Each December we ask our analysts to reflect on the past year and share one topic that has grabbed their attention. From anticipating a generational shift in values among prospective parents to understanding successful strategies behind master’s-level enrollment growth, here are five ways they answered the question, “What have you learned this year?”

- Bachelor’s Earnings Expectations Soar Above Reality – Clint Raine

- Gen Alpha Brings Their Millennial Parents Into College Search – Johanna Trovato

- It’s Hard To Grow Both Domestic and International Master’s Enrollment – Richard Garrett

- Filling the Enrollment Data Gap – Chris Gardiner

- Smarter Choices: Today’s Students Are Understanding the Weight of Their College Decisions – Kim Reid

Bachelor’s Earnings Expectations Soar Above Reality

By Clint Raine

In 2024, I learned that the earnings expectations of students pursuing bachelor’s degrees are wildly inflated versus the actual earnings of bachelor’s degree completers. This is a critical perception gap, challenging colleges and universities seeking to slow declining confidence in higher education among the American public.

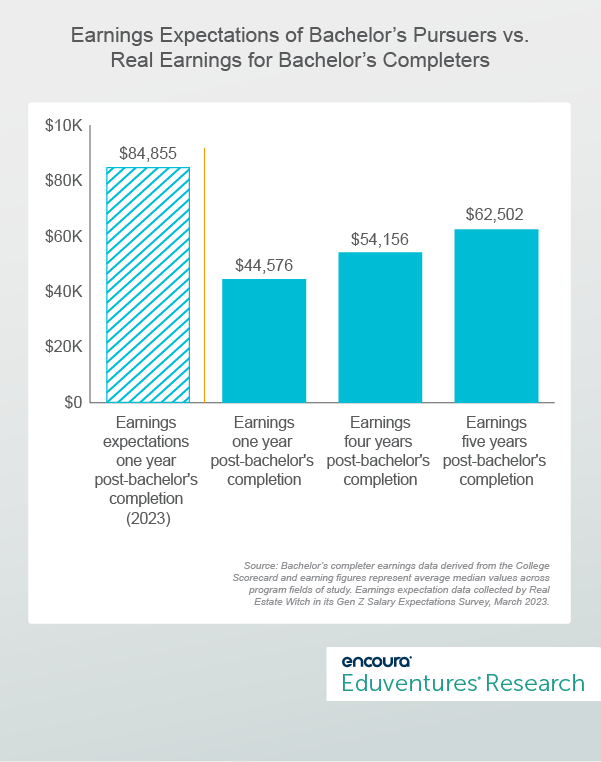

Based on available data, Gen Z students expected to make over $84,000 one year after completing their bachelor’s degrees in 2023. The average median earnings for actual bachelor’s holders, however, is about half this amount—just over $44,500. Even five years after bachelor’s degree completion, this figure is just $62,502, which is still more than 25% below first-year earnings expectations.

Figure 1.

Based on these earnings expectations, real median earnings may provide a sobering reality check for bachelor’s students. Unrealistic expectations, however, mask genuine success stories in bachelor’s earnings.

For example, real median bachelor’s earnings grew by 40% (just under $18,000) in the five years following degree completion—the second biggest earnings boost of all credentials except for professional degrees. Through another view, bachelor’s holders earn 6% more than associate degree holders one year after degree completion, but this bachelor’s earnings premium grows to 28% five-years post completion.

Finally, we should note that certain majors do show earnings well above $44,000 one-year post-completion. Examples include computer engineering ($78,700), nursing ($75,200), and statistics ($63,200).

The bottom line is that somewhere along the way, the average Gen Z bachelor’s student has set wildly unrealistic expectations for themselves. The risk is that if expectations aren’t met, these consumers will form negative opinions.

Like any investment, however, time and patience are required to realize gains, and, clearly, real bachelor’s earnings see marked growth over time. Colleges and universities need to play an active role in setting realistic expectations for their students to counter the narrative of declining value.

Gen Alpha Brings Their Millennial Parents Into College Search

By Johanna Trovato

In 2024, I learned that preparing for Gen Alpha to enter the college-bound pipeline also requires us to consider generational shifts among their parents. Both Gen Z and Gen Alpha are close to their families, making parent engagement a necessity. But as Gen X (parents of Gen Z) passes the baton to Millennials (parents of Gen Alpha), differences in considerations around college emerge.

