Eduventures’ research shows that 99% of all parents and guardians have a preference for the cost of their students’ college choices. It’s a consideration at every income level, not just among lower income families.

But even those who work closely with financial aid might be surprised at exactly how large the gulf in affordability is between lower income and higher income families. What does the most recent data say, and how should it inform your school’s affordability strategy?

Inequities Persist Regardless of Institutional Affordability Efforts

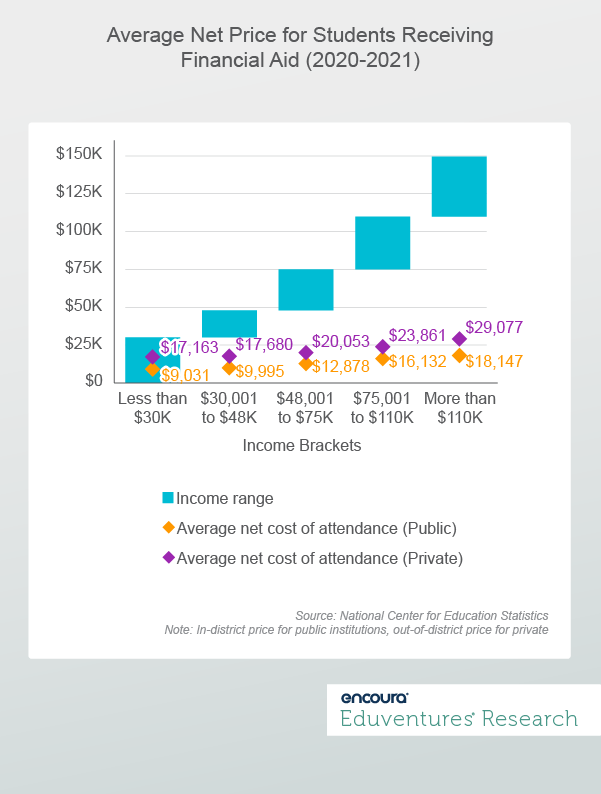

The unfortunate reality is that inequities in paying for college persist regardless of institutional efforts to create affordable access for all. Figure 1 shows the national data on average annual net cost of college (including tuition, room, board, and fees) for those who received financial aid relative to their family income ranges. The data includes students attending public institutions as in-state students and private institutions at the full out-of-state price.

Students from the lowest family income level (less than $30,000) pay about a third of their family’s income toward the cost of an in-state public education. If these students choose a private institution, they are likely to pay more than half their family’s income to attend.

In contrast, students from the highest income levels (more than $110,000) pay less than a fifth of their family’s annual household income to attend a public institution and about a quarter to attend a private institution. While this is still a lot of money, it highlights the substantially higher burden on lower income families.

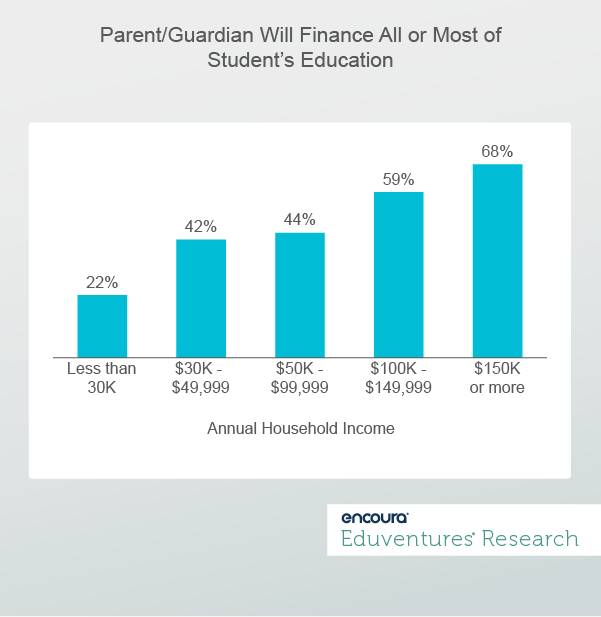

Furthermore, Eduventures Parent Research shows the percentage of parents/guardians who will finance all or most of their students’ educations across income levels (Figure 2).

