In 2021, international student enrollment in U.S. colleges and universities fell to a decade low of 780,000, marking a 23% decline from the 2018 peak. This outcome was years in the making, driven by a cocktail of divisive rhetoric, policy changes, visa restrictions, global competition, and topped off by the COVID pandemic.

In a previous Wake-Up Call, Eduventures noted that master’s level international enrollment exploded by 54% between 2021 and 2023, surpassing its 2018 high. With a fresh year of data to work with, was this momentum a coincidence—driven by pent up pandemic-era demand—or the start of a pattern?

Coincidence or Pattern?

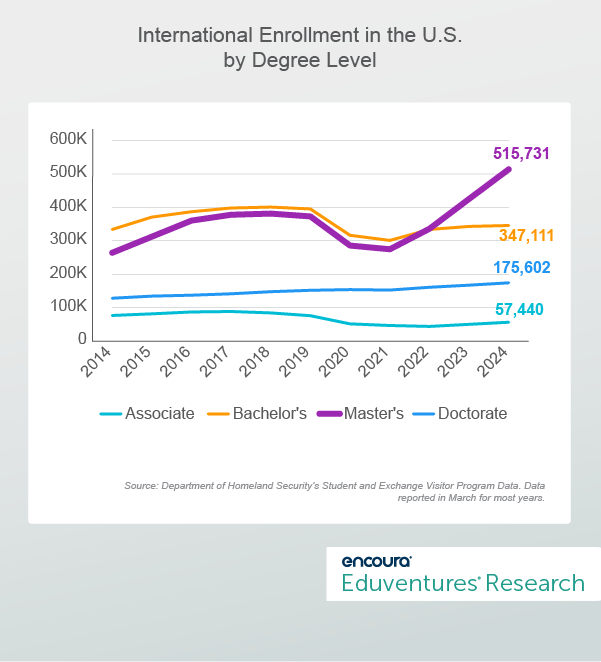

In a nutshell, newly released data suggests that international enrollment trends are continuing the trajectories that were developing in 2022 and 2023. For the associate, bachelor’s, and doctoral markets, this means slight and sustained growth in 2024. For the master’s market, this means a third year of explosive growth.

Figure 1 provides this updated view.

Figure 1.

As Eduventures cautioned last fall, at least some of the explosive growth seen at the master’s level can likely be attributed to pent-up demand and delayed enrollment from the pandemic. But 2024 also marks the third straight year of at least 20% year-over-year international growth at the master’s level, a trajectory that has not been seen since the years prior to 2016. Surely this may be a sign that the current uptick has some staying power—more trend rather than a flash in the pan.

If the pandemic is not the sole driver of this growth, what are some other possible explanations?

It may be that, suddenly, the U.S. is once again seen as the premier destination for international graduate students. While competition from Canada, Australia, and the U.K. had chipped away at U.S. market share in the preceding years, all of a sudden, newer policies in those countries may be weakening their appeal.

Australia is implementing a cap on the number of new international students it accepts, Canada is decreasing its current cap by 10% and including graduate students under the cap for the first time in 2025, and the UK has barred many international students from bringing family dependents with them. Many of these policies have been implemented as these countries react to increased migration and housing costs.

A Market in Tension

If you’ve been following along with Eduventures research over the last couple years, you may be scratching your head. Above, we see explosive international master’s student growth. But this may appear to be in tension with our analysis that the master’s market overall is entering challenging waters.

Both things can be true.

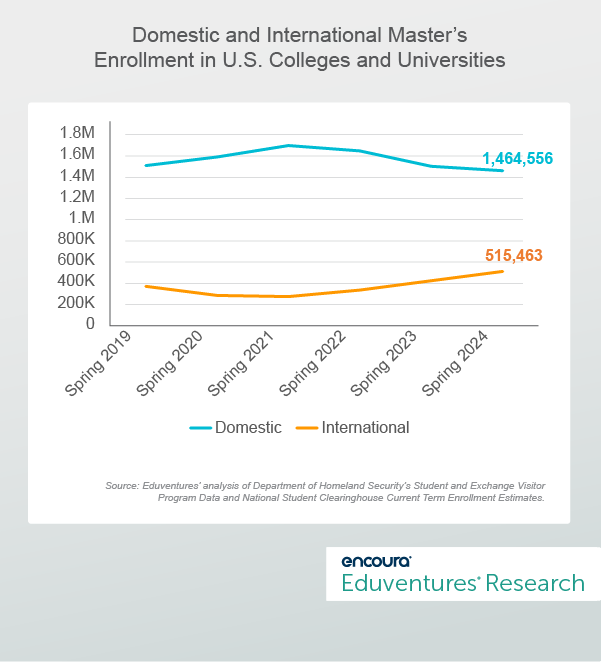

In fact, international enrollment is significantly boosting the master’s market, which has seen flagging domestic demand. We can really see these diverging paths when comparing international master’s enrollment to domestic master’s enrollment estimates (Figure 2).

Figure 2.

