This has never happened before—the planned merger of Capella Education and Strayer Education, two of the largest for-profit higher education companies in the country, is the first of its kind. In the past, big for-profit schools have snapped up small ones, some large players have sold off divisions and brands, and this year two giants (Education Management Corporation and Kaplan) announced plans to sell to nonprofits. But the U.S. has never witnessed two big, for-profit schools become one company.

Is the merger a sign of strength or weakness for these companies and for-profit higher education? A bit of both.

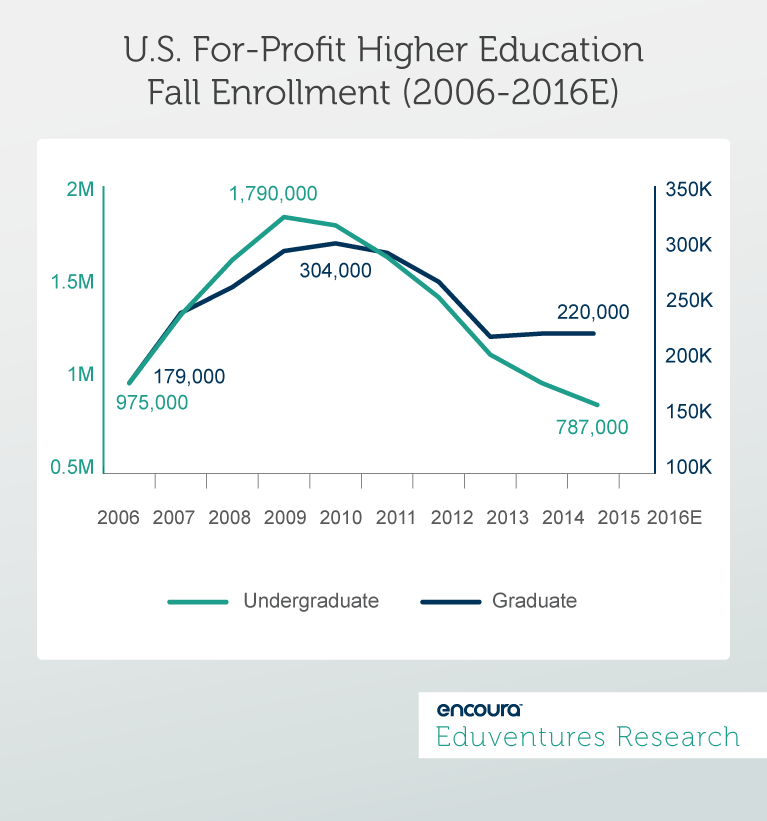

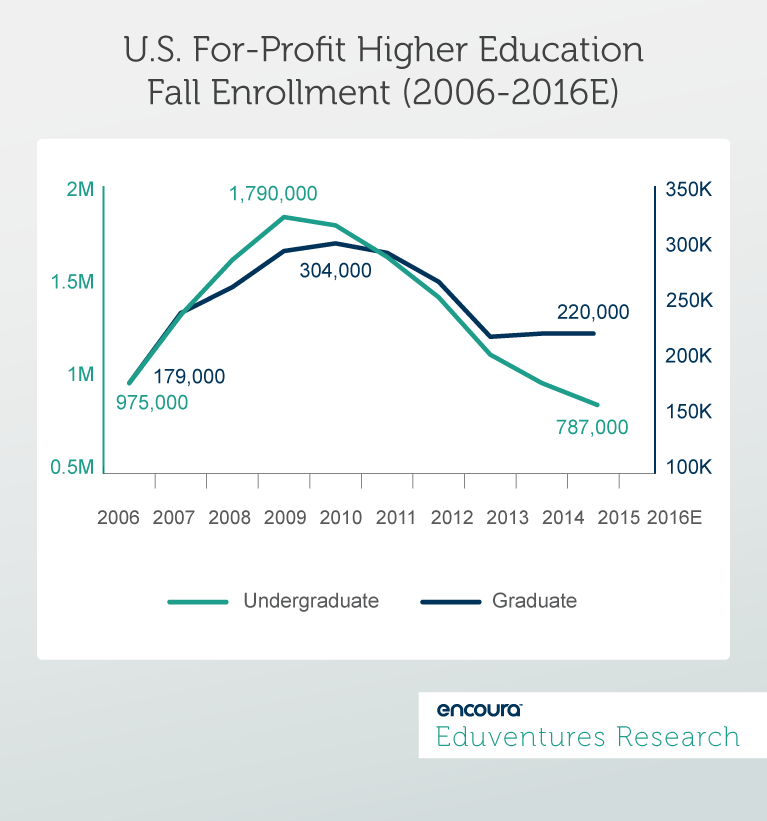

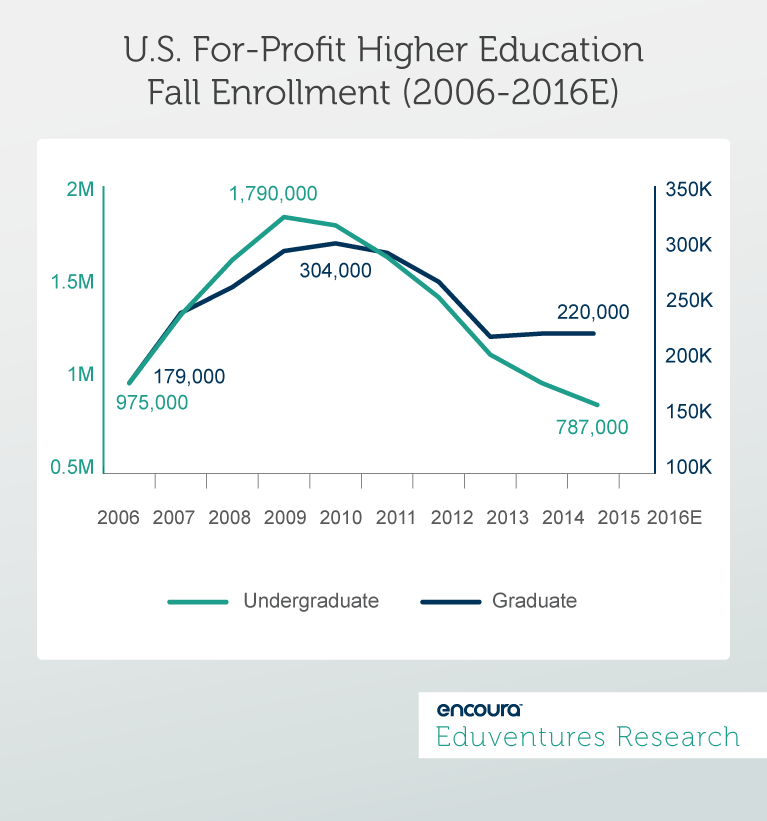

The backdrop to the merger is the rise and fall of for-profit higher education enrollment over the past decade (Figure 1).

Figure 1. Back to the Start

Source: Eduventures analysis of IPEDS and National Student Clearinghouse data- 2 and 4-year schools.

At the undergraduate level, for-profit enrollment grew 80% between 2006 and 2010, and more than 60% at the graduate level. The Great Recession, coupled with for-profit school emphasis on convenience and flexibility for working adults and hefty marketing budgets, propelled the sector forward.

But as the economy recovered and nonprofit schools embraced online learning and adult-friendly programming en masse, the for-profits crashed back to earth. Regulatory scrutiny under Obama exposed serious shortcomings at some institutions and tarnished the for-profit school brand.

For-profit undergraduate enrollment has tumbled well below the 2006 total. Today it accounts for less than 5% of the undergraduate market (compared to 10% in 2010). Graduate enrollment has stabilized at just under 8% of the market, but below the peak of 2011 when the sector enjoyed an over 10% share.

