On January 14, three Democratic senators wrote to the CEOs of leading Online Program Management (OPM) companies. The senators fret that OPMs, a growing force in online higher education, may be jacking up tuition and siphoning off public funds with insufficient accountability. A long list of questions about how these companies operate concludes the letter, with answers requested by end of January.

Lawmakers are not the only ones asking questions about OPMs. Last month, Eduventures published a report on the industry, Industry Guide to Online Program Management 2022: The Evolving Market, the first in a new series, which addresses a number of those questions.

And we have a couple of questions of our own. Is lawmaker interest a sideshow in a thriving OPM market or are these companies heading into rocky territory? And are the

OPM Realities

The goal of the new Eduventures OPM report series is to illuminate this large, dynamic, controversial sector. Our clients include OPMs and their institutional partners, but also numerous institutions that do not work with an OPM. We are not “for” or “against” these companies. Our job is to help our clients make smart decisions about the higher education market, including whether or not to contract with an OPM.

Eduventures defines OPMs as: a) companies that partner with universities to launch (primarily) online programs, and b) companies that provide service bundles (typically marketing, recruitment, program development and student support).

The senators want to know how many schools OPMs work with, how many and what kinds of programs they manage, who the students are, and what business models OPMs use. Our newly published report has some answers.

Yes, the OPM sector is large, fast-growing, and commercial, but some perspective is warranted.

In collaboration with our partner LISTedTECH, we have compiled a list of some 1,800 active program partnerships between OPMs and U.S. colleges spanning 250 unique institutions. The total U.S. OPM market is perhaps 20-30% larger than our figures suggest (some OPM-managed programs are hard to verify) but our dataset, the best available, is a good proxy for market trends.

OPM momentum is clear: we estimate that about 15% of four-year U.S. colleges and universities currently partner with an OPM, a ratio that has more than doubled over the past decade. But the typical school, even the typical school offering online degrees, does not work with an OPM.

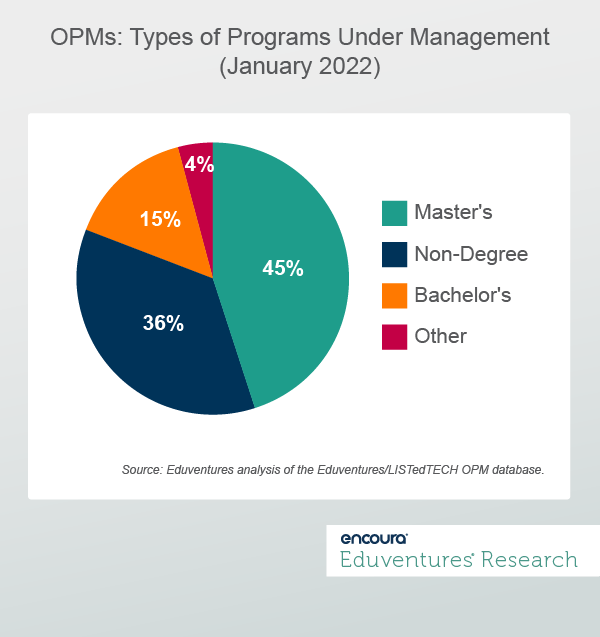

Figure 1 estimates the program-type breakdown under OPM management.

This breakdown illustrates that master’s degrees are most prominent. These short, career-focused programs target busy, academically-accomplished students who value online study. In recent years, a swell of non-degree programs, also aimed at people with at least a bachelor’s degree, have taken that logic one step further: even shorter (and more affordable) career-focused programs.

By contrast, the large online bachelor’s market has seen relatively little OPM activity. Companies are wary of higher student attrition and inflated support costs. The senators asked what proportion of students enrolled in OPM-managed programs receive Pell Grants. Based on Figure 1, relatively few.

If the senators think that the typical OPM student is a vulnerable, first-generation undergraduate, the data paints a different picture. Low graduation rates, the supposition behind another of the lawmakers’ questions, are less of a problem for online graduate programs compared to their undergraduate counterparts.

There is no doubt that OPMs have added lots of new programs in recent years. By our calculations, since Eduventures' last OPM report, published in 2018, OPMs have announced about 50% additional program-level partnerships above the cumulative active program total that year. Yet OPMs manage no more than 2-3% of all master’s programs in the country and perhaps 10% of online master’s programs.

Spurred by that massive injection of program inventory, we forecast OPM market size (excluding revenue flowing to school partners) to hit $4.6 billion by 2025, up 75% from 2020. A large sum but only 1% of total revenue for nonprofit higher education.

Business model is another concern for the lawmakers. Revenue share arrangements, where OPMs get sometimes 50-60% of revenue in exchange for upfront investment and ongoing services, are of particular interest. The senators worry that such arrangements, despite a regulatory carve out, may flout the spirit or the letter of incentive compensation rules barring colleges from paying staff or service providers based on enrollment.

Our research suggests that revenue-share remains the most common OPM business model, but most firms today also offer fee-for-service. Competition has lowered revenue share ratios, with some firms touting as low as 15-30%. Eduventures estimates that the average revenue-share ratio is now about 40%. There is much greater evidence of cost control, service innovation, and economies of scale in today’s OPM market. Exactly what counts as incentive compensation is a conundrum for higher education across the board.

