In 2019, the National Student Clearinghouse’s (NSC) research center published a widely-read report detailing the country’s population that holds some postsecondary education but has not completed a degree: the Some College, No Degree (SCND) market. NSC found that 36 million people in its database met this description—a massive number that represented a relatively greenfield opportunity for many schools.

But Eduventures projects that the true SCND prospect market is quite a bit lower than 36 million; our estimate puts it under seven million. So, how did we arrive at this figure and just who are these prospects?

Sizing the Market

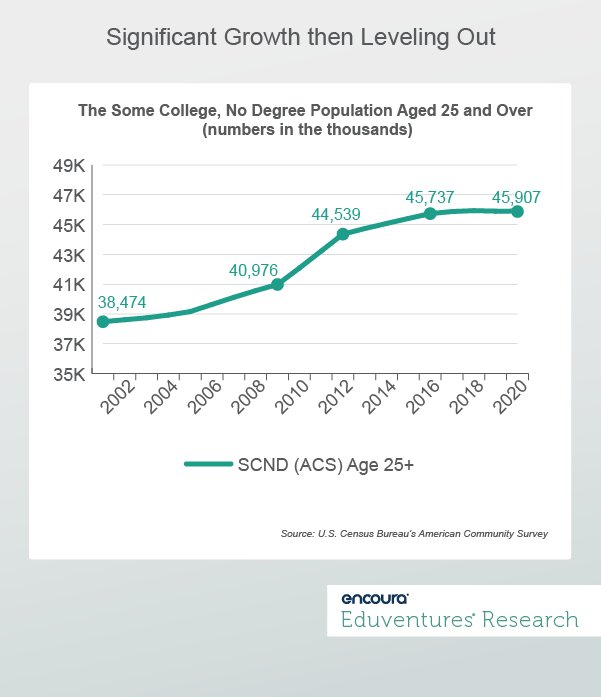

The NSC arrived at 36 million SCND based on its own enrollment records, so it’s best to think of this figure as a subset of the actual total. As of 2020, the U.S. Census Bureau’s American Community Survey, the premier source for detailed population and housing information in the U.S., pegged this number at closer to 46 million when focused on those aged 25 years and older (Figure 1).

According to Census Bureau data, this population grew by 19% from 2001 to 2020. But growth started to slow in 2012, and, since 2015, this population stagnated at just 1% growth.

Of course, the entire SCND group shown here should not be considered true postsecondary education prospects. NSC recognized this by reporting that just 10% of the 36 million analyzed in its report were potential completers, which they defined as those with at least two years’ worth of academic progress.

To get closer to the true number of SCND postsecondary prospects, let’s first drill deeper into the true prospective adult-learner segment that is most likely to enroll. The Eduventures Adult Prospect Survey™ Report series consistently reveals that the adults aged 54 and over segment is the only segment to report fewer than 10% of “Committed” prospects, i.e., those who indicate they “Definitely Will” or “Probably Will” enroll in a college or university over the next three years. Therefore, for the purpose of our analysis, we will limit the Eduventures SCND group to adults aged 25-54.

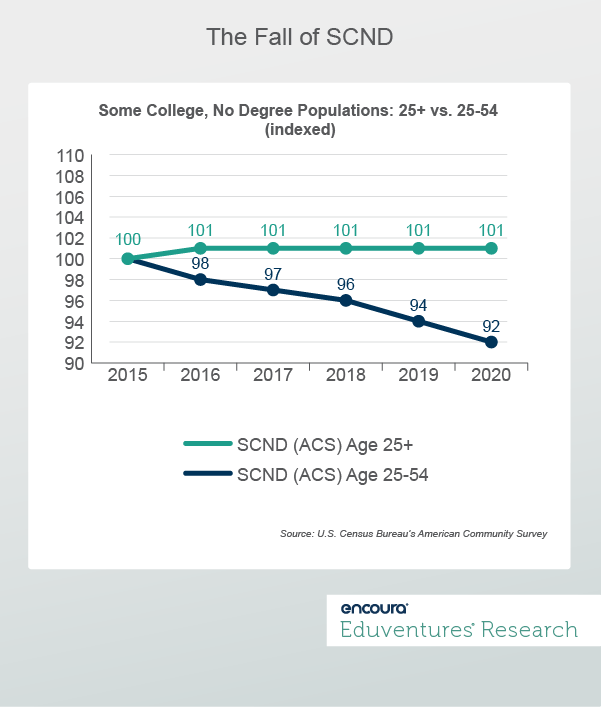

Focusing on the 25-54 age group reveals that, while the broader SCND population has plateaued in recent years, the core adult learner SCND segment is in decline. Figure 2 contrasts indexed population trends for the SCND aged 25+ and those for the subset capped at age 54 (age 25-54).

