Which non-degree programs are in demand? This is an increasingly common question from Eduventures clients. Population dips, a tight labor market, and a chorus of doubt about college ROI mean that many institutions are navigating softening degree interest. Non-degree programs—shorter, cheaper, and faster to launch—can serve as a complement or alternative to degrees.

But how do you get an up-to-date read on which schools are playing the non-degree card? While IPEDS offers useful data, it is backward-looking and incomplete, so we turned to an alternative: state higher education commissions charged with new program approvals. This shows that 2023 is on course to produce the highest number of new non-degree programs yet, and highlights what looks like a winning strategy.

Companies vs. Colleges

If you want proof that some think non-degree is worth a big bet, the recent announcement from 2U and HP is a case in point. Not only is HP—the computer hardware giant—launching a game design and management professional certificate on 2U’s edX platform, but it is covering the full cost for all learners.

The most successful non-degree programs on such platforms are offered by the likes of Google, Meta, and IBM, not universities. Companies have an interest in expanding their tech-ready workforce and want to ensure their products are top-of-mind.

So, how are colleges and universities responding?

Eduventures analyzed non-degree program approval trends in two states: Indiana and Tennessee. The Indiana Commission for Higher Education Commission and the Tennessee Higher Education Commission stand out for making detailed program approval data publicly available. Of course, two states don’t represent the nation—and only public institutions and for-credit programs are under their purviews—but they do speak to national trends.

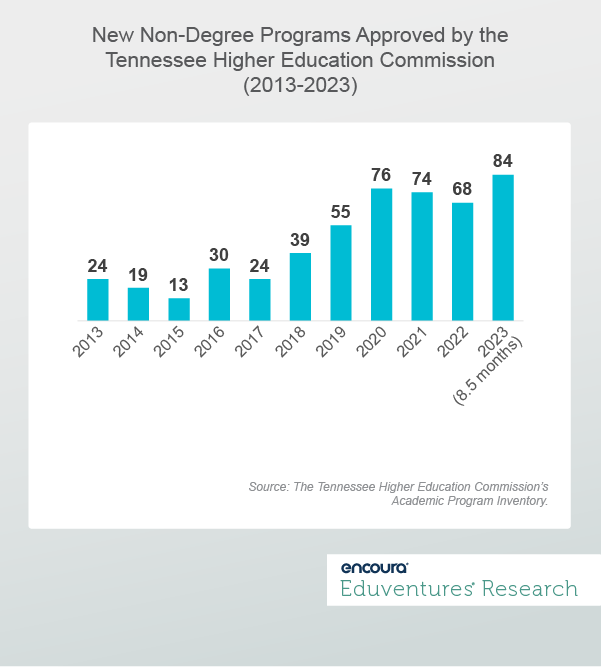

Figure 1 shows the number of new non-degree programs—undergraduate and graduate—approved in Tennessee over the past decade.

If approvals continue at the current pace, well over one hundred new non-degree programs will launch in Tennessee in 2023, a record. The same thing is evident in Indiana: about 50 non-degree programs were approved through the first half of the year, putting the state on track to best the previous high in 2019.

There is both undergraduate and graduate momentum. Almost 40 fledgling undergraduate certificates have been added in Tennessee in 2023, already surpassing the haul from any previous year. The state also turned out over 30 new graduate non-degree programs this year, higher than any prior full-year total. Ditto both trends in Indiana.

And more schools are active. In 2019, 21 Tennessee institutions launched new non-degree programs, but 30 have done so in 2023. R1s, regional publics, community colleges, and technical schools all feature non-degree programs.

This non-degree program boom is distinct from the big online platforms. No public higher education institution in Tennessee is a Coursera or edX partner, and only Indiana University, Bloomington, fits that description in Indiana (offering a few microcredentials and one master’s degree on edX).

Table 1 lists the 10 most visible major fields of study among non-degree programs currently offered by public institutions in Tennessee (undergraduate and graduate).

Undergraduate & Graduate Non-Degree Programs in Tennessee (active)

| Top 10 Undergraduate (% of current programs) | Top 10 Graduate (% of current programs) |

|---|---|

| 1. Healthcare = 22% | 1. Healthcare = 24% |

| 2. Mechanic & Repair = 15% | 2. Education = 22% |

| 3. Construction Trades = 14% | 3. Business = 10% |

| 4. Engineering & Engineering Tech = 11% | 4. Engineering & Engineering Tech = 6% |

| 5.< Business = 9% | 5. Biology/Biosciences = 4% |

| 6. Computing & IT = 7% | 5. Visual & Performing Arts = 4% |

| 7. Personal & Culinary Services = 6% | 7. Computing & IT = 4% |

| 8. Protective Services = 4% | 8. Area Studies = 3% |

| 9. Education = 3% | 8. Protective Services = 3% |

| 10. Transportation = 2% | 8. Public Admin/Social Services = 3% |

| Top 10 = 93% | Top 10 = 84% |

Table 1.

Table 1 might be interpreted as business-as-usual for institutions rather than direct competition with the tech giants.

The fields with the highest proportion of newer non-degree programs (launched over the past five years- suggesting an uptick in demand) are a mixed bag, including Computing & IT, Communication, and Personal Services/Culinary at the undergraduate level, and Biosciences and Business at the graduate level.

The average non-degree program is 20 semester credits at the undergraduate level, and 15 at the graduate level. Both averages are stable over time.

And there is little evidence of novel non-degree program names in the Indiana and Tennessee inventories. “Certificate” is by far the most common, and “microcredential” is rare.

Companies + Colleges

Among colleges, one response to the rise of non-degree programs offered by corporate giants like HP is to integrate these credentials into their own programs, touting the value of a “college plus company” curriculum. A good example is Purdue Global’s launch of certificates that combine its courses with those from Google, Microsoft, and Cisco.

But in 2023, the school eliminated or suspended a number of these new certificate programs. The Cisco and Microsoft certificates struggled with low enrollment. Some Google-aligned certificates were also withdrawn.

Does this mean that the college-plus-company strategy failed? Quite the opposite. Purdue Global still offers dozens of Google-paired programs (in project management, UX Design, IT Support, and Data Analytics) and shows strong enrollment momentum.

As recently as 2020, Purdue ranked 380th in the nation in terms of number of undergraduate certificates awarded. By 2022, the school ranked 8th, reporting almost 4,500 such awards. The Google-paired programs drove this growth.

These programs cost $10,000 each, are the equivalent of 30 semester credits, and take a year to complete. Not a microcredential, but more digestible than a degree. Students can bundle a Google certificate with Purdue Global courses in everything from accounting to cybersecurity. The school positions these programs as ladders to degrees, but they have value on their own.

The Bottom Line

State program inventories are a useful source of up-to-date intelligence on non-degree programs. Data from Indiana and Tennessee point to 2023 as the biggest year yet for new program launches.

Both undergraduate and graduate certificate conferrals continue to climb, even while bachelor’s conferrals fell in 2022, for the first time in years. Master’s conferrals were up 1.5% but enrollment was down.

As more tech giants see strategic advantage in launching their own non-degree programs, college-plus-Google may be a promising formula for institutions. The caveat is that the universities’ bachelor’s conferrals are down. Determining which certificates are true feeders into degree programs or lucrative in their own right—versus a low-price, low-margin substitute for degrees—will shape the long-term significance of today’s non-degree boom.

After all, HP is using certificates to grow talent, build brand, and sell hardware, not sell degrees.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Chief Research Officer at Encoura

Contact

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values, so you can create a productive and distinctive program portfolio.