Perhaps not quite at the fever pitch as it was in 2022, artificial intelligence (AI) remains omnipresent. Whether scanning the news, sparring with chat bots, googling a question, or following Eduventures’ Wake Up Calls, engaging with AI has become a daily occurrence for many.

AI’s sudden ubiquity in the public’s consciousness is one reason why we labeled it a “Program to Watch” at the 2023 Eduventures Summit – a label informed by increased market investment, in demand AI-aligned skills, and growing student interest.

Now that the dust has settled since that proclamation, let’s check in on the AI program market by previewing some insights from our recently published report: Eduventures’ Artificial Intelligence Program Market Dive.

Up, Up, and Away

It may be hard to believe, but AI has long had a dedicated Classification of Instructional Program (CIP) code, well before fields like data science and data analytics—a reminder that AI, while a newer concept in the public mainstream, has been around since the early 1950’s. This CIP code allows us to track key metrics, like program market size and direction, more directly over a longer period. For example, we found 1,271 AI completions in 2023 across all degree and certificate levels tracked by IPEDS, up from just 151 in 2014—an increase of over 700%!

While signaling explosive growth, however, these figures also reveal a very small market.

But these numbers only tell part of the story. We also closely follow three other CIP codes (described in Eduventures’ Artificial Intelligence Market Dive Report) that also include AI concepts and themes in their program definitions. Grouping all four AI-related CIP codes together allows us to broaden the scope of our analysis—we call it our “AI proxy.”

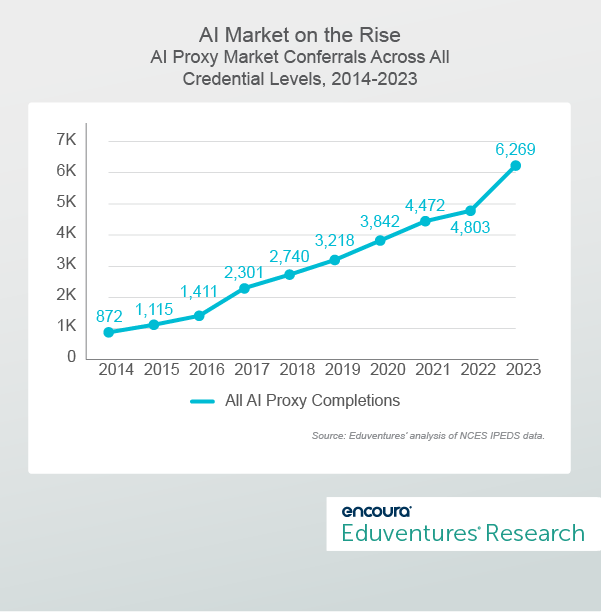

As Figure 1 shows, at least from a growth perspective, AI has certainly lived up to our label as a “Program to Watch.”

Figure 1.

Our AI proxy reveals a market that is almost five times larger than the AI CIP code alone. Over the last 10 years, all AI proxy completions grew by a 25% compound annual growth rate (CAGR) compared to 1% for the overall market, inclusive of all fields of study. Notably, AI proxy conferrals grew by an incredible 31% year-over-year in 2023—a period when overall conferrals declined by 3%.

Growth, however, is just one layer of market assessment. What else do we know about how this market has developed?

Not So Fast

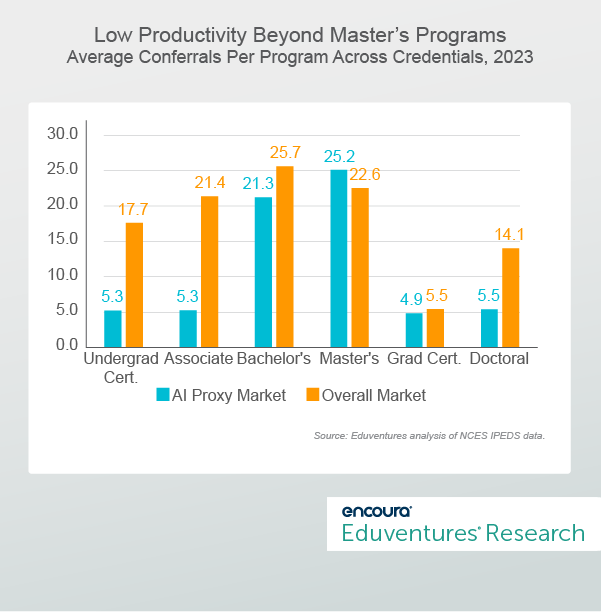

While conferral growth shows a clear upward trajectory, AI market productivity (or conferrals per program) tells a different story. In 2023, there were just 14.8 average conferrals per program in the AI proxy market across all credentials. This is far below the overall market average of 20.6 conferrals per program.

Below average productivity as a market signal isn’t necessarily a bad thing if it can also be traced to productivity growth. In the AI proxy market, productivity has declined since 2014, from 16.8 conferrals per program, and has plateaued since 2020. These indicators are not congruent with a goal of ambitious enrollment growth.

When broken out, as in Figure 2, only one AI proxy market segment—the master’s level—beats the overall productivity benchmark.

Figure 2.

Since only master’s level AI productivity beats the overall market average, this means that all other credential segments, especially the associate, certificate, and doctoral segments, have dragged AI market productivity down.

What other key signals can we observe in this market?

- Master’s significance. Master’s programs make up 30% of AI proxy programs, and this is almost twice the master’s program share in the market overall (16%). Additionally, these 30% of programs claim 50% of all AI proxy conferrals, which is almost three times more than the overall market (18%).

- Research institutions dominate. Almost half (46%) of AI-aligned programs track to R1 and R2 institutions compared to the 26% overall market average. In the master’s market alone, the most significant AI program market, R1 and R2 schools combined account for 70% of AI proxy programs (compared to 50% of overall master’s programs).

- International student reach. There is considerable international student activity in the AI market. In 2023, about one-third of AI proxy conferrals were tracked to international students. This compares to just 6% in the overall market. Some of this may be pent-up demand lingering from the pandemic period, but even in 2022, the international conferral proportion in the AI market was 22% - much greater than average.

The Bottom Line

So, where does the AI market go from here? Will it resemble the ever-growing data analytics program market as the next sure thing? Or perhaps the E-commerce program market that saw momentum through the dot-com bubble but diminished with the dot-com crash and receded into broader programs?

Eduventures thinks the answer lies somewhere in between.

The market potential for AI as an independent degree program is likely a specialized opportunity, suitable mainly for early adopters and institutions that have the research expertise and resources to offer high-quality programs in this rapidly evolving field.

For most schools, launching a standalone AI degree program will not be prudent. But it is likely imperative that all schools weave some AI-aligned content into their curricula. Most schools should think about AI as an opportunity across a range of existing programs thereby creating different AI coverage areas through individual courses, or even concentrations, that align to signals from the labor market.

Identify new program opportunities—at the undergraduate or graduate level—to expand market reach and drive enrollment growth.