The latest CHLOE Report (Changing Landscape of Online Education) was published today. Born of a longstanding partnership between Eduventures and Quality Matters—and more recently EDUCAUSE—CHLOE takes the pulse of online higher education in the United States by surveying chief online learning officers (COLOs).

This year’s report covers multiple topics, from online strategy to OPMs. This Wake-Up Call digs into one topic from this year’s CHLOE report: online program pricing.

If online can help institutions lower costs, its contribution to higher education grows enormously. But are more schools using online to control costs and lower prices? Do COLOs say that lower prices drive enrollment?

The Price is … the Same?

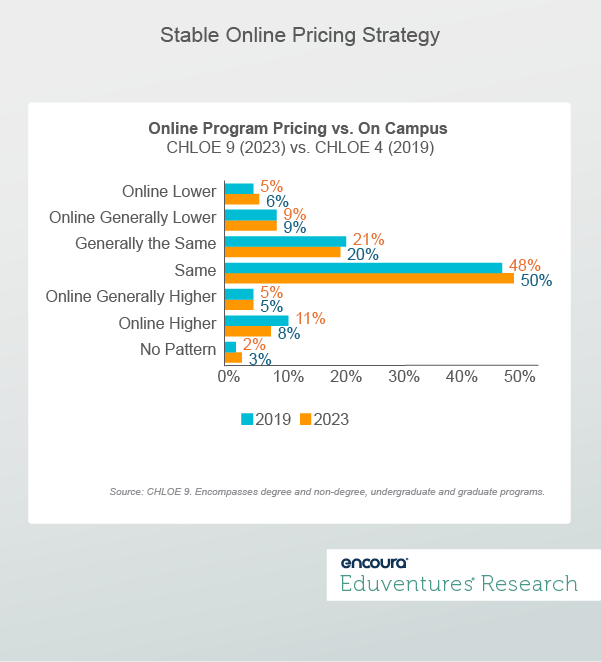

Despite the commotion of the past few years—a global pandemic, emergency remote learning, soaring inflation, and softening enrollment—online program pricing strategy, according to CHLOE 9 (fall 2023), looks remarkably similar to CHLOE 4 (fall 2019), see Figure 1.

Figure 1.

Small changes are visible between the two CHLOE surveys, however. The proportion of COLOs who reported higher online pricing fell over time and the share that offered lower priced online programs edged up. Neither change is statistically significant but may be directional. Fewer premium-priced online programs are consistent with a more competitive market, and additional lower-priced ones indicate that more schools are achieving economies of scale.

The next question is whether one pricing approach outperforms. Are low-priced online programs associated with enrollment gains? Are COLOs too conservative on price, ignoring evidence that cutting prices pays dividends?

CHLOE 9 found no pattern on enrollment and price. Whether COLOs price online programs higher, lower, or the same as on-campus, similar proportions express positive or negative sentiment about online enrollment trends. About 50% of COLOs agree that their online programs are growing faster than those on-campus, while 30% disagree, regardless of pricing strategy.

There is also no association between pricing strategy and online budget direction year-over-year for FY24. Online higher-price and online lower-price schools were just as likely to cite online budget gains, decreases, and stability.

The Price is … Irrelevant?

CHLOE 9 data is a reminder that pricing strategy does not exist in the abstract. Many factors, beyond price, drive enrollment. A strong program may be enhanced by a high price, while a low price may cheapen a weak program. Enrollment or financial troubles may drive pricing but prove insufficient to overcome wider problems.

School A’s low price might be School B’s high price. CHLOE 9—just like CHLOE 4— found that (typically more expensive) private institutions are most likely to use online to lower prices. This might be a great strategy if underlying demand is strong, and the program is compelling. But the strategy might flop if reduced online pricing is still uncompetitive.

We recently highlighted the outsized success of Georgia Tech’s very affordable online masters of computer science program, asking why so few schools have emulated this approach. The lesson of Georgia Tech’s program is not that low pricing is a winning strategy. The real lesson is that an elite institution with a stellar reputation in an in-demand field can—with enough institutional will—innovate on delivery and price to change the game. Few schools can replicate this combination.

