The class of 2025 was long been projected to be the largest in U.S. history. As we welcome the class of 2026 to our campuses, it is all downhill from here. But while institutions in some areas of the country are bracing for impact, others have been in free fall for a while. Many are looking to more demographically favorable out-of-state markets like Texas, Florida, and California, hoping to emulate the successes of other institutions in these markets.

As we officially cross the demographic cliff this fall, where do we stand on regional demography? What does your institution need to know to develop the best out-of-state strategy?

California Dreaming?

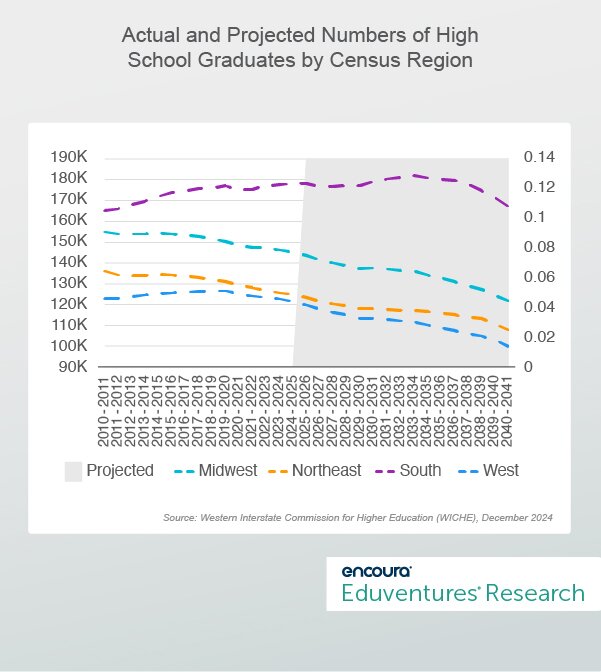

High school demographics—past and future—vary by region. Figure 1 shows actual numbers of high school graduates from 2010 to 2024 followed by projected numbers in 2025. (Note: for ease of comparison, we will not get more granular than U.S. Census region, but it is worth noting that within these regions, graduation patterns vary.)

Figure 1.

Figure 1 reveals that declining graduation trends started well before 2025—as early as 2010 in the Midwest and Northeast. In the West, this trend began in 2020.

Only in the South, a large region spanning Delaware to Texas, has there been an increase in high school graduates that will continue for the next decade. The South also produces the greatest volume of high school graduates by far. Perhaps, institutions are right to target Texas and Florida in their out-of-state recruitment—many have been successful.

But there are also several challenges with pinning your out-of-state strategy to demography alone.

Not All Students Are Willing To Travel

First, most students don’t stray far from home for college. According to the Eduventures Admitted Student Research™, the median distance first-year students traveled to college in 2024 was 81 miles in the Northeast, 106 miles in the South, 112 miles in the Midwest, and 609 miles in the West, which includes Hawaii and Alaska.

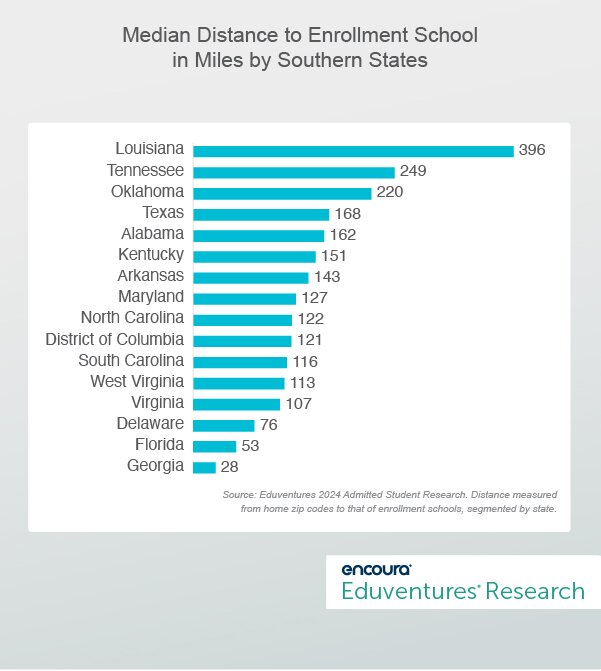

Again, there is variation among the individual states within those regions. Figure 2 shows the median distance between school and home among Southern states.

