The old adage that nothing is certain but death and taxes is due for an update. We’re now assured that the arrival of a new academic calendar invariably sparks renewed debate over the merits, or lack thereof, of online program management (OPM) companies and OPM transparency.

The latest edition in this ongoing saga comes with a new twist: 2U’s launch of a “Transparency Framework” just before the publication of a new report by The Century Foundation (TCF) on OPMs and public institutions.

Has OPM transparency indeed come to this growing and frequently contested marketplace? Here's our take.

Below, we offer our preliminary report card on these developments to shed more light on the OPM marketplace.

2U’s Transparency Framework

Eduventures has been searching for “the ghost" of OPM efficacy data for some time. Specifically, how do the outcomes of outsourced online programs compare to those produced and managed by schools themselves? We’ve seen a proliferation of claims by OPM providers that their programs improve learner engagement and improve outcomes. Absent the availability of independently verified, program-level data, however, it has been challenging for schools to make informed decisions about their relationships with these companies.

While several service providers have taken steps to close this gap, 2U’s launch of its Transparency Framework merits attention, particularly in light of the recent headwinds and stock price decline that this company has experienced. Scheduled for release in 2020, the Transparency Framework promises to include the company's contractual details, pricing, and related business metrics as well as indicators of student outcomes.

Some of this promised data is included in what 2U already publicly reports to investors, and in fact 2U published an annual "Impact Report" between 2014 and 2016. Other data contained in the new Framework, however, could raise the transparency bar for OPMs and others.

For example, the publication of net promoter scores, included in the Impact Report, could shed valuable light on how students experience these online programs. According to 2U, other metrics will include retention and graduation rates, as well as “employment outcomes and licensure passage rates.” Will this evidence reveal more about online learning and employability than other available datasets?

There’s no wizardry to collecting this data. The proof will be in how it's reported and made available in order to identify new patterns and insights. Absent similar data from other OPMs, it may be difficult to distinguish true transparency from commercial self-interest.

Grade for the Transparency Framework: B+

A promising start; significant potential for industry-wide improvement if data is easily and independently made available for further analysis.

TCF’s Public University Contract Analysis

TCF’s latest report builds off its 2017 study of OPM contract data. Titled Dear Colleges – Take Control of Your Online Courses, it attempts to up the ante by focusing exclusively on contracts from public institutions.

Specifically, the report contends that public institutions run the risk of defaulting on their mission of serving “the public interest” when they contract with OPM providers, particularly those that rely on tuition or revenue share agreements. According to this report, these contracts function as a “wolf in sheep’s clothing" as schools relegate key operational and instructional responsibilities to profit-motivated private entities, endangering students who attend these public institutions. OPMs (i.e., the wolves) escape the scrutiny that for-profit schools receive, exposing students to outsized risk and minimized reward.

TCF bases its conclusions on 79 public school contracts. But, as TCF acknowledges, just over half of them (41) cover OPM services. The other half appear to also include learning management systems (LMS) providers. Both conventional LMS and open-source platforms (e.g. Sakkai) are included alongside more OPM-relevant agreements with Bisk, Academic Partnerships, Wiley, and Everspring.

Of the 41 OPM contracts examined, about half of these (53%) represent a revenue share model. As a result, TCF offers a broad indictment of the OPM market based on roughly 21 contracts with public institutions.

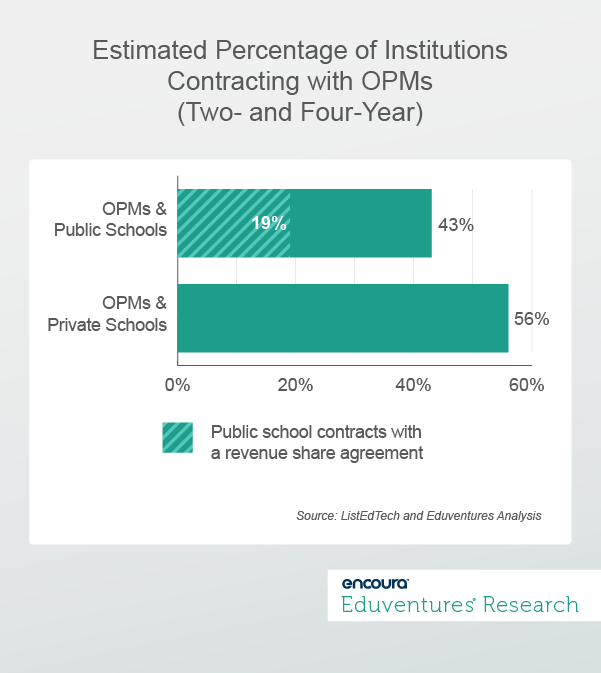

Eduventures’ analysis of current data suggests a more complex market. Figure 1 shows our current estimate of how the market is divided between public and private schools. Notably, these estimates include OPM providers only and exclude providers of other technology and service segments.

We estimate that about 43% of all schools working with OPMs are public institutions. A minority of these public contracts (19% of all public institutions) are likely using a revenue sharing model.

This suggests that the range and variety of these agreements exceeds TCF’s analysis, and certainly merits further inquiry. It also suggests that revenue sharing agreements are in the minority and perhaps are on the decline.

Eduventures’ Grade for TCF’s “Dear College” Report: C-

Unique access to OPM contracts and some helpful recommendations for schools are overshadowed by a narrow view of a complex marketplace.

The Bottom Line

No doubt, the OPM marketplace is begging for greater transparency. These latest efforts, however, represent very different motivations and may have limited impact.

2U’s plans for its Transparency Framework build upon its earlier efforts to collect and distribute outcomes and business data. The new challenge, however, will be whether data supplied by this market-leading service provider will satisfy its critics. 2U has held fast to its mantra of “no back row” – that the programs it delivers to students encourage deeper engagement and improve outcomes. Perhaps the Transparency Framework is 2U’s latest effort to do the same to its own marketplace: eliminate passivity and enhance performance.

While TCF should be commended for collecting and releasing this new contract data, its new report signals a doubling-down on its conviction that for-profit business models pose a critical threat to higher education, particularly on public campuses. Perhaps TCF should focus future efforts on balancing consumer protection with a more precise portrait of a large and diverse marketplace.

The greatest irony here may be the silence of institutional leaders themselves. Perhaps both 2U and TCF could incorporate such perspectives in order to shed more light on the true outcomes and operations of the OPM marketplace.

Thursday, October 24, 2019 at 2PM ET/1PM CT

- How do prospective adult learners make decisions regarding their educational futures?

- How can institutions and service providers better understand and anticipate the behaviors of prospective adult learners?

Thank you for subscribing!

Thank you for subscribing!