Data on the price of consumer goods and services reveals a staggering 160% surge in college tuition and fees from 2000 to 2022, second only to hospital services. This long-standing trend gains fresh relevance amid the Great Resignation’s impact on employment, marked by unprecedented wage hikes and abundant job opportunities. As a result, fall 2022 graduate enrollment declined for the first time in over a decade.

Considering this shifting landscape, institutions offering graduate programs must reassess their value propositions and pricing strategies. Key questions for institutions: How much are master’s prospects willing to pay and which features would they pay more for?

Master’s Prospects Align with Market

According to IPEDs, private institutions charge a median of $30,000 for two years of graduate education, compared to the public-school median of $17,500 for in-state students and $36,000 for out-of-state students. According to Eduventures’ annual Adult Prospect Research™, master’s degree prospects say they are willing to pay a median of $34,000 out of pocket, which is in close alignment.

So far so good.

It is important to recognize, however, that different types of master’s prospects have different expectations. Moreover, there is pricing diversity among institutions, including price by factors like reputation and brand, program type, and modality.

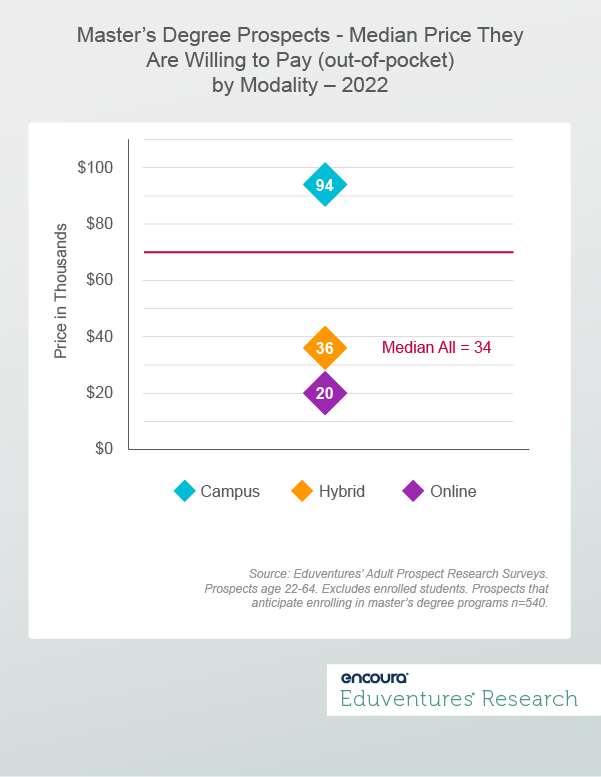

Modality, as we know, greatly affects how prospects perceive value. But to what extent? Figure 1 shows how master’s prospects’ preferred modality of instruction impacts their pricing expectations.

Prospective master’s students seeking fully online programs indicated a median price of $20,000, well below the overall median of $34,000. Hybrid programs, which blend online and campus elements, closely align with the overall median price at $36,000. In contrast, those interested in fully on-campus programs indicate a willingness to pay a much higher median price—$94,000!

While it’s not surprising that online prospects expect lower costs and on-campus prospects expect higher costs, the significant $74,000 gap between these groups highlights a substantial difference in how prospects perceive program value. But what exactly drives this divergence of values?

Premium Features

In an effort to connect a monetary value to program features, Eduventures asked master’s prospects which program features they would be willing to pay more for. Figure 2 shows the master’s prospects responses by modality (campus, hybrid, and online) and ranks of the features that prospects are willing to pay more for.

Master’s Degree Prospects by Modality – Features They Are Willing to Pay More For – 2022

Features Willing to Pay More For Campus Rank Hybrid Rank Online Rank Program directly aligned with my work/career goals 3* 1 3 High-quality faculty 1 3* 6 Reputation of college, university, or education/training provider 6 2 4 Fully online coursework 9 6 1 Evidence of successful career placement 7 3* 7 Ranking of college, university, or education/training provider 2 8 8 Proximity to where I live/work 3* 7 9 Ability to complete the program at an accelerated pace 8 9 2 Ability to choose whether to take my courses online or on-campus/in-person 10 5 5 Meaningful in-person or on-campus experiences 5 12 13 Figure 2.

Source: Eduventures' Adult Prospect Research Surveys. Prospects age 22-64. Excludes enrolled students. Prospects that anticipate enrolling in master’s degree programs n=540.

*Indicates tie result.

Among all modalities, the most valued feature is having a program directly aligned with career goals. There are, however, notable differences among master's prospects based on their chosen modality.

Online master's prospects prioritize "fully online coursework" as the feature they are most willing to pay extra for, despite their preference for a lower overall median price.

Hybrid and campus master’s prospects both value “high quality faculty,” ranking it in the top three preferences. Notably, these two groups share more similarities with each other than with online master’s prospects.

While hybrid master’s prospects prioritize the “reputation of college, university, or education/training provider,” campus master’s prospects focus on the “ranking of college, university, or education/training provider.” These indicators, while slightly different, both reflect the importance of quality. Additionally, campus-based master's prospects place value on "proximity to where I live/work," which aligns with their need to commute.

These trends underscore the importance of aligning program features with pricing and highlight how prospects’ priorities differ depending on their chosen modality.

The Bottom Line

To tackle declining master's degree enrollment, institutions must proactively strategize their program pricing and features. This entails a thorough examination of pricing expectations against benchmarks and an honest assessment of how program features are both marketed and followed through on. Modality, along with factors such as program discipline (not featured in today’s post!), significantly influences prospect pricing expectations.

By gaining insight into the features that prospects prioritize and pricing variability, institutions can strengthen their competitive positions in the program market.

Never Miss Your Wake-Up Call

Thank you for subscribing!

Learn more about our team of expert research analysts here.

Eduventures Senior Analyst at Encoura

Encoura Digital Solutions serves as an extension of your enrollment marketing team, boosting your institution’s reputation and visibility with proven digital marketing strategies, to connect you to your best-fit graduate students.