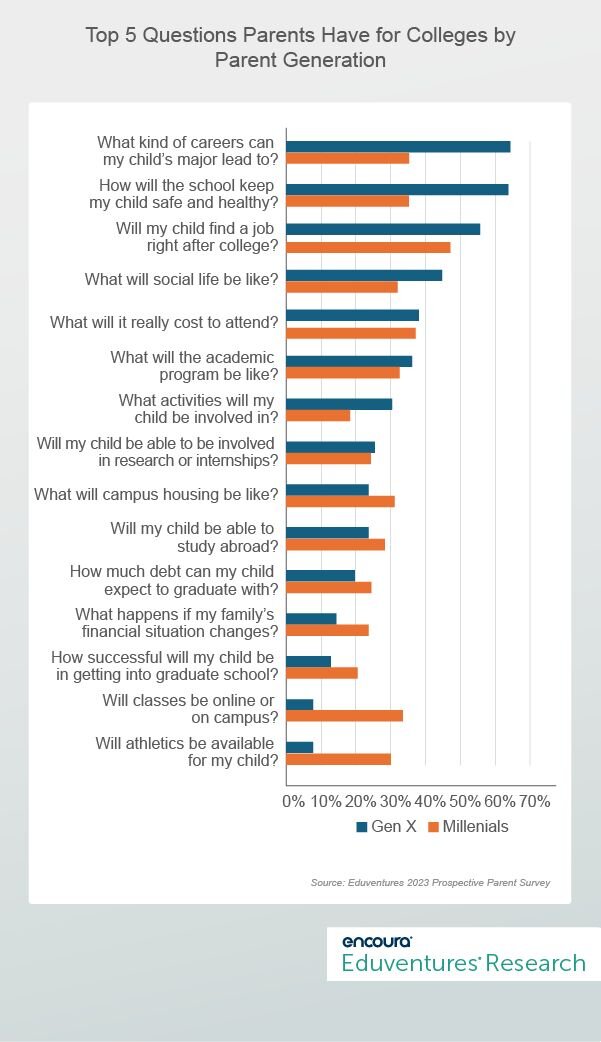

Figure 2 shows how parents of college-bound high school sophomores, juniors, and seniors rank their top five questions for colleges.

Figure 2.

This shows that both Gen X parents (born between 1965 and 1979, with an average age of 51 in our sample) and Millennial parents (born between 1980 and 1995, with an average age of 40) wonder about job placements, cost, and career outcomes most. But significantly, fewer Millennial parents want to know about career preparation and outcomes compared to Gen X. Millennial parents also less often wonder about the safety, social life, and activities of their children once in college.

Instead, Millennial parents are more curious about course modality (perhaps influenced by pandemic online learning) and the availability of athletics (perhaps wondering if years of club sports will translate into athletic scholarships?).

Overall, Millennials appear to have a broader range of questions for colleges than Gen X, who seems mainly focused on preparing their child for a career in a safe and supportive environment.

These differences raise further questions about these rising student and parent generations:

- To what degree will Gen Alpha students be influenced by their parents?

- Will the current focus on career outcomes wane, and will higher ed require a new value proposition?

- How will Gen Alpha students and Millennial parents perceive institutional brands?

In 2025, I am looking forward to exploring these and other questions with new parent and student data, including, for the first time, college-bound Gen Alphas.

It’s Hard To Grow Both Domestic and International Master’s Enrollment

By Richard Garrett

In 2024, I learned that surprisingly few R1s embody domestic and international master’s growth.

“R1” is shorthand for the 146 universities deemed—by the Carnegie Classification—to be the most research-intensive in the nation. R1s make up only 8% of schools with master’s programs, but award 40% of master’s degrees. “R1” means prestige.

While master’s programming does not influence R1 status, the designation drives master’s-level interest. R1s are popular with domestic and international master’s students, which presents these universities with a dilemma.

