There is no denying that the health-aligned program market has experienced massive growth in recent years. Health-aligned bachelor’s and master’s degree conferrals both grew by more than 50% between 2012 and 2019. But as we emerge from the COVID-19 pandemic, what about the road ahead?

Over the past year, we’ve received this and related questions from institutions wanting to understand how COVID-19 might affect prospective student academic interests. On the health-aligned market, musings focused on two pivotal questions: Would images of overworked doctors and nurses and an increasingly contentious public health debate dissuade prospects from pursuing a career in healthcare? Or would those factors serve to motivate prospects and continue fueling pre-pandemic health-aligned market growth?

So far, evidence points toward the latter.

Looking Back

Consider this: at the bachelor’s level alone, the health professions and related programs market saw a net gain of 1,206 programs between 2012 and 2019. Sixteen percent of all new bachelor’s degree programs launched during that time were health related. Health-aligned bachelor’s degree conferrals surged from 164,489 in 2012 to 252,718 in 2019.

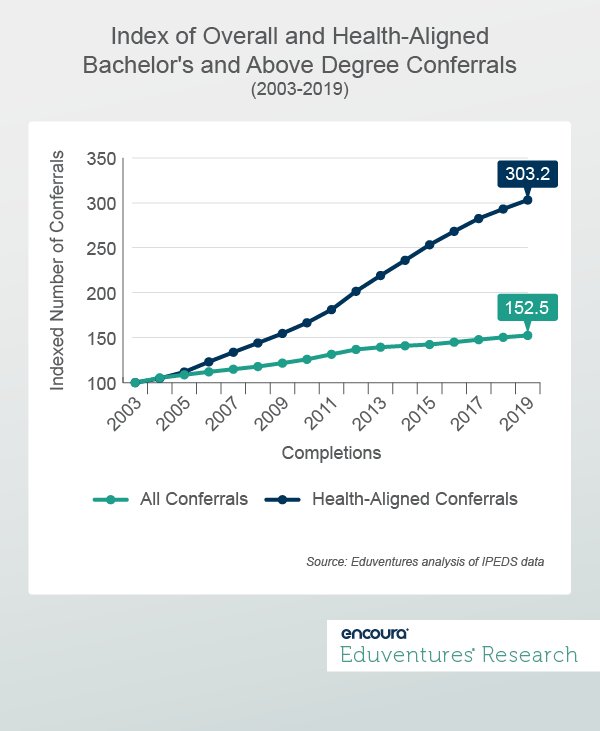

Expanding our scope beyond the bachelor’s market, Figure 1 contrasts the indexed growth of all bachelor’s and above degree conferrals with health-aligned bachelor’s and above degree conferrals.

At least pre-pandemic, the health program market showed no signs of slowing down, as health-aligned degree completions greatly outpaced the overall market. Some of the markets seeing the most growth across bachelor’s and above degree programs over the last five years in which conferral data is available (2015-2019) include: registered nursing (+23,000 completions), health services/allied health (+21,000 completions), medicine (+20,000), dentistry (+6,826), public health (+5,000), and healthcare management (+5,000).

But conferral data is just a proxy for student demand, so what have prospects actually told us they want to study?

We Want Health

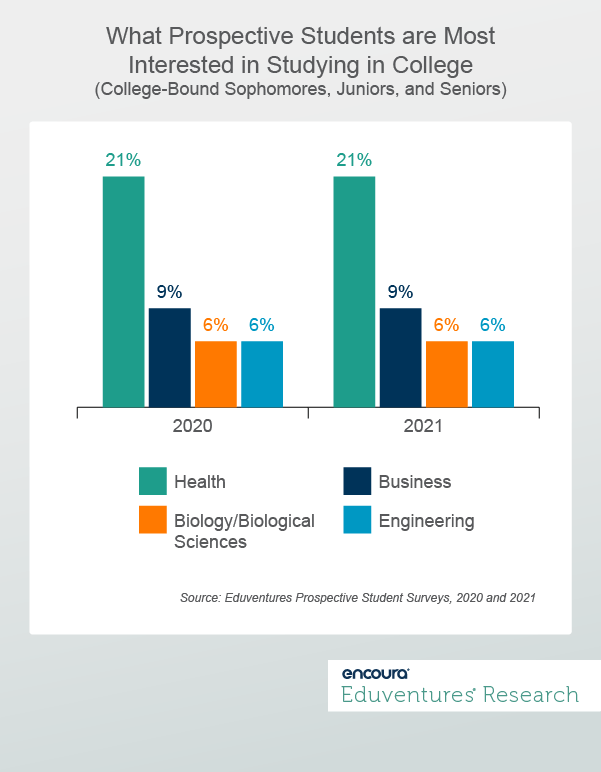

Eduventures’ Prospective Student Survey™ reveals insights into the preferences, expectations, and desired experiences and outcomes of high school sophomores, juniors, and seniors. The two most recent surveys, fielded in winter 2020 and 2021, provide a pre- and mid-pandemic view of the top four academic fields students are most interested in studying: health, business, biology, and engineering (Figure 2).

Pre-pandemic and mid-pandemic snapshots reveal no change among the top four academic areas of interest for traditional-aged prospects, with health being the consistent top choice by 12 percentage points—a significant margin—across these years. Among specific health fields, nursing was the top choice among prospects, receiving 29% of responses in 2020 and 28% in 2021, while interest in medicine saw the biggest jump from 11% to 21% over those years. .