Figure 2.

Figure 2 illustrates that half of college-bound seniors in Texas chose colleges that were about 168 miles from their homes. Given the size of Texas, this means that 78% of students stayed in their home state. And Florida students are slightly more grounded to their home state: the median distance to their enrollment institutions is a mere 53 miles, with 82% staying in-state.

The Competition Is Getting Fierce

The other increasing challenge with building recruitment pipelines in regions with favorable demography is that everybody is doing it. The popularity of these markets means that competition has become tight, not only for out-of-state institutions trying to recruit there but also in-state institutions trying to keep their students at home.

Certainly, with the right investments and long-term strategies, many schools have built brand equity in geographically distant markets. Some institutions have made substantial investments, for instance, by placing local recruiters and establishing face-to-face relationships with local schools and students, many of which have paid off over time.

But the harsh reality going forward is that there will be fewer high school graduates overall. Combined with the growing skepticism about the value of higher education, this means that institutions will compete for a shrinking pool of prospective students. And not all will meet their enrollment targets. To maintain—let alone grow—enrollment, institutions will have to take market share from their peers.

More Colleges Will Close

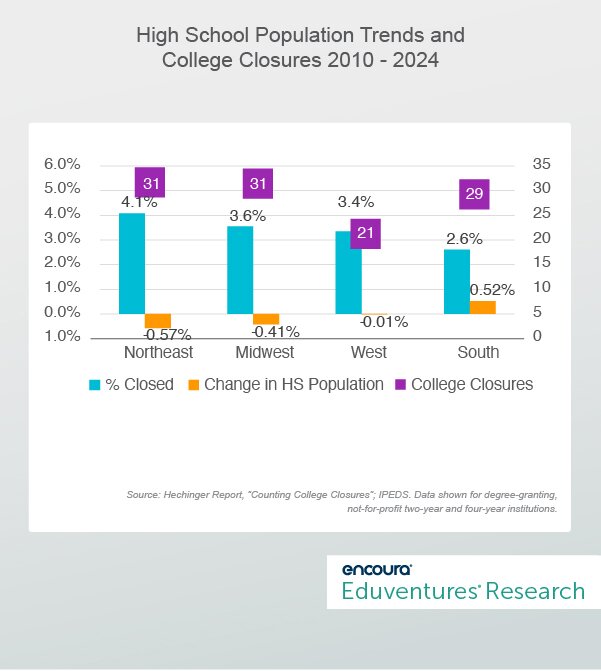

This means that college closures will accelerate in the next decade. Figure 3 shows that between 3-4% of not-for-profit institutions in the U.S. closed between 2010 and 2024, with some regional variation.

The Northeast and Midwest, already in demographic decline, showed a higher rate of college closures compared to the West and South (Figure 3).

Figure 3.

The South, which saw a growth of 0.5% in its high school population, is not far behind the Northeast and Midwest in terms of the total number of closures (29 vs. 31). But if we consider closures as a percentage of the total number of institutions in the region, we see that the South experienced the smallest percentage of college closures between 2010 and 2024 (2.6% vs. 3.5-4.1%).

And these closure figures may be optimistic, since they exclude college mergers for which national data is scarce.

The Bottom Line

It’s not too late to prepare for weathering the storm. Self-aware institutions that invest wisely and stay the course have an opportunity to come out on the other side with a strong value proposition and brand. But the future is now, and preparation will require strategic work:

- Understand and meet market expectations. Too often, institutions don’t spend enough time investigating how their offerings align with the expectations of their markets. Prospects are increasingly focused on value and outcomes and weigh college against other options. Gen Alpha and their Millennial parents are officially in the college pipeline. Savvy and self-aware institutions study their markets and adjust their offerings to their target audiences.

- Deliver on outcomes. Delivering solid outcomes for the students you currently serve can bolster your institution’s defense against the demographic decline by ensuring your current market continues to perceive your institution as a strong choice. Don’t underestimate the power of word-of-mouth reputation which, with alumni migration, has the potential to cross state borders.

- Choose your out-of-state region wisely. Going after markets solely for their favorable demographics without considering other factors can lead to disappointment in the current environment. Consider carefully where to find students who are most likely to apply and enroll. Stay open to the possibility that this may be closer to home, even if demography suggests challenges. Carefully plan your entry into new markets—smart, informed investments and long-term thinking can lead to success.