Increasingly, institutions looking to boost undergraduate enrollment are racing to recruit in out-of-state markets. But how do institutions determine which states to add to their out-of-state portfolios? How often should institutions chase volume? And how often should they chase affinity?

A solid out-of-state recruiting plan should include a balance of both. But any plan should be informed by a strong understanding of the most current out-of-state market dynamics—and not all markets are created equal.

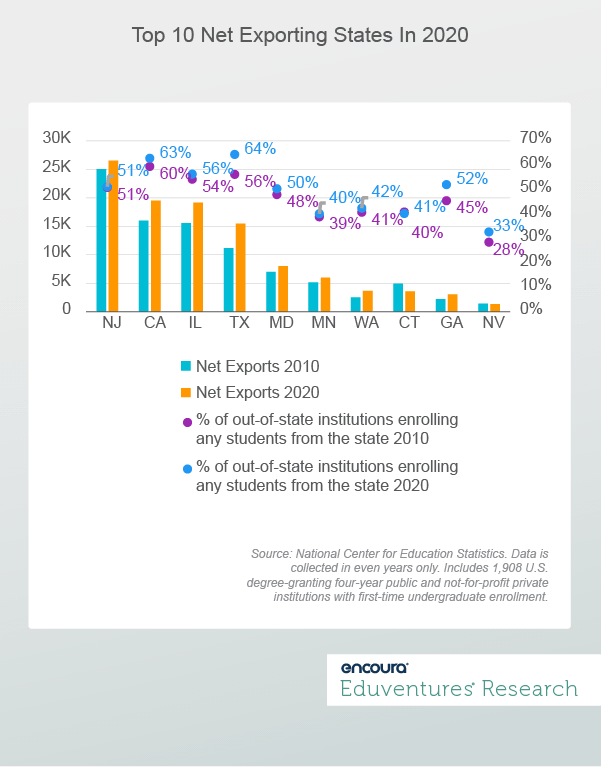

Eduventures analyzed national data on the residence and migration of first-time degree and certificate seeking students enrolling as undergraduates within 12 months of high school graduation (see Figure 1).

The national data shows us which states are the largest net exporters of students—states that lose the most students to out-of-state enrollment compared to the number of students that enroll in-state.

These top 10 states account for 96% of the export volume across the country in 2020. New Jersey, California, Illinois, and Texas alone account for 73% of this export volume.

Every institution must evaluate their strategy in these states given their scale. But recruiting in these states is made more difficult by the fact that many other schools are recruiting there too, making these markets crowded with many competitors.

About half (51%) of all four-year undergraduate-serving institutions enroll out-of-state students from New Jersey. Enrollment of out-of-state students from California (63%) and Texas (64%) is even more common. This tells us that while more institutions nationally target California and Texas, New Jersey is fertile ground for those that do actively recruit in the state.

Table 1 shows the top five states each of the top 10 exporters lose students to. It shows that New Jersey students largely stay on the eastern seaboard, while students from California are more likely to travel from coast to coast. Generally, migration follows a strong regional pattern.

| States Students Export to for College | #colspan# | #colspan# | #colspan# | #colspan# | #colspan# | #colspan# | #colspan# | #colspan# | #colspan# |

|---|---|---|---|---|---|---|---|---|---|

| NJ | CA | IL | TX | MD | MN | WA | CT | GA | NV |

| PA | AZ | IN | OK | PA | WI | CA | MA | AL | UT |

| NY | NY | WI | AR | VA | ND | OR | NY | TN | CA |

| MA | OR | IA | LA | NY | IA | ID | RI | SC | AZ |

| CT | WA | MO | NY | NC | SD | MT | PA | NC | ID |

| FL | MA | MI | CA | DC | IL | AZ | NH | FL | OR |

Table 1

These migration patterns are affected by factors like the Western Undergraduate Exchange (WUE)—the regional tuition program that allows students to attend WUE institutions at in-state rates across the west. Similarly, migration is also affected by less amiable competition in neighboring states that extend in-state tuition to students in abutting markets.

For private institutions, regional discounting programs, brand equity, and location often influence the degree to which an institution can recruit more nationally as opposed to more regionally.

