Many institutions looking to expand their bachelor’s program portfolios are finding themselves in uncharted territory. Prior to 2022, all new program opportunities were assessed within the context of a growing bachelor’s market using conferrals as a key measure of student demand. But this has changed.

Bachelor’s conferrals have now declined for the second straight year—a result of the double whammy of pandemic disruption and enrollment decline. While conferrals remain the go-to proxy for market demand, they are also a lagging indicator. This means that current enrollment trends won’t show up in the most up-to-date conferral data.

Given these dynamics, how should institutions recalibrate new program identification in the current environment?

The Enrollment/Conferral Relationship

To understand how much conferrals lag the market, let’s start with a look at the bachelor’s market overall:

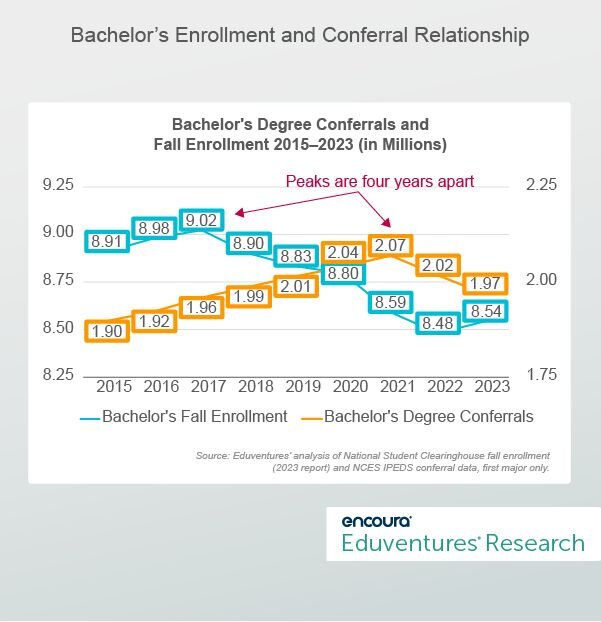

- Conferrals. Bachelor’s degree conferrals have experienced steady growth over the last decade, peaking in 2021 with 2.07 million before declining to 2.02 million in 2022. This initial decline included both traditional-aged and adult students and a range of institution types and academic fields. Now, we are contending with another year of bachelor’s conferral decline, down to 1.97 million, in 2023.

- Enrollment. Bachelor’s enrollment peaked in fall 2017—four years prior to the conferral peak—with just over nine million enrolled. Since then, enrollment steadily declined through fall 2022 (8.48 million enrolled), held relatively steady in 2023 (8.54 million), and as of last week’s update, increased in 2024.

Figure 1 illustrates the lag between conferral and enrollment numbers, charting both metrics from 2015 to 2023.

Figure 1.

Figure 1 shows a direct relationship between bachelor’s fall enrollment and bachelor’s degree conferrals: students who enrolled in the fall of 2017 would typically graduate four years later, in 2021. It also shows that enrollment began declining in 2018, four years before conferrals showed its first decline (2021).

This means that, at least in many cases, important trends could be missed if conferral data is the only demand proxy used. In a flat or declining market, we need to rethink how to identify program opportunities.

Enrollment Data to the Rescue?

While the National Student Clearinghouse (NSC) has published total undergraduate enrollment by (high-level) academic fields for many years, it shifted to a more detailed view for the first time in fall 2022. Starting in 2022, NSC has broken out undergraduate enrollment for major program groups (four-digit CIP code) for four-year undergraduate institutions and other institutional groups.

In 2023, 90% of students at four-year institutions were enrolled in bachelor’s programs. This makes the NSC four-year institution data a useful proxy for recent bachelor’s degree enrollment, providing a balance to conferral data.

To understand how this enrollment data can help us interpret conferral data, here are a couple of examples:

Example 1: Human Resource Management and Services

Figure 2 illustrates the indexed growth for both conferrals and enrollment between 2018 and 2023 in the Human Resources Management and Services program area. It indicates that conferrals in this market have declined by 15% between 2018 and 2023, compared to a 5% decline among overall business field conferrals. This strongly suggests potential challenges in launching a program within this field.

Figure 2.

Undergraduate enrollment, on the other hand, has grown 9% overall, reaching 40,000 in 2023. This comes as undergraduate enrollment in the business field broadly declined by 1% overall between 2018 and 2023.

These factors signal positive market indicators based on enrollment growth and outperformance of the broader business market. This shows how a program area with declining conferrals could warrant a closer look.

Example 2: Biology, General.

Conversely in the Biology, General market, conferrals peaked in 2021 but were still 5% larger in 2023 compared to 2018. This market’s conferral data has better growth trends compared to the whole bachelor’s market both long-term (2018-2023, +5% to -1%) and recently (2022-2023, -2% to -3%). Conferral data indicates that this program area is outperforming the overall market, suggesting a potential market opportunity (see Figure 3).

Figure 3.

But undergraduate enrollment data shows an 11% decline between 2018 and 2023 (aligned with the national trend in Figure 1). This suggests this major has begun declining and is not as promising a program area as conferral data shows.

An even deeper look into biology would show that it is often a staple academic program for institutions offering science majors. While generic biology bachelor’s enrollment has declined, smaller program areas like Physiology, Pathology, and Related Sciences (29%) and Neurobiology and Neurosciences (46%) have seen growth between 2018 and 2023. This points to students potentially seeking more specificity and clarity for their career paths in this area.

The Bottom Line

Traditionally, conferral size and growth have been the go-to market indicators to identify new program opportunities. With the overall bachelor’s market in decline, this approach must be reevaluated in certain situations.

Of course, there are some bachelor’s program areas beating the trend. Notably, both Computer and Information Sciences and Psychology had both long-term (2018-2023) and recent (2022-2023) conferral growth. But these are the exceptions among the 10 largest broad bachelor’s program areas.

As more institutions face enrollment challenges, we are entering a new era for identifying strong programs. A more sophisticated approach may be required that considers both conferrals and enrollment (and, often, other critical market indicators) to help identify new program opportunities.