Two years ago, we wrote about the state of the accounting bachelor’s and master’s program markets, highlighting falling student demand and the imminent modernization of the Certified Public Accountant (CPA) exam at that time. Two years later, student demand remains down, and, to add a new wrinkle, there has been a mass exodus of accountants leaving the profession.

At the same time, Eduventures has received an uptick in questions about the accounting market from our partner institutions. This begs the question: what is the current state of the market and how can schools best position themselves for success?

Students Don’t Want To Be Accountants?

As previously reported, growth in accounting-aligned bachelor’s and master’s degree conferrals slowed in 2016 and declined further in subsequent years. Current enrollment estimates from the National Student Clearinghouse (NSC) reveal these markets are still experiencing downward pressures.

Figure 1 tracks three segments of both undergraduate and graduate enrollment: overall enrollment, enrollment in business-related programs broadly, and enrollment in accounting-aligned programs at four-year institutions.

|

Undergraduate Enrollment Trends |

2018 Enrollment |

2023 Enrollment |

2018-2023 % |

|---|---|---|---|

|

Undergraduate Total |

9,649,916 |

9,429,725 |

-2% |

|

Undergraduate Business |

1,610,442 |

1,591,037 |

-1% |

|

Undergraduate Accounting |

209,001 |

167,852 |

-20% |

|

Graduate Enrollment Trends |

2018 Enrollment |

2023 Enrollment |

2018-2023 % |

|

Graduate Total |

2,919,432 |

3,088,243 |

6% |

|

Graduate Business |

467,359 |

448,449 |

-4% |

|

Graduate Accounting |

36,849 |

24,717 |

-33% |

Source: Eduventures’ analysis of National Student Clearinghouse Fall Enrollment Estimates

At the undergraduate level, since fall 2018 when total enrollment declined by 2% and overall business enrollment declined by 1%, accounting-aligned enrollment shed one-fifth of its size. Once claiming 13% of all business-aligned enrollment in 2018, accounting’s enrollment share shrank to 10.5% as of 2023—a 19% drop!

The accounting decline is even more acute at the graduate level. Since fall 2018, when total enrollment grew by 6% and broad business enrollment declined by 4%, accounting-aligned enrollment declined by one-third. Accounting’s share of all business enrollment dropped by 30% over the same period—from 8% to 5.5% market share.

Some of this decline may be attributed to CIP “code switching,” as more schools began reporting their programs to STEM-aligned IPEDS CIP codes to attract international students. For example, since accounting is not STEM-designated, Eduventures has found some accounting programs reporting to “management sciences and quantitative methods, other” which has STEM designation.

But this doesn’t tell the whole story. Real enrollment decline is supported by similar trends with the CPA exam. For example, in 2022, just 67,000 people took the CPA exam—the lowest level since 2006.

Given the positive professional outcomes of this profession, this trend is perplexing. For example, the College Scorecard indicates that five years after completing an accounting bachelor’s degree, graduates make a median salary of $71,000 annually, which is over $6,000 more than the median across all fields of study. What is going on?

Accountants Don’t Want To Be Accountants Either?

Perhaps accounting success stories become harder to find when so many professional accountants don’t want to be accountants anymore. Since 2019, the labor market has witnessed an exodus of over 300,000 accountants—the single largest occupational decline among business-related occupations (which have grown by more than three million jobs during this period).

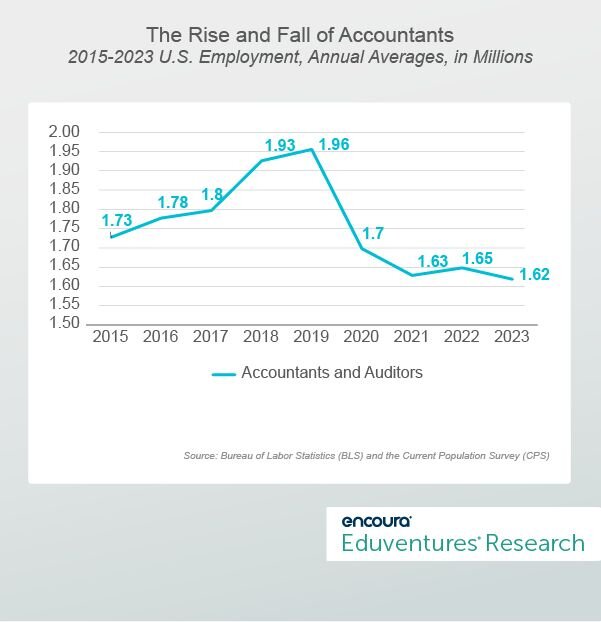

Figure 2 tracks the rise and then fall of accountants from 2015 to 2023.

