The master’s degree has long served as a pillar of opportunity for colleges and universities, and it’s easy to see why. On the surface, the story is quite simple: graduate enrollment and master’s conferrals were up through 2020. Good news, right? Well, before you go off and launch that new master’s program, there is a deeper story about decreasing market efficiency that needs to be told.

At this year’s Eduventures Summit on June 15-17 in Boston, we will start telling this story by providing a first look of our forthcoming research, The Eduventures Master’s Market Update. Keep reading for a preview of that session.

Mapping the Master’s Market

For one, it’s relatively cheap for schools to offer, given the lower associated support costs compared with undergraduate degrees. It’s also a good fit for online delivery, which has benefitted from the online boom of the past decade. Lastly, of course, master’s demand has been up.

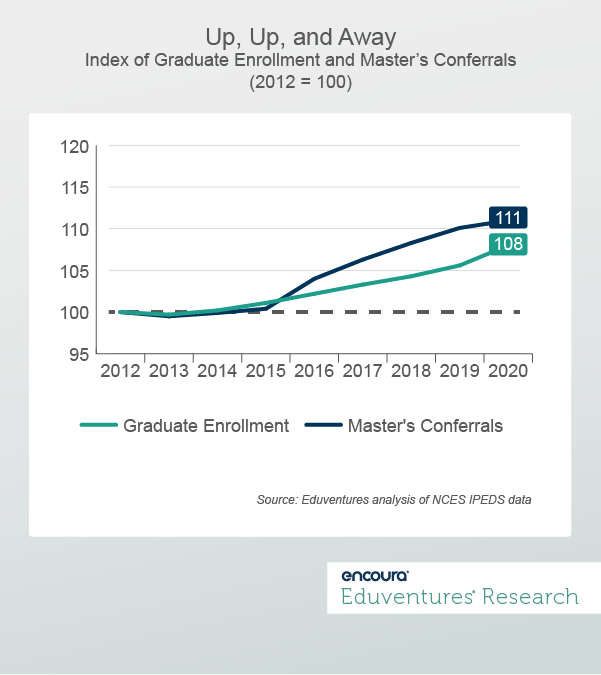

You can see in Figure 1, both graduate enrollment (8%) and master’s degree conferrals (11%) grew between 2012-2020, sending strong signals of student demand—particularly following 2015. Compared to the undergraduate market, which saw first-time degree-seeking enrollment shrink by 15% during this same period, the graduate market (dominated by master’s degrees) has been a breath of fresh air.

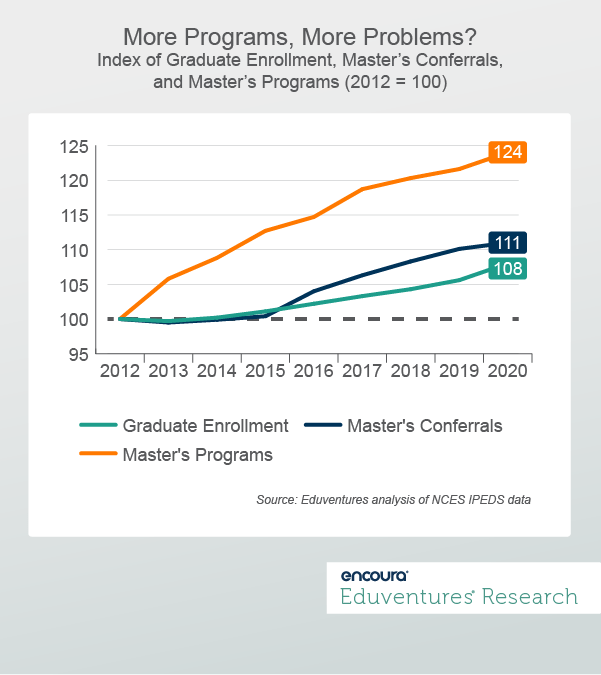

In response to these trends, schools have not been shy in launching new master’s programs— sometimes with just a whiff of market opportunity or at the urging of a lone faculty champion. And therein lies the problem.

According to NCES IPEDS data, master’s programs swelled by 24% between 2012 and 2020, growing from 32,148 to 39,840 programs—that’s over 900 new programs per year on average! A 24% growth rate in supply far outpaces the demand growth (Figure 2).

Supply outpacing demand suggests tightening competition and flagging program efficiency (conferrals per program), both of which are troubling signs for new market entries. Indeed, between 2012 and 2020, the master’s market became 10% less efficient—shrinking from an average of 23.6 conferrals per program to 21.2 conferrals per program.

Add in a series of additional pressures (detailed below), and it’s easy to see how unsustainable the program growth rate and how concerning the program efficiency trend, really is:

- Graduate enrollment has lost some steam. Though graduate enrollment grew by 8% between 2012 and 2020, this is a significant slowdown compared to the prior eight-year period (2004-2012) when graduate enrollment grew by 17%.

- A falling enrollment rate. While graduate enrollment grew between 2012 and 2020, the graduate enrollment rate, or the proportion of qualified Americans (those with a bachelor’s degree) enrolling in postsecondary education, actually declined during this same period.

- A tight labor market. In March 2022, 10 states hit record-low unemployment rates as employers continued their searches for talent. In fact, by May 2022, 18 states have reported more people employed than they did in February 2020, just before COVID-19’s first wave. Falling unemployment typically leads to falling postsecondary enrollment among adult prospects. Additionally, on May 3, the Bureau of Labor Statistics reported that the number of job openings reached a high (11.5 million) in its Job Openings and Labor Turnover Summary series. With plenty of jobs seemingly for the choosing, some master’s degree value may fade.

- A new era of worker empowerment. When millions of workers left their jobs in 2021, employers scrambled to fill the empty positions. Higher pay. Greater flexibility. More perks. All strategies used to get more people at their (now more often remote) desks. If this trend continues, will employees feel happier in the jobs they currently have and less pressure to return to school for a master’s degree?

- More and more alternatives. Interest in cheaper and less time-consuming non-degree program options is on the rise. Eduventures’ Adult Prospect Research™ shows that the proportion of adult graduate prospects interested in pursuing a non-degree program increased by 65% between July 2019 and October 2021, while interest in pursuing a master’s degree declined by 13% during that same period.

In our Eduventures Summit breakout session on June 16, we’ll explore these trends in greater detail and critically explore more specifics around the concept of master’s program efficiency. Which markets are bogged down by competition? Where might there be master’s program opportunity? Most importantly, how is efficiency trending across specific fields of study?

The era of COVID-19 was, and remains, a challenge. Budgets were pressured. Energies were tapped. Attention was maxed out. But schools now have an opportunity to remaster their master’s program strategies by adopting a leaner and more objective mindset. The first step in doing so is understanding the full master’s market story.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Contact

Eduventures Quantitative Specialist, Client Research at Encoura

Contact

The Program Strength Assessment (PSA) is a data-driven way for higher education leaders to objectively evaluate their programs against internal and external benchmarks. By leveraging the unparalleled data sets and deep expertise of Eduventures, we’re able to objectively identify where your program strengths intersect with traditional, adult, and graduate students’ values, so you can create a productive and distinctive program portfolio.