June 14-16, 2023 | Boston, MA

Special Keynote Session: José Andrés

An eye-catching headline from the National Student Clearinghouse’s spring 2023 enrollment report: master’s and doctoral degree enrollment is down, but graduate certificates keep growing.

Activity is plentiful—new non-degree programs are launched on Coursera and edX seemingly every week—but good data is hard to find, making it tough for schools to size up the non-degree graduate opportunity.

Eduventures has made something of a breakthrough: using a new source of data, we have uncovered half a million “missing” non-degree graduate students.

Whose “Graduate” Market?

A little-noticed feature of today’s graduate market is the confounding combination of enrollment growth and enrollment rate decline. As discussed in The Deceptive Graduate Enrollment Growth Story, a surge over the past decade in the number of working-age Americans with a bachelor’s degree has pushed graduate enrollment ever-higher but disguised a drop in the proportion of people enrolling.

Can non-degree programs turn things around?

One way to sober up about the non-degree opportunity is to compare graduate certificate enrollment to master’s enrollment.

Graduate Certificate Enrollment vs. Master’s Enrollment

Graduate certificate revenue projections start to sag when you look at the official IPEDS data: about 87,000 people completed a graduate certificate in AY21—up strongly—but 10 times as many completed a master's degree.

But hold on, how do we square such modest scale with years of fuss about microcredentials and the tens of millions of learners touted by Coursera, edX, etc.? Aren’t these efforts often aimed at people with at least a bachelor's degree?

Indeed, the official graduate non-degree total has long been thought an undercount; a perception that the microcredentials surge only underscores.

Eduventures’ research points to new evidence that substantiates this undercount.

The “Missing” Graduate Students

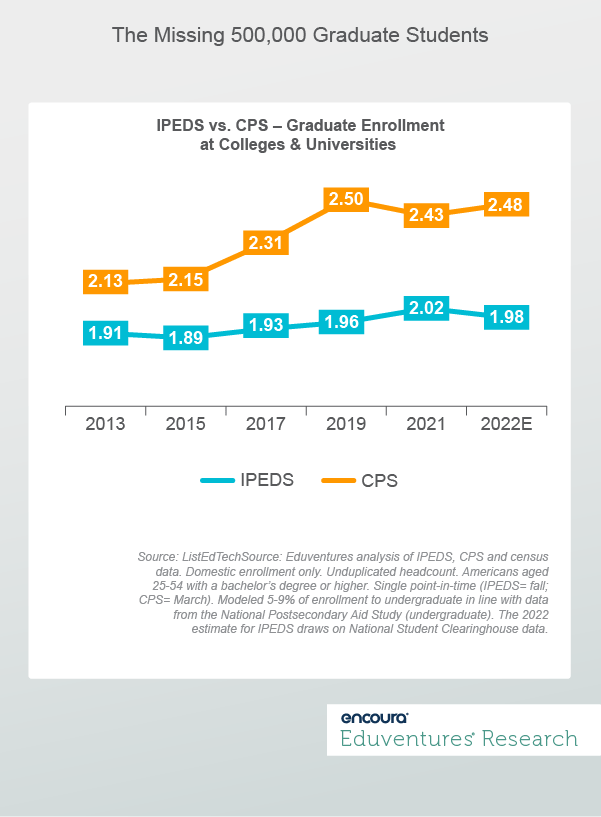

Figure 1 compares official IPEDS domestic graduate enrollment to implied graduate enrollment based on the Current Population Survey (CPS) from the U.S. Census Bureau. The CPS covers many topics, including college or university enrollment. One useful thing about the CPS is that the enrollment question does not specify degree or non-degree, credit or noncredit. This avoids the sharp credit/noncredit divide in IPEDS and the blurred degree/non-degree one.

Using the CPS, and controlling for age and prior education, offers a second opinion on the completeness of graduate enrollment reported to IPEDS.

To the CPS, Americans report significantly higher “graduate” college and university enrollment than official IPEDS figures—some 225,000 higher in 2013, rising to about half a million from 2019 onward. In other words, from 2019, the CPS suggests that the domestic “graduate” market is about 25% larger than indicated by IPEDS.

Moreover, according to IPEDS, domestic graduate enrollment among Americans aged 25-54 grew less than 4% between 2013 and 2022. But the CPS points to 16% growth once uncounted non-degree and noncredit graduate students are factored in.

This is consistent with the boom in non-degree programs offered by institutions through platforms like Coursera and edX, a trend that took off post-2015 (see Figure 1).

This is a breakthrough.

Using the CPS to estimate the scale of “missing” graduate non-degree and noncredit enrollment throws much-needed light on this murky market.

Notably, CPS samples are sufficiently large (some 25,000 Americans in the right age and educational attainment ranges each year) to ensure low margins of error (<0.5%).

IPEDS requires schools to report all credit enrollment, suggesting that most of the “missing” students reported in the CPS are noncredit. But since many nondegree graduate programs have credit and noncredit pathways, and many schools were leery about reporting graduate certificates for fear of Gainful Employment rules, a sizable number of for-credit graduate students may also be implicated.

We can debate what counts as “graduate” enrollment, but there is no question that the CPS points to much higher numbers of Americans educated to bachelor’s level or above enrolling in colleges and universities than encompassed by IPEDS alone.

The Bottom Line

The non-degree boom is real: CPS data points to some half a million uncounted students enrolled in graduate programming, both non-degree and noncredit. CPS data also points to much faster graduate market growth than accounted for by official IPEDS figures.

This is good news for schools keen to expand non-degree programming. Without non-degree innovation, the graduate market would be flat at best.

But the undoubted appeal of these programs aside, the graduate enrollment rate—the share of Americans eligible to enroll at the graduate level who actually do so—is still down. The rate—derived by Eduventures from the same CPS data that uncovered the “missing” graduate students—picked up somewhat in 2022 compared to the lows of 2020 and 2021 but was still 10% below the rate in 2019 and almost 20% below 2013.

There is evidence of supply growing faster than demand: the number of graduate certificate programs reported to IPEDS has expanded faster than conferrals, and program growth continues to outpace enrollment at Coursera and edX. Schools need to craft their non-degree strategies carefully.

By the way, this underlines the growing appeal of B2B (schools marketing to businesses rather than consumers). Platforms like Coursera, edX, and Udemy recently announced booming B2B revenue but with B2C stagnant at best. The non-degree B2B space will be the subject of a future Wake-Up Call.

Eduventures will continue to track the graduate non-degree market. The CPS and other sources offer useful insights about the non-degree space in particular industries and occupations. And let’s not forget non-higher education players in the non-degree graduate space.

But here is the ultimate question: what kind of innovation—or economic turmoil—might make the higher ed graduate enrollment rate climb again?

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Chief Research Officer at Encoura

Contact

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values so you can create a productive and distinctive program portfolio.

Over the past few years, graduate enrollment has continuously ticked upward growing by 12% between 2013 and 2021. However, based on National Student Clearinghouse estimates, fall 2022 brought us the first graduate enrollment decline in almost a decade. If graduate enrollment growth is no longer a guarantee, other market tensions—like increased program competition, proliferating non-degree programs, and a falling graduate enrollment rate—become much more acute challenges.

Enjoy this webinar where Eduventures Senior Analyst Clint Raine will equip institutions with findings from the latest Eduventures Masters Market Update™ and successful master’s program innovation strategies.