International students want to study on campus, while a growing proportion of domestic students prefer online. Many international students pay premium tuition, while all schools are under growing scrutiny to demonstrate value-for-money for U.S. students.

Many R1s have doubled down on international recruitment. Between 2013 and 2023, R1s grew domestic and international master’s conferrals by about 55,000 each, even though international accounted for only 22% of conferrals in 2013. Despite being premiere brands, R1s increased domestic master’s conferrals merely at the same rate as other schools.

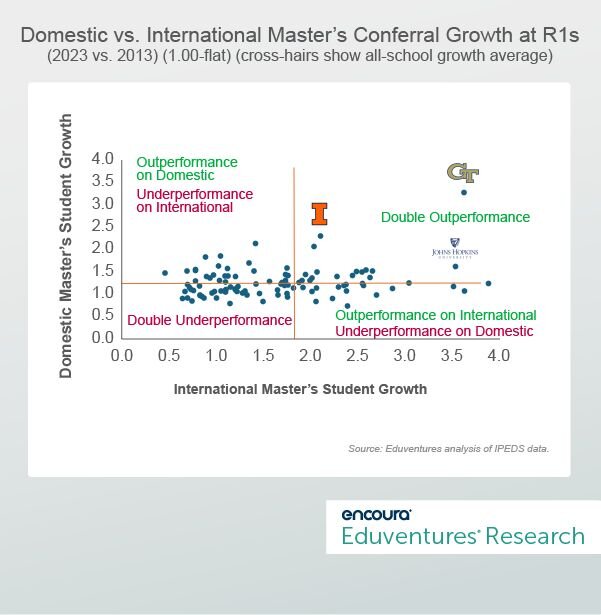

Among 104 R1 universities (excluding those with smaller baseline enrollment), only 17 (16%) grew both U.S. and international cohorts faster than average (across all institution types) through 2023 (see Figure 3).

Figure 3.

In Figure 3, three “double outperformance” strategies are visible:

- A: Pioneer low-priced, built-to-scale master’s programs online (in a limited number of fields) to super-charge domestic enrollment, but keep most other master’s programs on-campus (e.g., Georgia Tech, University of Illinois Urbana-Champaign, University of Colorado Boulder).

- B: Offer a larger suite of market-oriented, competitively-priced online master’s programs combined with a STEM program portfolio on campus (e.g., Johns Hopkins, Purdue, University of Texas Arlington).

- C: Provide some conventionally-priced online and hybrid programming alongside a top-branded campus (e.g., University of California-Berkeley, Cornell, Yale).

These outperformers do not necessarily have the “right” or “finished” model, but they are reaping the rewards of diversified enrollment momentum and revenue flexibility. Plenty of R1s have a growing array of online programs but struggle if the price, experience, and positioning are wrong.

In a tightening master’s market with skeptical regulators and a protectionist president about to enter the White House, more peer schools would be advised to emulate the strategic agility embodied by the “R1-17.”

Filling the Enrollment Data Gap

By Chris Gardiner

In 2024 we made strides in filling a longstanding critical information gap in higher education data: 12-month bachelor’s degree enrollment.

Why does 12-month enrollment matter? Fall enrollment data, long the standard, fails to reflect the growing complexity of enrollment patterns, especially as online learning becomes more prevalent.

12-month numbers provide a clearer picture of the total number of students enrolled. As bachelor’s enrollment declines—due to demographic shifts, questions about the value of a degree, and return-on-investment challenges amid a tight labor market—understanding the impact across all types of students and institutions becomes critical.