OPM Futures

Beyond size and shape, are the senators asking the right questions about OPMs and will this probe morph into new regulation?

The senators’ starting point is: what good is regulation of universities if ever more institutional activity is undertaken by private companies not bound by such rules?

This is a fair question. While colleges and universities, if in receipt of federal student aid, must report all manner of data to the U.S. Department of Education, OPMs have no such obligation. Yet, as the senators note, those same federal dollars help fuel OPM balance sheets. Whether the OPM has a revenue share or fee-for-service contract with its partner schools, the typical student in an OPM-run degree program is drawing on federal grants and/or loans.

But it is a mistake to think of OPMs as the latest incarnation of predatory for-profit schools. Insofar as the typical student on an OPM-managed program is enrolled in a master’s degree program, the much bigger data gap is almost zero information on master’s degree completion rates across the board. Without a benchmark, simply knowing how OPM-managed programs perform will not be very illuminating.

The senators are on stronger ground when it comes to student debt. Federal College Scorecard data includes average debt levels by program, including graduate programs, permitting a comparison between market norms and OPMs.

The rise of non-degree programs run by OPMs, most not eligible for academic credit or federal student aid, counters the narrative that OPMs are addicted to public money. Growing OPM interest in employer-pay models and international markets are other examples of diversification away from federal dollars.

Chastising OPMs for high tuition when most online programs are operated by schools on their own also risks missing the bigger picture. Just like schools, OPMs run the gamut from very expensive to very affordable online programs. Incenting schools to do more to leverage technology to lower costs might be regarded as the more pressing challenge.

The senators want OPMs to disclose what proportion of expenditure goes on instruction and student support versus marketing. But there are no standards here. Is a school or OPM that spends less than average on instruction to be praised as innovative or criticized as shortchanging students? Of course, partner institution spend must also be factored in.

The irony is that OPMs, by consolidating marketing and support spend across multiple programs and schools, likely boost efficiency and effectiveness in ways many institutions struggle with. Contrary to the senators’ instincts, some OPM partnerships may result in superior value for money for students.

Following an earlier inquiry by two of the same senators just before the pandemic, a handful of OPMs (e.g., 2U, Wiley, Academic Partnerships) released their own “transparency” reports. These are valuable documents but are inevitably inconsistent and hardly disinterested. The senators want more but are likely to get a similar smorgasbord of information in response to their latest inquiries, producing as many questions as answers. Whether the senators want single year or longitudinal data is not specified, so they will likely get a hodgepodge.

As well as operational questions, the senators might also have asked how institutions have benefited (or not) from OPM alliances. Letters to prominent OPM partners would elicit the other half of the story.

In Eduventures' view, this new probe is unlikely to result in anti-OPM regulation. The OPM story is too robust and nuanced, and “victims” are hard to find. There is healthy competition among OPMs, and schools continue to enter and exit partnerships as they see fit. OPMs are part of a much larger market of service providers with which most schools willingly engage to obtain capacity and expertise. Strategic outsourcing can boost innovation, quality, and customer service; a lack of due diligence can lead to bad contracts and ineffective partnerships. Competition—and scrutiny by accreditors and the U.S. Department of Education—will counter wayward OPMs and reckless institutions.

Regardless, it is hard to see sufficient political will to single out OPMs when the long-delayed reauthorization of the Higher Education Act remains a far-off prospect and other issues consume congressional attention.

Bottom Line

The senators are right to pay attention to OPMs as a dynamic force in higher education, to call out regulatory tensions, and to ask for more data. Lack of data perpetuates sometimes outdated views on the nature of OPMs, can overplay their significance, and obscure pressing questions for higher education as a whole.

But market forces, rather than additional regulation, may do the most to shape the future of the sector. Insofar as OPMs embody enrollment outperformance, operational nous, and strong customer service, some schools will want to work with them. If average institutional capability catches up, OPMs will be looked back on as catalysts rather than usurpers.

We offer our latest report—available to Eduventures clients—as a contribution to the OPM debate. Two forthcoming reports will look more closely at the prevalence of OPMs within certain sectors, field of study patterns among OPM-managed programs, and the enrollment impact of working with an OPM.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Chief Research Officer at Encoura

Contact

Eduventures Research Senior Fellow at Encoura

Contact

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values so you can create a productive and distinctive program portfolio.

Tuesday, February 1, 2022 at 2PM ET/1PM CT

Current students, alumni, faculty, and staff are some of your institution’s most influential brand ambassadors. What if you could discover prospective students connected to these key influencers using data you already own? Affinity Connection™ (formerly Legacy Student Locator®) makes it easier than ever to find students associated with your key constituents – now within the Encoura platform.

In this webinar, we’ll show you how Affinity Connection will help you:

- Find the latest matches with more frequent data matching, processing, and delivery (now weekly updates)

- Visualize and track the success of your Affinity Connection campaign in Enrollment Lens®

- Quickly upload, select, and export match data in Encoura

Join the Encoura team on Tuesday, February 1st at 2pm ET/ 1PM CT to see firsthand the evolution of the former Legacy Student Locator program to the upgraded Affinity Connection program.