Domestic master’s enrollment has dropped 14% since its peak in 2021. Both spring 2023 and spring 2024 enrollments are below the pre-pandemic 2019 baseline. This decline is likely due to a strong labor market and increased interest in graduate certificates - a graduate market segment that has grown by 23% since 2019.

Meanwhile, international master’s enrollment is up 87% over the same period. When combined, this means that overall master’s enrollment is essentially flat (up 0.1%).

The importance of this international resurgence cannot be understated.

Finding the International Master’s Momentum

While international student enrollment is not available at the programmatic level, newly released degree conferral data from NCES IPEDS allows us to pinpoint international student concentration and momentum. Perhaps there is no better example than the computer science master’s market.

Just over 22,000 master’s degree conferrals were reported to the computer science CIP code in 2023. That data alone is not shocking. When compared to 2022, however, we find that computer science master’s conferrals almost doubled from around 12,000 that year. What gives?

Since conferrals are a delayed demand metric, 2022 master’s conferral data is representative of the sharp international enrollment decline seen in 2020 and the subsequent bottoming out that occurred in 2021. To illustrate this, consider that 70% of computer science master’s degrees were conferred to international students in 2019—before any pandemic-related disruption. In 2022, the international proportion dropped to 58%, representing the lowest level of international student activity in the field for some time.

Jump forward to 2023, and this figure skyrockets to 74%, representing the highest level of international student activity in this field ever recorded. In other words, for every four computer science master’s degree conferrals last year, three went to international students.

To place that 74% in context, just 18% of all master’s degrees, across all fields of study, were conferred to international students.

So, just how much has renewed international master’s enrollment shaped individual program markets? Figure 3 details the 20 master’s program markets that saw the biggest year-over-year conferral gains from 2022 to 2023 along with the proportion of those degrees conferred to international students.

|

Master’s Field of Study |

2023 Conferrals |

2022-2023 YOY Conferral Change |

2023 International Conferral Activity (market avg. = 18%) |

|

Computer Science |

22,163 |

10,086 |

73.7% |

|

Computer and Information Sciences, General |

18,305 |

7,882 |

69.6% |

|

Management Science |

21,814 |

4,730 |

38.2% |

|

Information Science/Studies |

8,392 |

2,571 |

52.9% |

|

Business Analytics |

3,487 |

2,267 |

63.4% |

|

Information Technology |

8,437 |

2,018 |

49.4% |

|

Electrical and Electronics Engineering |

8,726 |

1,959 |

59.6% |

|

Management Sciences and Quantitative Methods, Other |

15,066 |

1,877 |

47.1% |

|

Engineering/Industrial Management |

4,967 |

1,288 |

45.3% |

|

Curriculum and Instruction |

17,238 |

1,282 |

2.1% |

|

Computer Engineering, General |

3,284 |

1,230 |

71.2% |

|

Data Science, General |

2,325 |

1,142 |

34.8% |

|

Engineering, General |

3,659 |

1,111 |

46.4% |

|

Social Work |

34,299 |

1,055 |

1.3% |

|

Mental Health Counseling/Counselor |

8,592 |

1,019 |

1.6% |

|

Industrial Engineering |

2,733 |

1,011 |

70.4% |

|

Applied Behavior Analysis |

4,502 |

990 |

2.8% |

|

Computer and Information Systems Security/Auditing/Information Assurance |

7,653 |

984 |

21.0% |

|

Research Methodology and Quantitative Methods |

1,179 |

847 |

39.4% |

|

Econometrics and Quantitative Economics |

4,331 |

754 |

63.6% |

Source: NCES IPEDS.

Figure 3

Remember, the overall master’s market international conferral average in 2023 was 18%. As Figure 3 shows, 16 of the top 20 fields with the greatest master’s conferral growth had above-average international activity, averaging 53% (except for those linked to U.S.-specific licensure requirements).

Furthermore, between 2022 and 2023, growing fields showed an average of 21% international conferrals, whereas declining fields averaged 14%.

The Bottom Line

The international master’s student boost is clear. With domestic master’s demand softening, institutions may be scrambling to get their pieces of the pie.

The risk, however, is that international demand can be volatile—as seen both before and during the pandemic—and where the wind blows international demand is oftentimes outside the control of colleges and universities.

Consider the University of Central Missouri and the University of Texas at Dallas. As of 2022, both universities reported international graduate enrollment proportions of 61% (vs. an average of 16%). In 2016, Central Missouri had 2,400 international graduate students and UT Dallas had 5,600. By 2019, prior to the pandemic, these numbers had decreased to 580 and 4,600 respectively. In 2022, they had increased again to 2,600 and 6,000.

Certainly, more rollercoaster than rocket ship.

Eduventures advises taking a balanced approach. Start by identifying key international markets for the U.S. Then stay informed about competition, understand U.S. policy trends, recognize popular academic fields for international students, and avoid overextension of international reach.

Encoura Digital Solutions serves as an extension of your enrollment marketing team, boosting your institution’s reputation and visibility with proven digital marketing strategies, to connect you to your best-fit graduate students.