The allure of low prices can be deceptive. Eduventures’ Adult Prospect Research™ finds an association between price and enrollment commitment. There is no question that prospective students cite lower prices more than any other factor when asked what would motivate enrollment. But “Committed” prospects—defined as self-reported high likelihood to enroll in the next three years—say they are willing to pay on average about a third more out-of-pocket than are their less-committed peers.

A surge in international computer science master’s enrollment post-pandemic rewarded institutions with conventionally priced, campus-based programs, reducing Georgia Tech’s market share for the first time in a decade.

CHLOE 9 finds that schools with larger online enrollment are more likely than average to levy higher-than-campus online program prices. Market success and reputation can support higher prices.

Circumstances matter when determining online pricing strategy.

The Price is … Strategic?

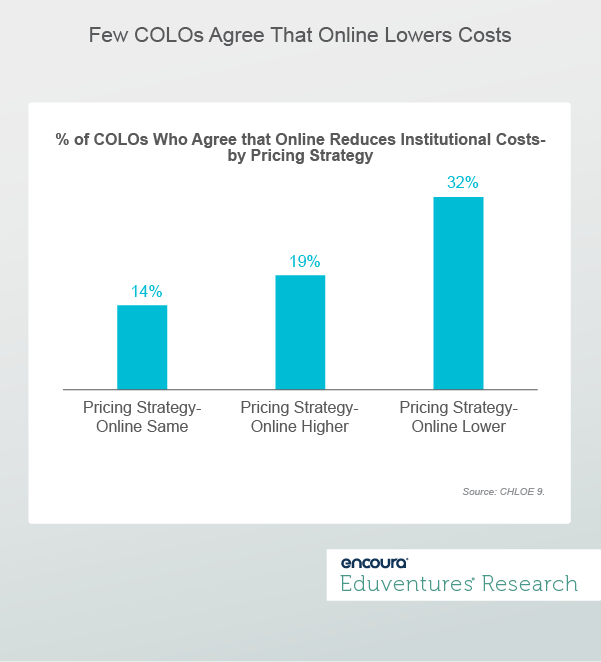

One interesting correlation in CHLOE 9 is between online pricing strategy and the perception of whether online drives down costs. Figure 2 posits that COLOs who price online and campus programs the same are least likely—and their lower-priced online counterparts most likely—to think that online learning, regardless of price, reduces institutional costs.

Figure 2.

Basic economics is fundamental to pricing strategy. COLOs see comparable pricing by modality as not just as a quality signal but also as consistent with cost of delivery.

This suggests that most institutions operate essentially the same instructional model (faculty type and role, pedagogical approach, etc.), regardless of modality. Limited instructional innovation—not modality—is the cost driver.

But Figure 2 also says that a minority of COLOs do use online to lower costs. That almost a fifth of COLOs who charge more for online programs also think that online is cheaper to deliver, points to margin maximization.

A third of COLOs who charge less for online also think online is cheaper to deliver, but two-thirds disagree and still charge less. Some may conclude that prospects expect online to be cheaper and price accordingly. Others conclude lower pricing is a marketing strategy disconnected from cost: boost enrollment and reputation until more realistic pricing is possible. Again, circumstances matter.

The Bottom Line

The CHLOE survey is a unique resource for understanding the development of online higher education, through the lens of the people who lead it.

On price and cost, the latest CHLOE findings show that the typical COLO remains conservative on online pricing and is skeptical that the modality lowers institutional costs. The latter helps explain the former. The lack of any clear association between price and enrollment suggests that COLOs are right to be cautious. The price needs to fit the circumstances, not necessarily be higher or lower.

But whether to better navigate a competitive market or thrive in a recession, a contrarian COLO would be advised to take another look at online margins. If online simply replicates or even adds to legacy costs, its contribution is diminished. Rethinking instructional labor to enhance student learning and lower cost—optimizing instructor-led, peer, and self-paced learning—is the goal. If technology is not integral to this aspiration, what is?

We hope you enjoy the latest CHLOE report, packed with insights on online and institutional strategic alignment, fees and discounting, perceptions of AI, and more. Please join us for an upcoming CHLOE 9 webinar.

CHLOE 9: Strategizing the Future of Higher Education Through Online Learning

Learn what online higher education leaders from across the U.S. had to say in this year’s CHLOE 9 (Changing Landscape of Online Education) Survey.