In the race to grow revenue at institutions across the country, one statistic weighs heavily on the minds of higher education leaders: nearly one-third of students entering college do not return after their freshman year. Despite this picture, however, it may be unclear which levers a given institution should take to improve retention.

Why is this the case? Research on the causes of low retention identifies a range of contributing and thorny factors such as academic pressures, social belonging and engagement, and lack of student support. Eduventures’ own research identifies several successful strategies, but also suggests that these vary widely depending on institutional circumstance.

As a result, many schools have turned to technology solutions, not because they see them as a silver bullet, but in the hope that these solutions will support the range of strategies to improve retention. The marketplace for such solutions, however, is just as messy. Like institutions, solutions approach the challenge of retaining students in many ways. Which retention strategy is best—early-warning, analytics, advising, or degree auditing?

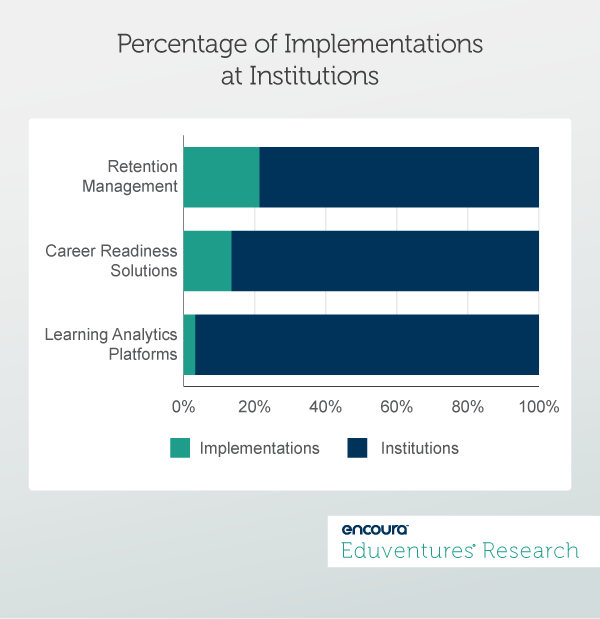

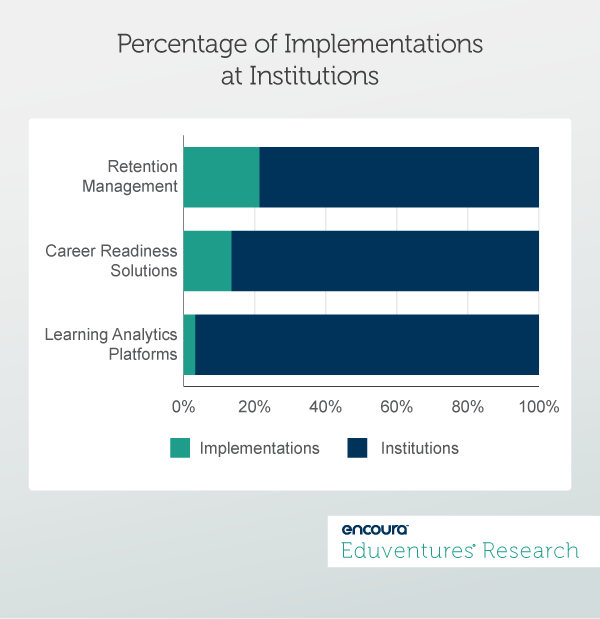

In our recent Wake-Up Call on student success we explored the varied meanings of this widely-used term—including retention, career success, and student achievement—and how they impact the selection of student success technologies. We also explained how our partnership with LISTedTech would allow us to measure which student success solutions institutions are using and will inform three reports on these solutions. We highlighted data, shown in Figure 1, around the implementations of three technologies that aim to support student success: retention management solutions, career readiness solutions, and learning analytics solutions, across all institutions (two- and four-year, public and private).

When it comes to retention solutions specifically, our data indicates that just over (Figure 1).

Figure 1.

Upon looking at Figure 1, you may wonder why the percentage of institutions with a retention management solution is not much higher. This brings us to the question: What exactly do we mean by “retention management solutions?” One reason the percentage of implementations may seem low is because we are applying a more precise definition than many may use when talking about this technology segment more generally. Our definition seeks to clarify the retention marketplace by focusing on solutions that enable institutions to collect, monitor, and act on student data to improve retention via functions such as early warning systems for at-risk students, communication forums between advisors, faculty, and students, and methods to manage student interventions, such as advising, coaching, engagement, etc. (Figure 2).

Figure 2.

What are our main findings? Here are three:- Retention management solutions remain popular. Unsurprisingly, many institutions are focusing on acquiring retention technology solutions. This data, however, may not signal a higher priority on other types of student success, such as student achievement (measured through learning analytics solutions) or career readiness (measured through career readiness solutions).

- The market may be slowing. As higher education leaders struggle to identify the right levers for retention, we may well see the acquisition of retention technology solutions slow. This slower growth may occur as institutions pause before acquiring them until they are more sure what precise lever(s) will work best at their institutions.

- Solutions that enable a complete view will have a higher chance of success. Some institutions, for example, seek to enrich data about grades and attendance with financial aid status and class load data to get insight into the likelihood of a student leaving her degree programs. As a result, solutions that allow for integration with other systems would stand a higher chance of gaining traction.

Where Will We Go Next?

Going forward we will dive further into retention solution data, highlighting such questions as:- Which specific solutions within each segment have gained the most traction in institutional implementation?

- What external pressures are driving implementation of specific segments?

- What downward pressures threaten to hinder the growth of implementation?

- Does the implementation picture look different within different sectors, e.g., two-year or four-year institutions, private or public?

- What are the implementation trends of each segment and what could we learn from them?

- Could we gain insight from this data into institutional preferences for student success technologies and how they might align to institutional student success priorities?