The Eduventures-defined SCND aged 25-54 population has declined by 8% since 2015, from about 27 to 25 million in 2020. This decline aligns with the increased national attention paid to credential attainment over the last decade-plus, as higher degree attainment over time inevitably translates to a smaller Some College, No Degree population. But let’s add one more variable.

In October 2021, Eduventures launched its most recent Adult Prospect Survey capturing the latest pulse of the adult-prospect market. When asked how likely they were to enroll or re-enroll in a college or university over the next three years, 27% percent of SCND respondents answered “Definitely Will” or “Probably Will” thereby meeting Eduventures’ threshold of a “Committed” prospect.

Projecting this proportion onto the entire SCND aged 25-54 population leaves us with a national pool of 6.8 million core SCND postsecondary prospects.

The SCND Prospect Pool

While still a relatively large number, 6.8 million is a far cry from 36 million. It also represents a group that must be convinced that returning to an education pathway is the right decision for them— a conversation made more challenging given previous attempts to attain a degree. Therefore, it’s even more important to understand the preferences these prospects have and how they differ from other adult prospects.

As a start, we’ve highlighted several takeaways based on our October 2021 Adult Prospect Survey:

- SCND prospects are less likely to consider four-year schools. When asked about what type of school they would most likely enroll in, 58% of our SCND sample indicated a community college and 36% indicated a vocational or technical school (compared to 33% and 28%, respectively, of all other adult prospects). Of the four-year school options, in-state publics received the largest response (31%), which was still well below the enrollment likelihood of all other adult prospects (43%).

- Higher price sensitivity influences SCND school type preference. While both groups select “affordable tuition and fees” as their top desired program feature, 64% of SCND prospects expressed they are “worried” or “very worried” about paying for postsecondary education compared to 49% of all other adult prospects. Additionally, 46% of SCND prospects indicated that their interest in enrolling would increase if prices for learning materials required for the program were reduced, compared to 33% of all other adult prospects. Higher price sensitivity explains much of the higher likelihood of enrolling in programs with lower price tags.

- Higher time sensitivity drives program preference. In addition to price, SCND prospects report higher time sensitivity compared to other adults. Thirty-five percent of SCND prospects indicate “options to work at your own pace” as a top desired program feature, and 41% of SCND prospects report “self-paced courses or programs” would increase their interests in enrolling (compared to 29% and 35%, respectively, of all other adult prospects). Critically, SCND prospects do not want their prior time in postsecondary education to go to waste; 25% of this group reports the “ability to transfer my prior credits” as a top program feature (compared to 16% of all other adult prospects).

- Non-career expectations point to familial motivations and the practical nature of SCND prospects. While career-specific goals between these two groups line up (e.g., both expect to earn more money as a result of continuing their educations), non-career expectations reveal some daylight. Where only 27% of all other adult prospects report “provide an example to my family” as a top non-career expectation, this figure jumps to 37% for SCND prospects. On the other hand, while 35% of all other prospects selected “use my talents to improve society,” only 28% of SCND prospects selected the same perhaps indicating the more practical nature of this group.

The Bottom Line

Based on our analysis, the SCND market . Rising levels of educational attainment will continue to drive the SCND population down, and with the proliferation of evermore alternative postsecondary educational options providing less expensive and time-consuming pathways to credentials, it will only become harder to stand out to these prospects.

But schools that use data to craft programs and messaging that meets the needs of SCND prospects will fare better in this market. Ultimately, SCND prospects need to see the clear pathways to and afforded by a college degree, absent as many barriers as possible, and understand how the next college attempt might be different from the last.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

This recruitment cycle challenged the creativity of enrollment teams as they were forced to recreate the entire enrollment experience online. The challenge for this spring will be getting proximate to admitted students by replicating new-found practices to increase yield through the summer’s extended enrollment cycle.

By participating in the Eduventures Admitted Student Research, your office will gain actionable insights on:

- Nationwide benchmarks for yield outcomes

- Changes in the decision-making behaviors of incoming freshmen that impact recruiting

- Gaps between how your institution was perceived and your actual institution identity

- Regional and national competitive shifts in the wake of the post-COVID-19 environment

- Competitiveness of your updated financial aid model