Drawing on Eduventures’ 20-plus years of experience helping universities develop, launch, and assess academic programs, the Program Spotlight Series of Wake-Up Calls calls attention to best practices in program development.

Consider this: in 2016, there were 236,000 academic programs offered by 6,700 title IV eligible institutions of higher education in the U.S. That is an increase of 34,500 academic programs since 2012, or one new program per institution per year, not counting program closures. Program demand assessment has been a longstanding part of Eduventures’ research portfolio, allowing us to keep a finger on the pulse of programmatic trends. Recently, we noticed an increase in requests around special focus programs. Of course, there are several highly specialized programs that are successful on a large scale—think of cybersecurity, for instance, which has skyrocketed in popularity in recent years. These are not the types of programs under consideration here. Today, we consider the venture into uncharted program territory. The common denominator is usually a small, or even non-existent, market. Are these kinds of niche programs a good idea? Those considering niche offerings are in good company. Penn State’s World Campus offers degrees in Turfgrass Science and Management. Plymouth State University utilizes its access to the rivers, lakes, and mountains of New Hampshire to train undergraduate students in the discipline of Adventure Education. At Arizona State University, you may even pursue doctoral level studies in the interdisciplinary field of Animal Behavior. These programs are often sub-areas of broader academic fields otherwise offered as a concentration within a more generalized program. Sometimes multidisciplinary, we consider them niche because they are specialized.

Consider this: in 2016, there were 236,000 academic programs offered by 6,700 title IV eligible institutions of higher education in the U.S. That is an increase of 34,500 academic programs since 2012, or one new program per institution per year, not counting program closures. Program demand assessment has been a longstanding part of Eduventures’ research portfolio, allowing us to keep a finger on the pulse of programmatic trends. Recently, we noticed an increase in requests around special focus programs. Of course, there are several highly specialized programs that are successful on a large scale—think of cybersecurity, for instance, which has skyrocketed in popularity in recent years. These are not the types of programs under consideration here. Today, we consider the venture into uncharted program territory. The common denominator is usually a small, or even non-existent, market. Are these kinds of niche programs a good idea? Those considering niche offerings are in good company. Penn State’s World Campus offers degrees in Turfgrass Science and Management. Plymouth State University utilizes its access to the rivers, lakes, and mountains of New Hampshire to train undergraduate students in the discipline of Adventure Education. At Arizona State University, you may even pursue doctoral level studies in the interdisciplinary field of Animal Behavior. These programs are often sub-areas of broader academic fields otherwise offered as a concentration within a more generalized program. Sometimes multidisciplinary, we consider them niche because they are specialized.

If you build it, will they come?