Roughly a fifth of the lowest income families can afford to provide substantial financial support to their students. These students will largely be on their own to pay for college.

Among parents/guardians in the lowest income bracket, 77% expect their children to attend a public institution and set their maximum annual cost of attendance limit at about $10,500 (on average). For the remaining 23% who consider out-of-state public or private schools, their average budget limit increases to about $12,000, indicating limited willingness or ability to pay.

Families in the lowest income band spend an average of $1,000 more than the national average net cost for in-state public institutions (shown in Figure 1). This means they are stretched right to the edge. Their budget for college expenses remains relatively unchanged when considering out-of-state or private institutions. But the gap between their spending limit and the actual cost of private institutions is wide—about $5,000.

While it is not surprising to see some of these differences, it is surprising just how wide the disparities are among families at different income levels. This reminds us that affordability strategies must be different for students and families in different income bands.

What can colleges do to address the needs of low- and middle-income students?

Historically, we’ve seen a small number of colleges, like Berea College, provide free tuition to all students. These universities are few and far between, but higher education has been making some strides in recent years.

Statewide Solutions:

At the state level, 33 states provide income-based free tuition to state residents. Thirty states offer free community college and nine offer free four-year college. The proliferation of these programs is changing the calculus for all institutions, placing pricing pressure on schools in affected markets.

Individual School Action:

Absent or in addition to statewide programs, individual institutions are also taking steps to improve affordability—an easier task for some than others. Elite institutions with large endowments, for example, are able to strategically provide free tuition for key segments of students.

- Duke University offers full tuition grants for admitted students from the Carolinas whose families earn $150,000 or less. For students whose families earn $65,000 or less, Duke also offers financial assistance for housing, meals, and some other expenses without packaging any loans. But most institutions do not have the wherewithal to be this generous.

- Hope College, in Michigan, is betting on Hope Forward, its “pay-it-forward” model for tuition. The small Christian college is asking donors to fund the full tuition for a cohort of entering students. These students are not required to repay tuition (as in income repayment programs). But their educational experience at Hope includes co-curricular programming that instills the value of a “life of positive impact rooted in gratitude and generosity”—indicating that Hope is betting they will give back when it is their turn.

- Texas State University offers the Bobcat Promise, a grant program that guarantees to meet the demonstrated need of new freshmen pursuing 15 credit hours with an adjusted gross family income of $50,000 or less. It is one of the public colleges operating in a state where free tuition is not yet on the books, offering substantial help to the students who need it the most.

One size does not fit all. These examples show how schools of all kinds can develop purpose-built strategies that meet the needs of students in their markets, within their capacities. In the coming years, we anticipate more institutions implementing strategies designed to bridge the affordability gap for students from lower income families.

The Bottom Line

Institutions must fully recognize how difficult the situation is for families with lower incomes. It’s hard to convince a family paying a third or more of their income that college is a strong value. To shape your institution’s future affordability strategy, start by asking these questions:

- Which students are most vulnerable on affordability? You can’t provide free tuition to all students. But perhaps you can focus on those who need it most. Analysis of your admitted student data should indicate which students decline to attend for financial reasons. Understanding who these students are within the context of your mission should help identify a segment of students to whom your institution should extend additional financial resources.

- How can you help this segment bridge the gap? Identify the level of support that will solve the challenges of this key segment. Free tuition would be nice, but maybe significantly increased aid or no-loan packaging would make a substantial difference.

- How can you support this strategy? Start with the students' needs, then think about how your institution might pay for them. Doing the opposite limits your ability to address the problem. Your institution will need to think beyond its current capabilities to make an impact. Imagine an ideal scenario, inform the discussion with institutional realities and back into a practical plan.

- What is your pricing environment? Consider how state and institutional tuition policies will impact how your tuition strategy will be perceived. Will your strategy effectively be enough to compete for students from lower-income backgrounds in your market?