FinTech, the buzzword du jour to describe the intersection of financial technology and business, is defined by Emsi as, “technology and innovation that competes with traditional financial methods.” The term is used interchangeably to refer to the industry itself and the skillset required to work in the industry—from programming to blockchain to machine learning expertise.

The number of job postings requiring FinTech skills has grown exponentially in recent years and is predicted to continue growing through the next decade. So, what does this mean for higher education? If so, what is the ideal FinTech credential?

Growing Employer Demand

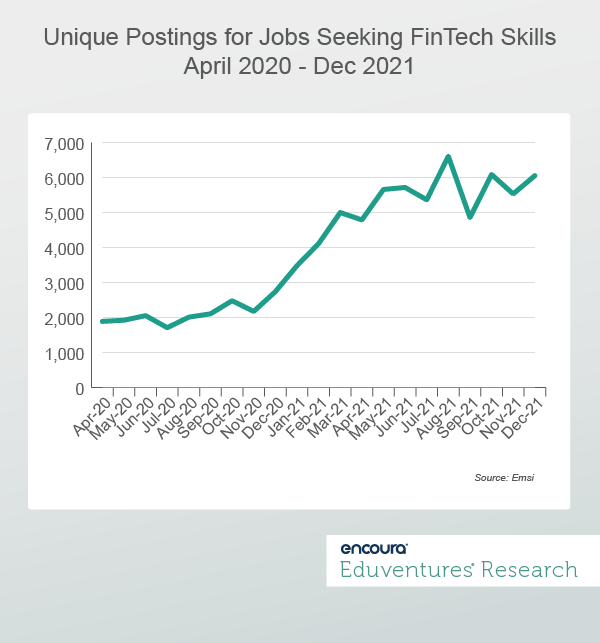

The FinTech labor market is booming. Figure 1 showcases the increase in job postings seeking FinTech skills over the last year. Between April 2020 and December 2021, U.S. FinTech job postings jumped from 1,887 to 6,052—a 221% increase over 20 months (compared to all job postings which increased 68% over the same period).

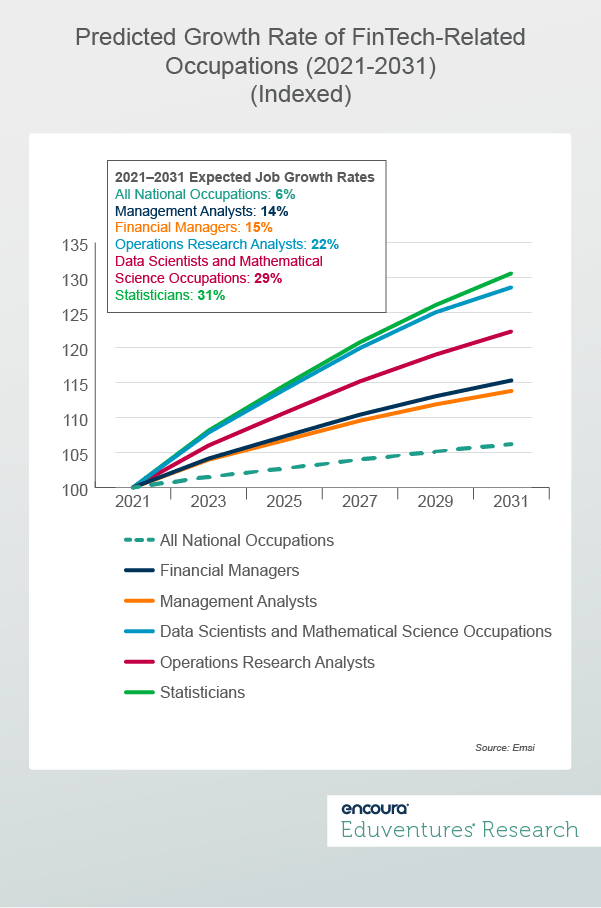

And not only have FinTech occupations grown over the last year, but these occupations are also expected to grow up to 4.5 times the average over the next 10 years. Figure 2 features the predicted 10-year growth of the five occupations identified by Emsi as those most relevant to FinTech.

Note that each of these FinTech-related occupations is expected to grow at a higher rate than the national occupational average growth rate (6%)—with growth rates as high as 31%—indicating strong demand for employees with FinTech skills over the next 10-plus years.