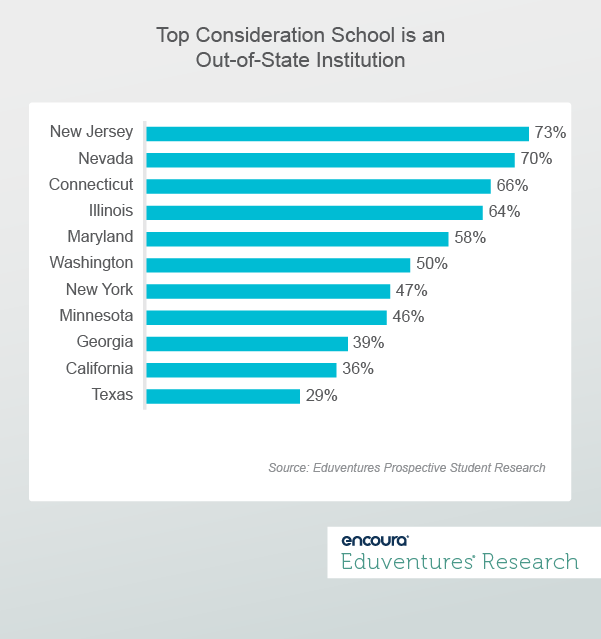

While the net export metric is a good indicator of market size for out-of-state students, it’s not perfect. It doesn’t take into account the college-going culture of a state, in particular, the likelihood that a student will attend college-out-of-state. Our Prospective Student Research™ shows the proclivity of students to study out-of-state (Figure 2).

New Jersey students are most likely to consider out-of-state education. Texas students are least likely to leave their home state—you’ll have to visit many more schools to find your travelers here. If we’re going with hokey metaphors, recruiting in New Jersey is like shooting fish in a barrel; recruiting in Texas is like finding a needle in a haystack.

The Bottom Line

Sound out-of-state recruiting strategies must take the largest net exporters into consideration. It is also important to be realistic about the number of resources to dedicate to highly competitive markets. Follow these six guidelines as you make your plans:

- Consider the top four markets (New Jersey, California, Illinois, and Texas). These states are too large to ignore, but competition is stiff, so plan wisely.

- Develop state-level strategies to narrow your focus and optimize resources. For example, focus on metro areas or feeder high schools, or find students in majors that align to brand strengths.

- Don’t neglect your regional strategy. Your brand recognition will be highest in your own backyard. So, articulate a thoughtful regional strategy, even if you seem to be in a low volume region. Small numbers still add up. Consider which of these states is within your regional grasp.

- Place regional recruiters. Embedding recruiters will help you establish the relationships you need to develop the market. It will also help you better understand the college going culture and needs of students in the region.

- Find and strengthen affinities. In any market, you’ll stand out if you are able to find and strengthen affinities to students interested in enrolling out-of-state. Use insights, like those available in the Eduventures Prospective Student Research, to understand the terrain. Mindset profiles, major interests, and demographics will help develop a strong position.

- Create a regional communications strategy. In-state and out-of-state markets are different when it comes to communications with colleges. Understand your best methods for bringing your messages to the market, whether this is through search, digital campaigns, or relationship-building with key influencers.

The out-of-state market is crowded, but it is essential for most institutions to develop an out-of-state strategy that works for them. Start by understanding where the students are and where they will go.

Never Miss Your Wake-Up Call

Learn more about our team of expert research analysts here.

Eduventures Principal Analyst at Encoura

Contact

For a teenager, the college decision looms as a complex make-or-break moment, a pivotal turn on an imagined path to adulthood. Understanding the decision-making factors, along with perceptions around your institution, college, and more, will help you make data-driven decisions to stand out from your competition. By participating in Eduventures' Prospective Student Research, your institution will gain a better understanding of how college-bound high school students approach one of the most important decisions of their young lives.

Your team has big goals—like increasing applications and preventing melt. Encoura is ready to partner with you to reach students, their families, and alumni with timely messaging that matters most. Maximize data you already have to meet students in their decision journeys. Connect and engage with them on the apps and devices they use the most.