The Doctor Will (Virtually) See You Now: A Look at the Emerging Telehealth Market

Jun. 29, 2021

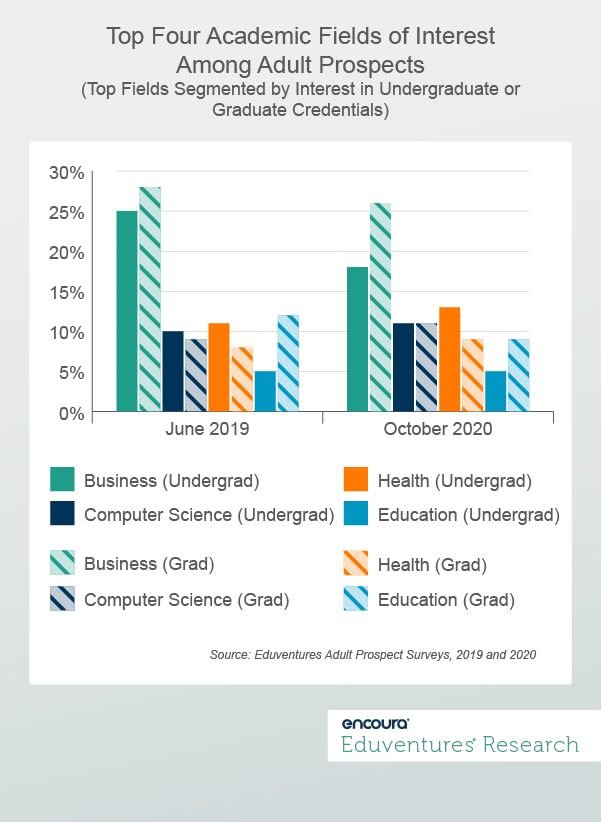

Eduventures’ Adult Prospect Survey™ provides similar insights for prospects aged 22 and older. Our June 2019 and October 2020 surveys also provide a pre- and mid-pandemic view of this populations’ academic interests (Figure 3).

While the traditional-aged cohort uncovered no shifting interests among the top academic fields of interest, we can observe some shifts among adults in the areas of business, computer science, education, and health-aligned programming. Health, while not the top choice for adult prospects, experienced an increase at both the undergraduate and graduate credential levels between 2019 and 2020. For that matter, only health and computer science saw increases across both levels of interest from pre- to mid-pandemic. And, like traditional-aged prospects, adults are most interested in pursuing nursing programs, while healthcare management interest ranks second.

With high and steady interest in health programming among traditional-aged prospects and growing interest among adult prospects, we can see the rock-solid nature of this market—even in light of the challenges presented by the COVID-19 pandemic.

Other Market Signals

Over the last few months, health-aligned associations have also started reporting application and enrollment updates that provide another view of potential market shifts. Some of those updates are detailed below:

- Nursing. In April, the American Association of Colleges of Nursing (AACN) reported that enrollment across baccalaureate, master’s, and doctoral nursing programs increased in 2020 “despite concerns that the pandemic might diminish interest in nursing careers.” Based on their Fall 2020 survey of 956 nursing schools, year-over-year enrollment increases were observed in baccalaureate (5.6%), master’s (4.1%), and Doctor of Nursing Practice (8.9%) programs.

- Public Health. In May, the Association of Schools and Programs of Public Health (ASPPH) reported a 40% increase in graduate-level public health degree program applications from March 2020 (17,353 applications) to March 2021 (24,176 applications) with ASPPH claiming that COVID-19 has opened a new chapter for the field. In listing the top seven public health graduate-level areas of study for applications, ASPPH reports that Epidemiology comes in at number one.

- Medicine. Late last year, the Association of American Medical Colleges (AAMC) reported a modest increase of first-year student enrollments in U.S. medical schools for the 2020-2021 academic school year. Medical school applications for the 2021-2022 academic year, however, were up by a significant 18%.

The Bottom Line

Historic conferral trends, prospective student interest, and recent application and enrollment data combine to signal that interest in health programming is not likely to wane any time soon. In fact, evidence suggests we are in the midst of at least a short-term spike in interest due to the pandemic.

More forward-looking, health-aligned professions are projected to see some of the fastest growth over the next 10 years. From 2021 to 2030, while all occupations nationally are projected to see 6% growth, healthcare support occupations (20%) and healthcare practitioners and technical occupations (10%) are both projected to outpace the national average.

What does this mean for schools?

Together, these trends point to continued opportunity for health-aligned academic programs. But, of course, program development is never that simple. For one, health programming can be more complicated to launch given licensure requirements and capacity issues around residencies and labs. Additionally, some health programs, such as nursing, carry higher-than-average instructional costs per credit hour.

Finally, while this overview of data signals promise, more in-depth research would be required to truly tease out viability for a particular school. For instance, schools considering a public health bachelor’s degree would need to understand that, between 2014-2019, programs (21% CAGR) slightly outgrew conferrals (20% CAGR) signaling what may appear to be a trend toward market saturation.

Interested in more in-depth health program research? Reach out to your CRA today.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Client Research Analyst at ACT | NRCCUA

Contact

Our mission at ACT® | NRCCUA® is to encourage higher education institutions to make more informed decisions. By providing data science and technology, we’ve helped over 2,000 institutions find and engage their best-fit students.

Toward this end, we’ve heard from many of our member institutions on how they’ve been able to achieve their goals through our research, technology, and solutions. We’ve compiled the Encoura Client Experience Collection to share their stories in the hopes that it will inspire and equip others to make more informed decisions, so that every student and institution can achieve their goals.