Figure 2.

One could note the post-pandemic stagnation in Figure 2 and think, surely, the pandemic forever altered the accounting profession by eliminating jobs that weren’t necessarily needed. Accountants, however, appear to be very much in demand. For instance, since 2021, accounting-aligned job postings ranked seventh among postings requiring a bachelor’s degree at a minimum.

Also, the Current Population Survey shows that the average accountant salary in 2020—the first year of significant exodus—was close to $89,000. In 2023, the average accountant salary had risen to over $102,000. This is up 15% compared to 9% salary growth for all occupations. Finally, the CPA Journal notes that the profession is facing a severe shortage of accountants given recent trends—something that will likely be compounded by a coming retirement wave.

What Is Driving the Trend? News publications have reported on a host of issues, from the monotonous nature of the work to cyclical work-life balance challenges or from competitive pay in other jobs to the fear of AI-driven redundancy. Some of the decline may be attributed to accounting teams becoming more efficient and embracing new technologies, but it is hard to see how this would be the lone cause for such a rapid and dramatic shift.

Given the sustained decline in enrollment and CPA test-takers, the shortage does not appear to be close to a fix.

Where Are the Accountants Going?

According to Lightcast’s job postings data, the top five business/management occupations seeking accounting-aligned skills (other than accountants and auditors) include financial managers, financial and investment analysts, general and operations managers, project management specialists, and management analysts.

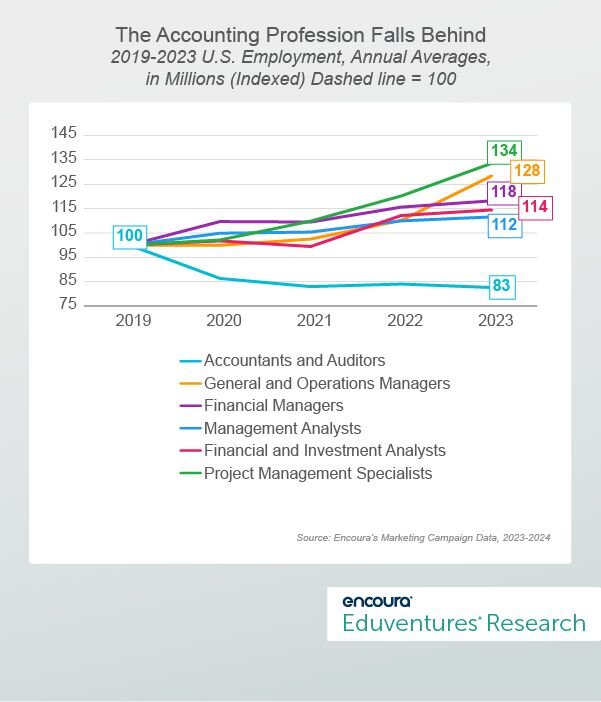

Figure 3 tracks the trajectory of these occupations and of the accounting occupation from 2019—its peak—through 2023.

Figure 3.

As Figure 3 shows, the top five business-related occupations that reveal the highest level of accounting-aligned skills demand (aside from accountants) have all grown over the examined period. While the number of accountants declined by 17% since 2019, these other five occupations all grew between 12% and 34%.

One Potential Reason? All five occupations report higher median earnings than accountants. For prospective students, this fact is compounded further given that, of these occupations, only accountants seeking CPA licensure are required to attain 30 credits of graduate education.

The Bottom Line

The accounting program market is facing a dilemma. Historically, programs have been able to point to stable, well-paying accounting jobs and attract steady student demand. The professional exodus, however, changes the calculus by shedding light on the unglamorous side of the job. Professional demand pressure is outside of a university’s control and harder to address. The teacher education program market provides a similar case study: the fact that we need teachers hasn’t fixed the fact that the teacher education market has long suffered enrollment pressure.

So, what should schools do with their accounting programs?

For starters, they should ensure their programs are positioned for a flagging market. This means making them as competitive as possible. Does the program have the right features? Are the right messages being crafted for prospects? Is the value proposition clear? Are there multiple pathways for entry?

Beyond leading to careers as accountants, accounting programs should highlight other potential career paths. Emphasizing accounting as a skill rather than just a profession could ensure program sustainability in a changing labor market.

Finally, schools should be aware of the evolving conversation on CPA licensure routes. Ohio recently became the first state to remove the 150 credit-hour requirement for licensed certified public accountants, offering alternative routes that include professional experience and varying levels of accounting concentrations. Schools should be ready to understand how their accounting-aligned portfolios fit into this new model, which may be replicated by other states.

Eduventures Summit – higher education's premier thought leadership event – is returning to the Windy City next year. Secure your spot today!