Bringing in the fall 2024 class required admissions and financial aid officers across the country to become the closest of colleagues. And while the simplified FAFSA form might be new, Eduventures’ data consistently indicates that cost and affordability dominate the interests of prospective students as they make college choices.

Unfortunately, the complexity, processes, and individual circumstances in this area can result in an oversimplification in the way cost is messaged or an over reliance on complex terms and conditions for student audiences during the recruitment cycle. How can admissions teams better meet prospective students where they are and address their perceptions about paying for college?

Cost and Affordability at Every Turn

Figure 1 maps some of Eduventures’ most recent data points from 2024 across a variety of our surveys, showing that affordability is top of mind across the enrollment funnel.

Figure 1.

Figure 1 underscores just how prominent cost and affordability are in student decision-making. While a previous Eduventures post noted there is no such thing as “messaging away” affordability, enrollment teams can also work to make topics like cost and affordability more digestible and communicate them in a way that is prospective student-centered.

A good place to start is with the understanding that student perceptions around cost, affordability, and other considerations around paying for college don’t always align with reality. And can we blame them? Students entering college directly from high school might not even have a bank account, let alone understand terms like “S.A.I.,” “bursar,” “stacking,” and “C.O.A.,” among others.

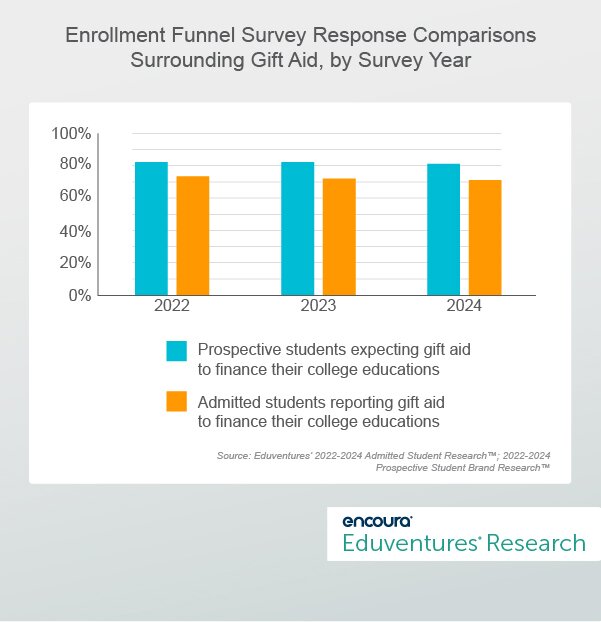

Figure 2 shows the gap between the percentage of prospective students expecting to receive gift aid and the percentage of admitted students reporting an award of gift aid in the last three years.

Figure 2.

In Figure 2, the gap between what prospective students anticipate in gift aid compared to what admitted students report receiving has been consistent across the last three years. This supports the notion that there are opportunities for greater cost clarity. While contextual factors such as college pricing and discounting drive gift aid distribution, we cannot ignore the gap between student expectations and understanding.

Developing resources focused on cost and affordability for incoming students supports long-term enrollment. Sallie Mae’s report, “How America Completes College 2024,” surveyed enrolled college students and those who had left college. Its findings noted financial challenges as the main reason enrolled students left or considered leaving school. National Student Clearinghouse data reported that, on average, just over 11% of first-time, full-time students at public four-year universities and private, non-profit four-year universities did not persist from their first years to their sophomore years of college.

Notably, this number does not account for summer melt or the students with intentions of enrolling in college but who don’t make it to the fall census reporting date - the ones that got away.

The Bottom Line

A transparent understanding of cost and affordability is mutually beneficial to the student and school. As we embark on year two of the simplified FAFSA form, enrollment teams should examine how they can support cost and affordability experiences for incoming students. This can take many forms with varying degrees of lift and resources.

Here are some ideas to get started:

- Commit to the College Cost Transparency Initiative. Embed its principles and standards of transparency and integrity into both financial aid offers and recruitment-related resources and communications. Admissions teams can take inspiration from financial literacy or financial wellness initiatives and consider how these conversations can be pulled into the recruitment and enrollment strategies.

- Leverage financial conversations of 2024 and keep momentum going for 2025. Bring together experts from areas like scholarships, billing, financial aid, admissions, orientation, and retention for financial literacy conversations focused on incoming students. Collaboration across multiple groups takes coordination, but students will thank you for the shared ideation and strategy it fosters.

- Dust off your digital shelves. Net-price matters to students. Ensuring your net price calculator is designed with prospective students in mind will help you and the interested student. Take an admissions lens to campus web pages centered on financial aid, cost, and billing to ensure they are incoming-student friendly.

- We’re all new here. The simplified FAFSA form has created a new opportunity for all. Ensure your admissions staff members have the tools they need to address conversations around cost. Build up their skill sets in a way that inspires confidence, comfort, and an understanding of how to address complex questions.

Eduventures Summit – higher education's premier thought leadership event – is returning to the Windy City next year. Secure your spot today!