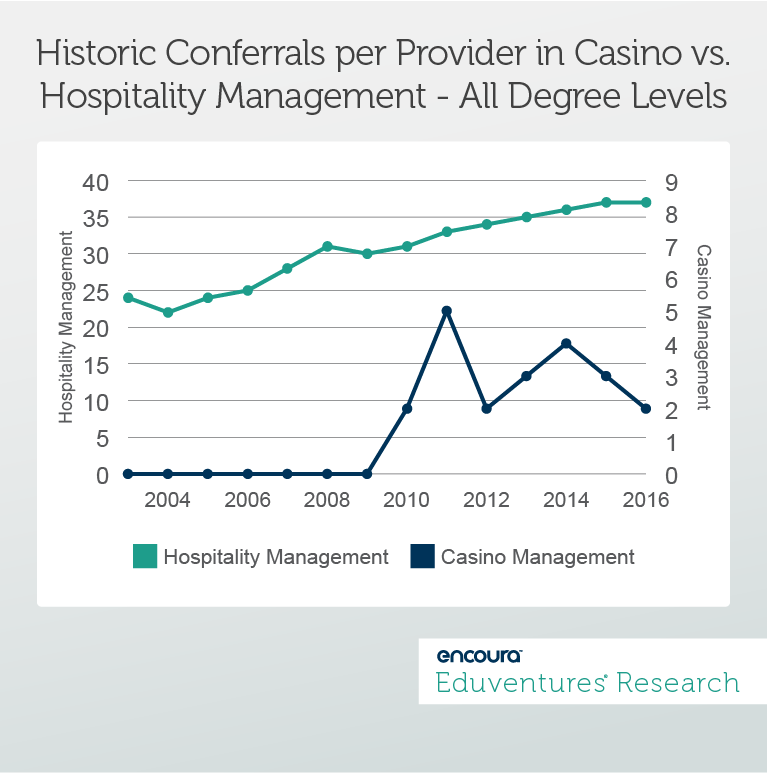

How will you know whether your faculty’s proposal to add a master’s program in equestrian marketing will be a viable endeavor for your institution? In short, you won’t know until you try. In many cases, you will be embarking into an emerging market, so there won’t be much historical data to learn from. The National Center for Education Statistics (NCES) revises its Classification of Instructional Program (CIP) codes once a decade, and so conferrals in emerging markets are reported to whichever code the institution deems the best fit. Likely, reported conferrals will end up in the vague “other” categories, which serve as receptacles for academic programs not neatly aligned with the current classification categories. So, while there may not be viability indicators specific to programs like equestrian marketing, we can, however, learn about niche program performance in general by examining historic conferral trends in some of the highly specialized CIP categories. Let’s look at some examples of niche categories compared to one of the more mainstream categories in related programmatic areas. To account for provider growth in these areas, we will review the average conferral per provider.Example 1: Casino Management vs. Hospitality Management

Conferrals per provider in hospitality management have steadily grown since 2004. In contrast, conferrals in casino management follow a rather erratic pattern, with very small conferral numbers per provider. This is not a function of a single institution experiencing recruiting issues for this particular program. Fifteen institutions reported a total of 34 completions in casino management in 2016.

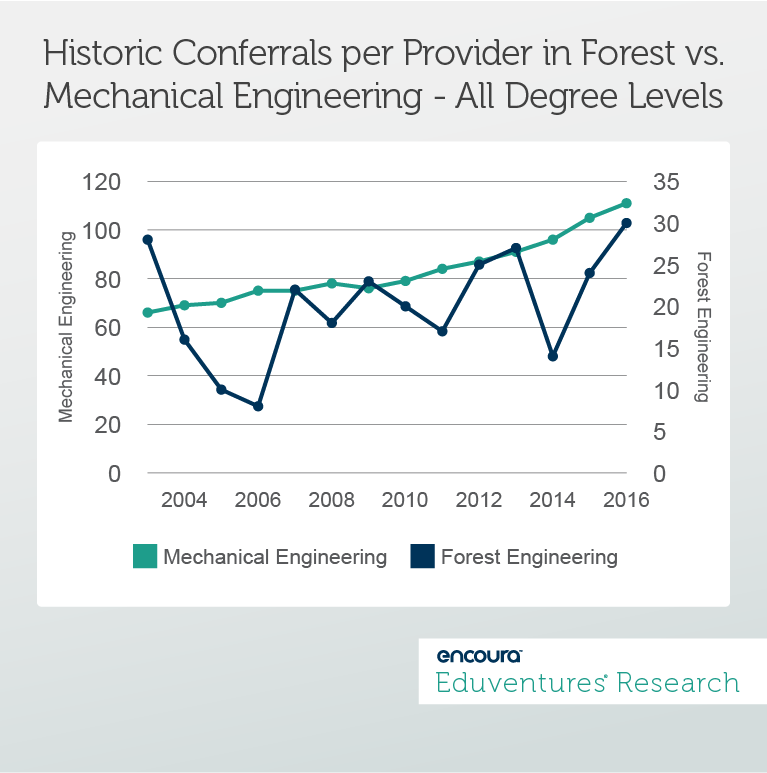

Example 2: Mechanical Engineering vs. Forest Engineering

Another example can be found in the field of engineering. With the focus on STEM education now starting as early as pre-school, one might expect engineering conferrals to follow a positive growth trend across all specialty areas. This trend certainly can be seen for the mainstream area of mechanical engineering.