Back in January, brushing aside pandemic turmoil, I stuck my neck out with some higher education predictions for 2021. Now that the year is drawing to a close, how did I do?

Here is a reminder of my 2021 predictions:

- Fall 2021 Enrollment: Expect a fall 2021 enrollment recovery, especially at four-year schools.

- Academic Program Sanity: Pandemic-driven cuts—and pockets of innovation—will end the “new programs” arms race.

- Flagships & Online: A few energized flagships will announce game-changing online learning strategies for traditional-aged undergraduates.

- For-Profits & OPMs: Don’t expect serious renewed legislative or regulatory curbs on for-profit colleges or OPMs.

In short, I was:

1. Expect a fall 2021 enrollment recovery, especially at four-year schools.

My premise for this prediction was an expeditious vaccine roll-out and good riddance to COVID-19. Most adult Americans did indeed get jabbed but a significant minority are holdouts, undermining the quest for herd immunity. COVID-19 did not go quietly, spawning the troublesome Delta variant just in time for the fall semester.

According to the latest National Student Clearinghouse data, based on 74% of schools reporting, total undergraduate enrollment in fall 2021 saw less serious decline (down 3.5% year-over-year) compared to a year earlier (down 4.5%), but a decline nonetheless. First-year trends were much improved: down almost 11% in fall 2020 versus only a 2.7% decline in fall 2021, but again still a decline. International undergraduate enrollment fell again (-3.1%) but performed much better than a year earlier.

So, I was wrong about a true undergraduate recovery, but at least fall 2021 looks better than fall 2020 (and Common App reports positive application trends for fall 2022). COVID-compromised campus re-openings plus acute labor shortages pushing up wages for Americans without a degree will continue to dog undergraduate enrollment prospects, particularly for adult learners.

But I was right about other enrollment trends. As I suspected back in January, the most selective schools turned things around, posting positive growth after shortfalls in 2020, while less selective institutions saw enrollment performance deteriorate beyond fall 2020 lows.

I was also right that graduate enrollment growth was positive once again, and that growth slowed versus 2020. International graduate enrollment bounced back strongly, pointing to open borders and the embrace of online study.

Wild cards for 2022 include the resumption of student debt repayments in February—suspended during COVID—and ongoing speculation that Biden might cancel some or all federal student debt. The first will do enrollment no favors, while the latter could be transformative. But resumption is much more likely than cancellation.

Not to be outdone, COVID’s latest move, the Omicron variant, is in the mix, too.

2. Pandemic-driven cuts—and pockets of innovation—will end the “new programs” arms race.

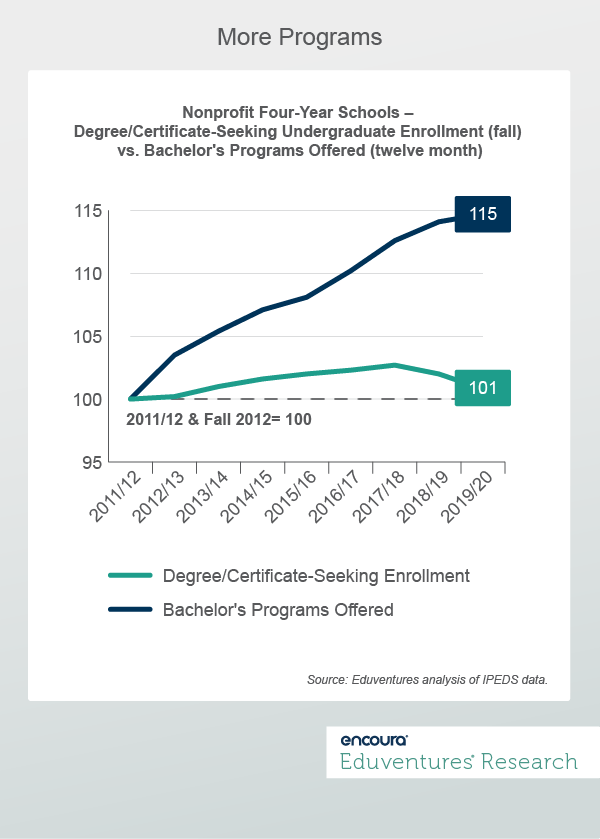

A year ago, I created a chart showing that over the past decade the number of bachelor’s programs grew faster than degree-seeking undergraduate enrollment at nonprofit four-year schools. My first prediction under this heading was that the 2019/2020 program data would show a further increase in bachelor’s volume.

That is exactly what happened. But in preparation for my review, I re-ran the chart to remove community colleges reclassified in IPEDS as four-year institutions after securing the right to award bachelor’s degrees. These schools do indeed add to the total number of bachelor’s programs available, but muddy the waters on enrollment since most students at such schools are not enrolled in bachelor’s programs.

Figure 1 offers an even starker contrast between nonprofit four-year school enrollment and bachelor’s program volume.

While nonprofit four-year enrollment managed only 1% net growth over the period, bachelor’s volume leapt 15%. As predicted, with the latest year of data now available, 2019-2020 saw yet more bachelor’s program growth even as enrollment slipped for the second year in a row. Bachelor’s program volume momentum in 2019-2020, however, was the weakest on record, up only 0.6 percentage points, suggesting that enrollment pressures are beginning to have an impact.

My follow-up prediction back in January was that pandemic-driven disruption would finally push the bachelor’s program line into the negative. We will not have this data until the middle of 2022, but my forecast remains unchanged: schools cannot afford to go on adding more bachelor’s programs without rationalizing the total number on offer. Too many programs inflate costs and dilute brand. Less is more.

3. A few energized flagships will announce game-changing online learning strategies for traditional-aged undergraduates, even as most schools emerge from 2020 bruised and disoriented by the pandemic’s crash course in remote instruction.