Two major companies, Corinthian and ITT, and many smaller ones, have gone out of business. Most other firms are treading water at best. A trickle of for-profits have become nonprofits, concluding that in higher education the profit motive is more trouble than its worth.

The best-known for-profit, University of Phoenix, hit over 500,000 students at its peak but today is less than a third of that size. Grand Canyon University continues to thrive, but its core strategy has been to build a winning traditional campus serving traditional-aged undergraduates, and let its larger online business bask in the reflected glow. A smart move but hardly ground-breaking. Indeed, Grand Canyon recently reiterated its desire to become nonprofit.

Against the Odds

Capella and Strayer have out-performed their peers. Both experienced the ups and downs of the market but stabilized earlier. Enrollment at Capella, at one time graduate only, has declined since its 2010 fall peak of 31,000 but not dramatically, holding steady at about 27,000 in recent years. Pre-2006, the company moved into the undergraduate market and grew to over 8,000 students, a total it retains today. Strayer has always been larger at the undergraduate level, and unlike most of its peers, has managed to kick-start fall enrollment again, to over 30,000. Graduate enrollment continues to hemorrhage and is now below 12,000 students.

Capella’s positive trajectory boils down to atypical transparency on student outcomes, a concerted push into competency-based education (CBE), and a genuinely strong brand at the graduate level in certain disciplines, such as behavioral sciences. The operational simplicity of fully online delivery is also a factor. What stands out for Strayer is a decision a few years back to reduce undergraduate tuition by 20%, incent student completion with further discounts, and launch the Strayer@Work custom corporate education initiative. Strayer’s Jack Welch Management Institute, run with input from the veteran General Electric CEO, is a rare example of a for-profit school trying to out-brand the competition. Both firms have a clean regulatory record.

Increased Scale

It is encouraging that the merger announcements do more than play up cost savings, estimated at $50 million over 18 months. Strayer’s multi-state campus network is positioned as an opportunity to roll out a blended version of Capella’s online CBE model with reduced costs that will be passed on to students. Capella’s latest quarterly report notes long-term gains in student persistence, something that ultimately any four-year institution must be judged on. Both firms have purchased coding bootcamps, a sign of openness to alternative postsecondary models.

The combined company, which will be called Strategic Education, would have about 80,000 students, placing it among the ten largest institutions in the country, and perhaps number two at the graduate level after for-profit Walden University. Strayer’s undergraduate scale and Capella’s lead at the graduate level gives some symmetry to the merger.

The merger press release talks up “increased scale,” a phrase unlikely to be cited by many conventional universities as the engine of student success. Yet scale is exactly where for-profit higher education must prove itself if it is to break through negative perceptions, address higher education’s big challenges, and be more than a curiosity at the margins of the mainstream.

The task for the new firm is to re-state why for-profit status is a virtue for students and taxpayers. The aggregation of Capella and Strayer’s capital, systems, technology, and programing must enhance the student experience in ways that most nonprofits struggle with. So far, most nonprofit schools report that adding online learning to the classroom has either no effect or increases rather than reduces cost, and quality gains are tough to pinpoint. Is a large for-profit best-placed to get more value from new technology?

Boosting quality, increasing access, and lowering cost is the magic combination in other industries, and innovation is typically profit driven. Providing high-quality, universal lifelong learning—surely the postsecondary challenge of the near-future—looks more daunting than ever if the levers of profit and technology don’t work.

As most other major for-profits have collapsed, retreated to the sidelines or seek a nonprofit refuge, the Capella-Strayer merger is an opportunity to innovate in a sector that has lost some of its ambition and to demonstrate that for-profit higher education is not, as critics allege, an oxymoron. It will be interesting to see what some of the other big remaining for-profit players still standing, like American Public University System, DeVry-Adtalem, Walden University, and University of Phoenix, do in response to this merger.

While Strategic Education has taken up the mantle of leadership in U.S. for-profit higher education, it must make scale matter to more than just shareholders.