019, Americans who worked for a large organization—those most likely to offer tuition assistance—were 25-50% more likely to enroll in college than their counterparts in smaller organizations.

These enrollment rates are lower than those for people outside the labor force, but their scale more than makes up for lower enrollment intensity. Based on CPS data, more than 60% of the American workforce—public and private—work at a large organization.

When it comes to full-time enrollment—most lucrative for schools—large organizations outperform smaller ones. In other words, student enrollment and completion get a boost when the company pays the tuition bill.

In 2020, as the pandemic shook the nation, undergraduate enrollment ticked up at large companies while slipping overall. Employees everywhere were anxious about the future, but those employed at large companies benefited from education subsidies that were better able to withstand economic shocks.

B2B Signals

Another takeaway from Figure 1 is that the enrollment rate for employees of large companies has not been immune to the steady enrollment rate decline that Eduventures has chronicled across higher education. Even at companies with generous subsidies, enrollment remains exceptional.

Guild recently let go of 12% of its staff, consistent with the enrollment pressures in Figure 1. EdAssist, owned by Bright Horizons, is the smallest and slowest growing segment of the parent company.

There is often a tension between what higher education wants to sell (degrees) and what companies and employees want to buy (shorter, cheaper, more direct business impact). InStride helped Medtronic, a leading medical device company, “recredential” 65 job roles from degree to non-degree entry to aid hiring.

Coursera and edX, offering massive collections of online courses at steep discounts, are muscling in seeing B2B as a counter to slowing consumer demand.

Intermediaries and their college partners need to sharpen the value proposition of degree programs. B2B firms are getting choosier about which schools they partner with, shying away from unwieldy catalogs and vanilla programs.

Evidence of intermediary desire to diversify is Guild’s decision to drop “education” from its name, emphasizing career services beyond degrees.

The Bottom Line

Should schools jump into B2B? B2B enrollment offers many advantages for institutions battling softening demand and ballooning costs. Insofar as the typical adult learner takes a transactional approach to higher education, B2B affords schools an efficient recruitment response.

These advantages make up for the fact that B2B arrangements, while helping to stem macro enrollment rate decline, have to date not been impactful enough to turn things around.

Companies can write-off up to $5,250 per year per employee for tuition assistance, but this threshold has been almost flat since the tax benefit was introduced in 1978 and buys a lot less than it used to.

As the market matures, it may be hard for most schools to win a deal with a B2B intermediary. Institutions may have more luck reaching out to local companies with something more customized but face the scale and cost trade-offs the intermediaries sought to overcome.

In the first quarter of 2023, Strategic Education reported that 26% of its higher education enrollment came from employer partners, up from 17% three years earlier when Mr. McDonnell made his prediction. Progress, but still a long way to go.

Trying to understand a particular B2B opportunity by industry, credential, or partner? Contact your Eduventures Client Research Analyst to schedule an advising session.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Chief Research Officer at Encoura

Contact

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values so you can create a productive and distinctive program portfolio.