Last week, Eduventures published its most recent study of prospective adult learners, the 2020 Adult Prospect Research Report™. While it confirms that demand for affordability and flexibility remain high, it also identifies some new patterns regarding how prospective adult learners make decisions about their educations, which we've identified as postsecondary capital.

Among these, data from our new study suggests that the attainment of postsecondary credentials is far less of an accelerator of social and economic mobility than previously assumed. Rather, access to postsecondary capital impacts adult learners in critically important ways.

We thought it would be timely to explore some of these findings and what they might mean for schools seeking to serve adult learners.

Adult Learners: Committed, Hesitant, or Skeptical?

Postsecondary education has long been thought of as an engine of career advancement and upward social mobility. Eduventures’ earlier studies have consistently identified these motivations among prospective adult learners. Providers of postsecondary credentials also continue to praise the connection between that new degree or certificate and middle class stability.

Much of this narrative is true: increased earnings and expanded job opportunities are often the result of new credentials or degrees. The 2019 Adult Prospect Research Report, however, reveals that the challenge may be about access to postsecondary capital: .

Adult prospects with greater access to postsecondary capital tend to seek more advanced credentials catalyzing greater career advancement, while prospects with limited credential attainment and less prior educational success are more restrained in their pursuit of advanced degrees.

These patterns emerge when we divide prospects by their levels of postsecondary interest. Survey respondents were asked to indicate whether they planned to enroll in school during the next 36 months. Prospects responding “definitely or probably” completed the rest of the survey. All others were offered an important qualifier: these prospects were asked whether they would be interested in enrolling “if time and money were no object.”

Based on this screening, respondents were divided into three broad categories:

- 17% Committed Prospects: would “definitely or probably" enroll

- 26% Hesitant Prospects: would be “extremely or very interested” in enrolling if time and money were no object

- 25% Skeptical Prospects: would be “somewhat or slightly interested” in enrolling if time and money were no object

The balance expressed no interest, even if time and money were no object.

The Demographics of Postsecondary Commitment

Several important trends emerged when we explored the demographic breakdown of these three categories. "Committed" prospects were younger, more diverse, and had lower annual incomes but higher rates of employment than their "Hesitant" or "Skeptical" peers. For example, "Skeptical" prospects were three times more likely to be retired or close to retirement. "Committed" prospects may have viewed the risk and investment of returning to school to be less daunting, but others found it less appealing.

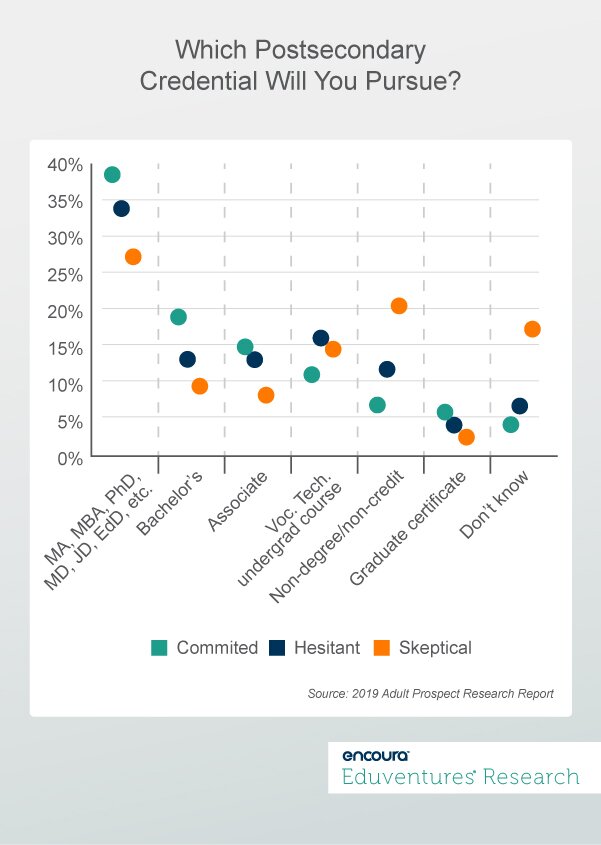

While access to postsecondary capital cuts across some demographic categories, how did it impact the decisions adult prospects made about which credential to pursue? Although most adult prospects remained interested in graduate degrees, Figure 1 reveals some notable gaps when we considered level of interest.

"Committed" prospects expressed greater interest in degrees, while their interest in non-degree credentials and certificates was more subdued. Since these prospects tended to be younger and have higher rates of employment, they still saw a degree pathway as their best bet to move forward.

More reluctant prospects, perhaps dissuaded by the requirements of time and money, remained less interested in these options. Instead, “Hesitant” and “Skeptical” prospects expressed greater interest in certificates, non-degree programs, and non-credit courses.

The Bottom Line

Longstanding assumptions about the connections between upward mobility and postsecondary credentials aside, schools and other providers should recognize the multiple factors at work when an adult decides to return to school (or not).

Students who may lack sufficient access to postsecondary capital may retreat from new credential attainment altogether, or gravitate toward shorter, transactional, and skills-based programs. Those with postsecondary capital could have more opportunities to “spend” it on acquiring more advanced credentials.

This data also suggests that the enrollment and retention of adult learners depends on something more than just a reliance on flexibility and convenience.

For schools and other providers in the adult learner marketplace, successful program development could come down to a few simple principles:

- Meet your prospective students where they are by deepening an understanding of where they have been, both educationally, personally, and professionally.

- Embrace the complexity that prospective adult learners bring to their enrollment decisions.

- Differentiate program and credential pathways based on the preferences and attitudes of your prospects.

The Eduventures 2020 Adult Prospect Research Report is currently available for download in Encoura Data Lab for all Eduventures subscribers.

Never

Miss Your

Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at ACT | NRCCUA

Contact

Thursday, February 20, 2020 at 2PM ET/1PM CT

Research on your admitted students can provide enrollment leaders insight into why students enrolled in their institution -- and perhaps more importantly, why they didn’t -- but without benchmarks, an institution can only understand its result in isolation.

Inevitably, an institution is compelled to ask: How does its admitted student metrics look in comparison to other institutions in its category. Using data from the Survey of Admitted Students™, our latest benchmark report outlines the nine key benchmarks that every college and university can use to inform recruitment, yield, and institutional identity.

In this webinar, Eduventures Principal Analyst Kim Reid will identify key strategic questions every enrollment leader should be asking to measure up the institution’s yield performance and how to take specific action to improve your class.