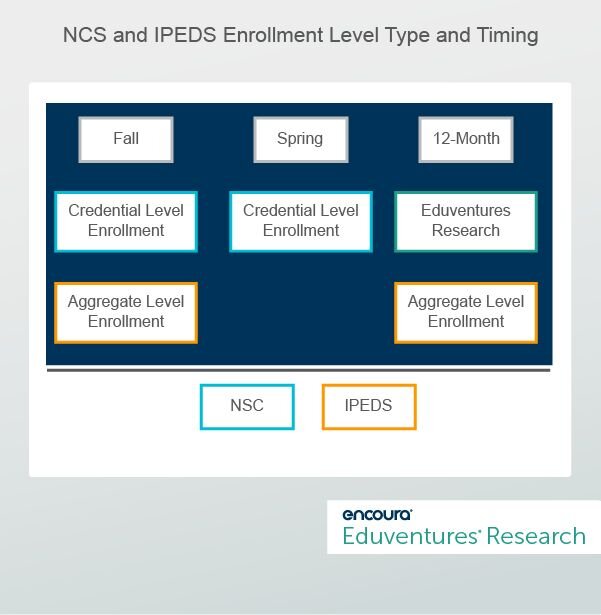

Since fall 2017, the National Student Clearinghouse (NSC) has reported fall and spring undergraduate enrollment by credential, including bachelor’s enrollment. IPEDS, the long-standing official enrollment database, provides data on fall and 12-month unduplicated enrollment. Both datasets, however, have limitations:

- NSC: Excludes 12-month enrollment altogether.

- IPEDS: While offering 12-month data on full-time/part-time status, transfer, demographics, and modalities, it aggregates this information at the undergraduate level, lacking detail by credential.

This “missing” data is 12-month unduplicated enrollment by credential, specifically for bachelor’s degrees (though also applies to master’s and doctoral levels, see Figure 4).

Figure 4.

Given these limitations of existing datasets, Eduventures is filling the gap.

Based on our analysis, we estimate that 10.31 million bachelor’s students were enrolled in credit-bearing programs during the 2023/2024 academic year. Additionally, we have estimated total bachelor’s online enrollment, as well as total and online enrollment for master’s and doctoral programs.

While understanding the current state of enrollment is valuable, we have also projected 12-month enrollment for future years. We expect this holistic enrollment view will equip institutions with insights to help face the impending “demographic cliff” and anticipate future demand in 2025 and beyond.

Smarter Choices: Today’s Students Are Understanding the Weight of Their College Decisions

By Kim Reid

This year I learned that traditional undergraduate students, contrary to popular belief, make rational enrollment decisions. Too often we think of 18-year-olds as mercurial, with motives that are difficult to parse. Despite their complex desires about college, the data shows they are choosing institutions that drive better outcomes.

Let’s compare two institutional segments that continuously compete in regional markets: moderately selective public and private schools.

Both sectors are struggling to grow enrollment post-COVID. According to the National Center for Education Statistics, between 2019 and 2022, enrollment of high school students immediately attending college after graduation declined 1% at moderately selective publics and 2% at moderately selective privates.

These segments have different price points and different value propositions. Yet Eduventures’ Admitted Student Research shows that moderately selective public institutions almost always best their private counterpart institutions in the same regional market.

Table 1 shows how student outcomes at these types of institutions differ.

Moderately Selective Institutions

(admit 41 to 80% of applicants)

|

Median |

Public |

Private |

|

Post Covid Growth |

-1% |

-2% |

|

Retention |

77% |

76% |

|

Graduation |

59% |

61% |

|

Net Price |

$28,680 |

$54,381 |

|

Debt on Graduation |

$20,906 |

$25,000 |

|

Year 1 Earnings for Graduates |

$43,750 |

$40,724 |

|

Debt as a Percentage of Year 1 Earnings |

46% |

59% |

Table 1.

When you look at the underlying outcomes data for each institutional segment, the allure of the public institution vs. the private is undeniable. While these public institutions are nearly equivalent on retention and graduation rates, the total net price is far lower (-47%) and debt is significantly lower (-16%) at the publics. Most importantly, first-year earnings are slightly higher (+7%) and debt as a percentage of first-year earnings is also superior (-13 percentage points) for the moderately selective public institution.

When a student has a choice between these two types of schools, rationality often steers them toward the public choice. Both segments are having difficulties, but the privates are struggling twice as much as the publics. In fact, moderately selective publics serve twice as many traditional undergraduates (28%) as the privates (14%).

To me, these outcomes metrics indicate that today’s student really understands the economic weight of their college decision. Let’s embrace their rationality. To do so, focus on building strong student outcomes from start to finish, a good salary, and manageable debt.

Eduventures Summit – higher education's premier thought leadership event – is returning to the Windy City next year at the Loews Chicago Downtown Hotel June 16-18, 2025!