It looks like I got this one completely wrong. An overriding desire to “get back to normal” and the ongoing vagaries of the pandemic appear to have inhibited any big online or hybrid traditional undergraduate push by flagships.

Leading schools have been exposed to online learning on a scale unimaginable pre-pandemic, but the movement of student hearts and minds has been less dramatic. Table 1 shows the delivery mode expectations for high school seniors with an “A” GPA—the typical flagship first-year student—planning to enroll in college the following fall. It compares pre-pandemic responses from late 2019 to those from late 2021.

| College Expectations of Delivery Mode | 2019 | 2021 |

|---|---|---|

| Fully Campus | 69.9% | 58.30% |

| Primarily Campus, Some Online | 17.50% | 15.60% |

| Balance | 4.30% | 7.00% |

| Primarily Online, Some Campus | 0.60% | 1.50% |

| Fully Online | 0.30% | 0.90% |

| Unsure | 7.50% | 16.70% |

Table 1.

Source: Eduventures Prospective Student Research (c.12,000 respondents each in 2019 and 2021).

Yes, the “fully campus” assumption fell by more than 10 percentage points in just two years, but the most obvious beneficiary was uncertainty. I interpret this as less that high schoolers have grown enamored of online learning and more the enduring unknowns of what the pandemic might do to carefully laid college plans.

A mere 2.4% of “A” prospects anticipate a fully or primarily online experience. This is more than double the rate in 2019, but again it is tough to conclude that this is all new online enthusiasm.

It should be noted that “A” prospects are less likely than average to anticipate lots of online learning, underscoring why few flagships see getting clever with online or hybrid offerings as a priority. Indeed, it may be other kinds of institutions that see hybrid in their futures.

The real test will be whether these elevated online ratios among high schoolers survive post-COVID.

As discussed under this prediction back in January, the success of University of Florida Online (UF Online), having uncovered significant demand (pre-pandemic) for online study among traditional-aged students set on attending the university but unable to secure a place on campus as freshmen, suggests similar opportunities for other oversubscribed flagships. But with most flagships suddenly test optional and keen to expand the freshman class to help manage market volatility, UF online-style extra capacity may seem superfluous. Expect to see new hybrid initiatives at the most inundated flagships, such as in California.

4. Don’t expect serious renewed legislative or regulatory curbs on for-profit colleges or OPMs, even now that the Democrats have achieved the Presidency-Senate-House trifecta.

This prediction has so far played out as more-or-less as expected. Consumed with vaccines, stimulus, withdrawal from Afghanistan, and massive infrastructure legislation, higher education has garnered little attention from the Biden administration amid acute congressional in-fighting. The House version of the infrastructure bill contains $40 billion in new funds for various postsecondary initiatives, but “free community college” was lost to negotiations..

The Higher Education Act was last reauthorized in 2008, the longest ever hiatus, and reauthorization is not even really on the agenda right now. The Department of Education has expedited loan forgiveness for students once enrolled at collapsed for-profit schools.

The for-profit flash points in 2021 were:

- To push the Accrediting Council for Independent Colleges and Schools (ACICS), the troubled for-profit school accreditor, closer to extinction (but the accreditor hangs on while an appeal is processed).

- To include (subject to negotiated rulemaking yet to play out) Department of Defense and GI Bill funds under the “90” portion of the 90/10 requirement for for-profits to generate at least 10% of revenue from non-federal sources.

- To exclude for-profits from the $550 a year Pell increase in the House version of the Build Back Better bill (but many expect Senate Republicans to strike this from the final text).

There was also, highlighted in April 2021, a Government Accountability Office (GAO) report on for-profit conversions, chiding the education department (and the IRS) for not always adhering to IRS guidance and for not adequately monitoring conversions over time. The education department acknowledged more could be done but kicked the can down the road in terms of formulating new procedures.

If passed or escalated, all four items could prove a significant blow to for-profit schools, but some may not come to pass or be defanged through litigation.

With mid-terms looming, the Democrats likely have less than a year to pull off any anti-for-profit sweep in the manner of Obama’s first term. The Department of Education just announced a new round of negotiated rulemaking for 2022, with something of a focus on for-profits. Fall 2021 enrollment numbers from the National Student Clearinghouse saw for-profits once again falling sharply after a 2020 reprieve, which may convince lawmakers that market forces are doing their jobs.

And Online Program Managers (OPMs)? Hardly a murmur. Neither the GAO nor the Office of Inspector General (OIG) investigations into OPMs have yet reported, and the reality of OPMs seems too nuanced (and too much about worldly-wise graduate students) for critics’ charges to really hit home with lawmakers.

Let’s see what 2022 brings. The end of ACICS and the 90/10 rule modification seem most realistic, in my view.

What’s Next?

Look out for my 2022 higher education predictions in early January…

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Chief Research Officer at Encoura

Contact

Thursday December 9, 2021 at 1PM ET/12PM CT

Digital content is a central part of a student's learning journey, but measuring student engagement with digital content often involves tracking logins, clicks, time spent on pages, or downloads. However, treating the measurement of student engagement with digital content this way overlooks key questions we may want to know about whether institutions are delivering effective digital teaching.

The shift to digital content (driven by the pandemic) has opened an opportunity for universities to understand how students engage with digital content and use those learnings to inform strategy.

This webinar will present the findings of Eduventures Principal Analyst, James Wiley's research into content engagement and highlight BibliU's approach. Topics include:

- The current state of measuring student engagement with digital content

- Best practices in measuring digital content engagement

- The advantages of measuring student engagement with content and its relationship to retention

- How BibliU measures engagement with digital learning materials

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values, so you can create a productive and distinctive program portfolio.