But FinTech demand is not only booming in the labor market, interest in FinTech-related courses and credentials among college students and adult learners has also been skyrocketing in recent years.

Growing Student Demand

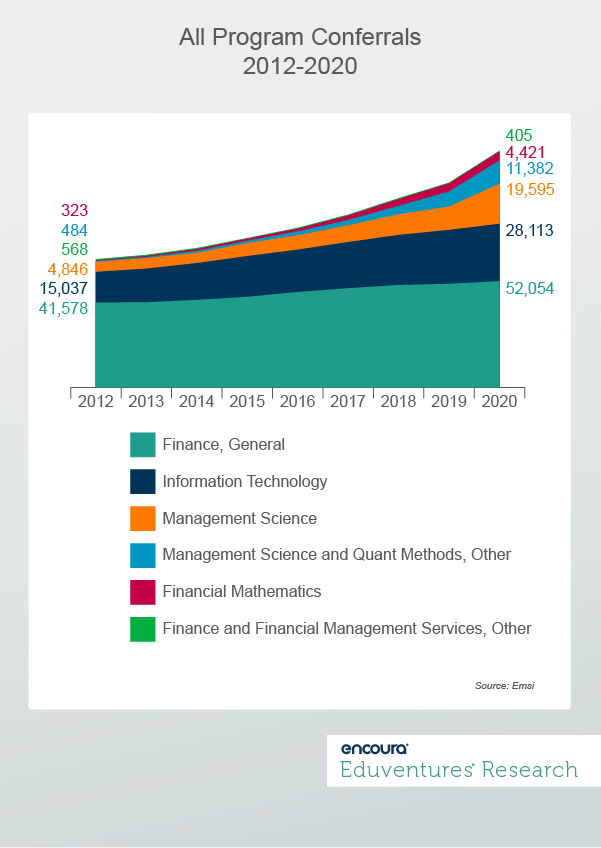

While the National Center for Education Statistics (NCES) did not create a CIP code to capture FinTech-specific conferrals until 2020, multiple programs have closely aligned. The growth of these FinTech-aligned programs in recent years signals increasing student interest in the industry. Figure 3 charts the conferral growth of five FinTech-related program areas, including finance and financial management services, management science and quantitative methods, information technology, financial mathematics, management science, and finance.

Together, conferrals for these programs have increased at a combined annual growth rate (CAGR) of 8% between 2012 and 2020, seven percentage points higher than the CAGR for all conferral growth during the same time frame (1% for reference). Financial mathematics and management science and quantitative methods, in particular, experienced explosive growth during the last eight years, with CAGRs of 39% and 48% respectively.

The growth of FinTech-aligned programming indicates that student interest in the financial and technology industries is expanding as rapidly as employer demand … and higher education is taking note.

Meeting Employer and Student Demand

Based on Eduventures’ analysis, institutions are still in the early phases of addressing increased employer and student FinTech demand. Here are a few different ways they have started responding:

- Launching FinTech degree programs. Just a handful of schools have launched FinTech bachelor’s or master’s degree programs in recent years—at last count, fewer than 10 U.S. institutions have launched FinTech specific degrees. Most of these launched as recently as 2019-2021, and favor master’s degrees over the bachelor’s level. Among them, there is a lack of consistency. Most schools decided to launch either a bachelor’s or a master’s program, and while most of the programs reside in schools’ business departments, not all do (e.g., Duke offers a FinTech master’s in engineering).The rarity of new degrees in the face of high demand may signal we’re still at the beginning of an emerging trend or, more likely, there is a hesitation among schools to launch FinTech degrees.

- Offering FinTech minors or concentrations. Other schools have responded to increasing FinTech demand by launching FinTech minors or concentrations under existing undergraduate or graduate degree programs. Perpetuating the ambiguity around where a FinTech degree belongs, most offer these concentrations within business degrees. The University of California, Berkeley (Berkeley), for example, houses its FinTech concentration in its master’s of engineering degree.

