With fall on the horizon, amid the FAFSA fiasco and mounting reports of college closings, institutions are ready for students to reenergize campuses—and institutional finances.

Increased enrollment volatility has led many tuition-dependent schools to seek new ways to diversify revenue streams. Over the past two decades, launching online programs has been a winning strategy, but with increasingly competitive online markets, many are considering other program opportunities.

What are other avenues for institutions seeking alternative revenue streams, and how should they get started?

Both undergraduate and graduate enrollment grew in fall 2023, according to the National Student Clearinghouse, reversing long-term declines in undergraduate enrollment and a recent drop in graduate enrollment. This has been good news for institutions and their chief business officers (CBOs), who are optimistic about the financial outlook of their institutions. In a recent survey, 85% of CBOs believe their institutions will be financially stable over the next five years.

But enrollment gains are not distributed evenly across sectors. The enrollment gap is widening between public flagships and regional public institutions—even some selective private non-profit institutions are facing enrollment challenges. Highly tuition-dependent schools are especially anxious about their upcoming fall classes.

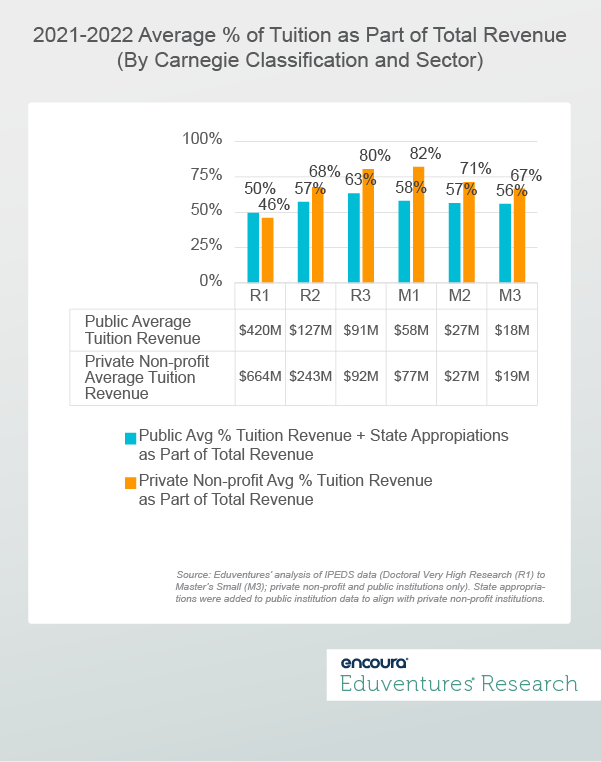

Figure 1 breaks down the average percentage of tuition as a portion of total revenue in 2021-2022 by sector (public and private non-profit only) and by Carnegie Classification (R1 to Master’s levels).

Figure 1.

Figure 1 illustrates how enrollment gains vary by sector. Public flagships and private R1 institutions lead the way with much higher tuition revenue (an average of $420 million and $664 million, respectively) and relatively low dependance on tuition as a portion of revenue (50% and 46%).

Among private non-profit institutions, Doctoral Professional (R3) and Master’s Large (M1) are the most tuition-dependent (80% and 82% of revenue). While headlines have focused on small colleges, and rightly so given recent closures, these institutions are potentially less diversified than their smaller counterparts.

At the same time, the smaller Master’s segments (M2 and M3) average only between $18-$27 million in tuition revenue, giving them less margin for error and more reason to resort to quick fixes.

Over the last decade, many institutions have solved for this by launching online programs, which often take time to develop. Online program expansion has also coincided with the rise of Online Program Management (OPM) companies. With revenue share business models, these companies can stand up new online programs and realize short-term revenue as quickly as the following fiscal year.

But now, the Department of Education has announced it is reevaluating the revenue share business model. This scrutiny, along with high-profile acquisitions and financial struggles in the sector, has infused the OPM industry with uncertainty, contributing to the search for other sources of revenue.

The New “Alternative Revenue” Kids on the Block

Increasingly, Eduventures partner institutions have turned their attentions to other sources of tuition revenue:

1. Non-Degree Programming

In recent years, non-degree programming has looked more enticing. In particular, launching noncredit programming often looks like a potential easy win, since these programs can get approved and into the market faster. But both for-credit and noncredit non-degree programming also offer numerous pitfalls, including:

- Low engagement. According to the Eduventures Adult Prospect Research™, non-degree prospects are the least engaged and least likely to enroll, making it a challenge to convert them once in the pipeline.

- High competition. To complicate matters, institutions must vie with prominent platforms such as Coursera and edX, along with other established providers like eCornell, which boast Ivy League distinction and offer over 140 noncredit certificates, many embedded with employers.

- Significant investment. Adopting a non-degree strategy to boost revenue can also be complicated logistically (e.g., existing faculty teach or hire new ones, student registration for noncredit courses, etc.) and can require significant investment to be strategic and competitive.

Institutions considering such a path forward should start by asking themselves these questions: Which current academic programs can be repackaged as non-degree? And, how can a new offering be built for both employers and individual students?

2. Course-Sharing Consortia

Another opportunity capturing the attention of institutions is the emergence of course and program-sharing consortia companies like Acadeum and Rize Education helping institutions implement new program opportunities for traditional undergraduates quickly. An institution can offer online courses to on-campus students in in-demand program areas without hiring new faculty. These online consortia are especially adept at supporting smaller, more tuition-dependent institutions that often have less graduate and professional programs to rely upon. But they also come with challenges:

- Institutional fit. Schools must think about institutional fit for these new programs, like how a new online program (often 5-10 courses) syncs with existing programs.

- Articulating hybrid learning. Institutions using online consortia often struggle to articulate the learning environment of a hybrid program. But Eduventures data suggests that one in four high school students would prefer to attend a hybrid program when they go to college, suggesting a market that has yet to be tapped into.

It should also be noted that the days of seeing cash-positive revenue in the next fiscal year are becoming harder to find. Of course, the type of institution, program offerings, and levels matter.

The Bottom Line

With unexpected challenges and changing preferences, institutions must think critically and strategically about tuition revenue diversification. Ongoing program evaluation—across modalities and the credit/noncredit spectrum—will always remain important. But these markets are not the clear revenue generators they used to be.

The first step is for institutions to evaluate program and labor market data to identify opportunities. Then, an institution needs to set clear goals for revenue generation- including specific targets and timelines, beyond the need to fill gaps. Putting in the work now to evaluate all new revenue opportunities can help to move toward revenue stability and sustainability.

Online Program Management: Navigating a Turbulent Market

There has been continued turmoil in the OPM market, from acquisitions to regulatory uncertainty, but institutions still see online enrollment as a viable growth opportunity and often need support. Join us for this upcoming webinar where Eduventures Senior Analyst Chris Gardiner will share insights into the complexity, challenges, and future of OPM-institution partnerships.