- Promoting FinTech initiatives. While several schools do not offer a FinTech degree or concentration, they still aim to compete in the FinTech space. These schools have promoted FinTech programming through initiatives like networking nights, FinTech courses, and student-led clubs. Most selective business schools, market themselves as FinTech providers despite only offering a few FinTech courses and other extracurricular programming. Business schools commonly promote their student-led FinTech clubs (e.g., Wharton’s student-led professional FinTech club).

- Launching FinTech certificates for adult learners. Berkeley, New York University, Cornell University, and University of Pennsylvania (Penn) have all recently launched non-degree FinTech certificates through their executive education online programs. Additionally, schools like University of Michigan, Penn, the University of Texas, Austin have launched online FinTech certificates through MOOC providers like Coursera and EdX.

While these observations underline that schools are beginning to respond to FinTech’s emergence, confusion exists around exactly what this response should look like.

Though FinTech remains an emerging industry, early data demonstrates employers seeking FinTech skills are less likely to require candidates hold a bachelor’s or graduate degree than employers in similar industries like engineering, finance, and business administration. Table 1 shows the educational level requirements that job postings require for FinTech compared to a few other industries.

Table 1. Education Level Listed on Job Postings

Industry

No Education Listed

High School or GED

Associate Degree

Bachelor’s Degree

Master’s Degree

Ph.D. or Professional Degree

FinTech

36%

16%

1%

44%

15%

4%

Engineering

29%

7%

6%

58%

19%

7%

Finance

22%

7%

5%

66%

21%

5%

Business Administration

7%

14%

13%

78%

28%

5%

Computer Science

4%

2%

3%

86%

35%

11%

This includes any mention of an education level listed within the job postings.

Postings may be tagged with multiple education levels.

Source: Emsi

Importantly, Table 1 suggests that the FinTech skillset is more important in securing employment than a FinTech degree which, in turn, suggests that the credential itself is not what is most important. Rather, how schools are preparing students for FinTech careers with both hard and soft skill training may be what matters most. Preparation can be through a degree, but it can also be through individual courses, extracurriculars, bootcamps, or non-degree certificates.

Eduventures predicts that FinTech certificates, particularly those tailored toward adult learners, will continue emerging as an upskilling opportunity for adults interested in exploring FinTech careers or furthering an existing career.

The Bottom Line

Despite ambiguity around the rightful place of FinTech in higher education, one thing is clear: employers are interested in hiring employees with FinTech skills and students are interested in gaining FinTech skills.

But dedicated “FinTech degrees” are rare, and Eduventures predicts they will likely remain this way. More so than in other professional business and technology industries, FinTech employers care more about the skillset than the degree. If schools want to stay competitive and ensure their programming reflects student interest and labor market demand, Eduventures recommends schools also include a close look at adding their FinTech programming through courses, concentrations, bootcamps, and certificate programs.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Quantitative Specialist, Client Research at Encoura

Contact

Wednesday February 23, 2022 at 2PM ET/1PM CT

Digital marketing is a topic that is often misconstrued. Some believe digital marketing is simply their email strategy, what their institution posts on the social media accounts, and their website presence. But those responsible for driving enrollment know it involves a bit more than that—and just as importantly, they understand that any successful strategy begins with a deeper understanding of their primary stakeholders: prospective Gen Z students.

In this session, we’ll share the latest research and marketing solutions that can help you deliver the right message to the right student at the right time on the right channel—ensuring you bring your best-fit students from prospect to enrolled. We'll cover how you can leverage Gen Z's favorite platforms (TikTok, Snapchat, YouTube, Instagram, and Facebook) with the right blend of marketing tactics, creating the "secret sauce" to future-proof your enrollment strategy.

Thursday February 24, 2022 at 2PM ET/1PM CT

Enrollment leaders are often challenged with “doing more, with less”. As you look for new ways to make your student engagement more targeted, how can you efficiently grow and change your class by coupling a few—or many—target markets together?

Join us on Thursday, February 24th to explore how utilizing data science and analytics can better identify populations where you can make the biggest impact—ensuring that your team can still do more, with less. We’ll explore:

- Ways to future-proof your enrollment strategy and avoid being caught flat-footed by unforeseen challenges in the marketplace

- How institutional marketing and enrollment teams can collaborate and educate one another so that your institution is set up for success

- Practical enrollment techniques and innovative digital marketing strategies that can improve your student engagement results for this spring and beyond